Employee Setup

Overview

Employee is used for add Employee, Employee detail, Payroll, Shift Schedule, Payroll Group

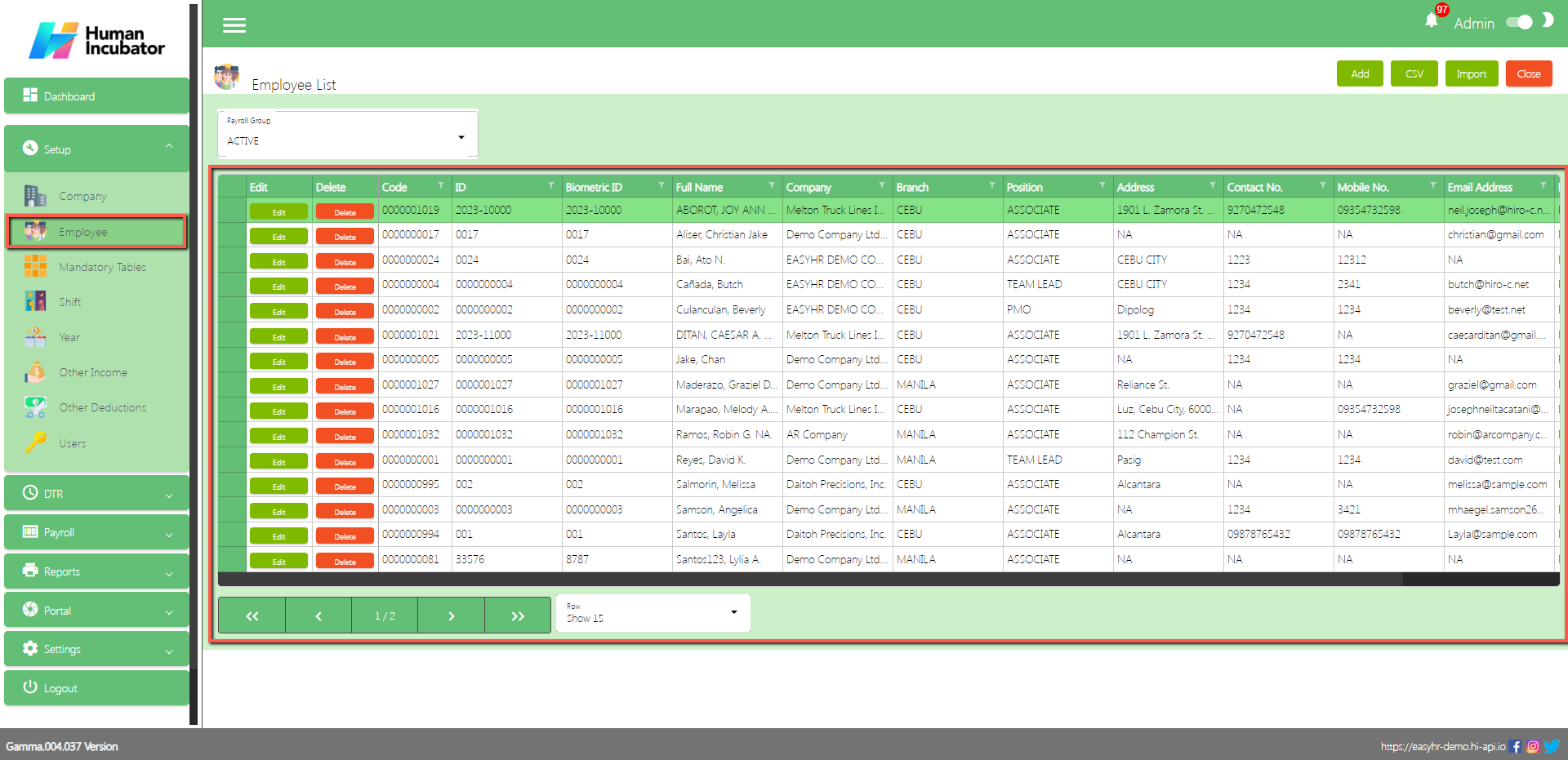

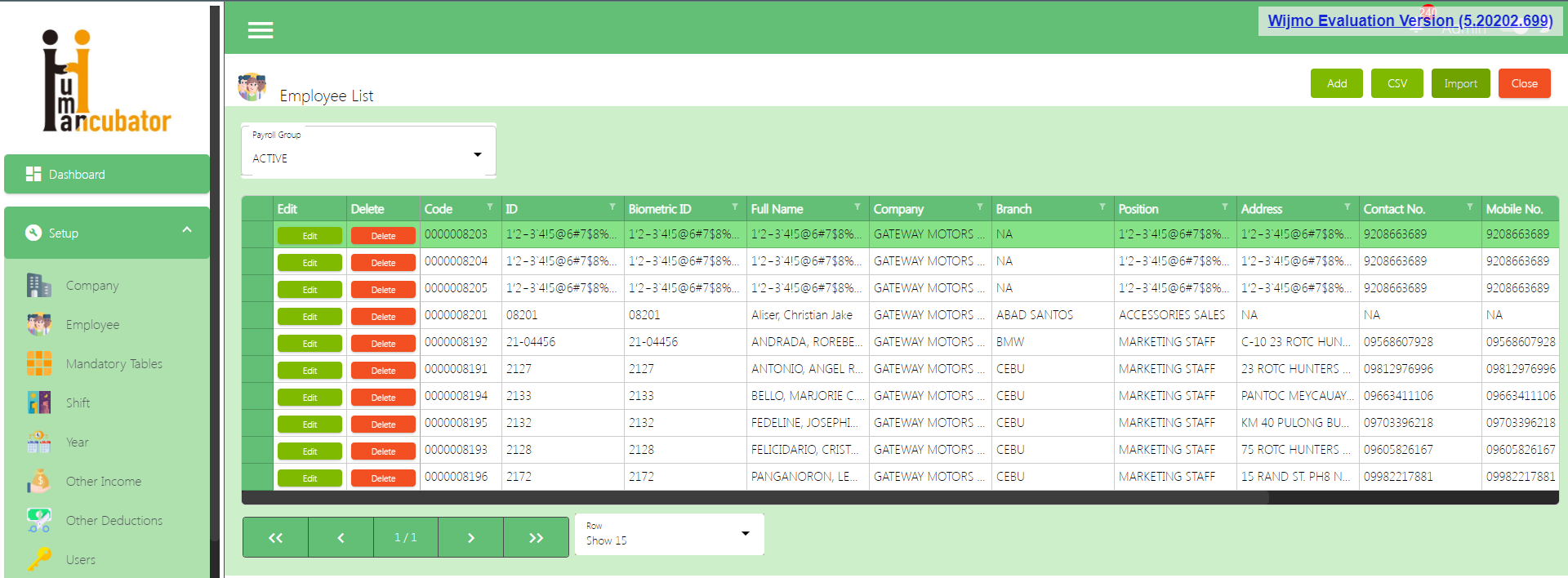

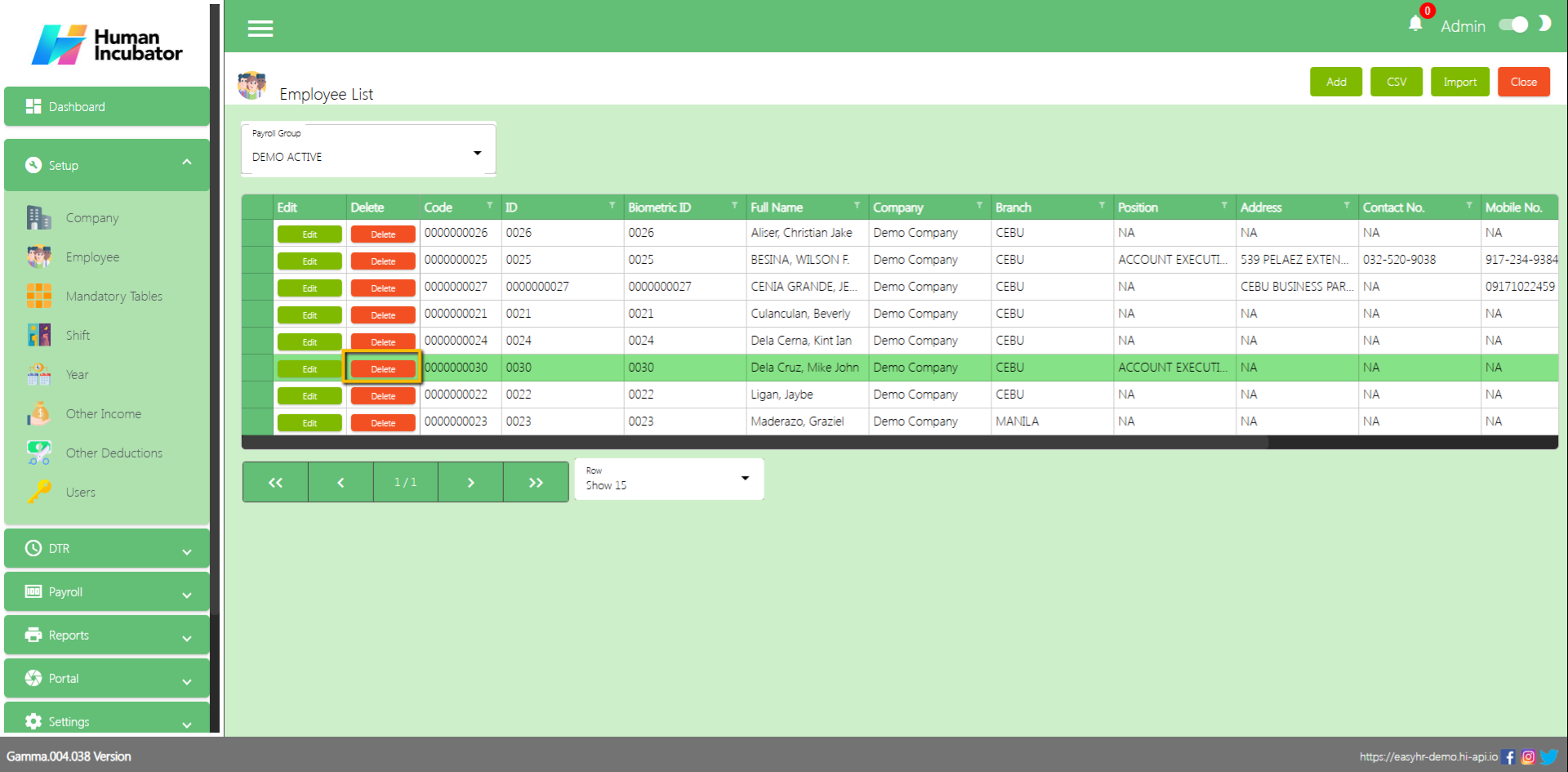

Employee List

Shows all the list of the employee

Employee List Column

- Edit: This is a button that has the function to edit the company

- Delete: This is a button that has the function to Delete the Employee (Note: You cannot delete the Employee once it already has a transaction data)

- Code: This will automatically generate according to the sequence of the added Employee

- ID: This is for the Employee ID

- Biometric ID: This is for the Employee Biometric ID if the Company is using a Biometric Device for their Employee’s logs

- Full Name: This is for the Employees Fullname

- Company: This is for the Employees Company

- Branch: This is for the Employees Branch

- Position: This is for the Employees Position

- Address: This is for the Employees Address

- Contact No.: This is for the Employees Contact No.

- Mobile No.: This is for the Employees Mobile No.

- Email Address: This is for the Employee’s Email Address

- Remarks: You can put any Remarks for this Employee

- Locked: If the Checkbox is checked then it is locked but if uncheck then it is unlocked. (Note: If the Employee is unlocked it will not show in the other module)

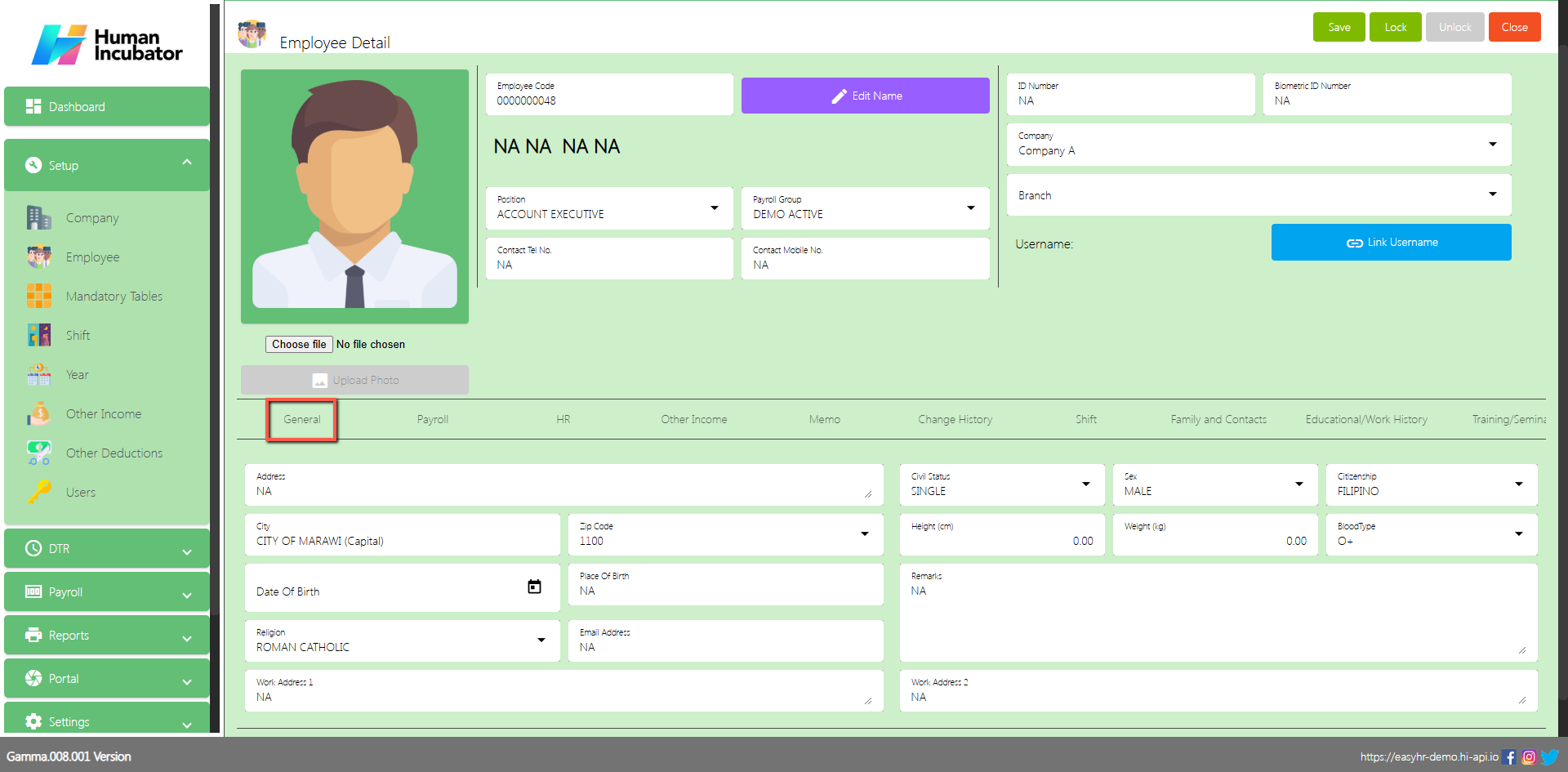

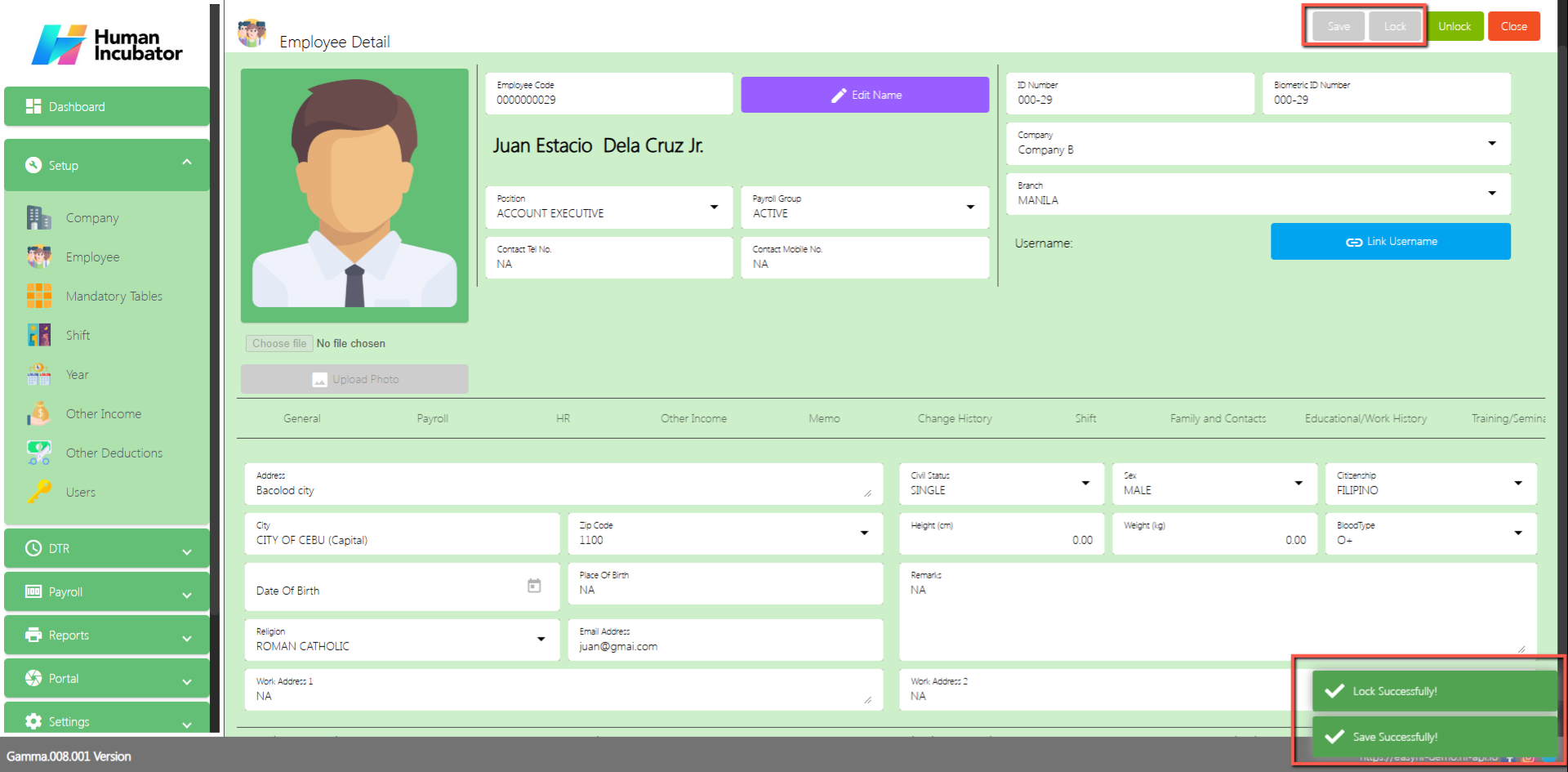

Employee Detail

Assumption: The user already clicked the Add button that can be seen on the Employee List.

Fill all the important fields for Employee Detail like:

- Click Edit Name button to fill up the Last name, First name, Middle name, Extension name

- ID number

- Biometric number

- Select Company

- Select Branch

- Upload Photo

- Select Position

- Select Payroll Group

- Contact Tel No.

- Contact Mobile No.

General

- Address

- Select City

- Select Date of Birth

- Select Religion

- Select Zip Code

- Place of Birth

- Email Address

- Select Civil Status

- Select Sex

- Select Citizenship

- Height

- Weight

- Blood Type

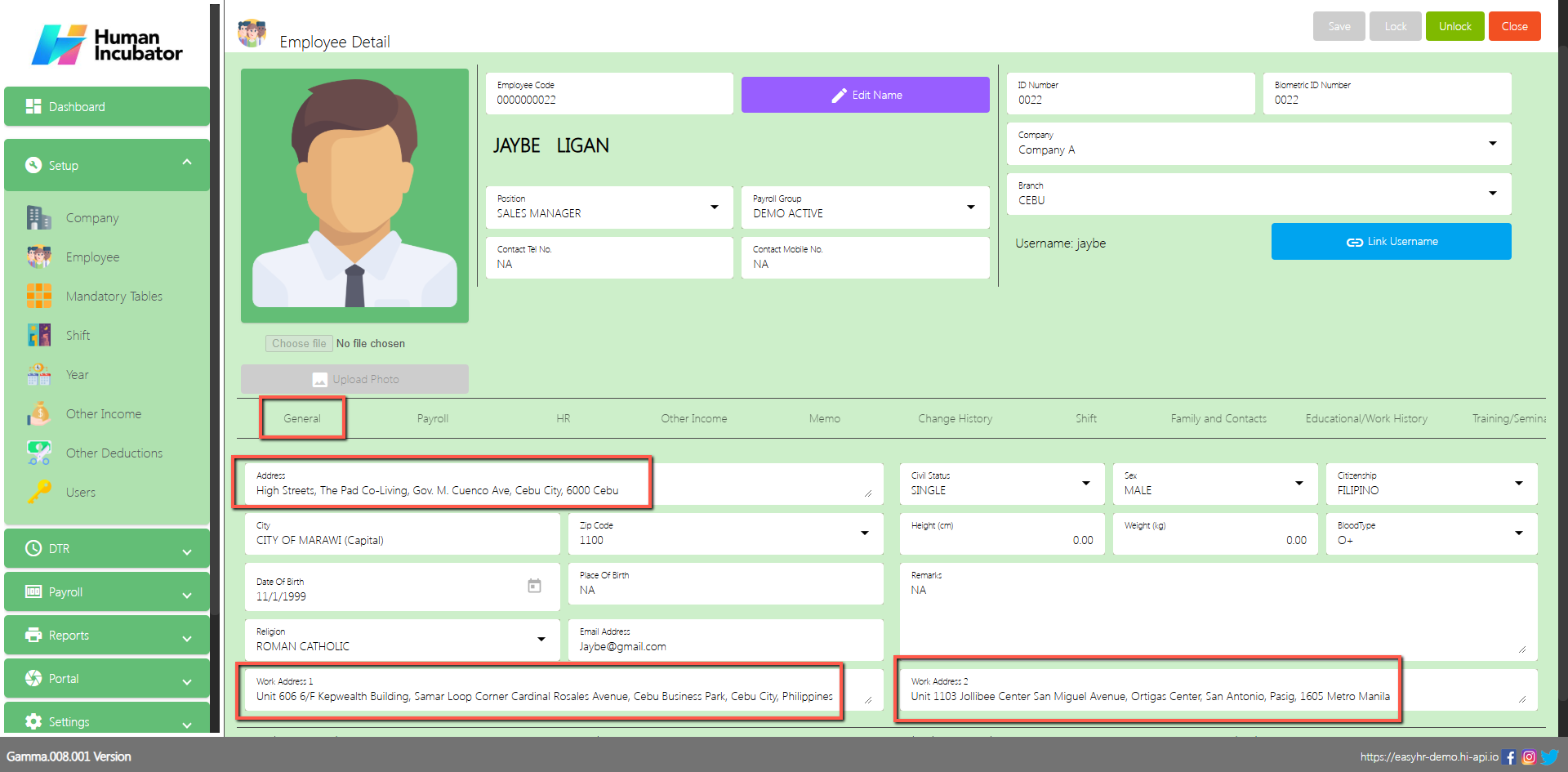

Employee 201 Geotagging & Official Business Feature

After the superadmin is done for the geolocation setup in the Company settings and Company detail

(Company Setup Geotagging & Official Business Feature)

In the Employee 201 you will need to setup for the address of the employee in the General tab and input the employees address on the Address field and the work address in the Work Address 1 or Work Address 2

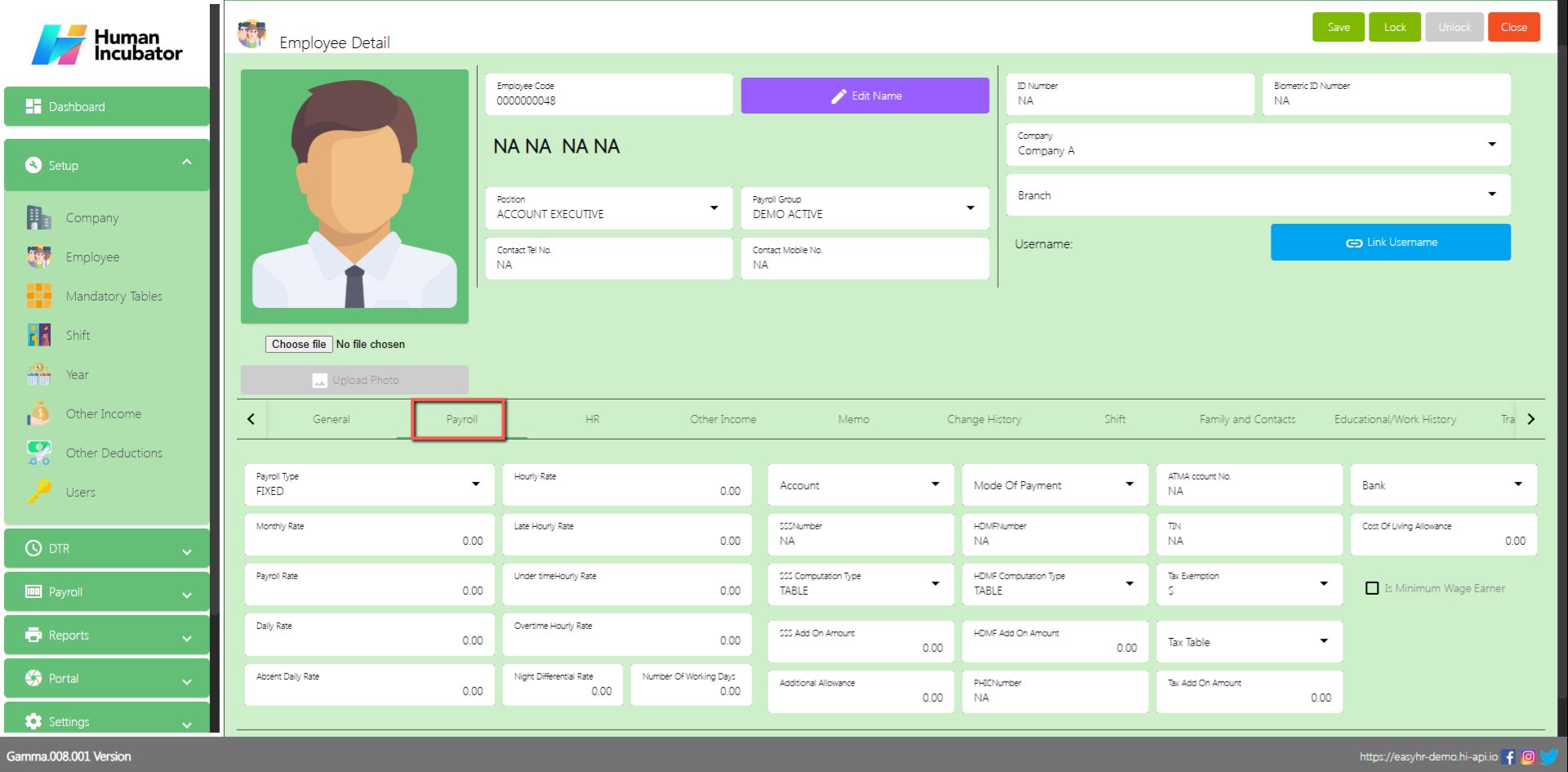

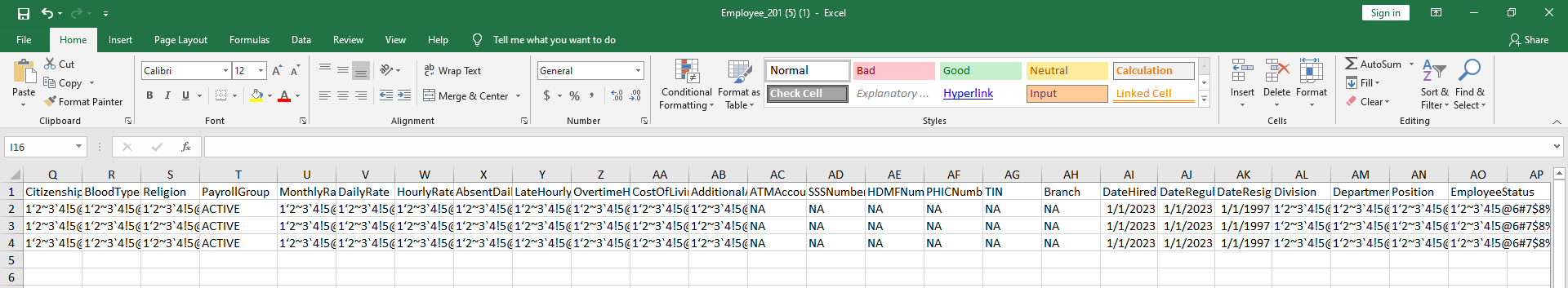

Payroll

In Payroll tab the user can input monthly rate and mandatory account of employee

Select and Fill all the important fields for Employee Detail like:

- Select Payroll Type

- Monthly Rate

- Number of Working Days

- Input SSS Number

- Input HDMF Number

- Input PHIC Number

- Input TIN

- Tax Exemption

- Select SSS Computation Table

- Select HDMF Computation Table

- Tax Table

- Select Mode of Payment

- Input Additional Allowance if Necessary

- Input ATM Account Number

- Select Bank

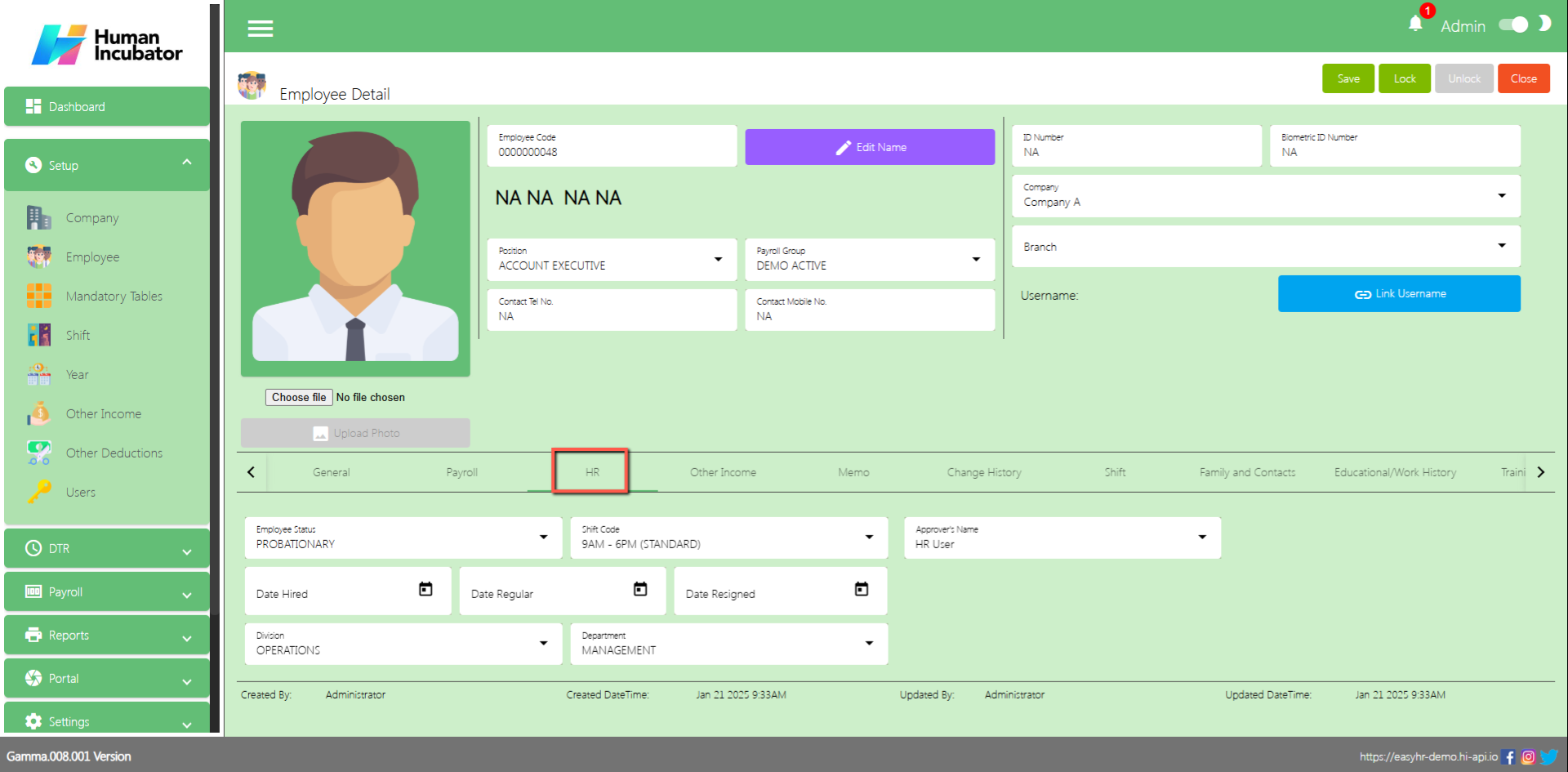

HR

In the HR tab the user can select the status of the employee and also the Date hired.

Select the important fields like:

- Employee Status

- Shift Code

- Date Hired

- Date Regular

- Division

- Department

- Approver’s Name

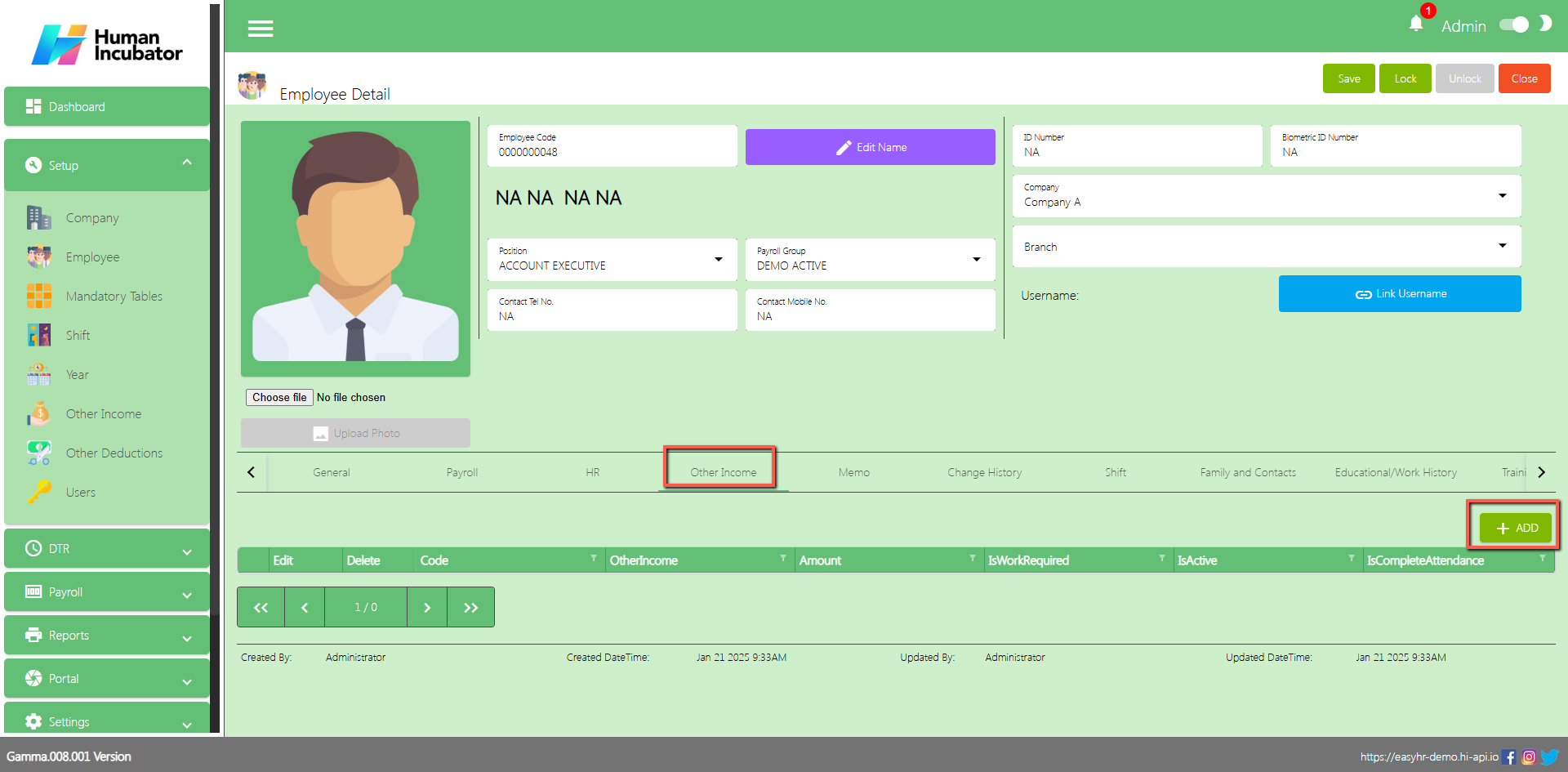

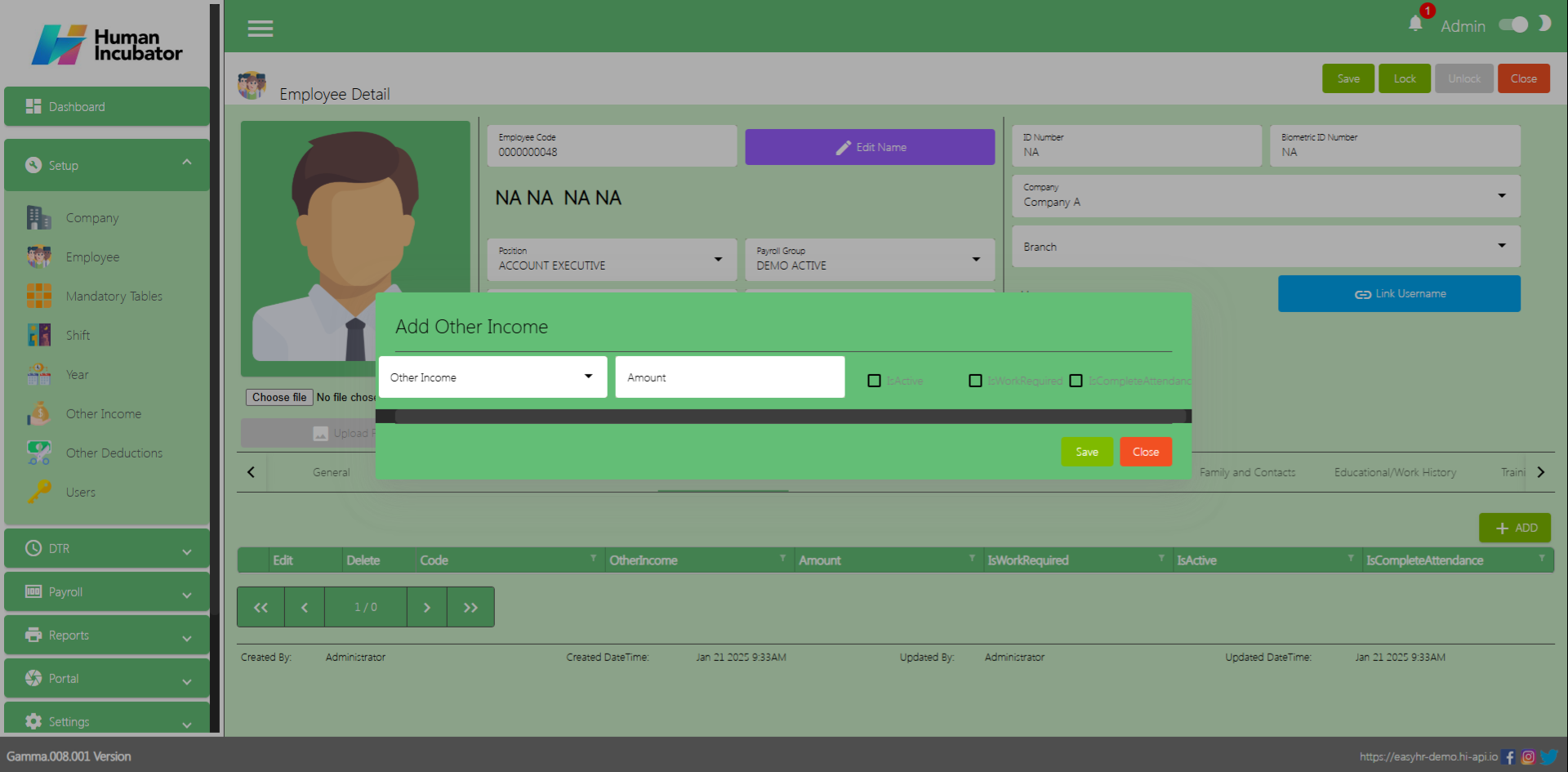

Other Income

In Other Income tab the use can add the other income of the employee

- Select other Income

- Input Amount

- Check the box IsActive, IsWorkRequired

- Click Save button to add in Other Income table

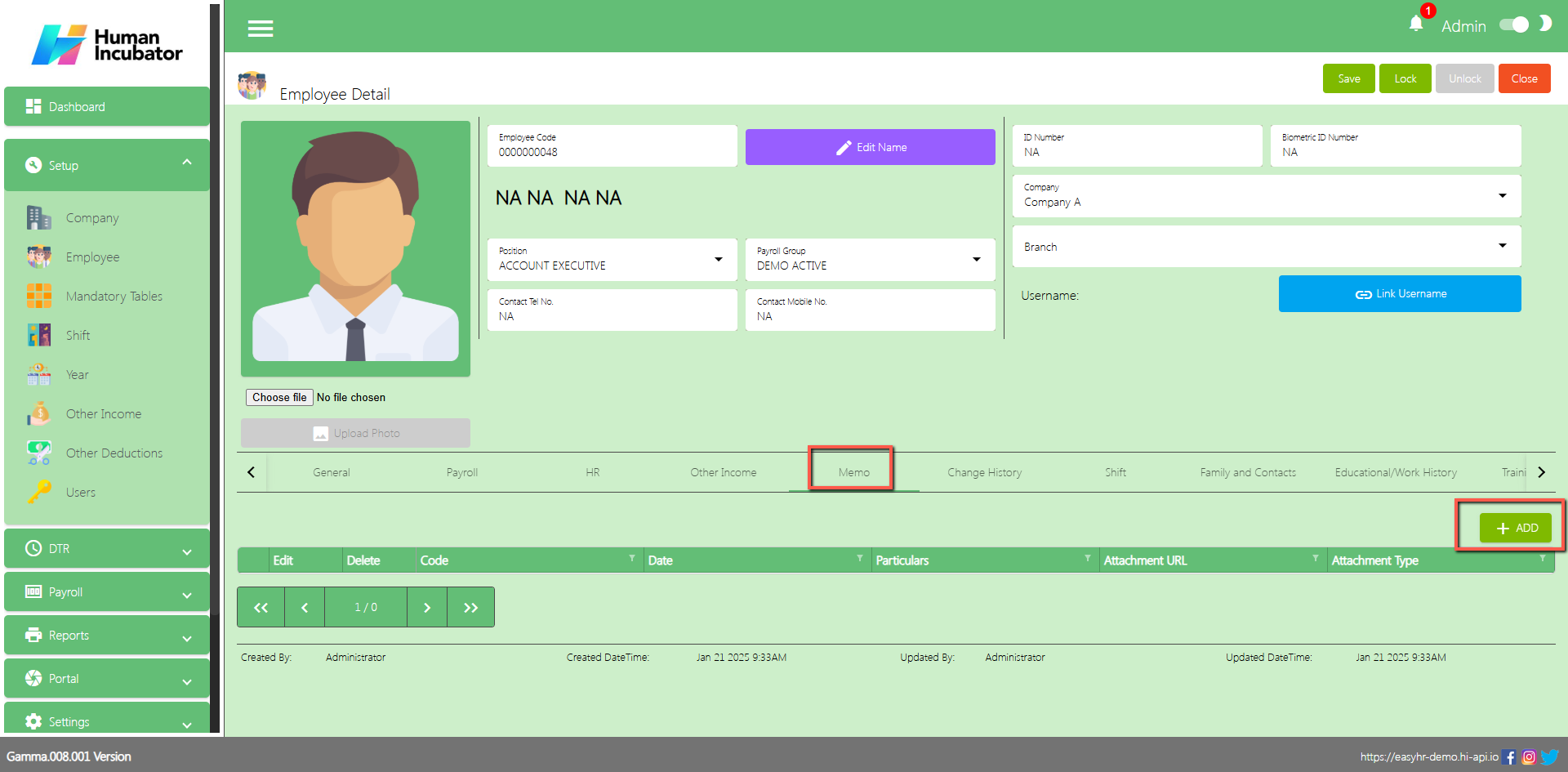

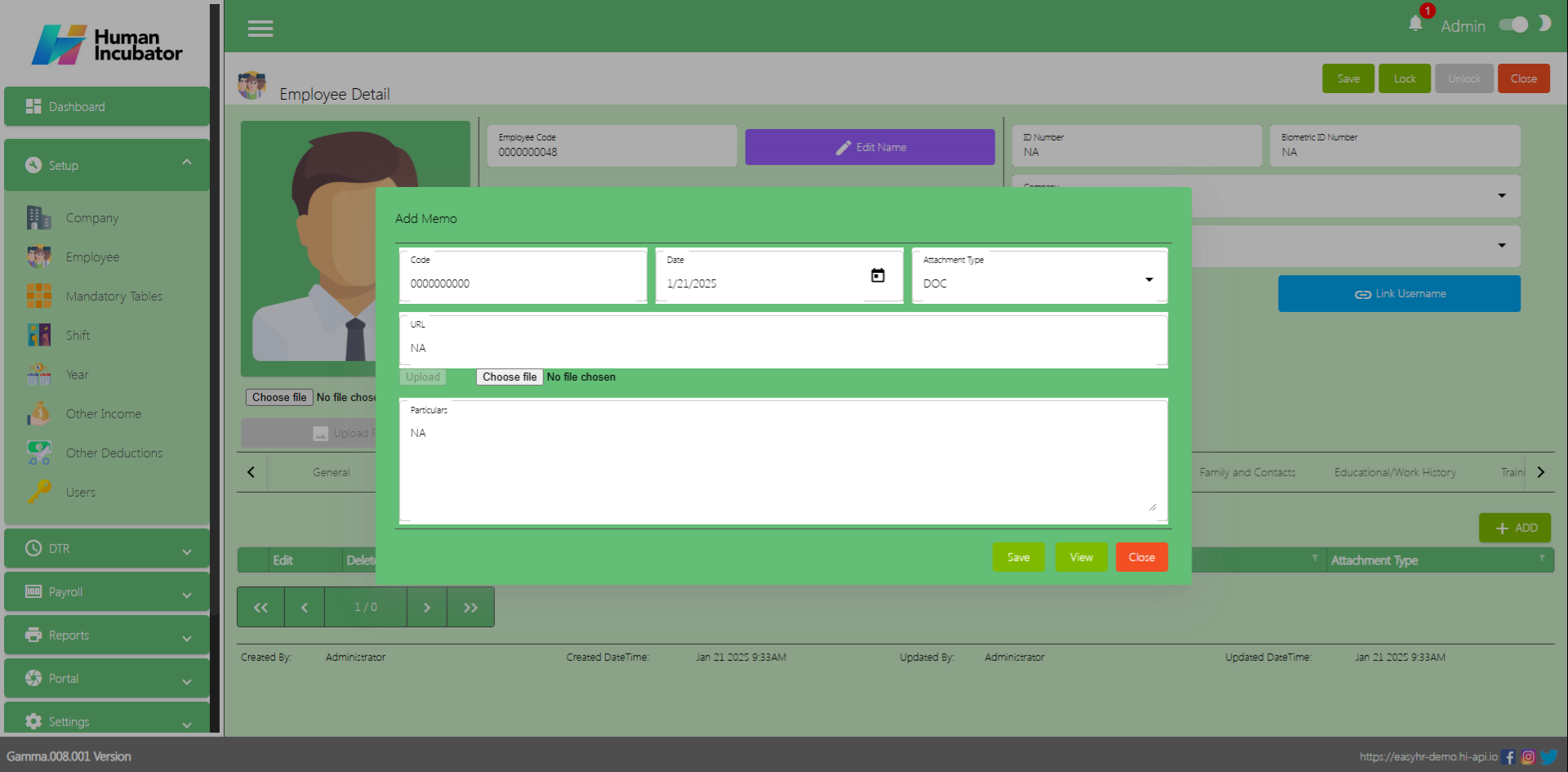

Memo

In Memo tab the user can Add the file for employee

- Select Date

- Select Attachment Type and Choose file

- Input Particulars if Necessary

- Can click View button

- Click Save button to Add in Memo table

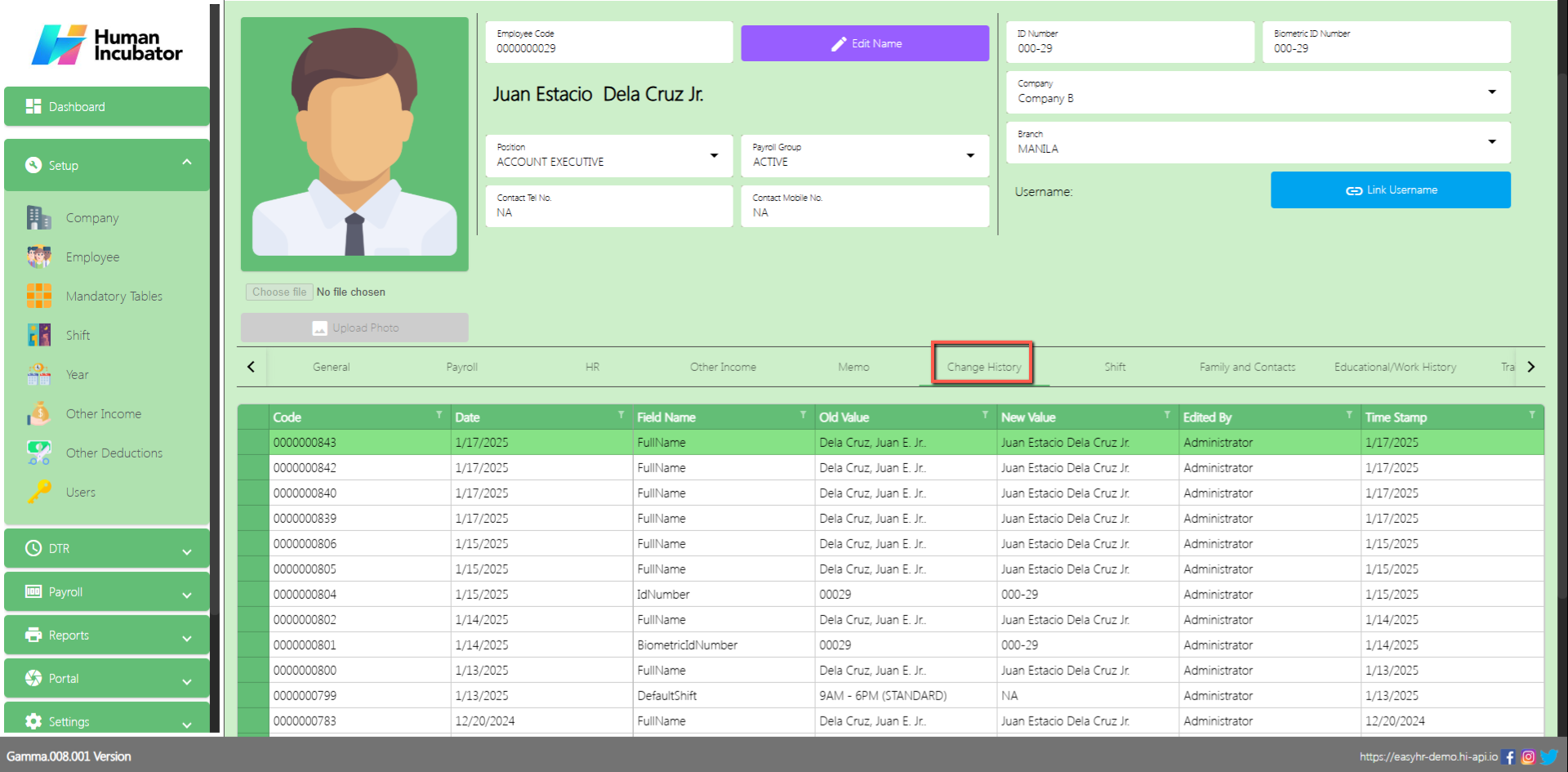

Change History

In the Change History tab the user can identify what are those changes in employee 201 or employee detail.

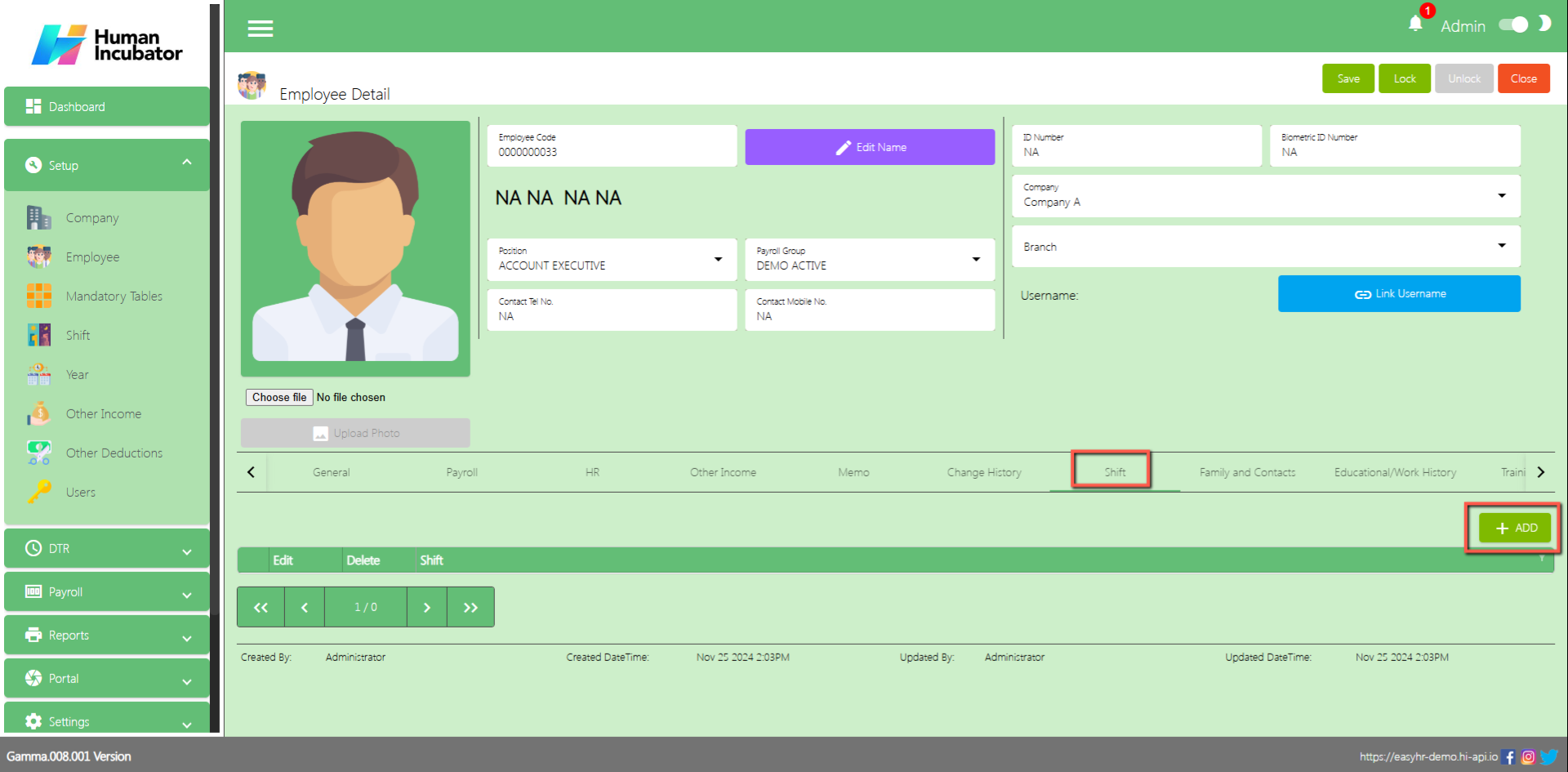

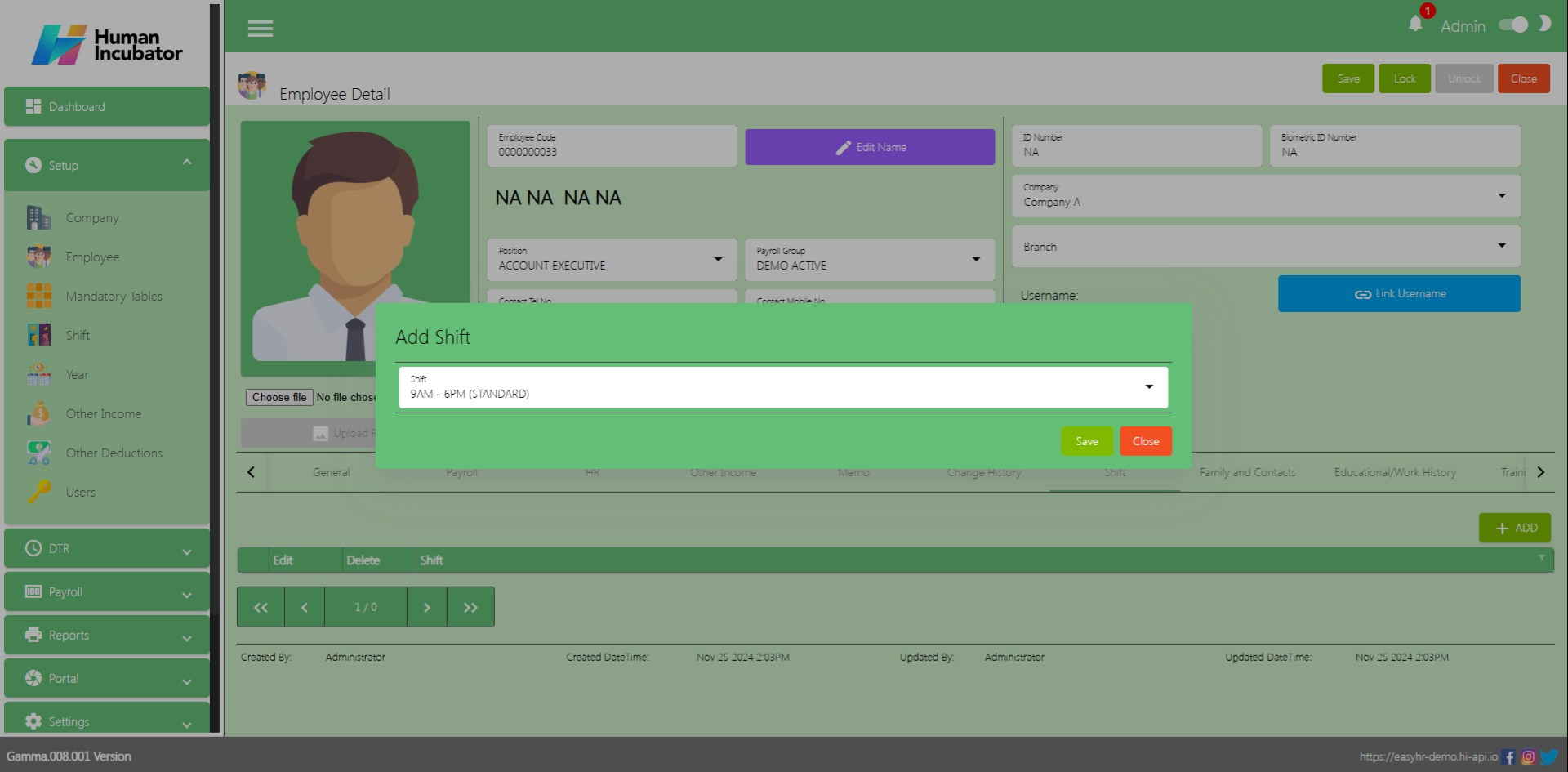

Shift

In Shift tab the user can Add other shift of employee

- Select Shift

- Click Save button to add in Shift table

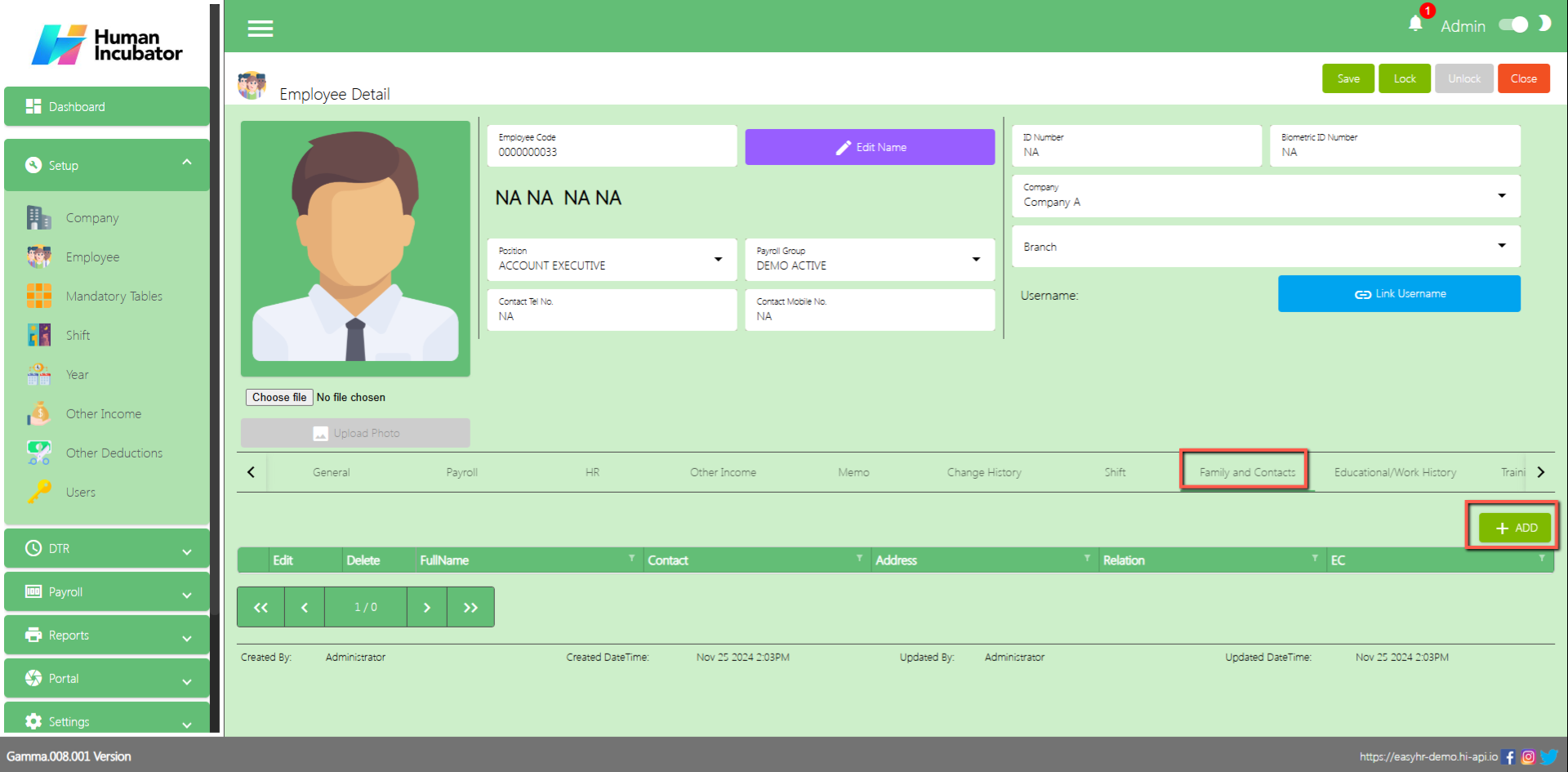

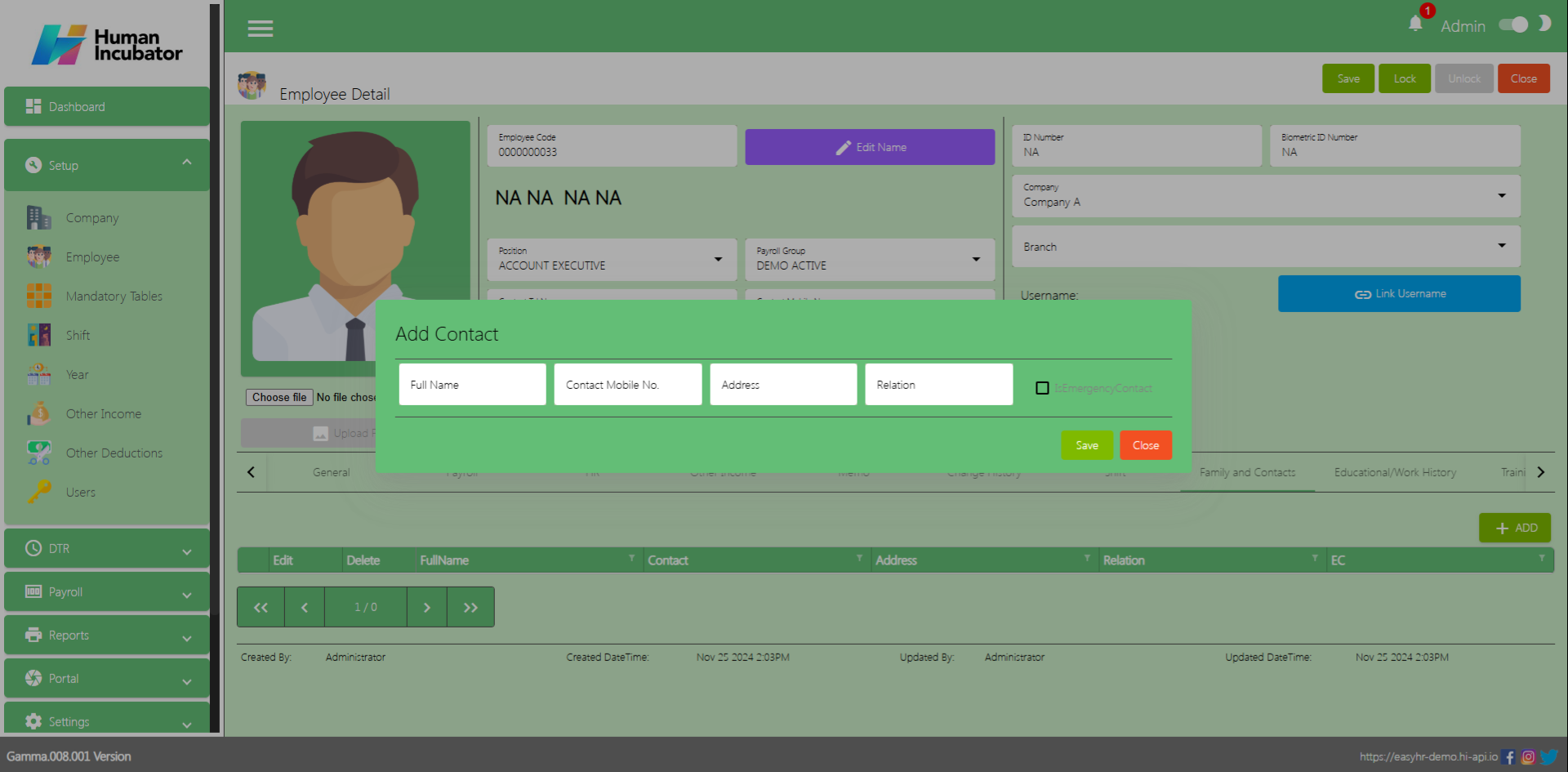

Family and Contacts

In Family and Contacts tab the user can Add contacts for his family

- Input Fullname

- Input Contact No.

- Input Address

- Input Relation

- Check “IsEmergencyContact”

- Click Save button to Add in table

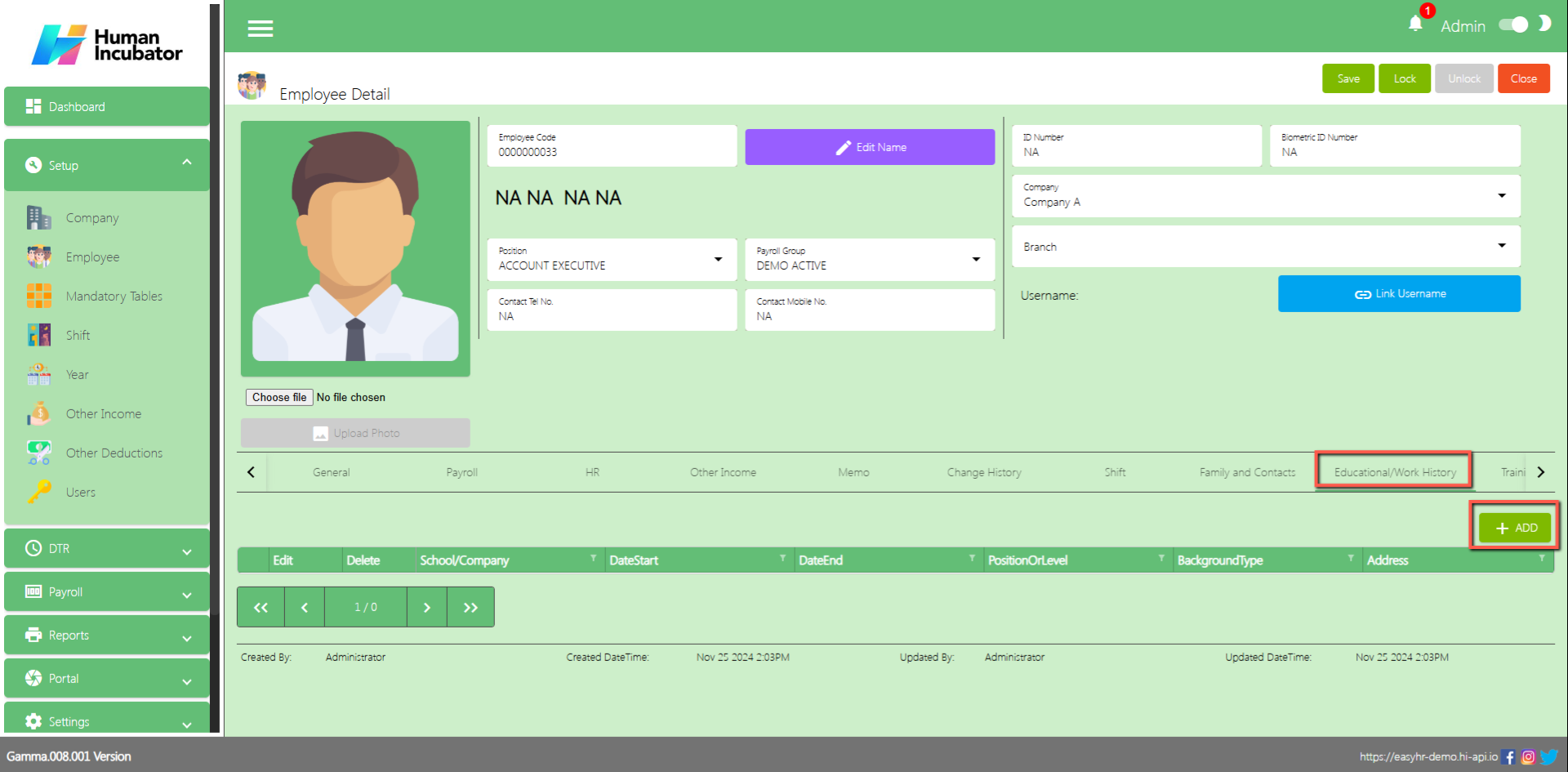

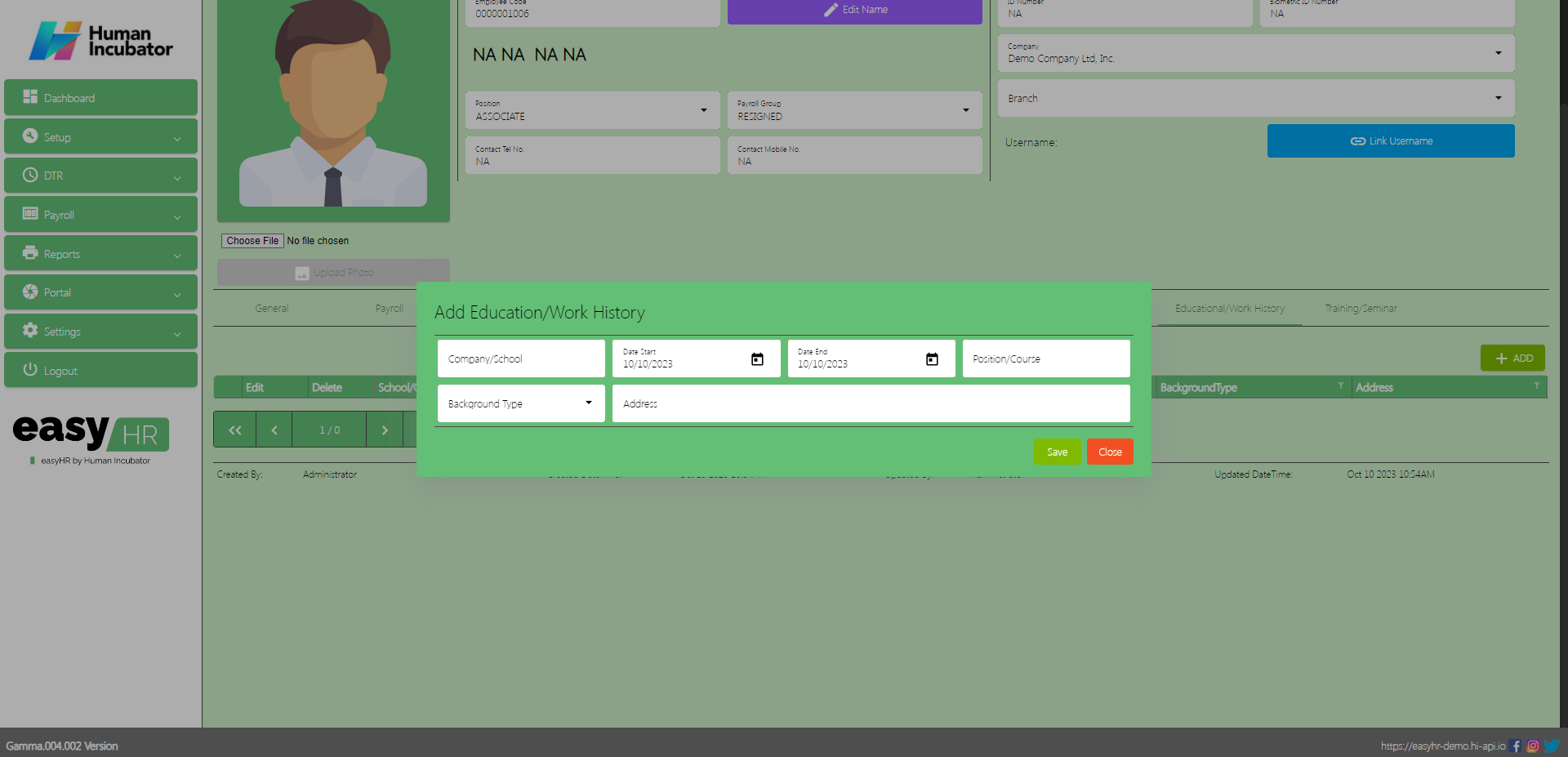

Educational/Work History

In Educational/ Work History tab the user can Add the educational attainment and Work History

- Input Company/School

- Select Date Start

- Select Date End

- Input Position/Course

- Select Background Type

- Input Address

- Click Save button to Add in table

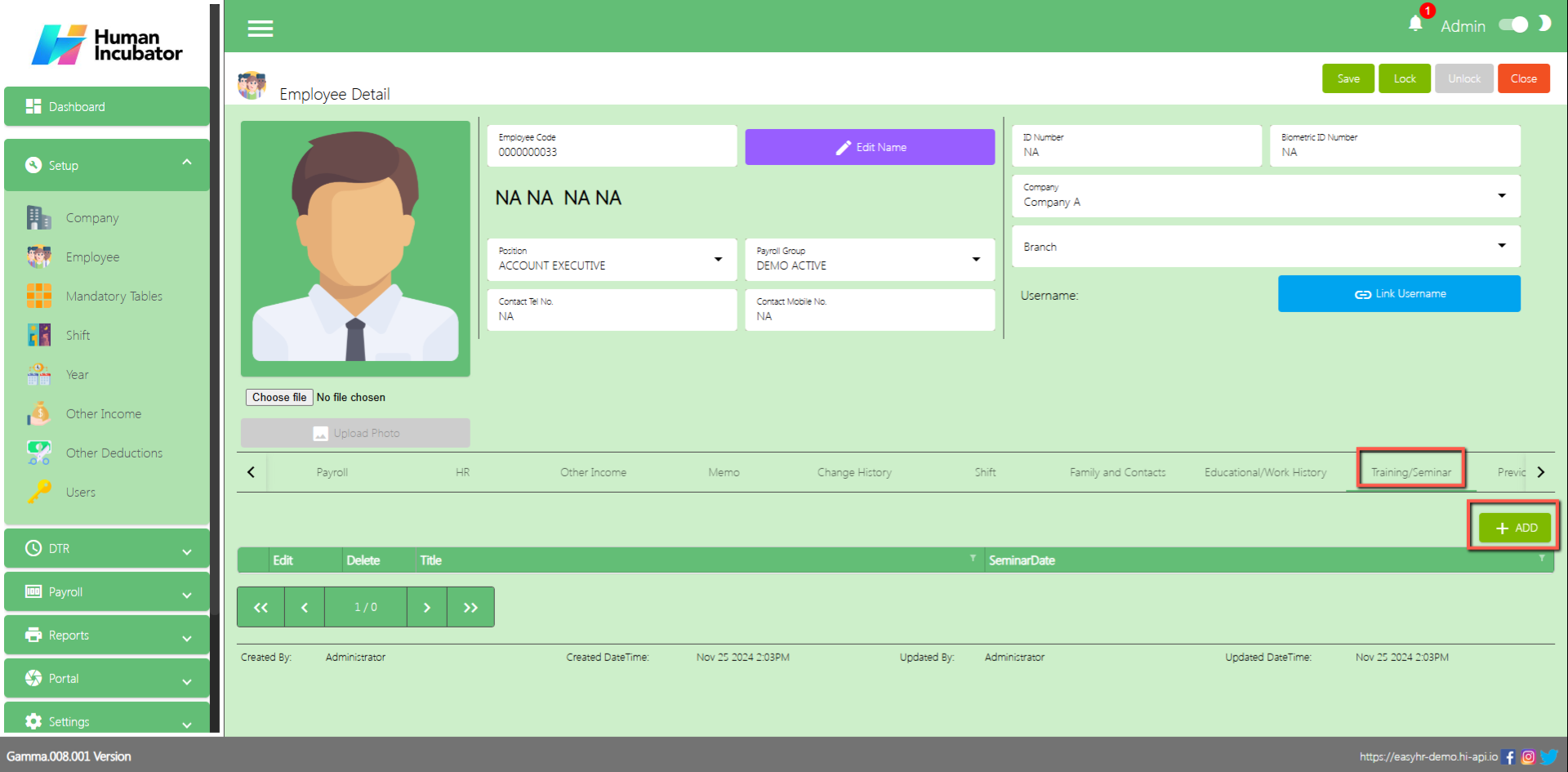

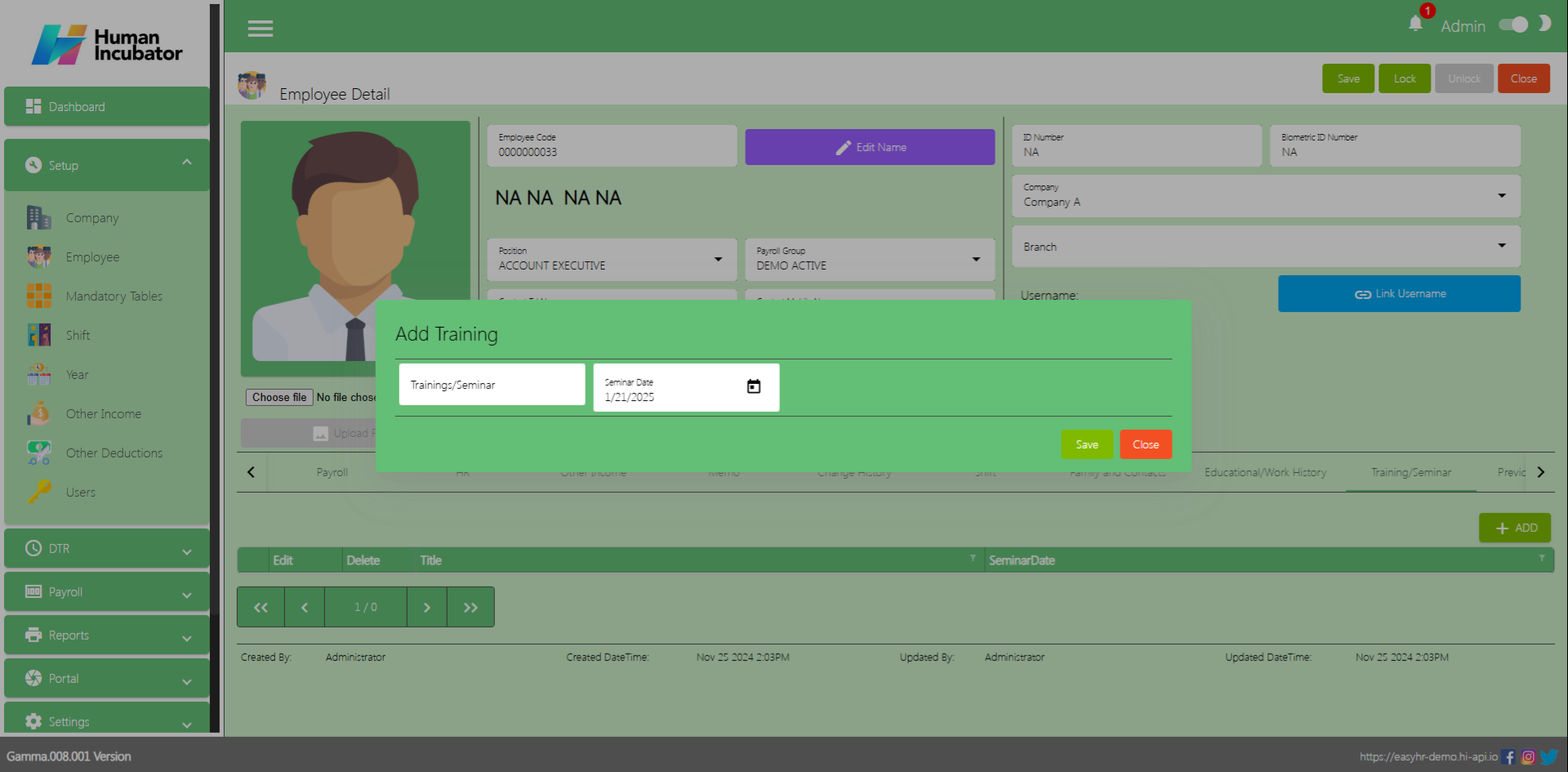

Training/Seminar

In Training/Seminar tab the user can Add if the employee has a seminar

- Input Training/Seminar name

- Select Seminar Date

- Click Save button to Add in table

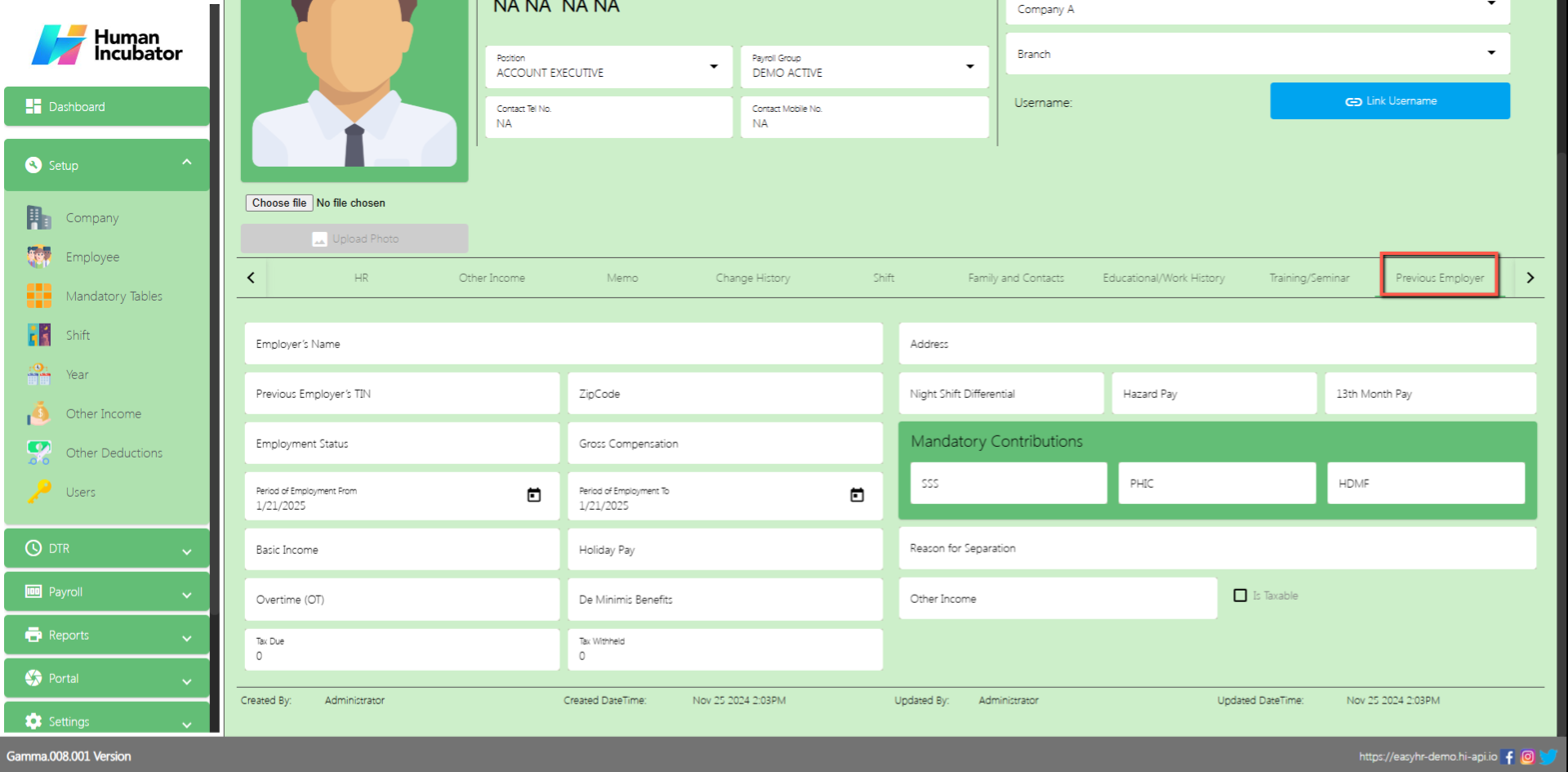

Previous Employer

You can add the Previous Employer of the employee

- Input Employer’s name (Company Name)

- Input Previous Employer’s TIN

- Input Employment Status

- Input Zipcode

- Input Gross Compensation

- Select Period of Employment from

- Select Period of Employment to

- Input Basic Income

- Input Overtime(OT)

- Input Tax Due

- Input Holiday Pay

- Input De Minimis Benefits

- Input Tax Withheld

- Input Address

- Input Night Differential

- Input Hazard Pay

- Input 13 Month Pay

- Input Mandatory Contributions (SSS,PHIC,HDMF)

- Input Reason of Separation

- Input Other Income

- Check Is Taxable if it is taxable

Save/Lock

- Make sure to save/lock the record so that in every transaction the employee details will show.

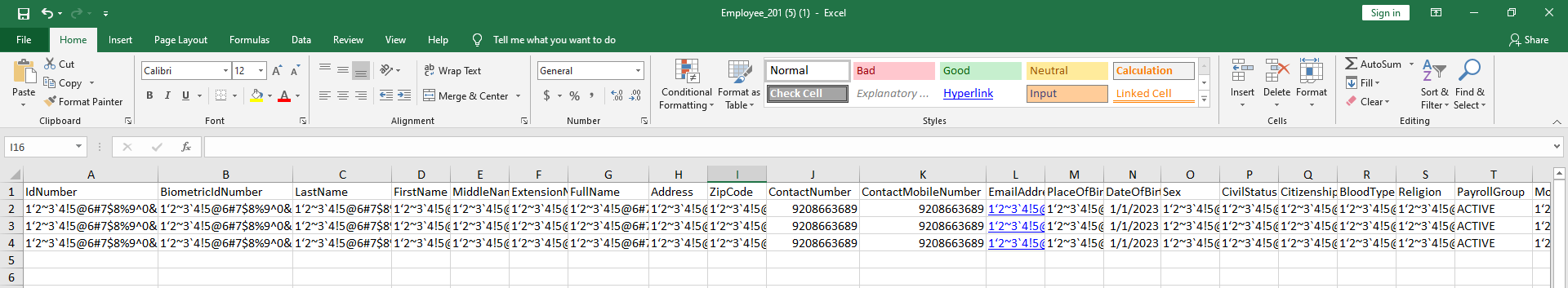

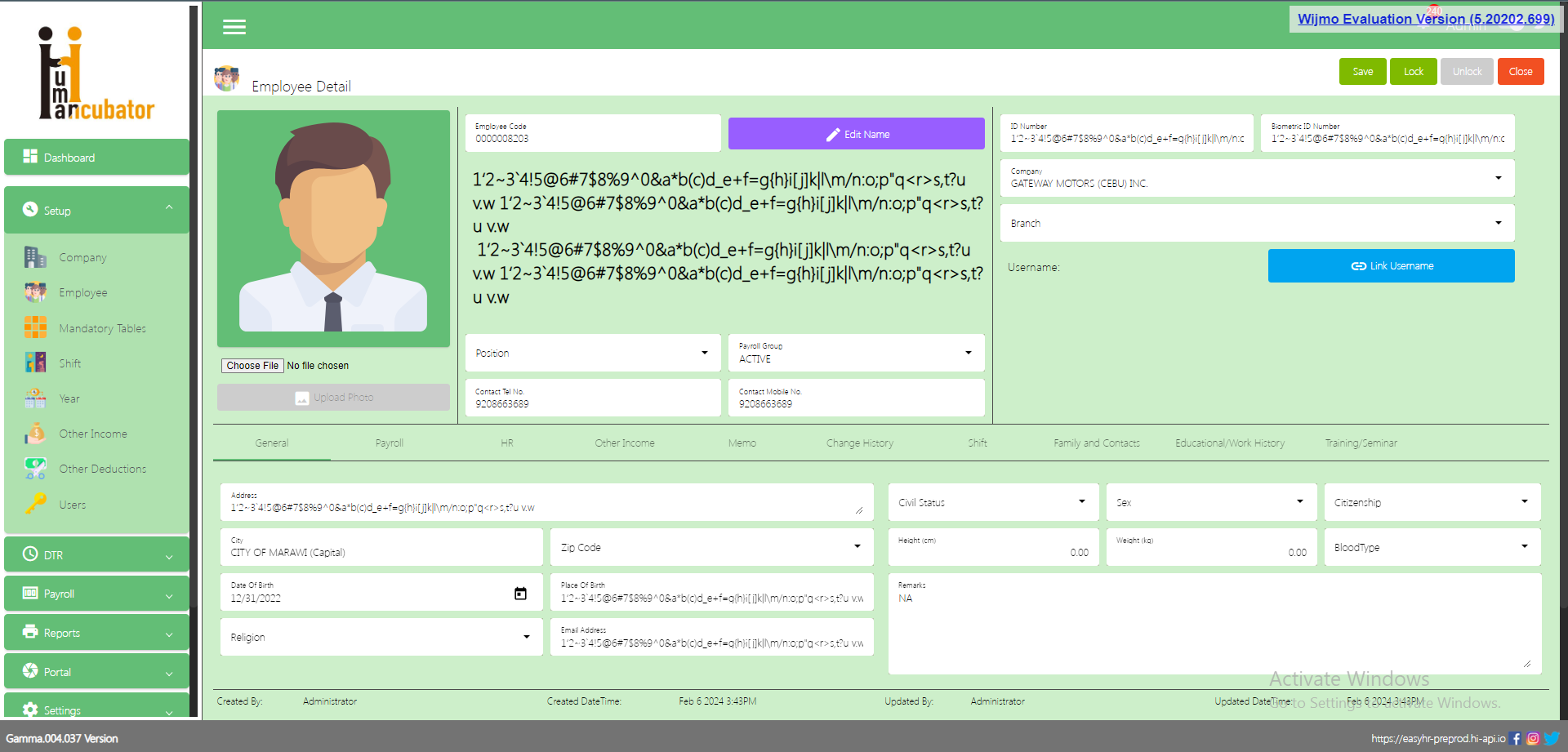

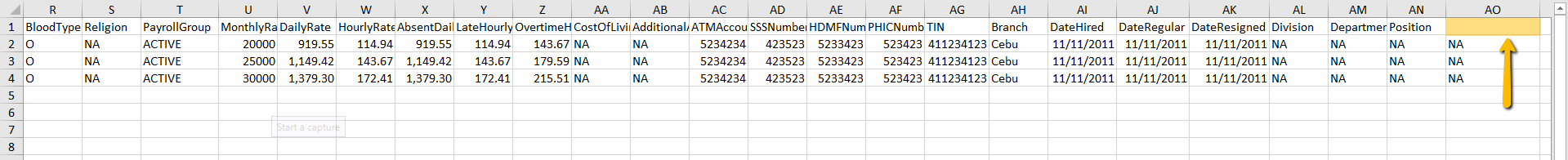

Employee Special Characters Importing

- Input special Characters in all the fields that is not Integer required

- Import in the Employee 201

- Can now accept Special Characters

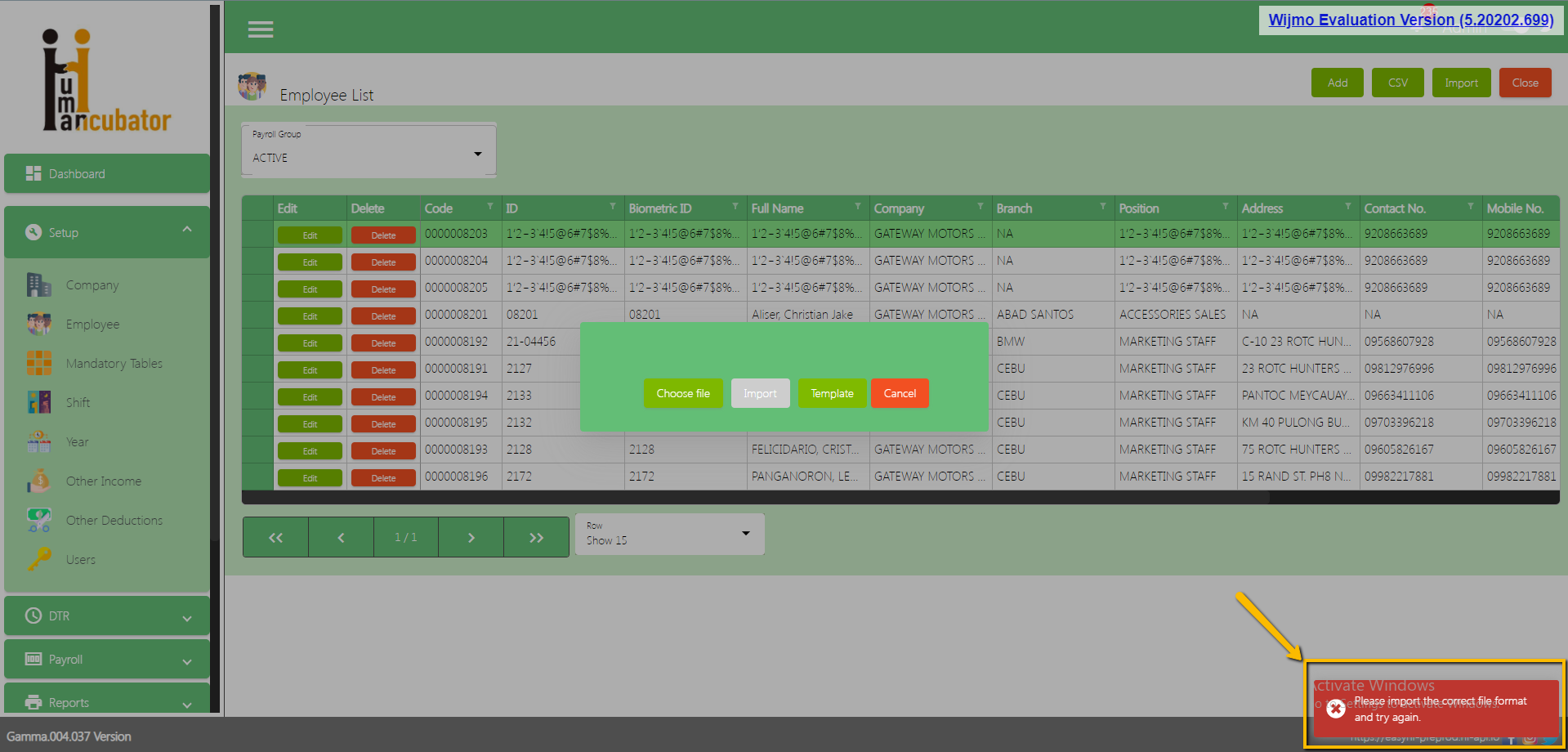

Import Employee Incorrect File format Error Message

- Delete column name “EmployeeStatus”

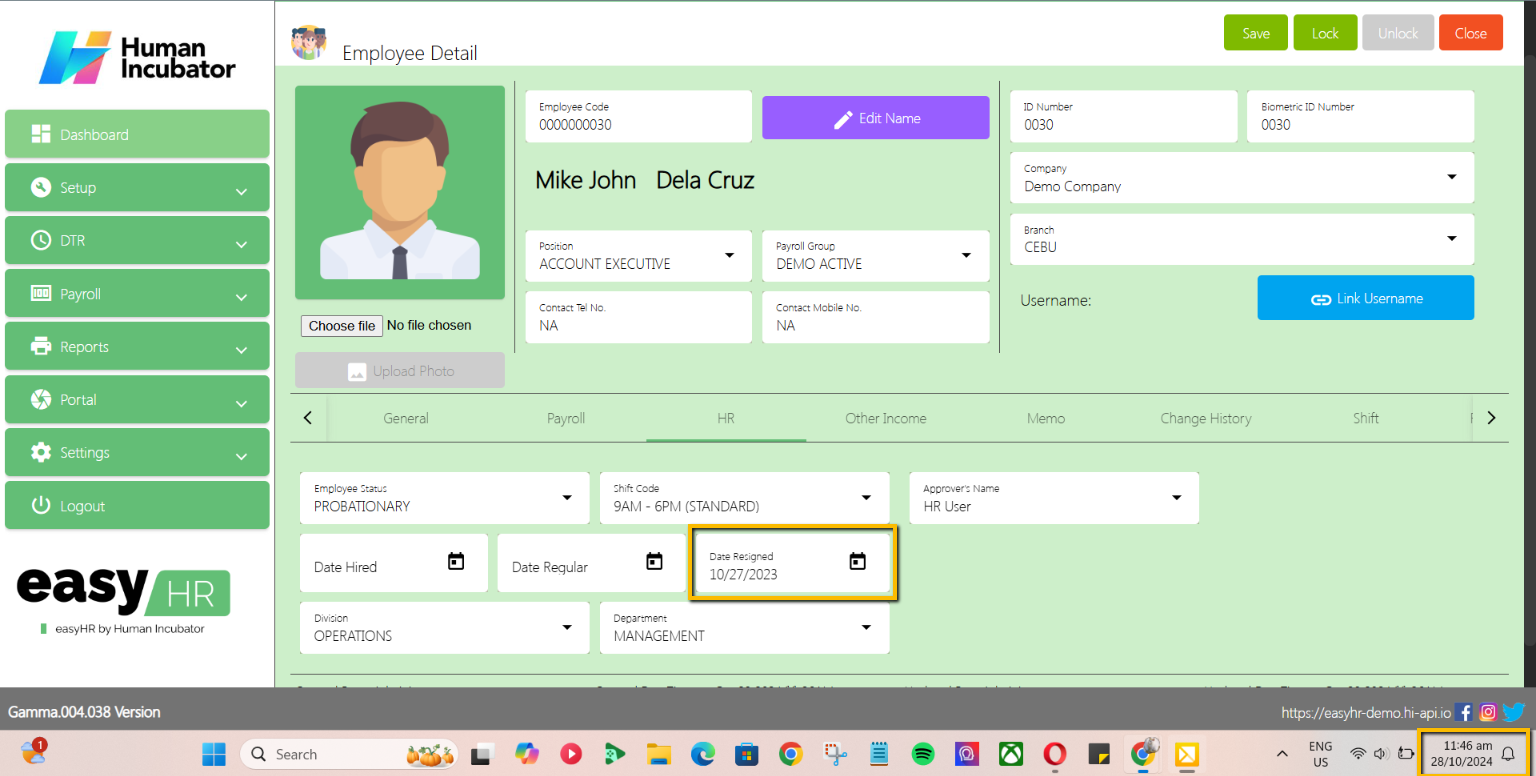

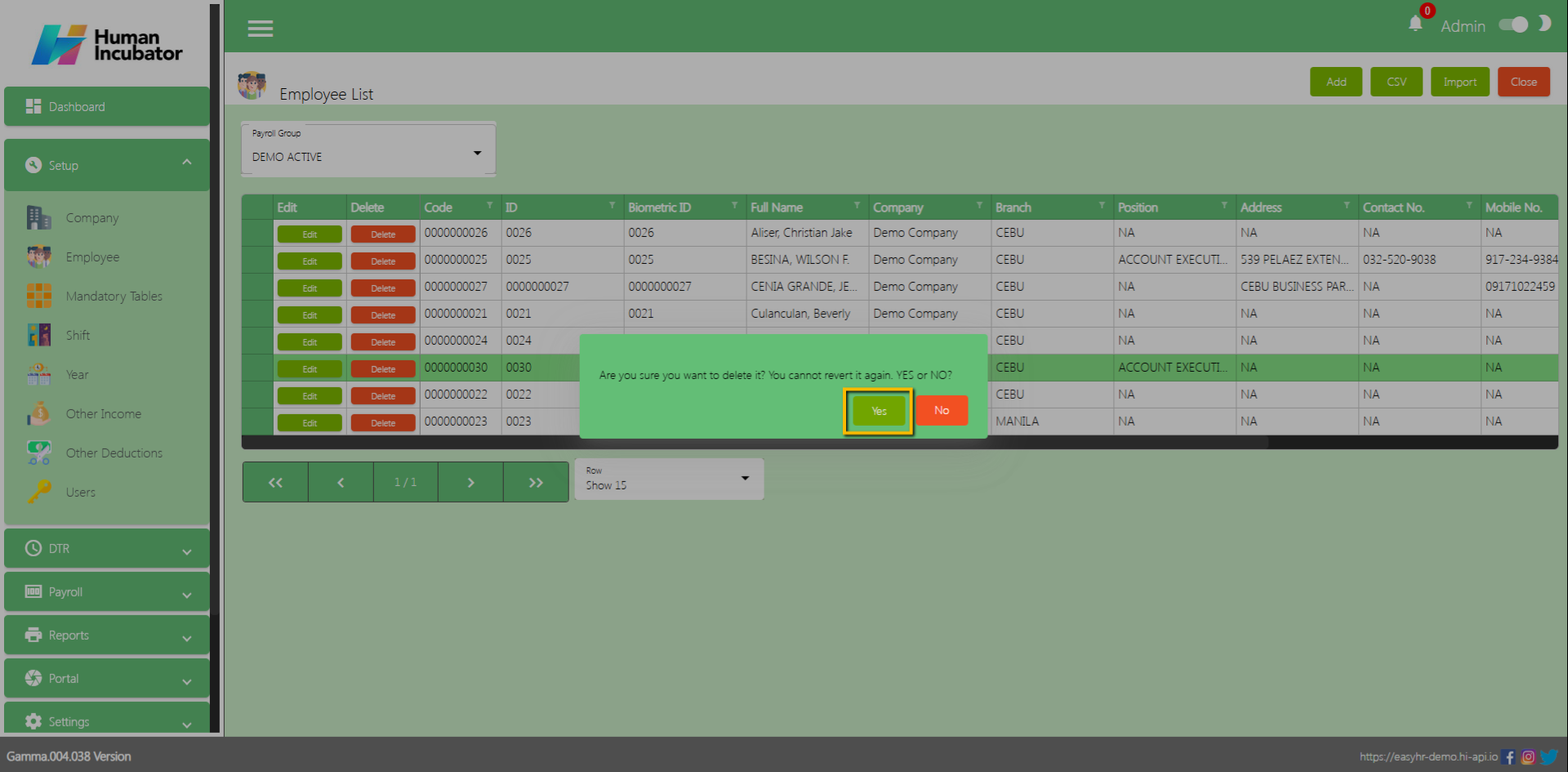

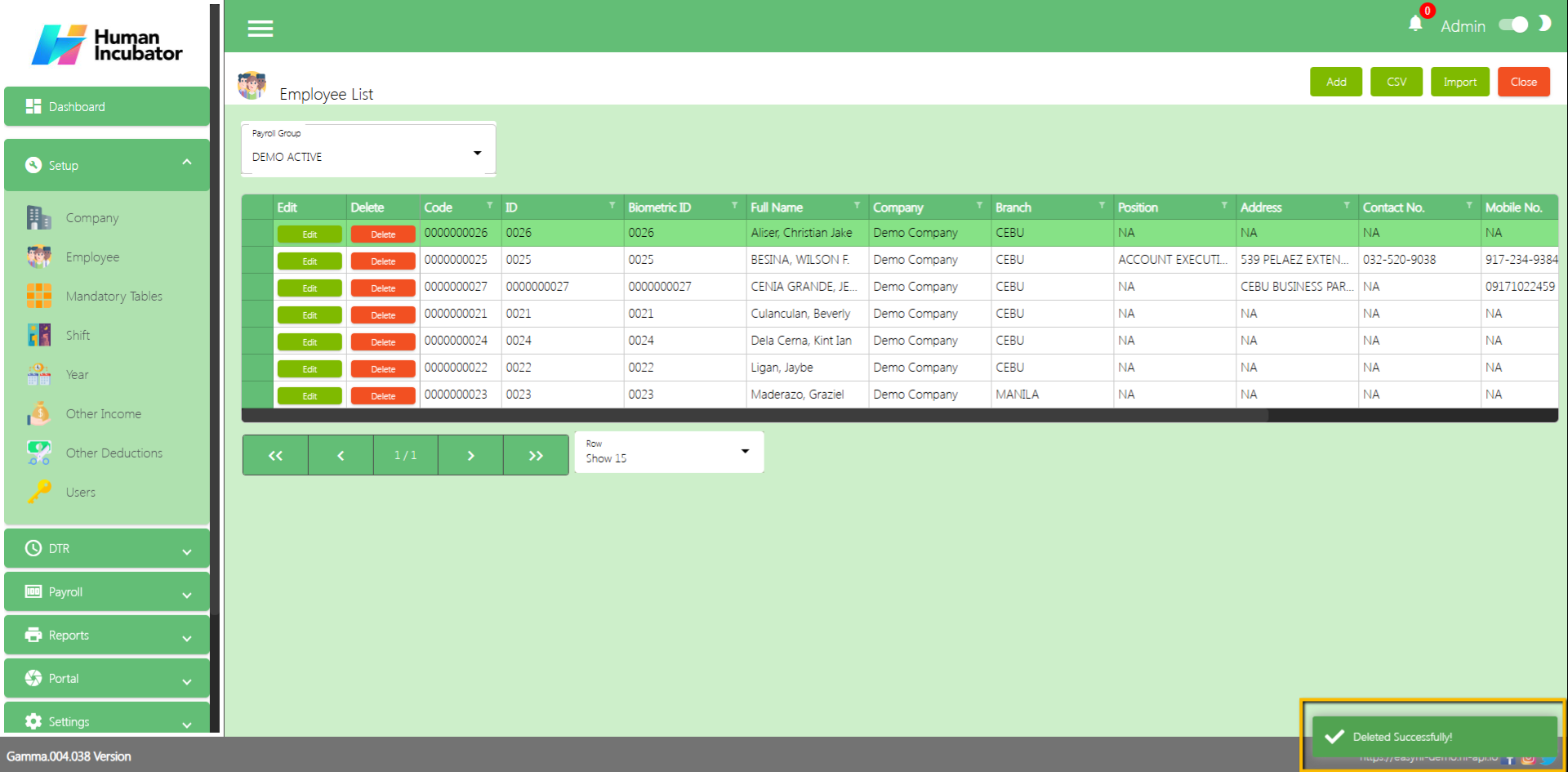

Employee Soft Delete

If the employee’s resignation date was at least a year ago from the present date you can soft delete the employee in the employee 201

- Click Yes for the Confirmation “Are you sure you want to delete it? You cannot revert it again. YES or NO?”

- Employee can be deleted from the employee 201

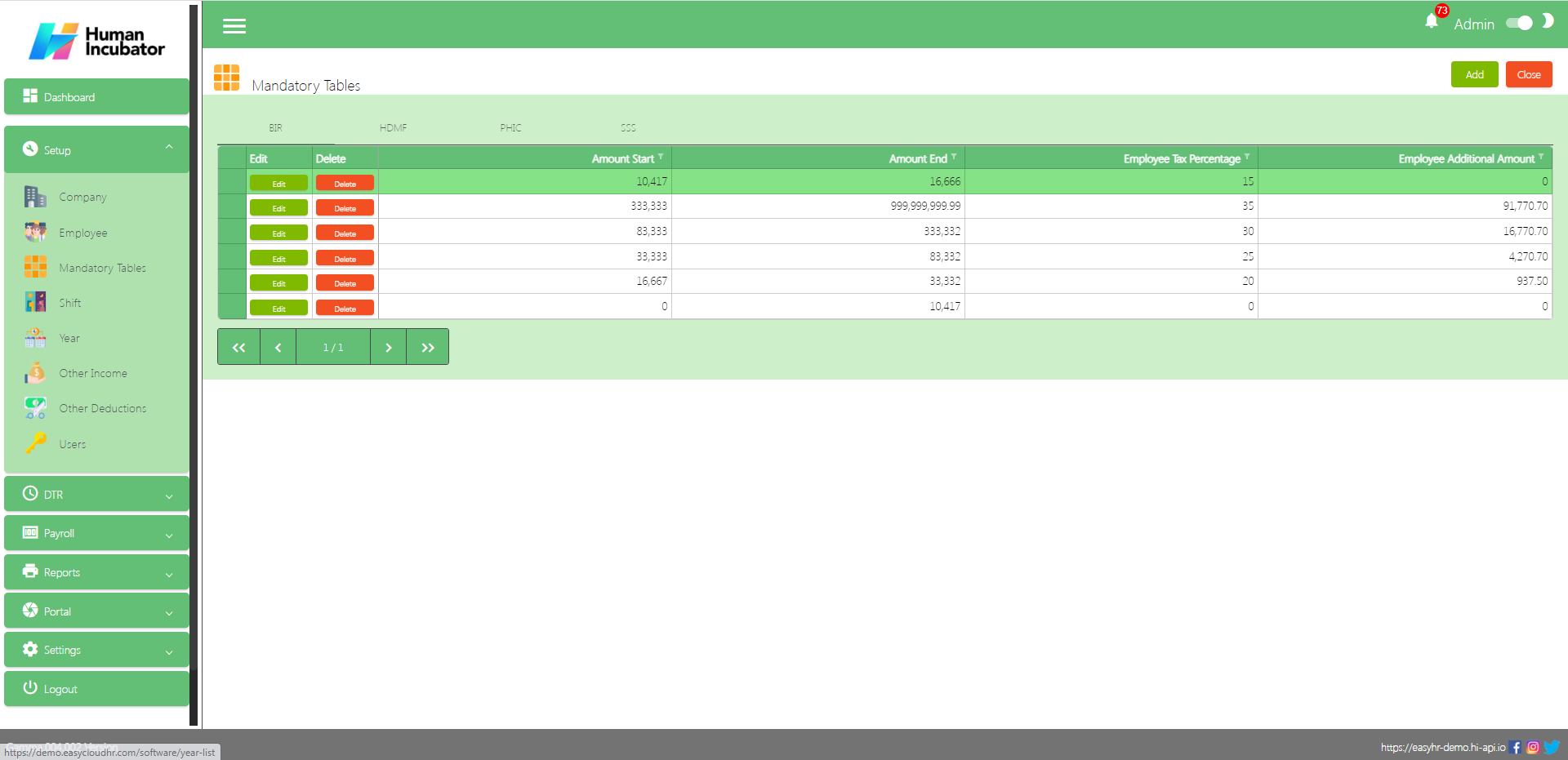

Mandatory Tables

Overview

Mandatory table is used for mandatory deduction for employee

Note: Please do not change the mandatory table it’s all based on the government mandate (Update the range mandatory deduction if there is changes in government mandate )

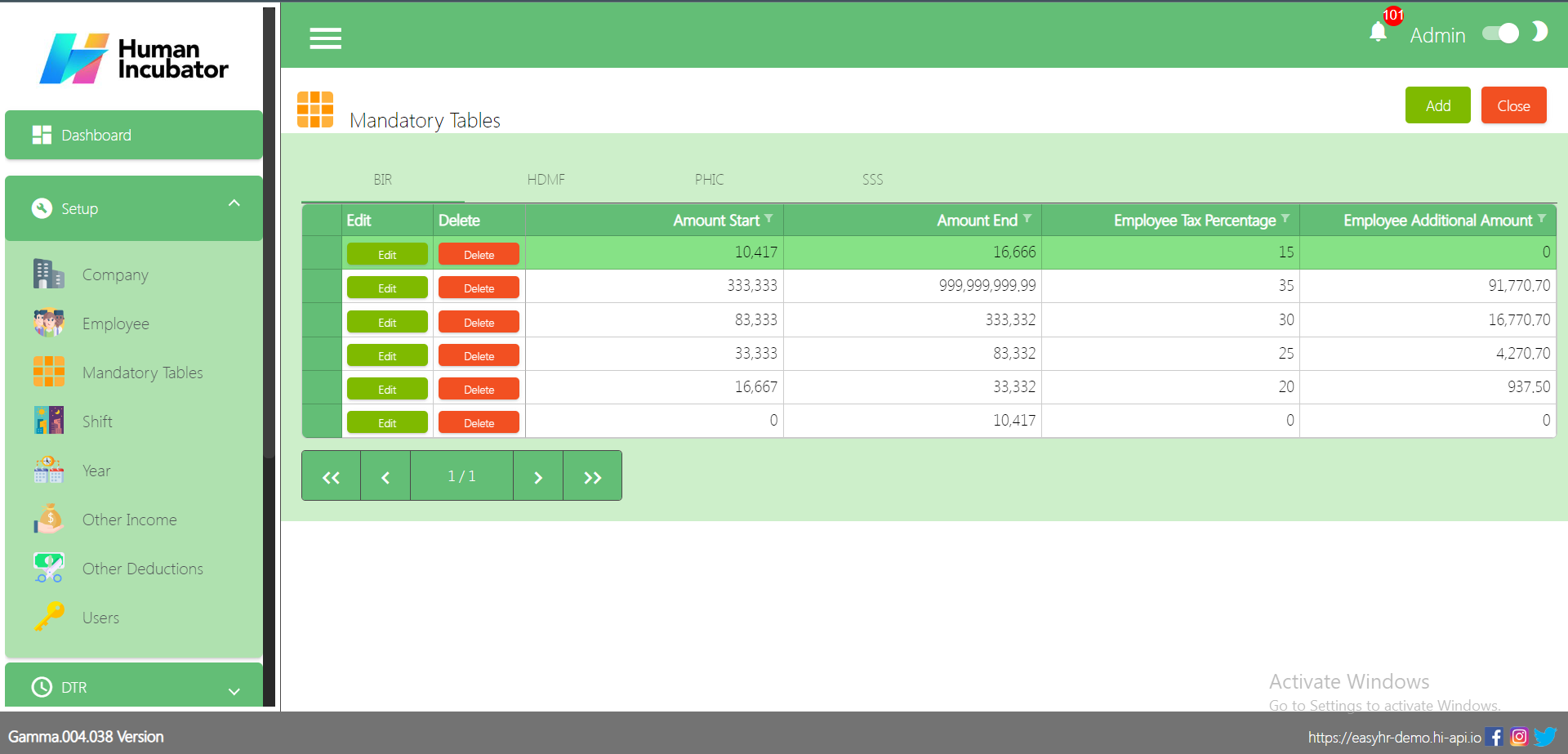

BIR Mandatory

BIR Mandatory is based on the Employee’s Payroll Rate

Column Table

- Edit: This is a button that has the function to edit the mandatory per line

- Delete: This is a button that has the function to Delete the mandatory per line

- Amount Start: This is the Range for the Employees Payroll Rate

- Amount End: This is the Range for the Employees Payroll Rate

- Employee Tax Percentage: Tax Percentage according to the Employees Payroll Range

- Employee Additional Amount: Additional Amount according to the employee’s Payroll Range

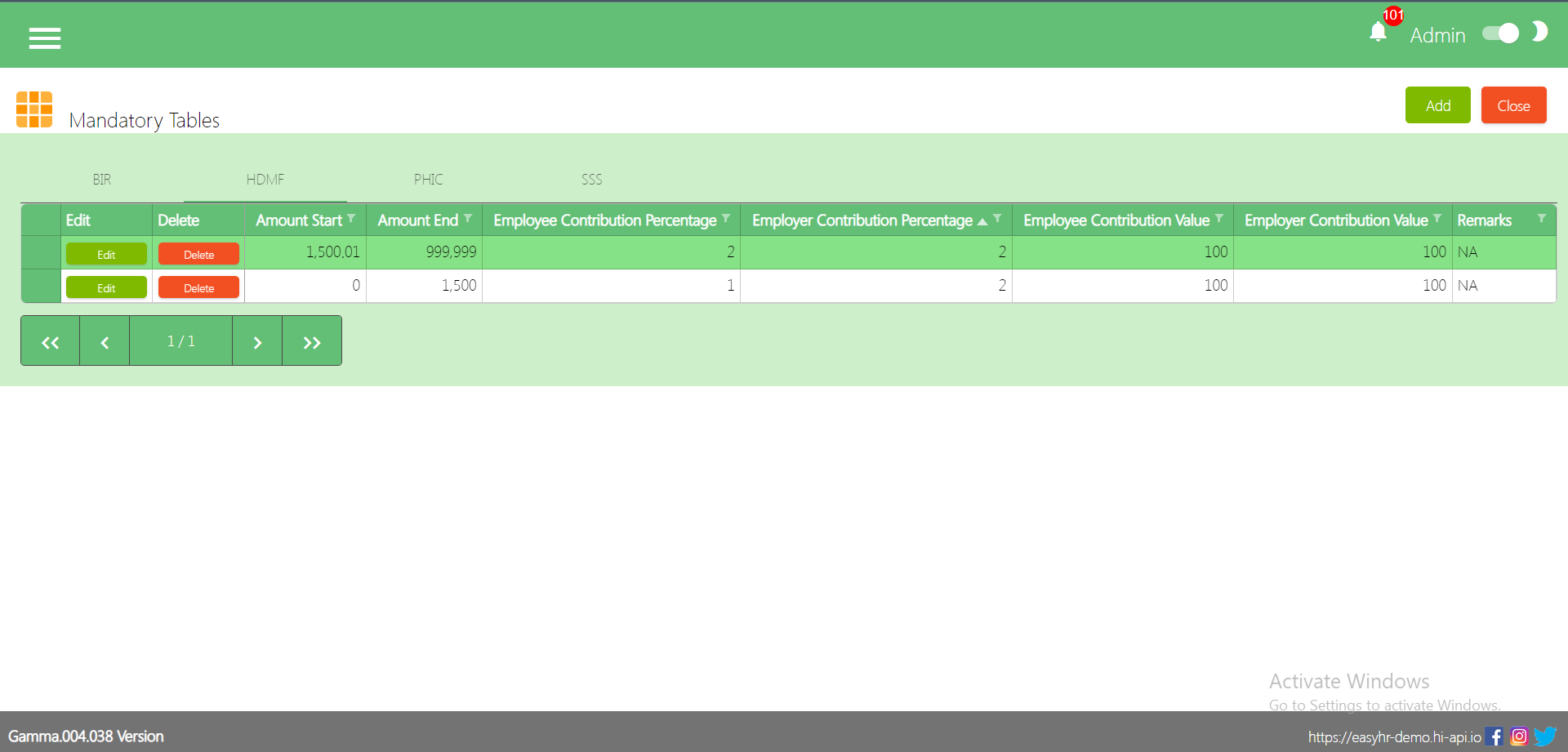

HDMF Mandatory

HDMF Mandatory is based on the Employee’s Payroll Rate

Column Table

- Edit: This is a button that has the function to edit the mandatory per line

- Delete: This is a button that has the function to Delete the mandatory per line

- Amount Start: This is the Range for the Employees Payroll Rate

- Amount End: This is the Range for the Employees Payroll Rate

- Employee Contribution Percentage: Contribution Percentage according to the Employees Payroll Range

- Employer Contribution Percentage: Contribution Percentage according to the Employer’s Payroll Range

- Employee Contribution Value: Contribution Value according to the employees Payroll Range

- Employer Contribution Value: Contribution Value according to the employer’s Payroll Range

- Remarks: You can input any remarks

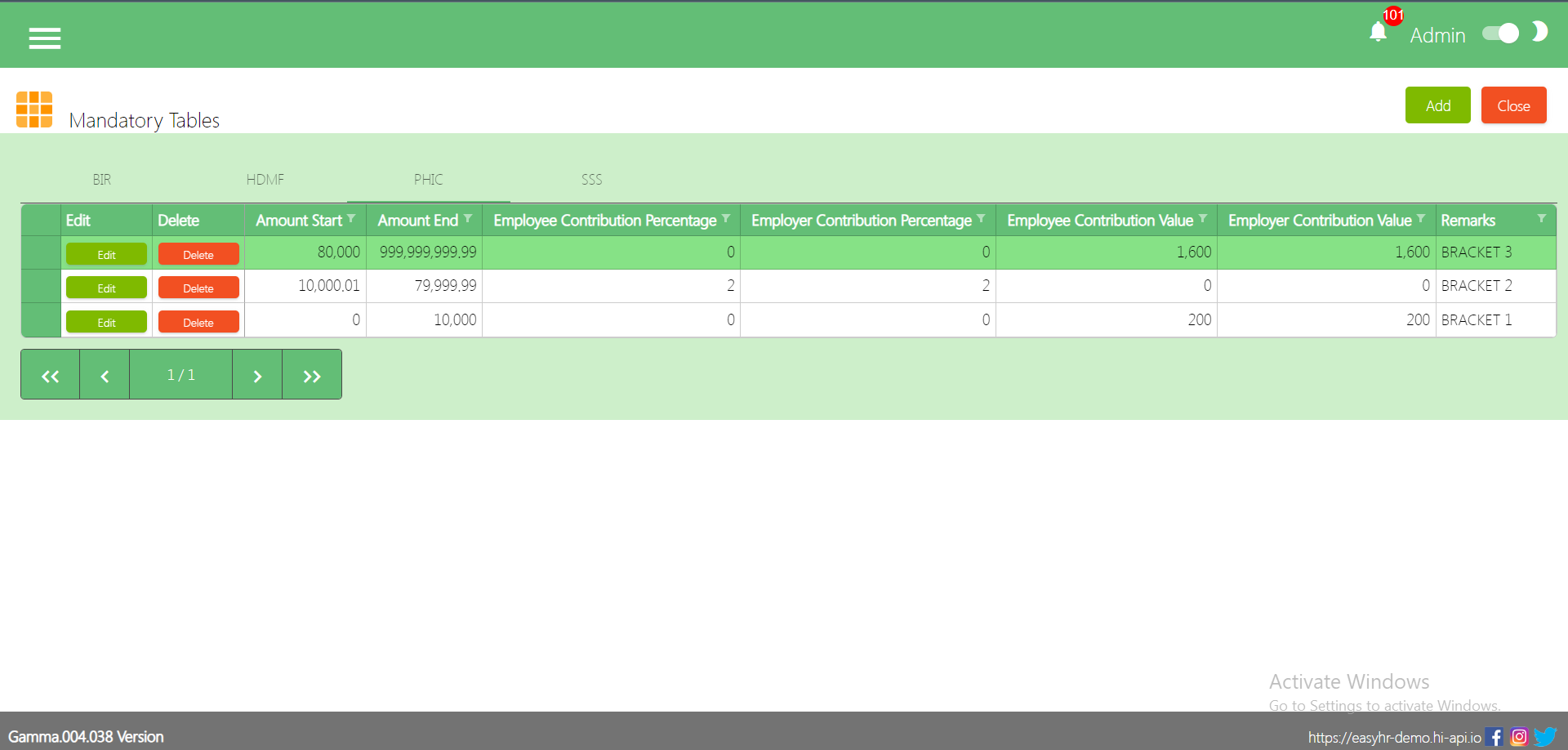

PHIC Mandatory

PHIC Mandatory is based on the Employee’s Payroll Rate

Column Table

- Edit: This is a button that has the function to edit the mandatory per line

- Delete: This is a button that has the function to Delete the mandatory per line

- Amount Start: This is the Range for the Employees Payroll Rate

- Amount End: This is the Range for the Employees Payroll Rate

- Employee Contribution Percentage: Contribution Percentage according to the Employees Payroll Range

- Employer Contribution Percentage: Contribution Percentage according to the Employer’s Payroll Range

- Employee Contribution Value: Contribution Value according to the employees Payroll Range

- Employer Contribution Value: contribution Value according to the employer’s Payroll Range

- Remarks: You can input any remarks

SSS Mandatory

SSS Mandatory is based on the Employee’s Payroll Rate

Column Table

- Edit: This is a button that has the function to edit the mandatory per line

- Delete: This is a button that has the function to Delete the mandatory per line

- Amount Start: This is the Range for the Employees Payroll Rate

- Amount End: This is the Range for the Employees Payroll Rate

- Employee Contribution Value: Contribution Value according to the employees Payroll Range

- Employer Contribution Value: contribution Value according to the employer’s Payroll Range

- Employer EC Value: This is also part of the Employers Contribution

- Remarks: You can input any remarks

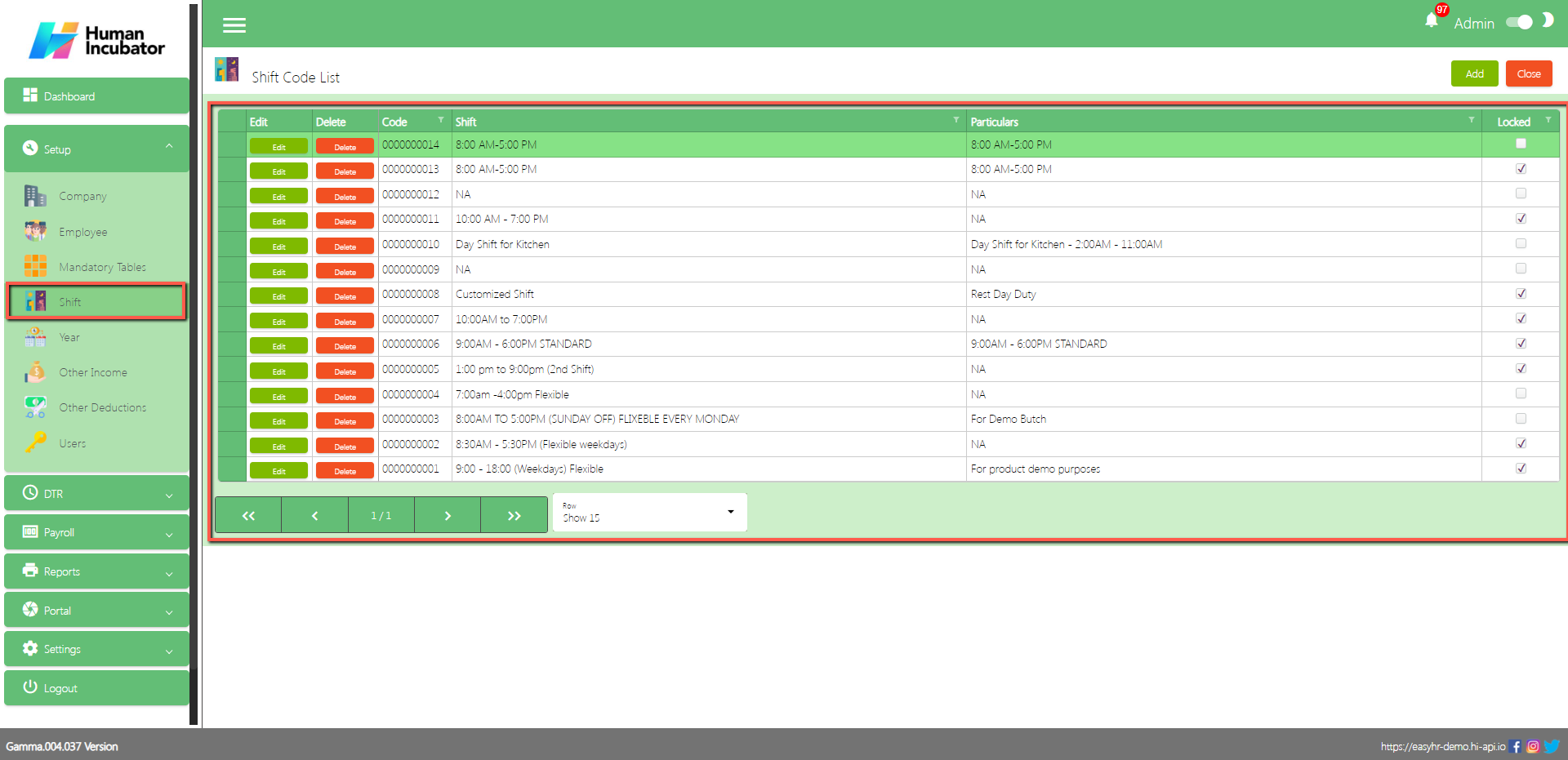

Shift

Overview

Shift setup is used for Shift schedule for employees and also the user can add more shift base in company shift schedule.

Shift Code List

Shows all list of shift schedule

Column Table:

- Edit: This has a function to Edit the Shift

- Delete: This has a function to Delete the Shift

- Code: This code will automatically generate according to the sequence of the added shift

- Shift: The name of the shift

- Particulars: in the Particulars this is just like the remarks you can input any details

- Locked: If the Checkbox is checked then it is locked but if uncheck then it is unlocked. (Note: If the Shift is unlocked it will not show in the other module)

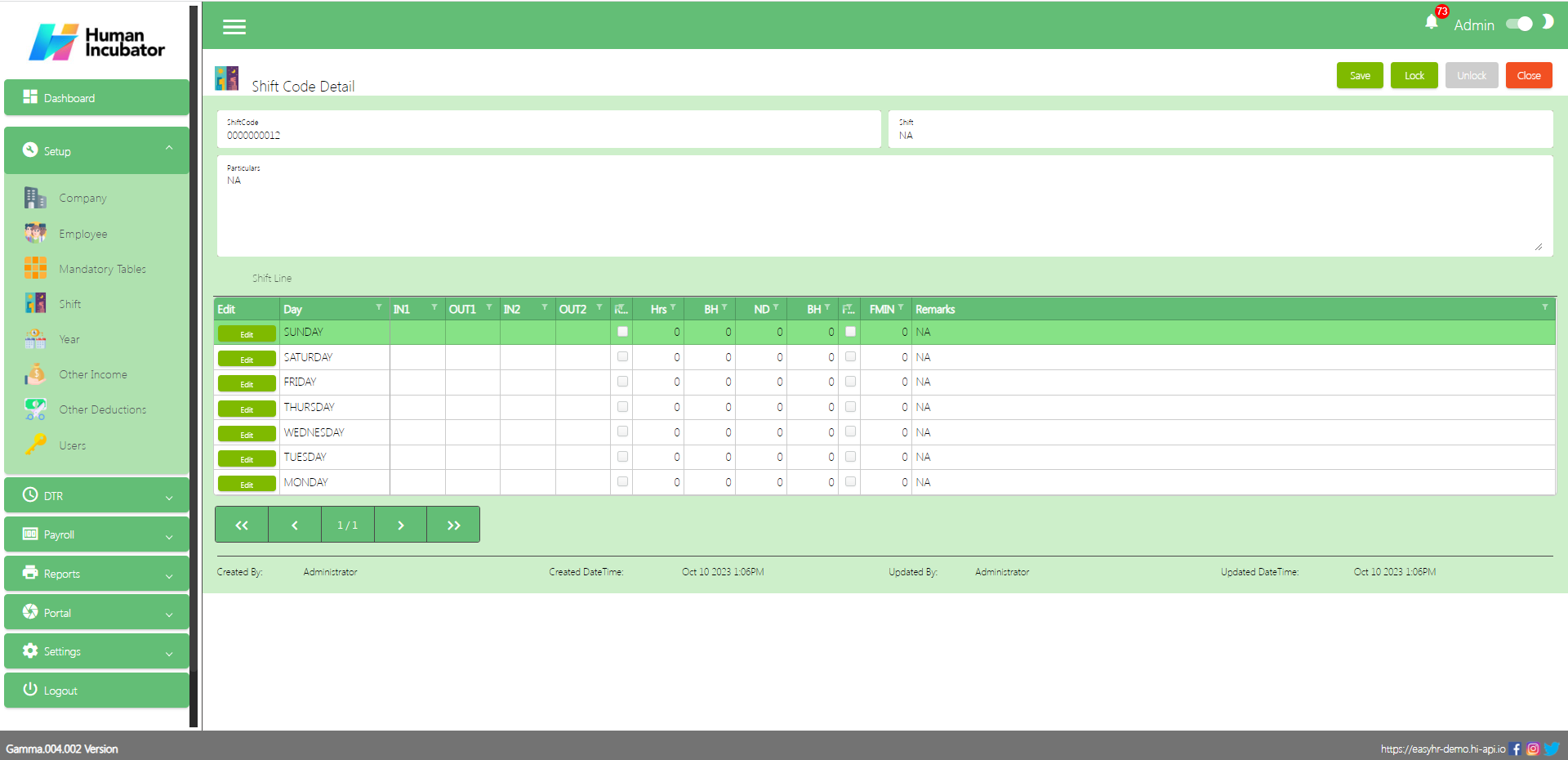

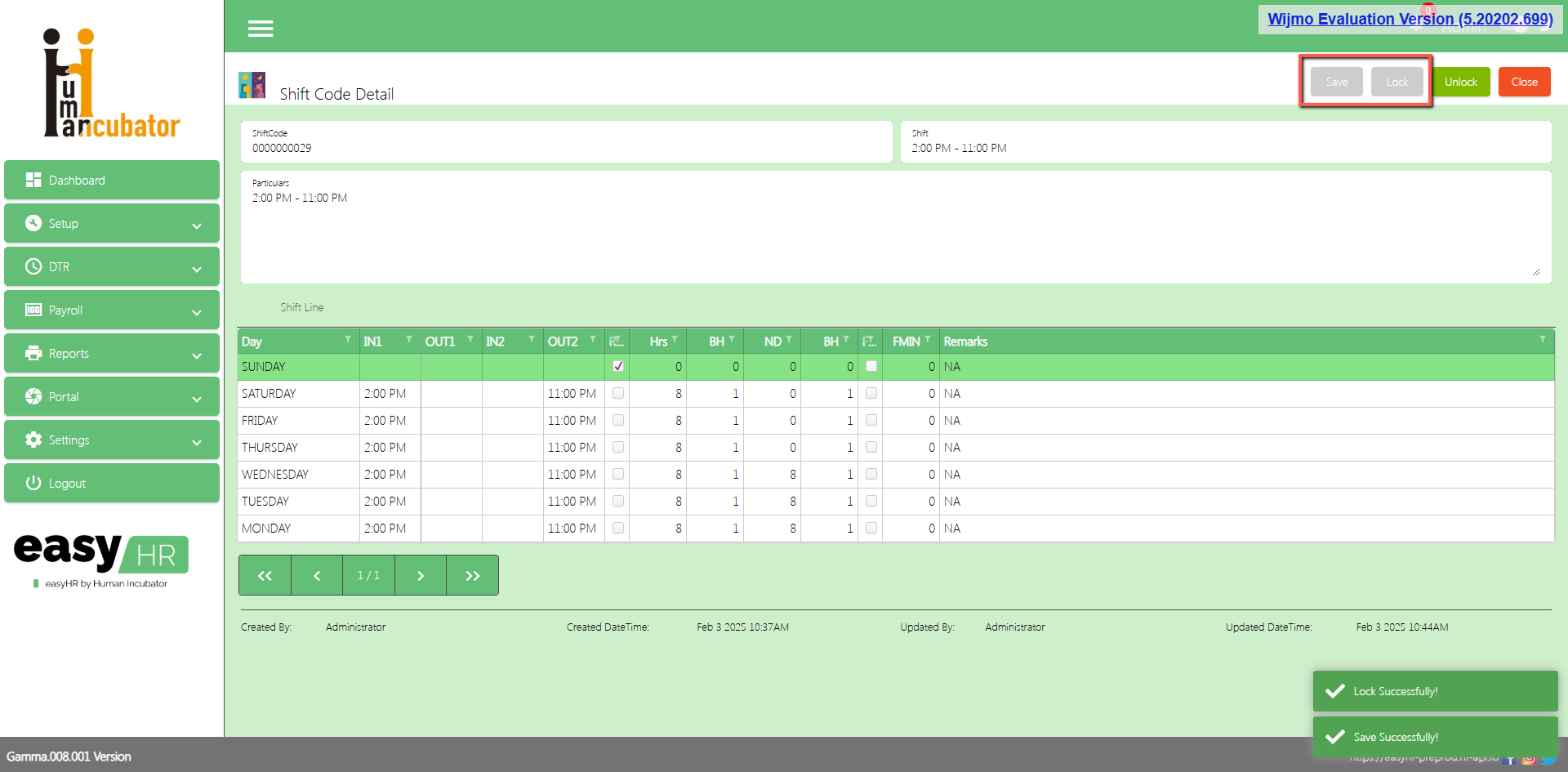

Shift Code Detail

Assumption: To Add a new shift, click the Add button that can be seen on the right side of the screen

Fill all the important fields for Shift Code Detail like:

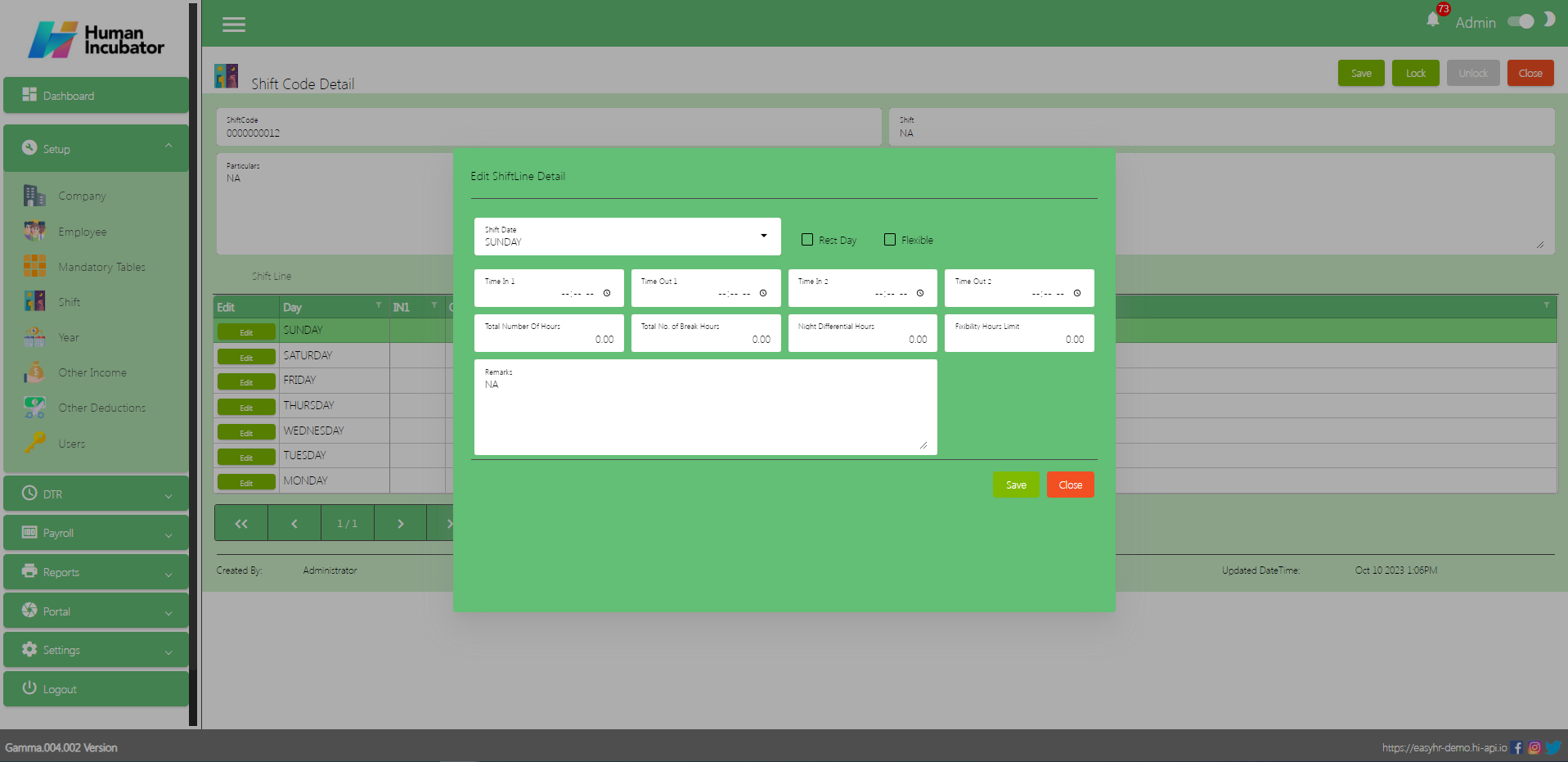

Shift Line

In Shift line the user need to click Edit to set the shift schedule of the employee ( Edit Sunday to Monday and set the Rest Day of employee )

- Input the Time In 1 hour and Time Out 2

- Input the Total Number of Hours

- Input the Total Number of break Hours

- Input the Night Differential Hours if necessary

- Input the Fix Hours Limit if necessary

- Remarks

- Click Save button to add in table

Save/Lock

Make sure to save/lock the record so that in every transaction the Shift will show.

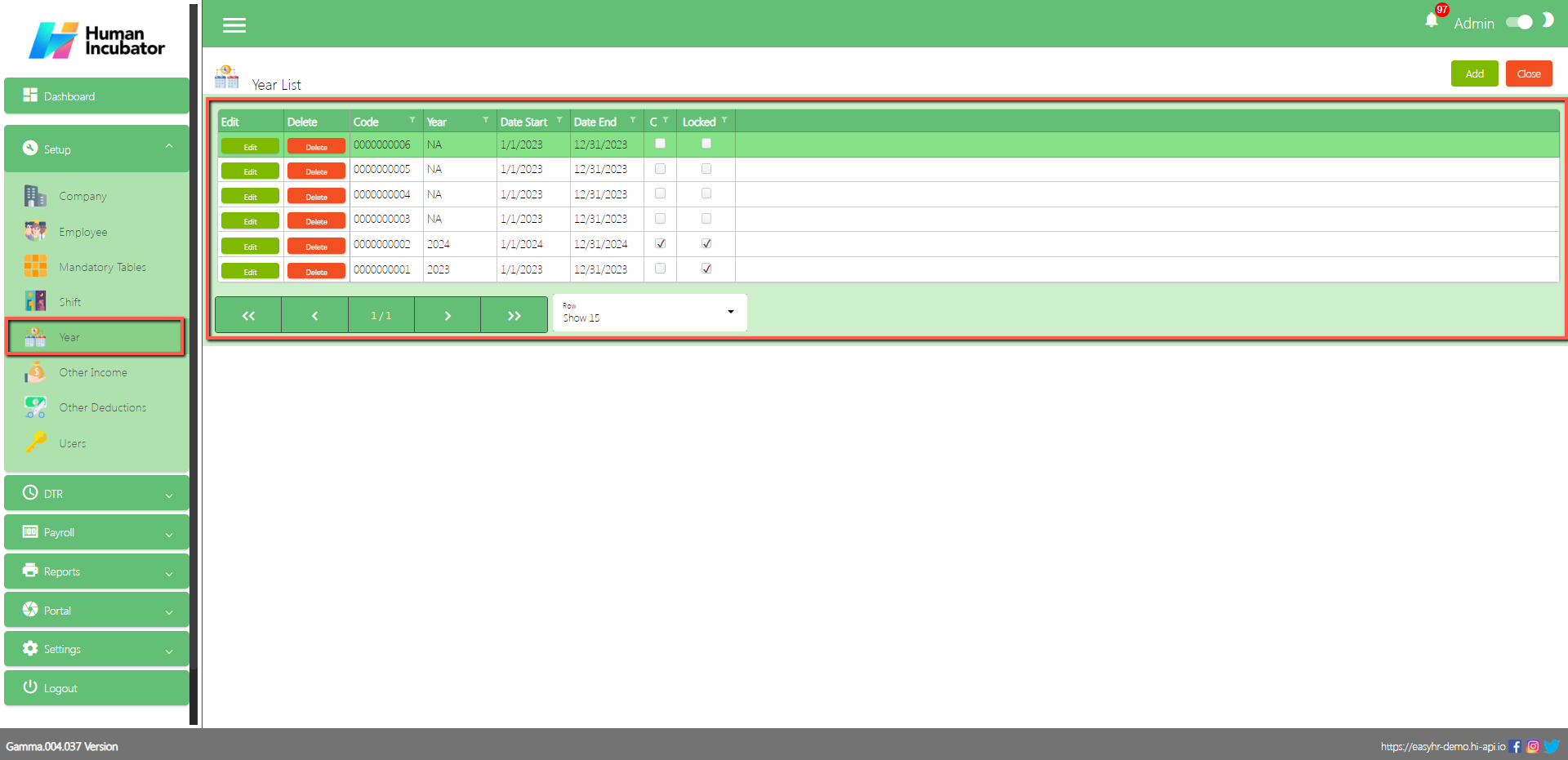

Year

Overview

Year setup is used for setting up a holiday in that particular year and also to add leave credits per employee.

(Note: Always make sure the current Year is locked)

Year List

Shows all list of year

Column Table

- Edit: This has the function to edit the Year

- Delete: This has a function to delete the Year

- Code: This code will automatically generate according to the sequence of the added shift

- Year: The is an input on what year added

- Date Start: Date Start of the Year

- Date End: Date End of the Year

- Closed: You can no longer select if the year is closed.

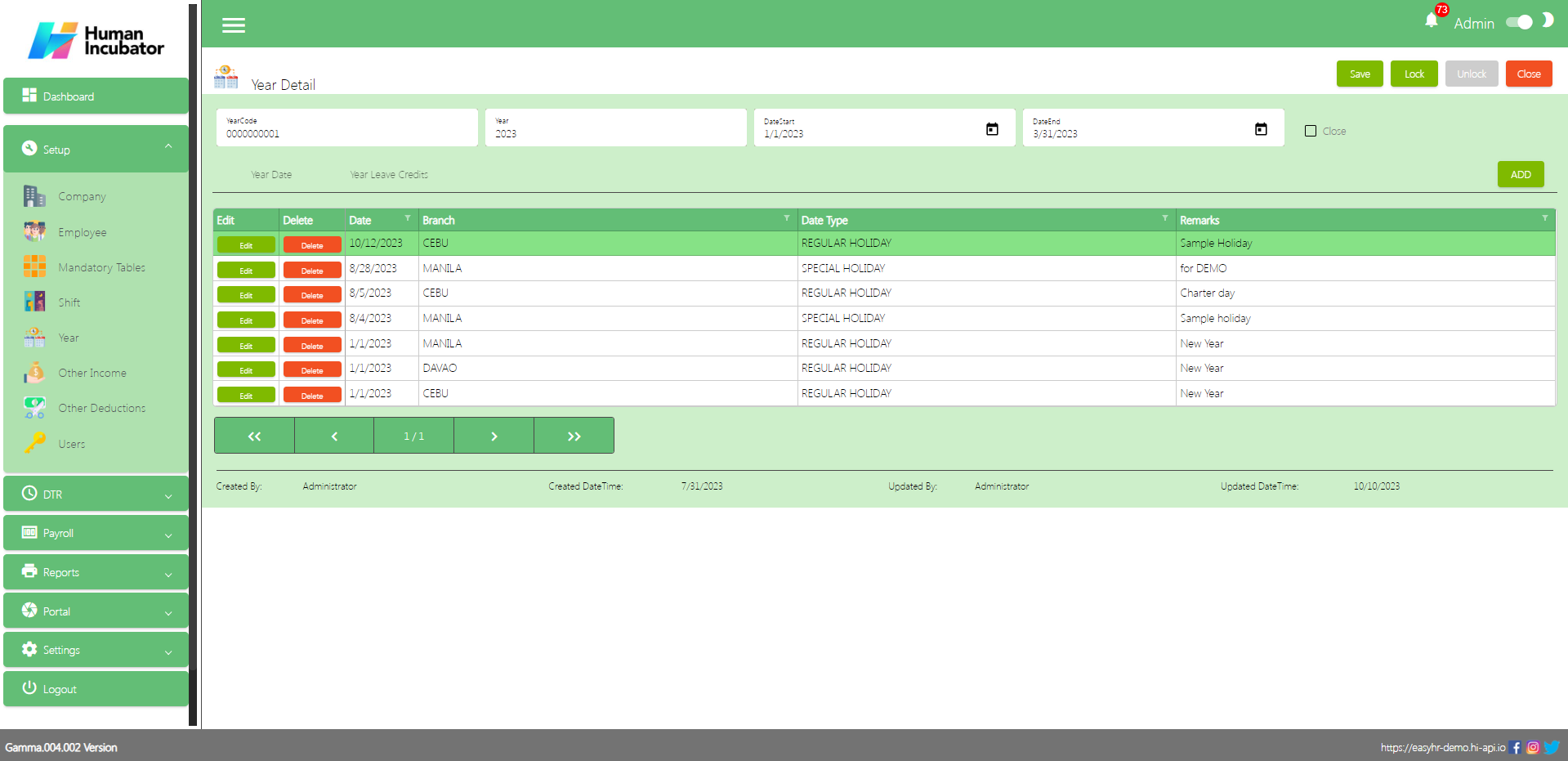

Year Detail

Assumption: To Add a new year, click the Add button that can be seen on the right side of the screen

There are 2 tabs that show in year detail

- Year Date

- Year Leave Credits

Fill all the important fields for Year Detail like:

- Year

- Select Date Start

- Select Date End

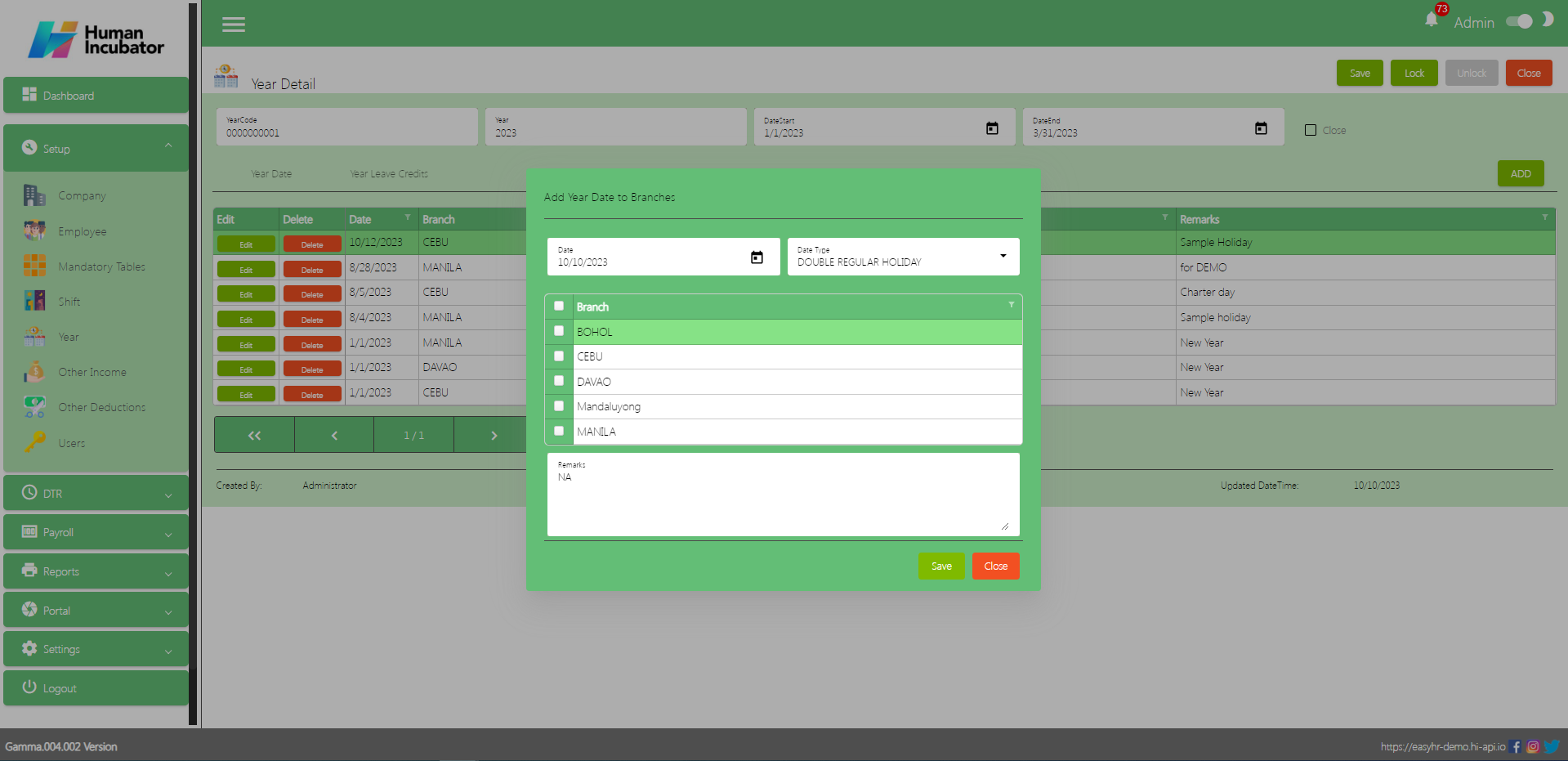

Year Date

In Year Date tab the user can Add all the regular holiday in that particular year

- Click Add button

- Select Date

- Select Date Type

- Select Branch

- Input remarks

- Click Save button to Add in table

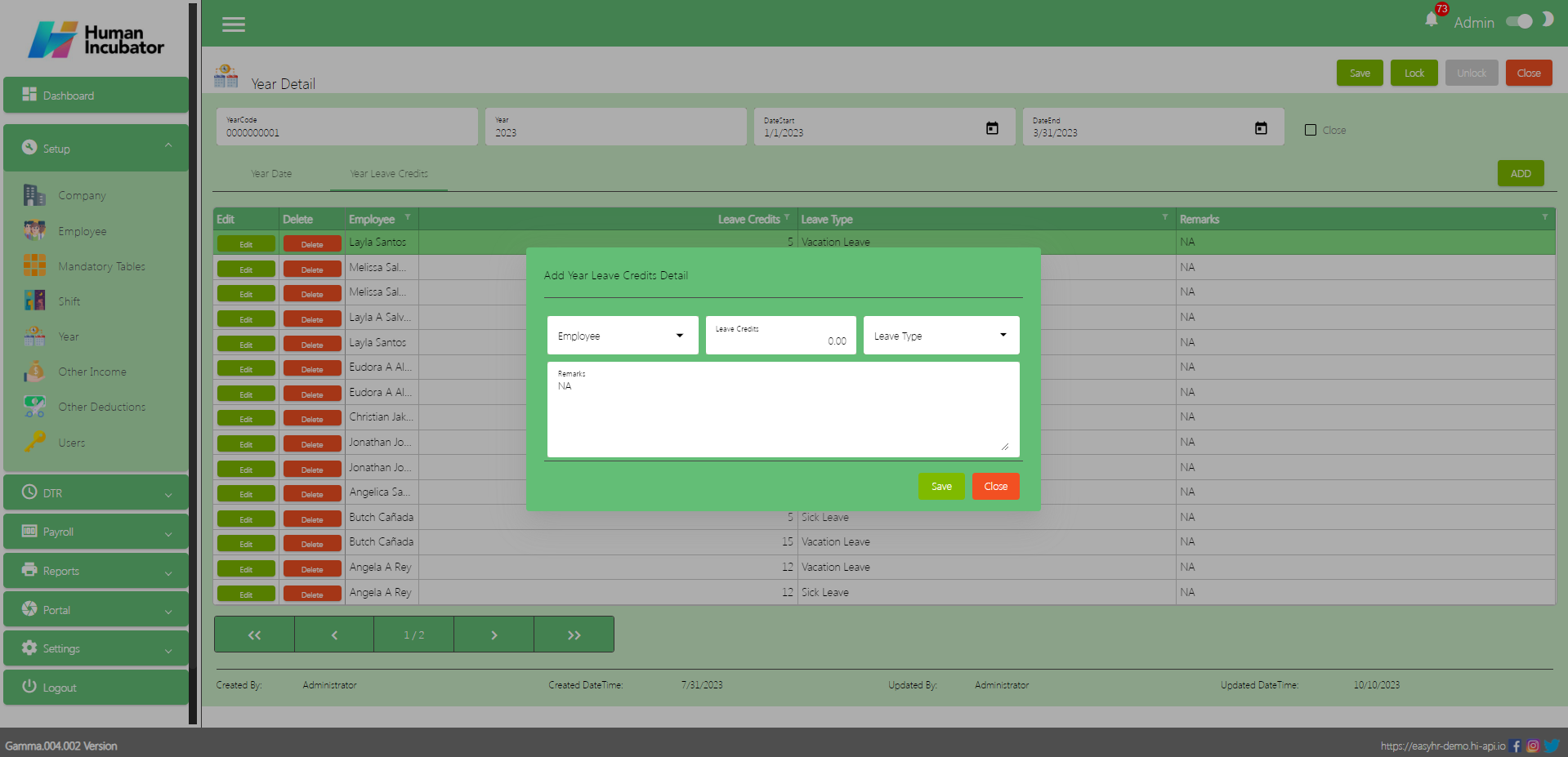

Year Leave Credits

In Year Leave Credits tab the user can add the leave credits per employee

- Click Add button

- Select Employee, Input leave credits and Select Leave Type

- Remarks

- Click Save button to Add in table

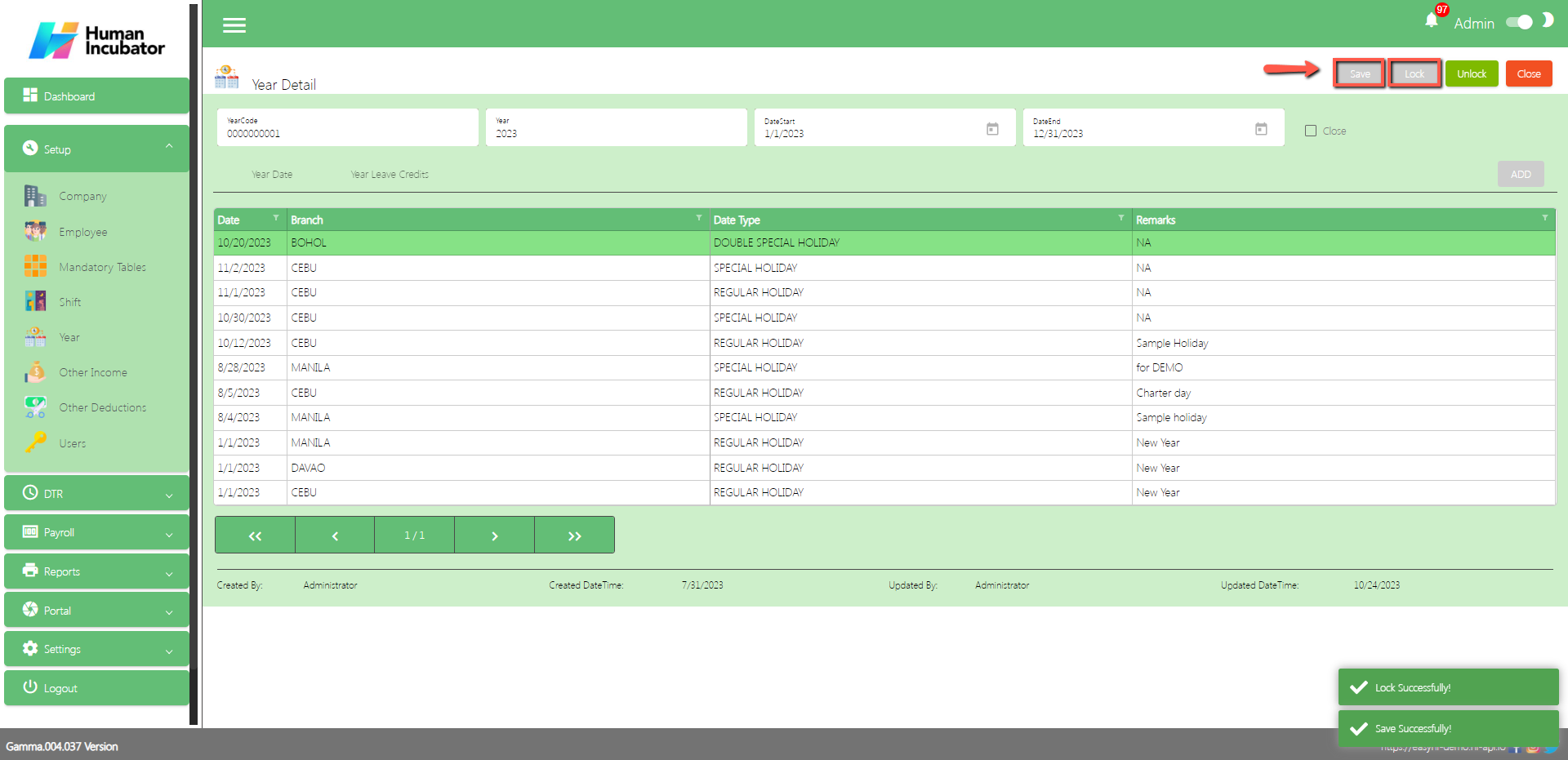

Save/Lock

Make sure to save/lock the record so that in every transaction the Year details will show.

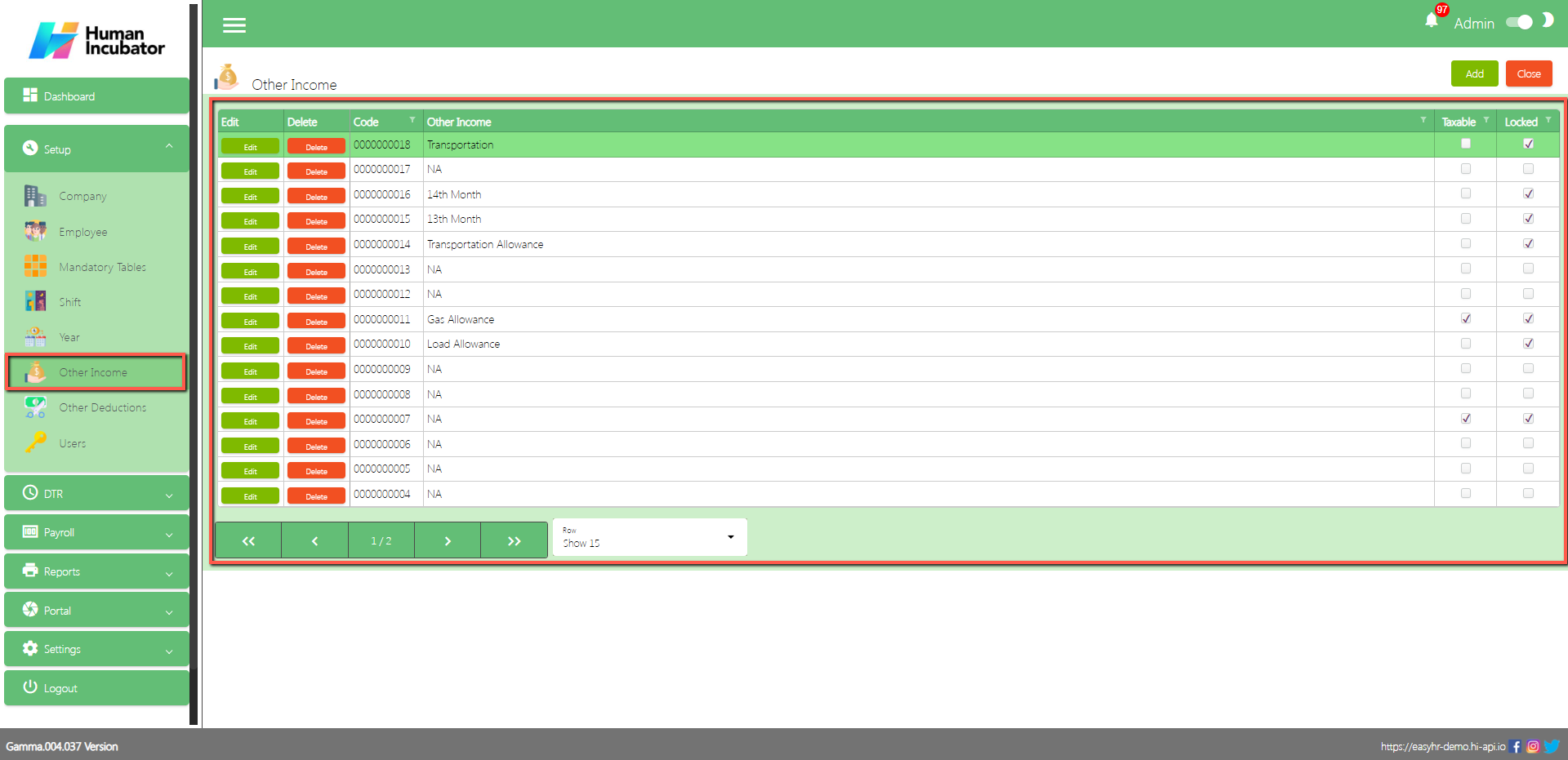

Other Income

Overview

Other Income setup is used for Making other income just like allowances of the company and also can add if Taxable or Non-taxable

Other Income List

Shows all list of Other Income

Table Column

- Edit: This has the function to edit the Other Income

- Delete: This has the function to Delete the Other Income

- Other Income: Name of the Other Income

- Taxable: Check if the Other Income is taxable, uncheck if not

- Locked: If locked you can now select this type of other income

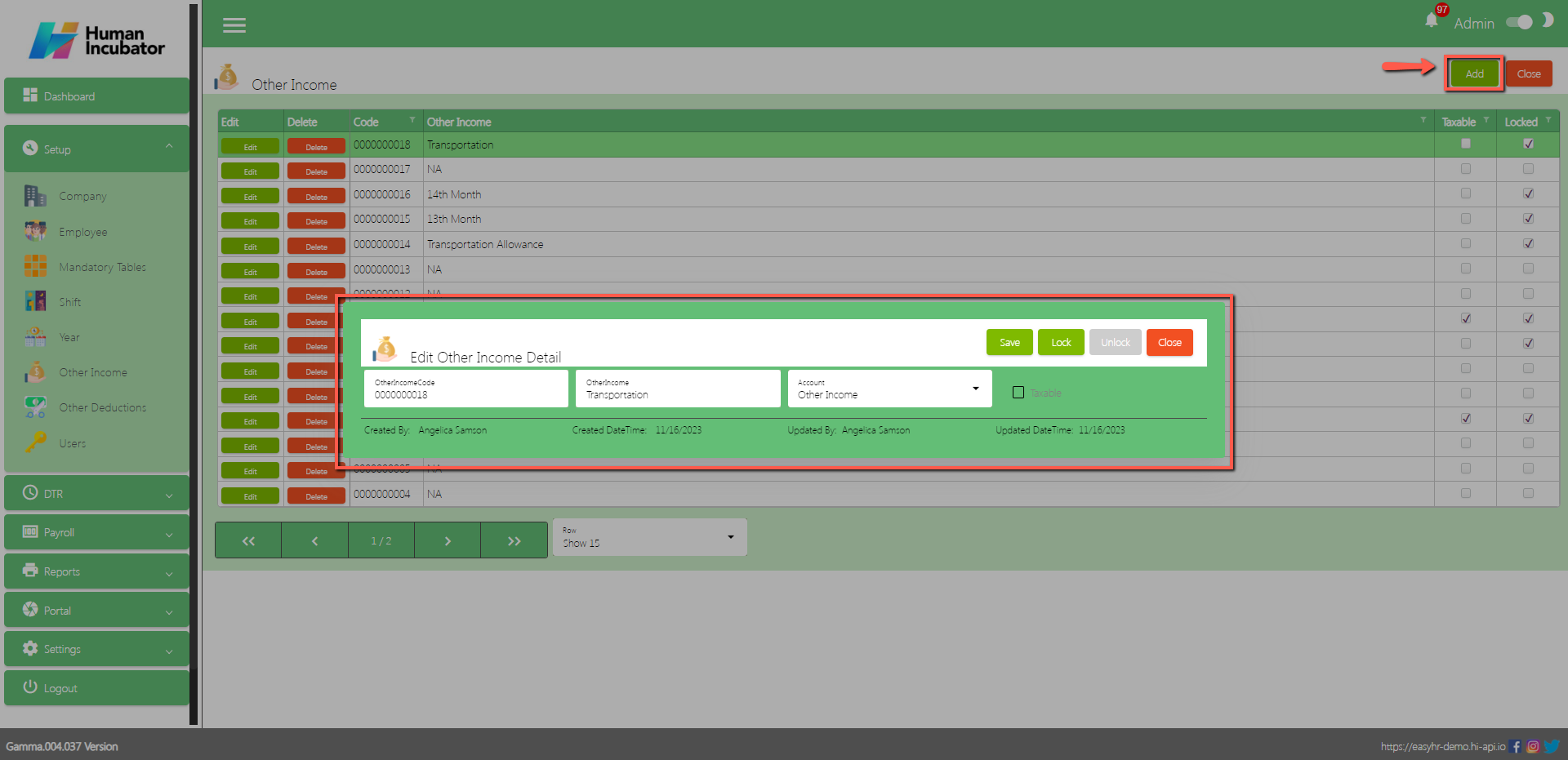

Other Income Detail

Assumption: To Add a new other income, click the Add button that can be seen on the right side of the screen

Fill all the important fields in Other Income detail like:

- Input Other Income name

- Select Other Income account

- Check the Check Box if taxable or non-taxable

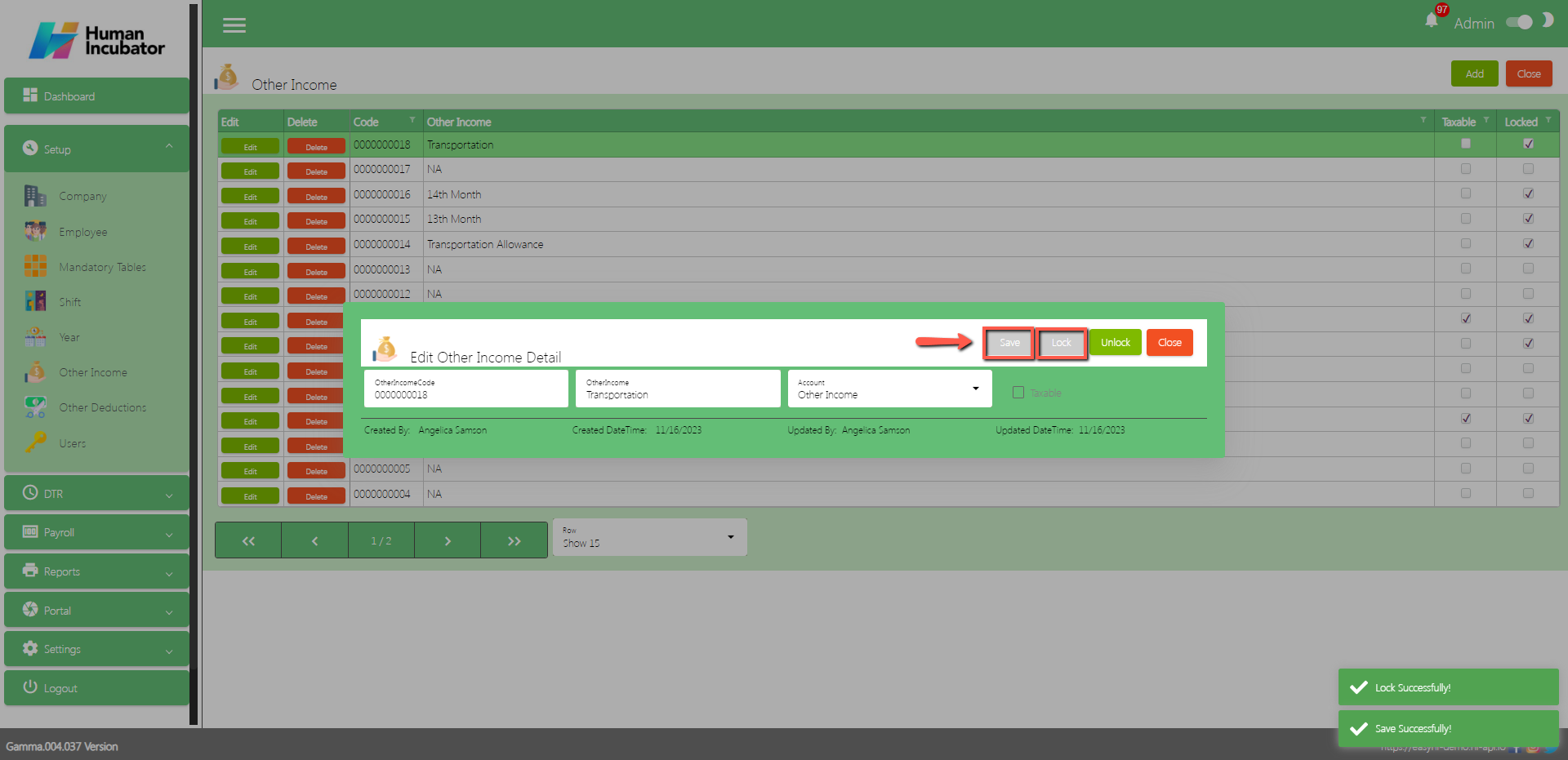

Save/Lock

Make sure to save/lock the record so that in every transaction the Other Income will show.

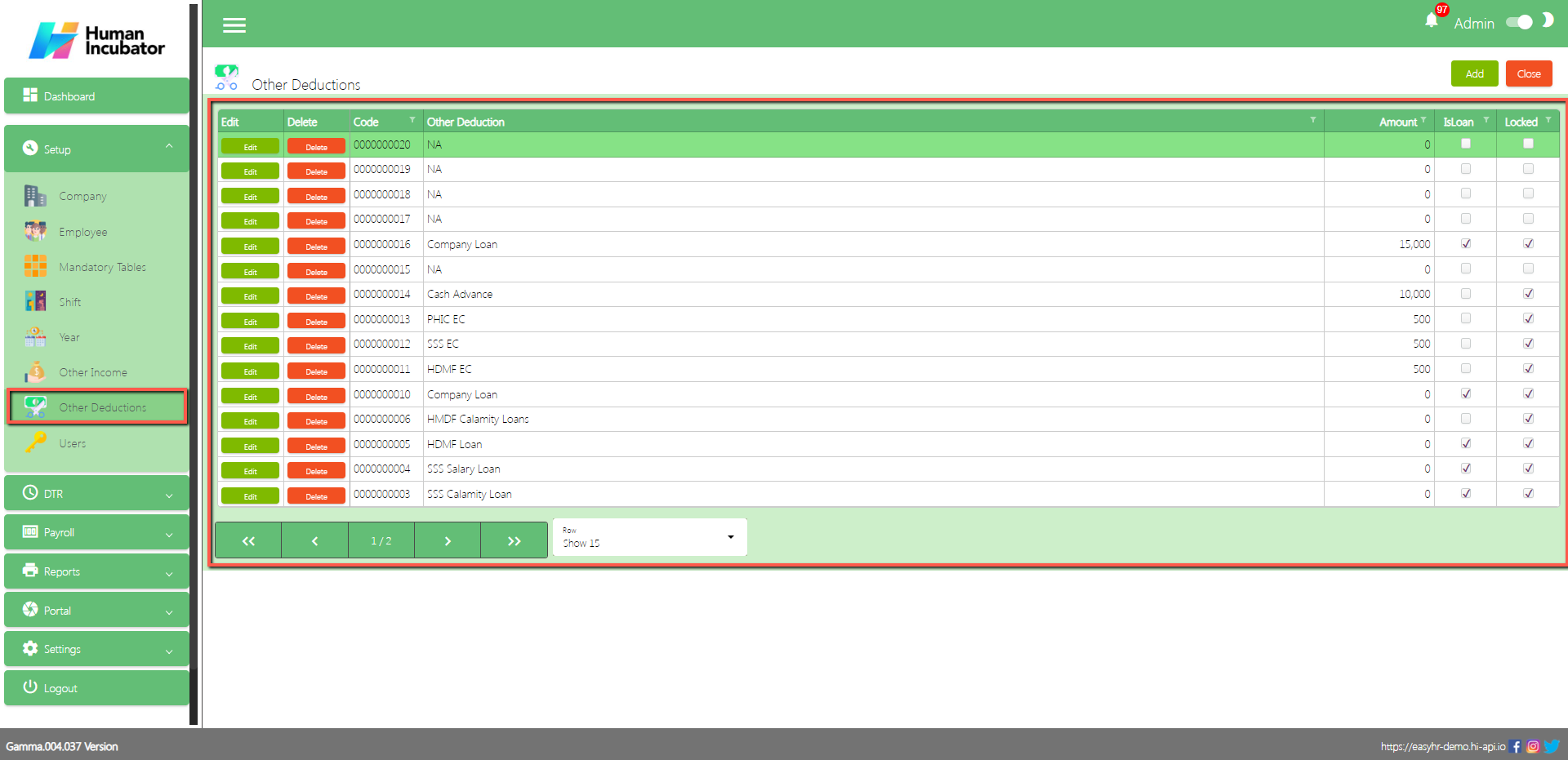

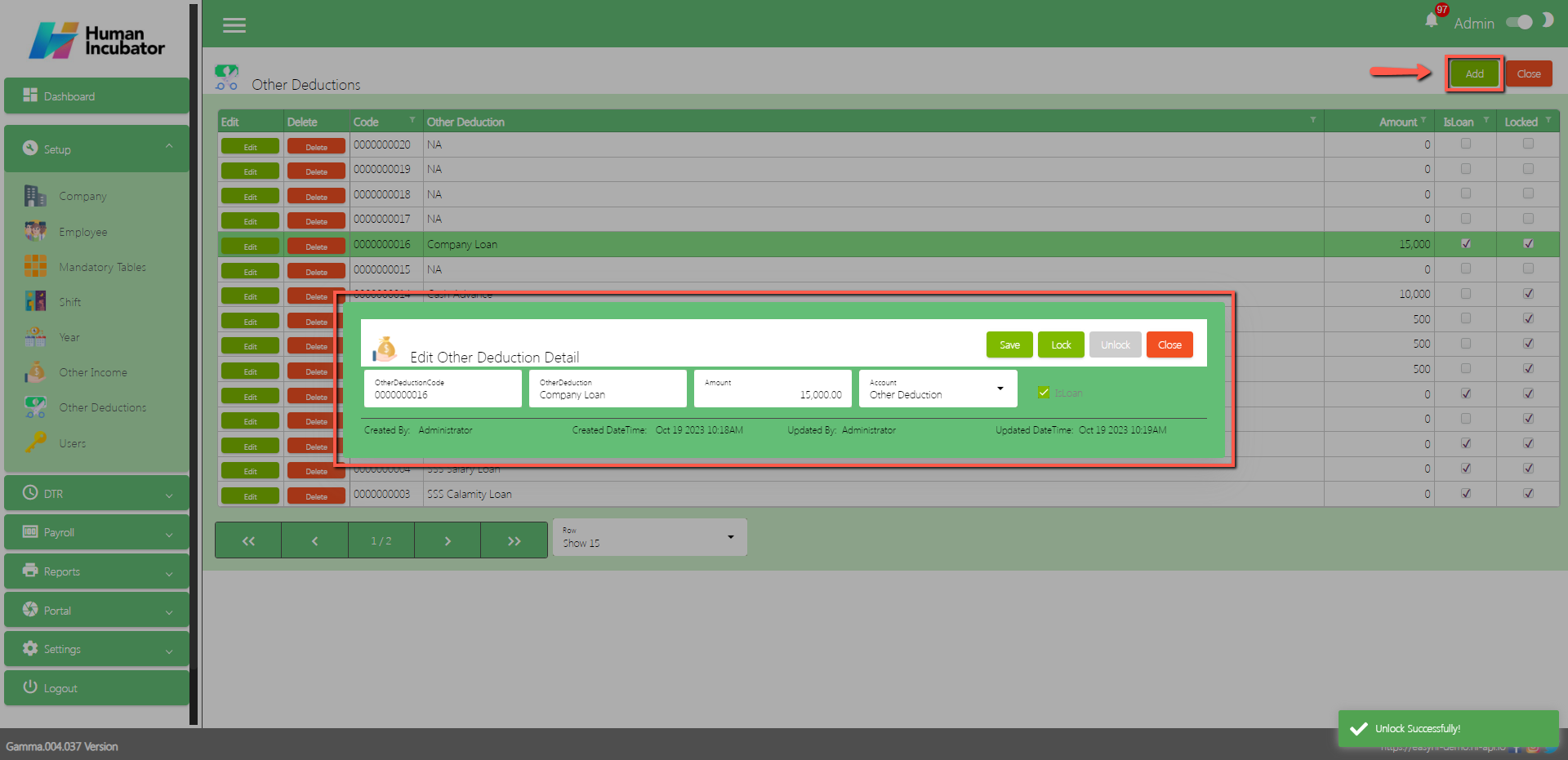

Other Deductions

Overview

Other Deductions setup is used for making other deductions just like Salary loans and all loans in company.

Other Deductions List

Shows all list of Other Deductions

Other Deductions

- Edit: This has the function to edit the Other Deductions

- Delete: This has the function to Delete the Other Deductions

- Other Deduction: Name of the Other Deduction

- Amount: This is optional you can either put and amout or not

- IsLoan: Check if this Other Deduction is a Loan Type

- Locked: If locked you can now select this type of Other Deduction

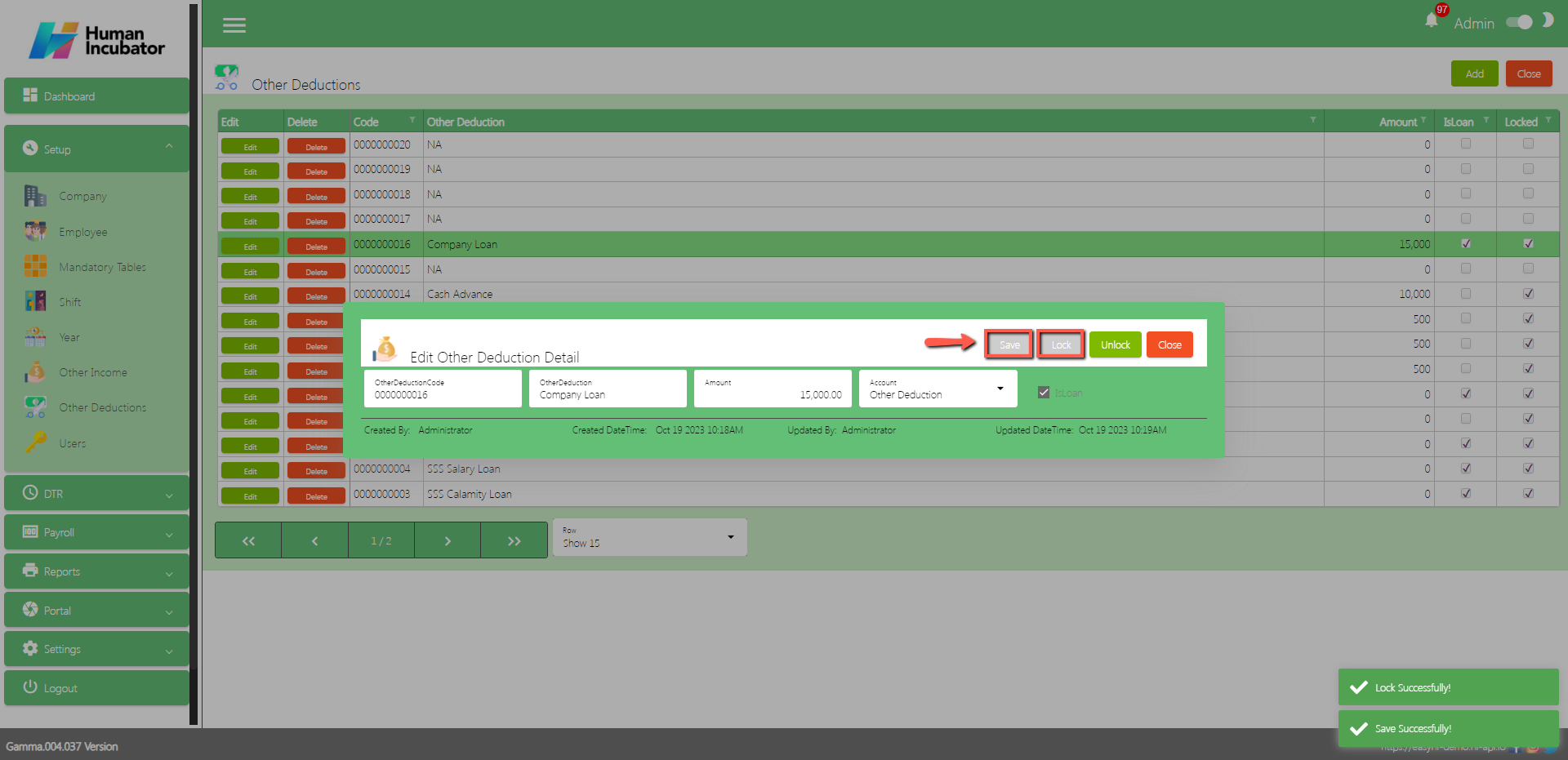

Other Deductions Detail

To Add a new other deductions, click the Add button that can be seen on the right side of the screen

Fill all the important fields in Other Deductions detail like:

- Input Other Deductions name

- Input Amount (Note: Input amount is optional)

- Select Other Deductions account

- Check the Check Box if IsLoan

Save/Lock

Make sure to save/lock the record so that in every transaction the Other Deductions will show. (Note: There should be at least 1 other deduction that is locked so that you can add a loan)

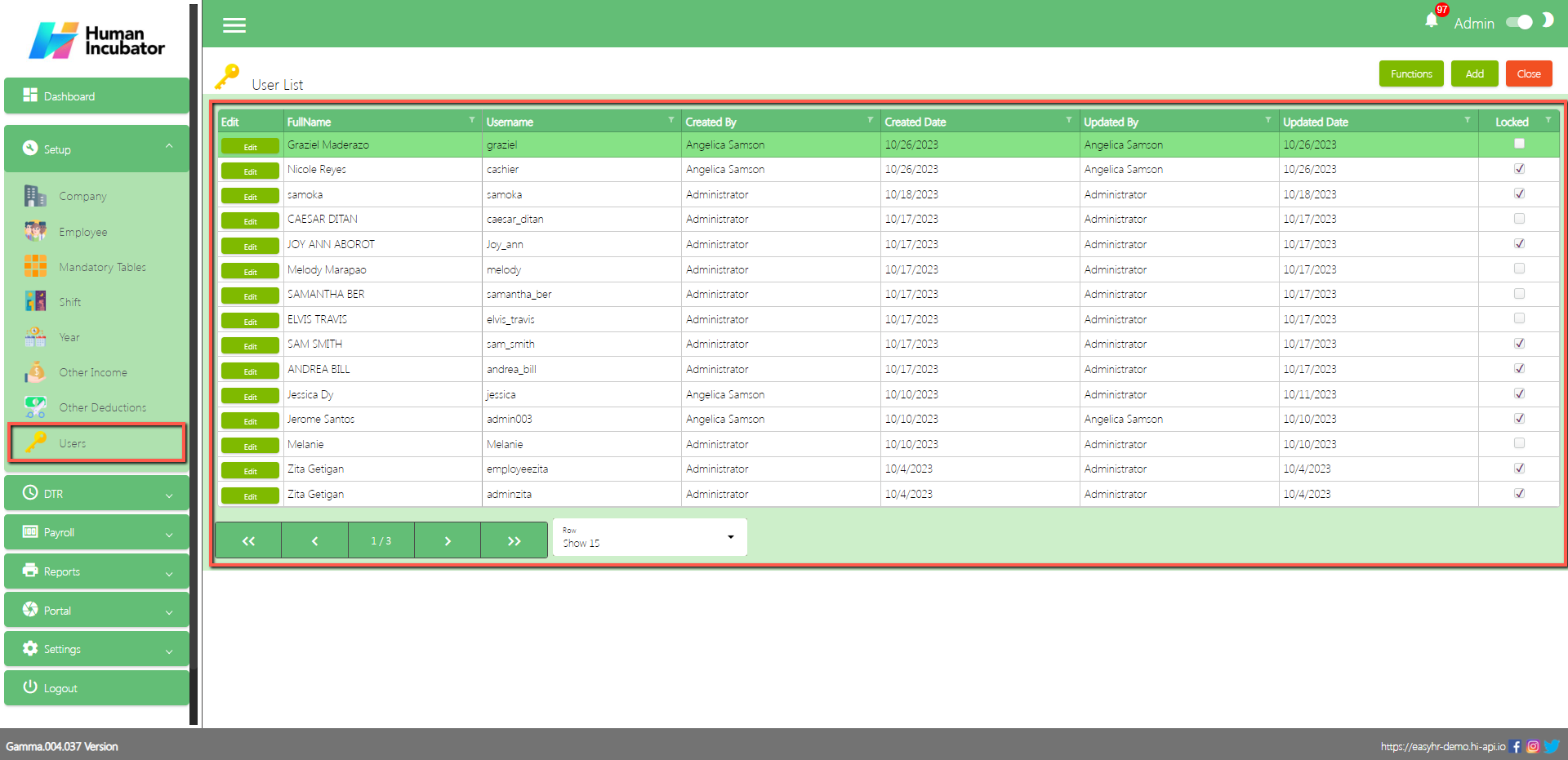

Users

Overview

Users setup is used for making the credentials of employees, user rights and also can upload more users.

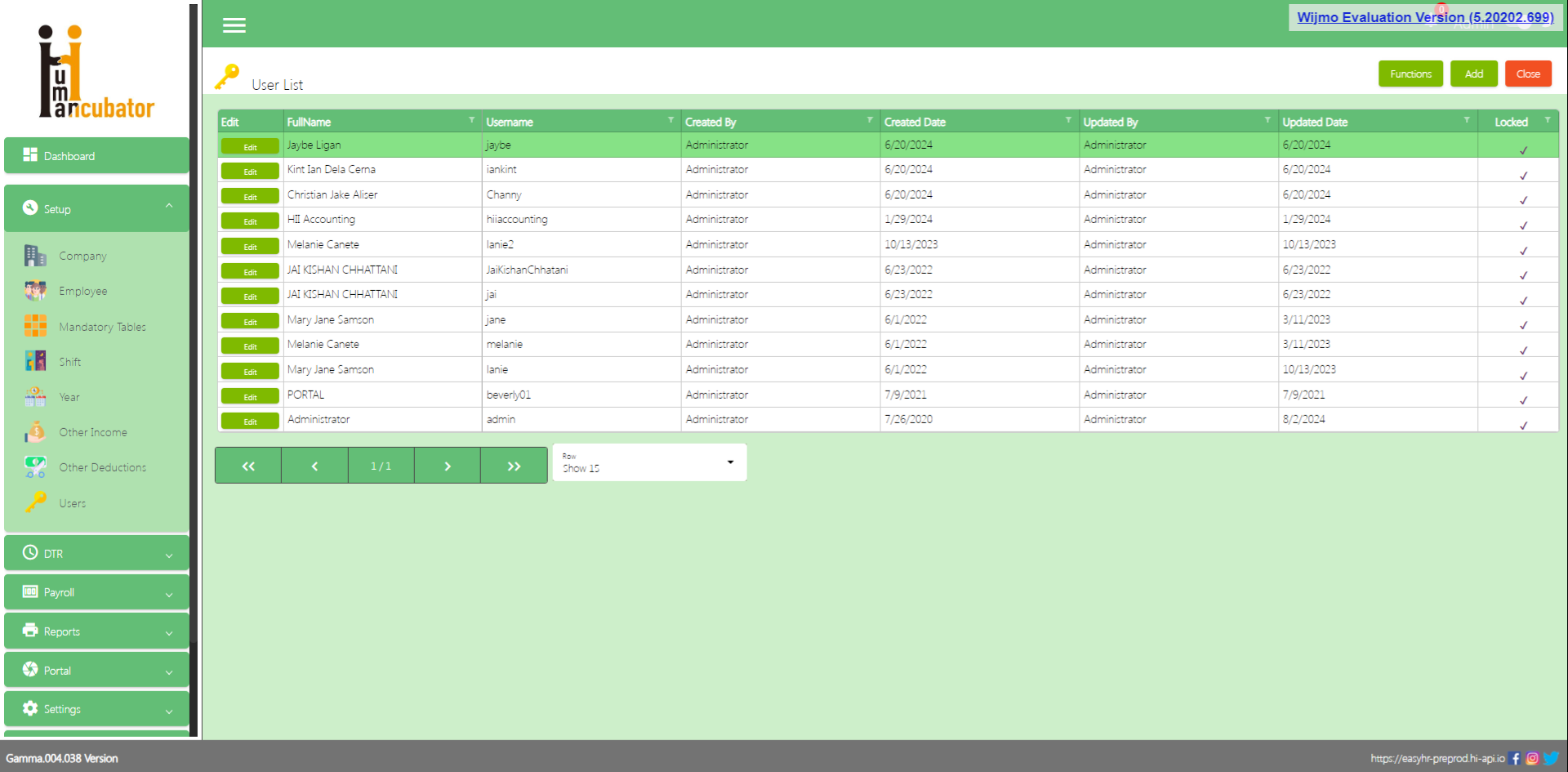

User list

Shows all list of Users

Table Column

- Edit: This has the function to edit the User

- FullName: Fullname of the user

- Username: Username of the user

- Created By: Fullname of the login user who created the user

- Created Date: Creation date of the user

- Updated By: Fullname of the login user who updated the user

- Updated Date: Updated date of the user

- Locked: If it is already locked you can now login the account.

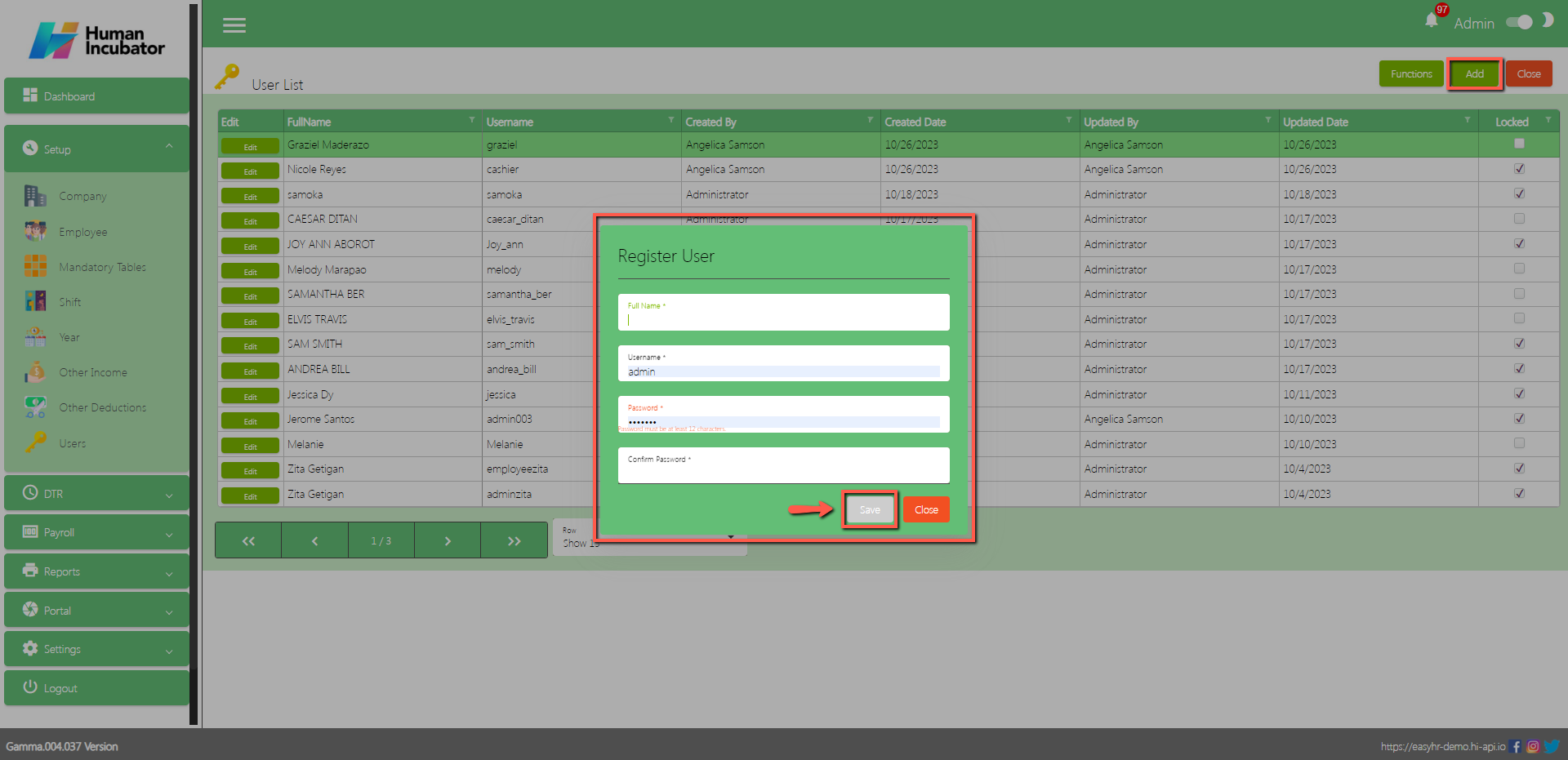

Register User

- To Add a new user, click the Add button that can be seen on the right side of the screen

- Fill all the important fields in Register User like:

- Input Full Name

- Input Username

- Input Password (Note: Password must require Uppercase, Lowercase, Numbers, Special characters except (=+_-?/{}][\|) and also must be at least 12 characters)

- Confirm Password

- Click Save button to add in table

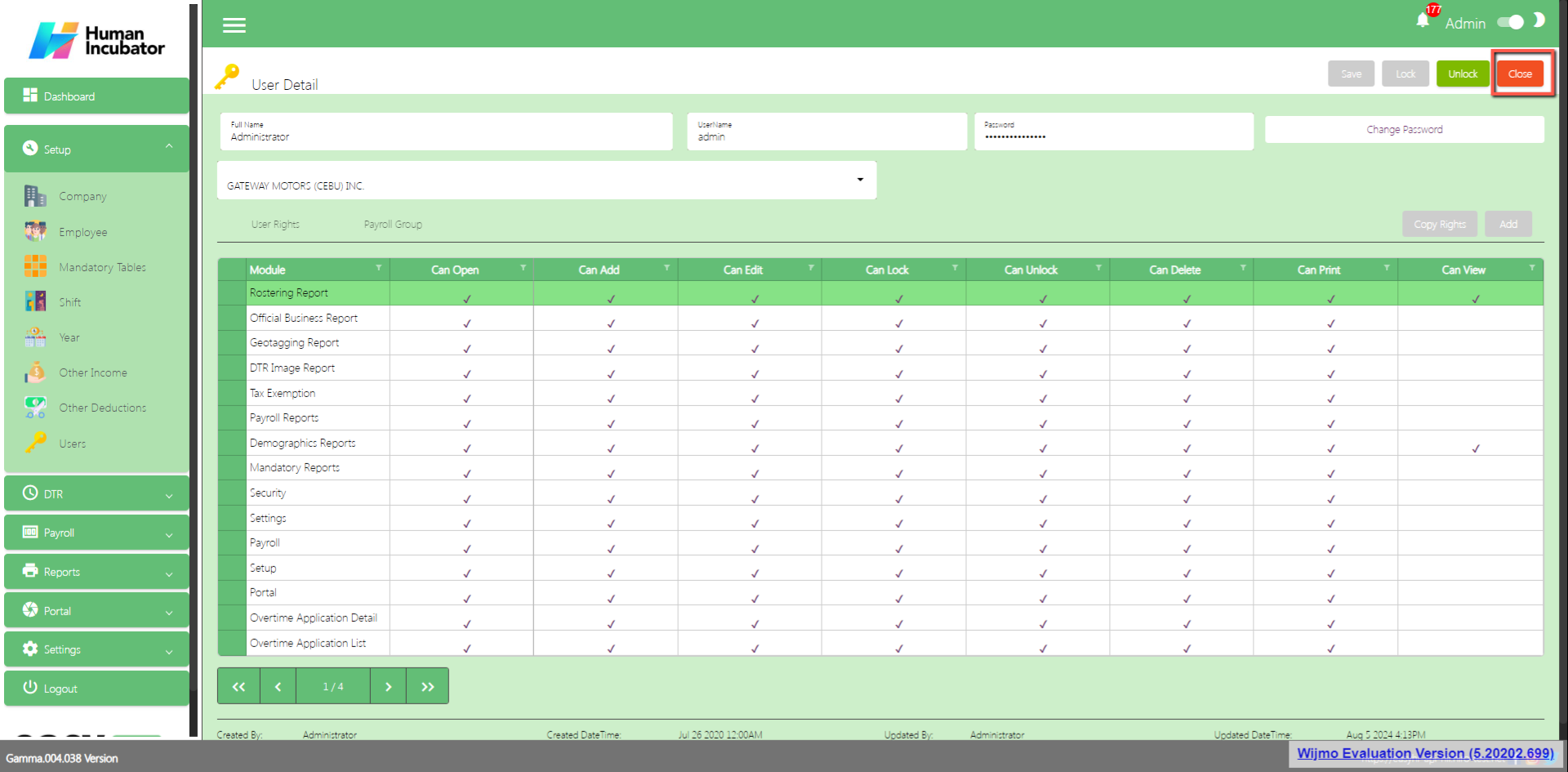

User Detail

- Click Edit button to add the user rights of employee

- There are 2 tabs in user detail

- User Rights and Payroll Group

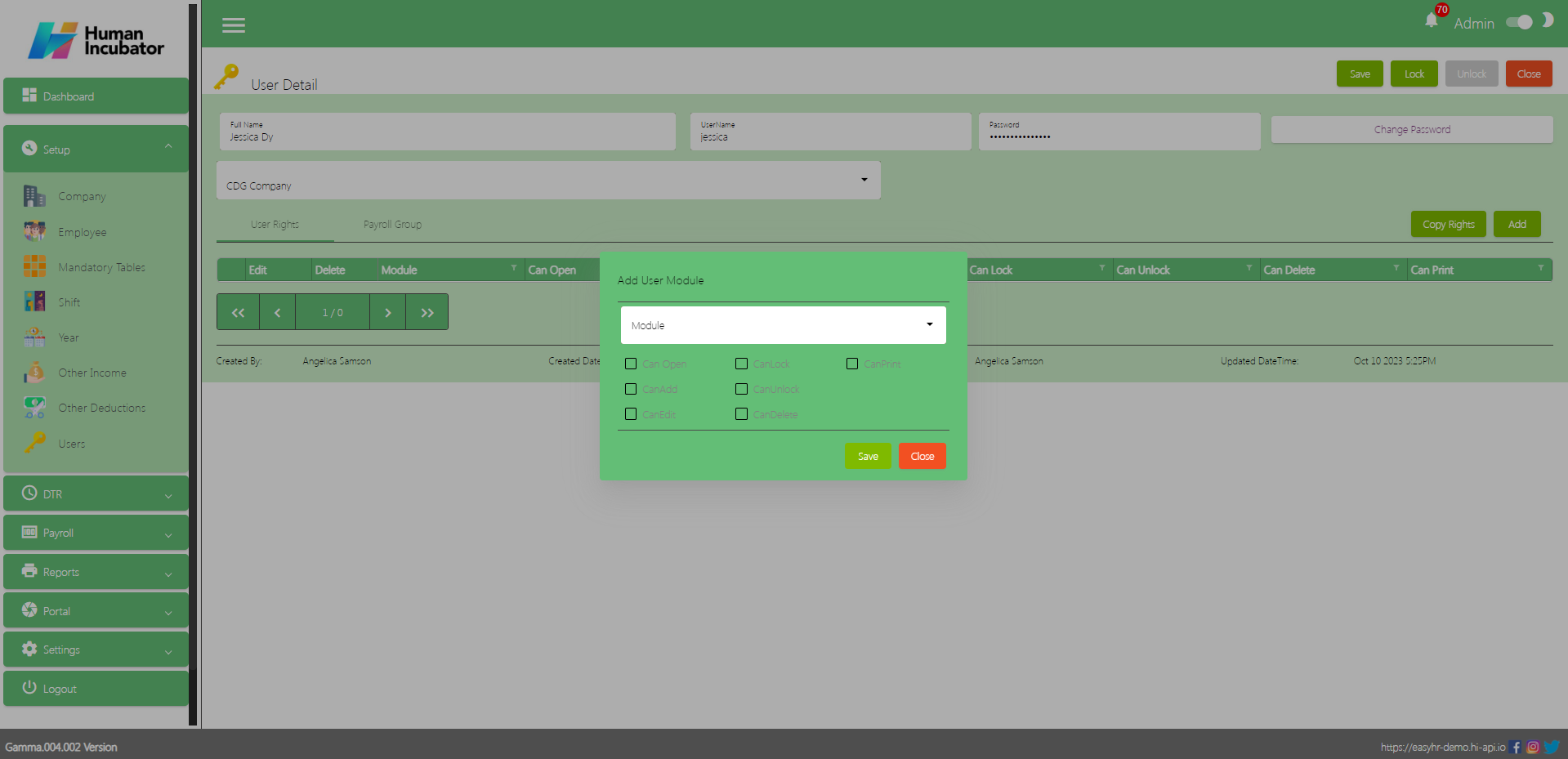

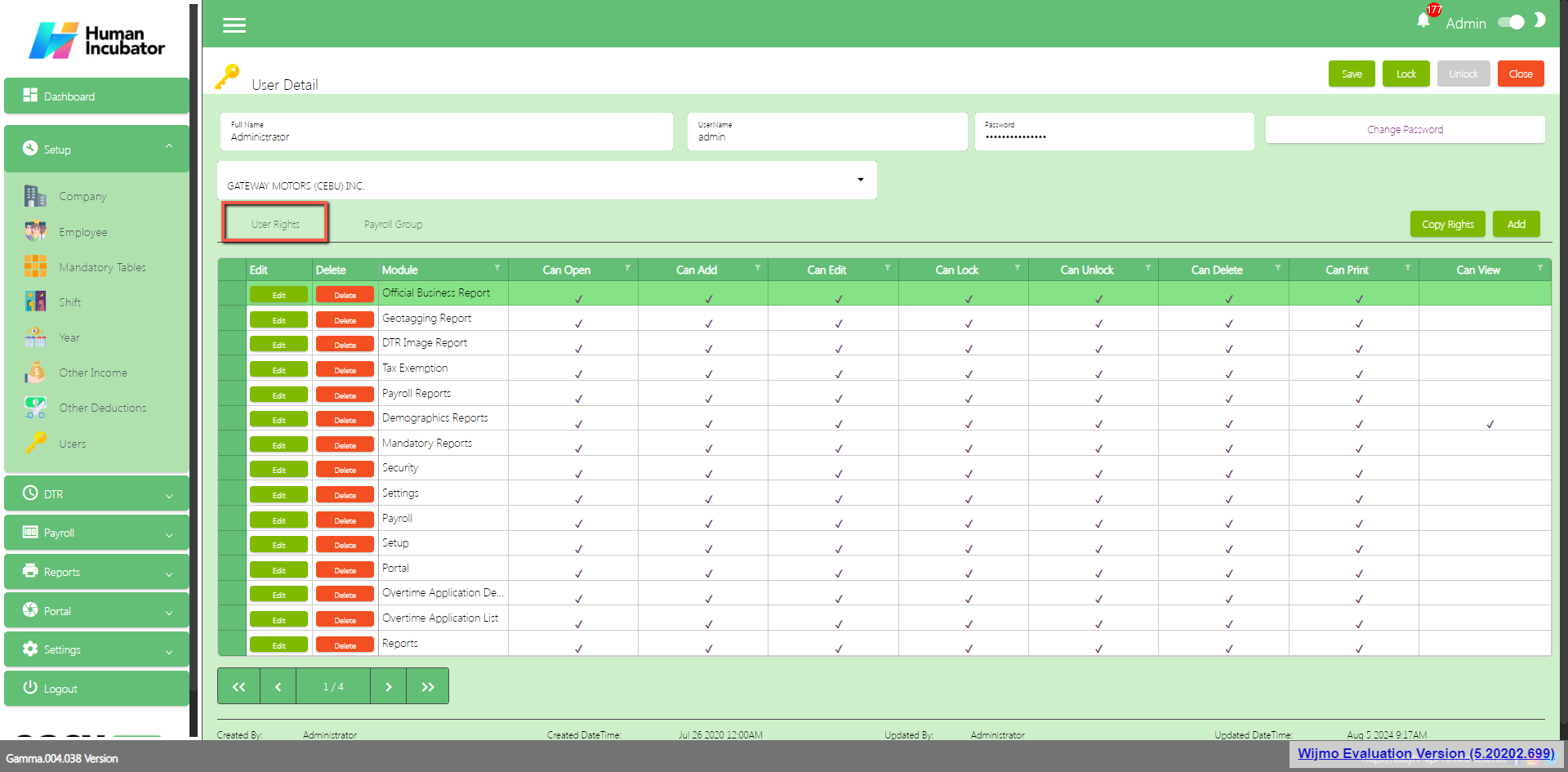

User Rights

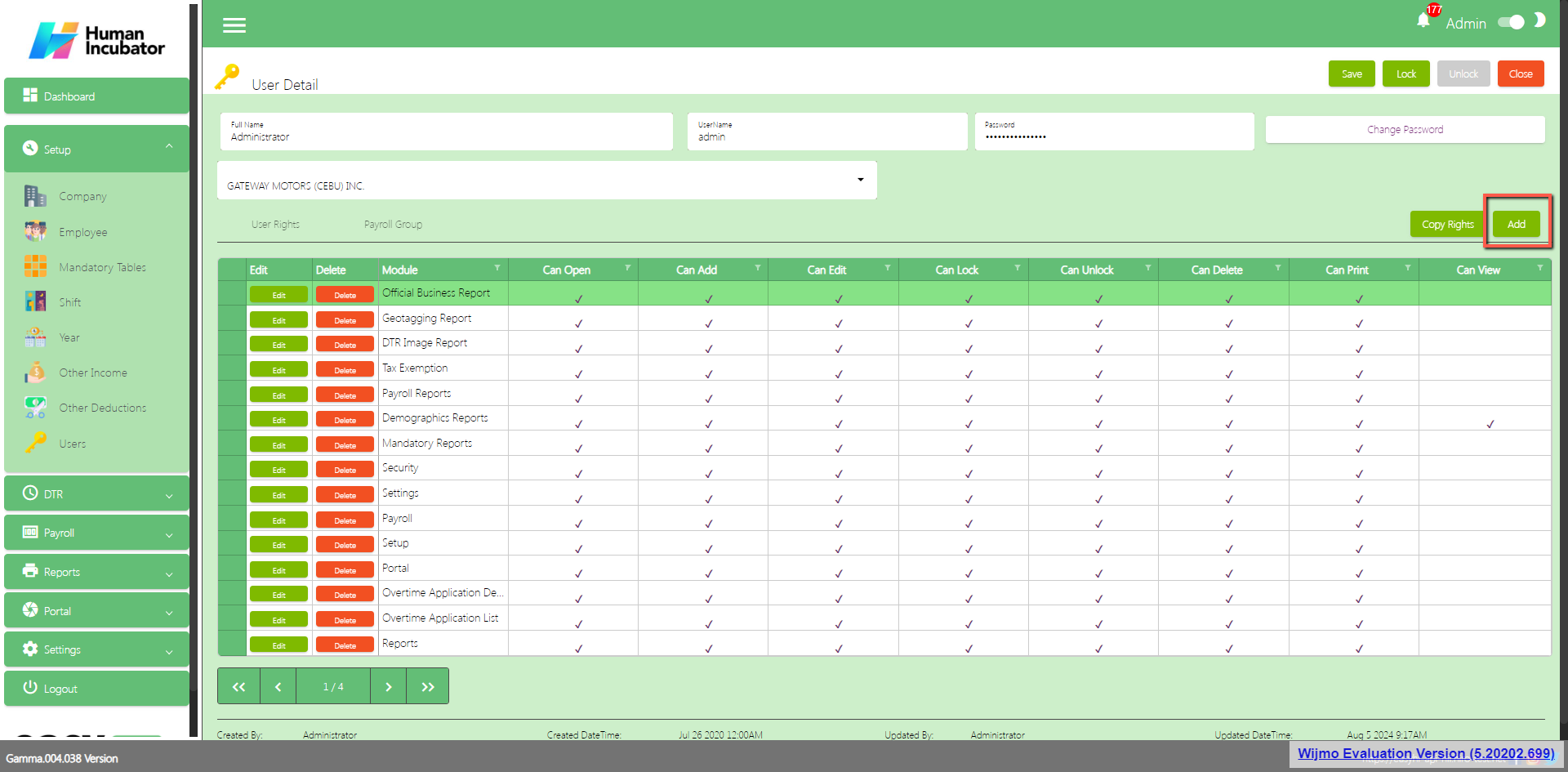

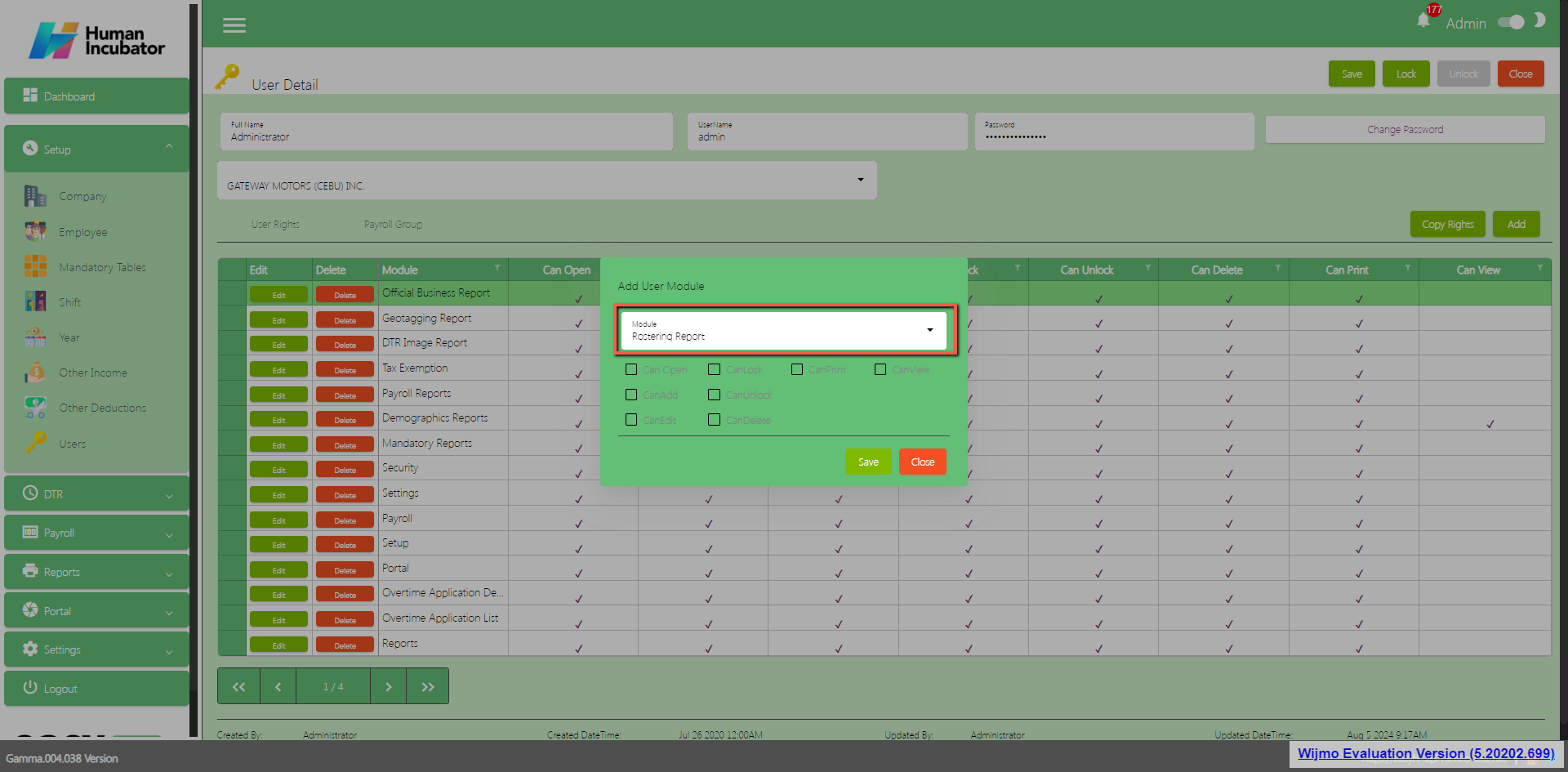

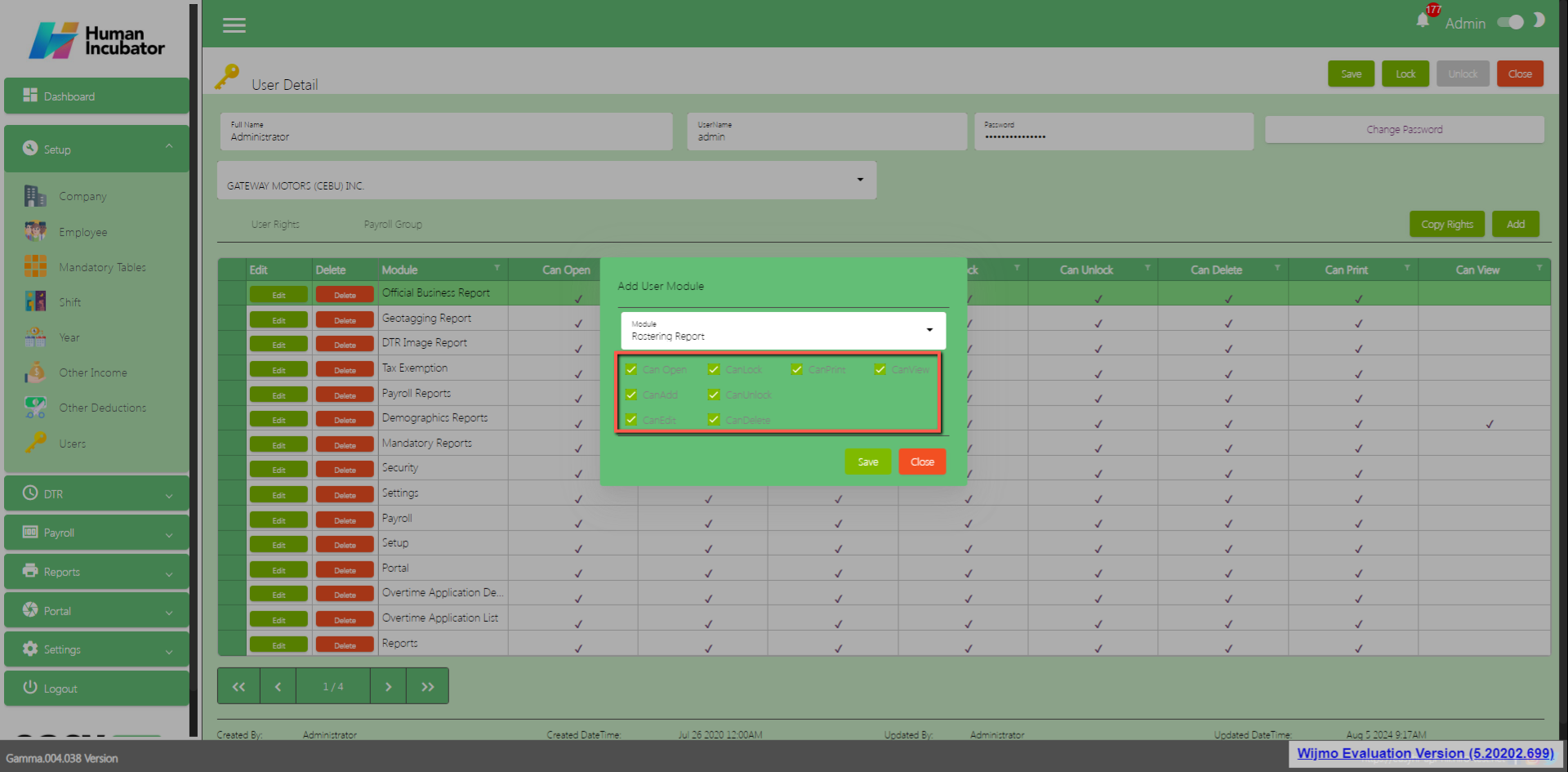

- Click Add button to add the user rights what module to access

- Select Module

- Check the Check Box

- Click Save button to add in table

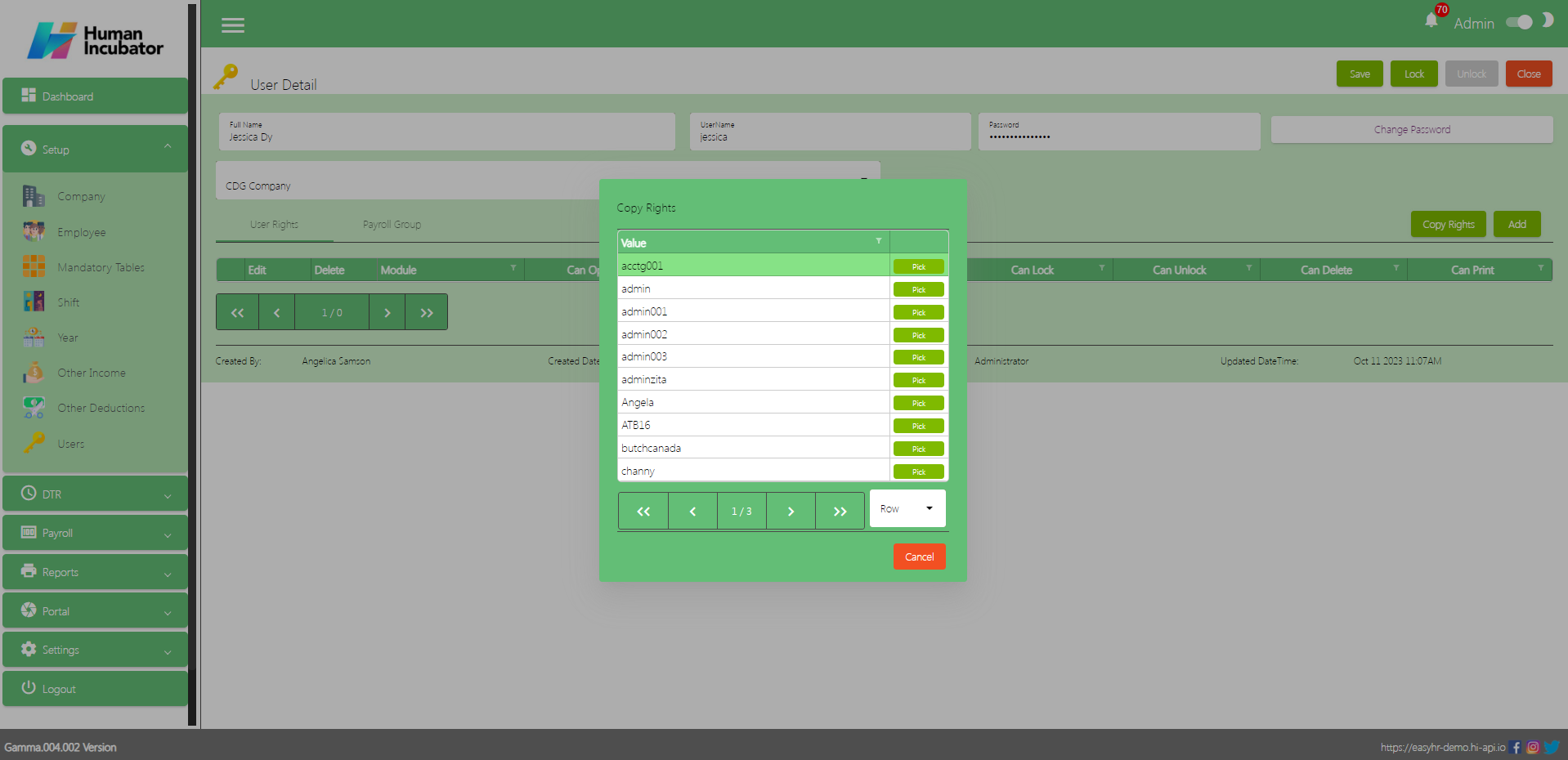

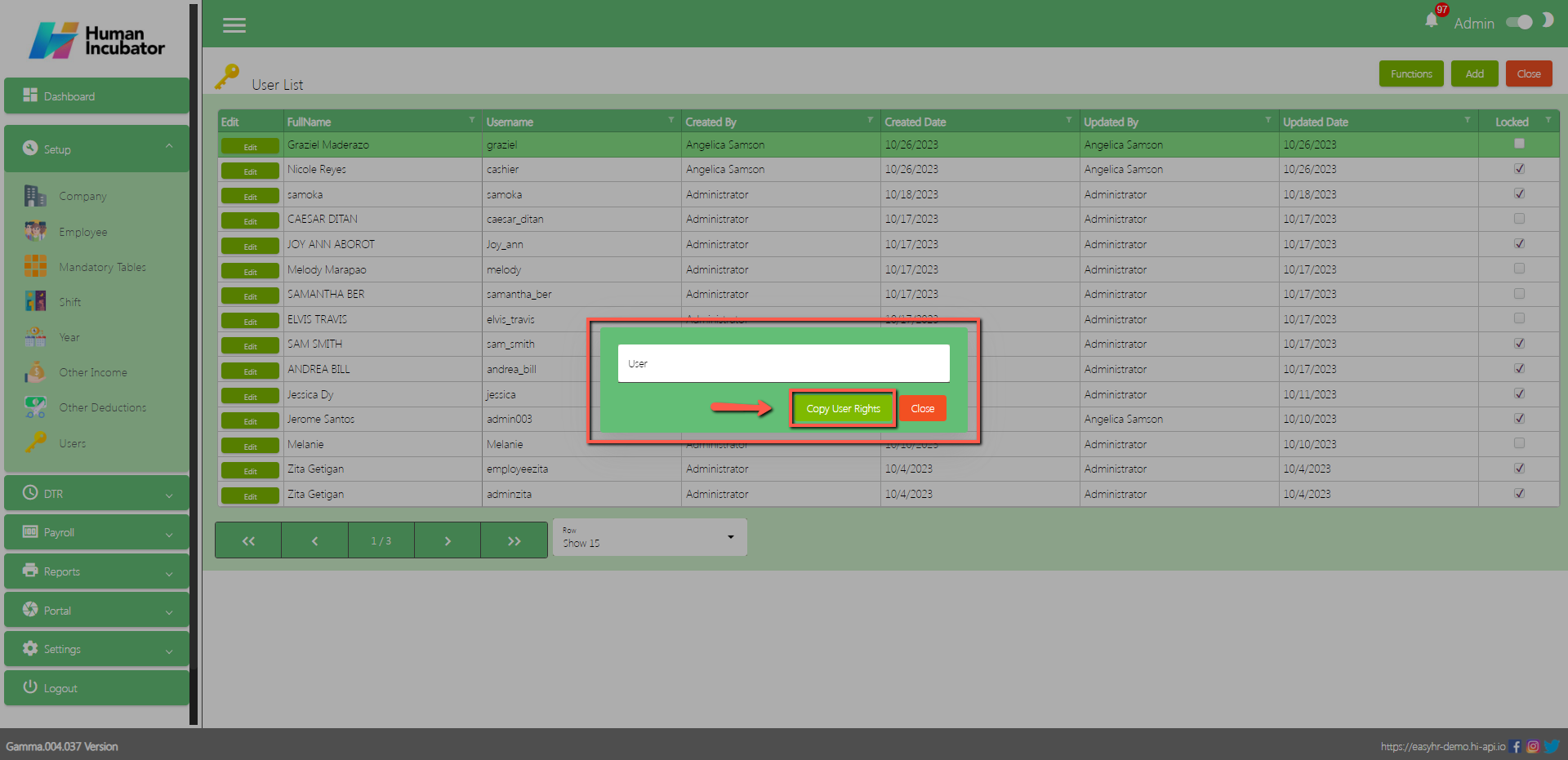

- Click Copy Rights button to copy the rights of employee

- Select the User need to copy rights

- Click Pick button to add in table

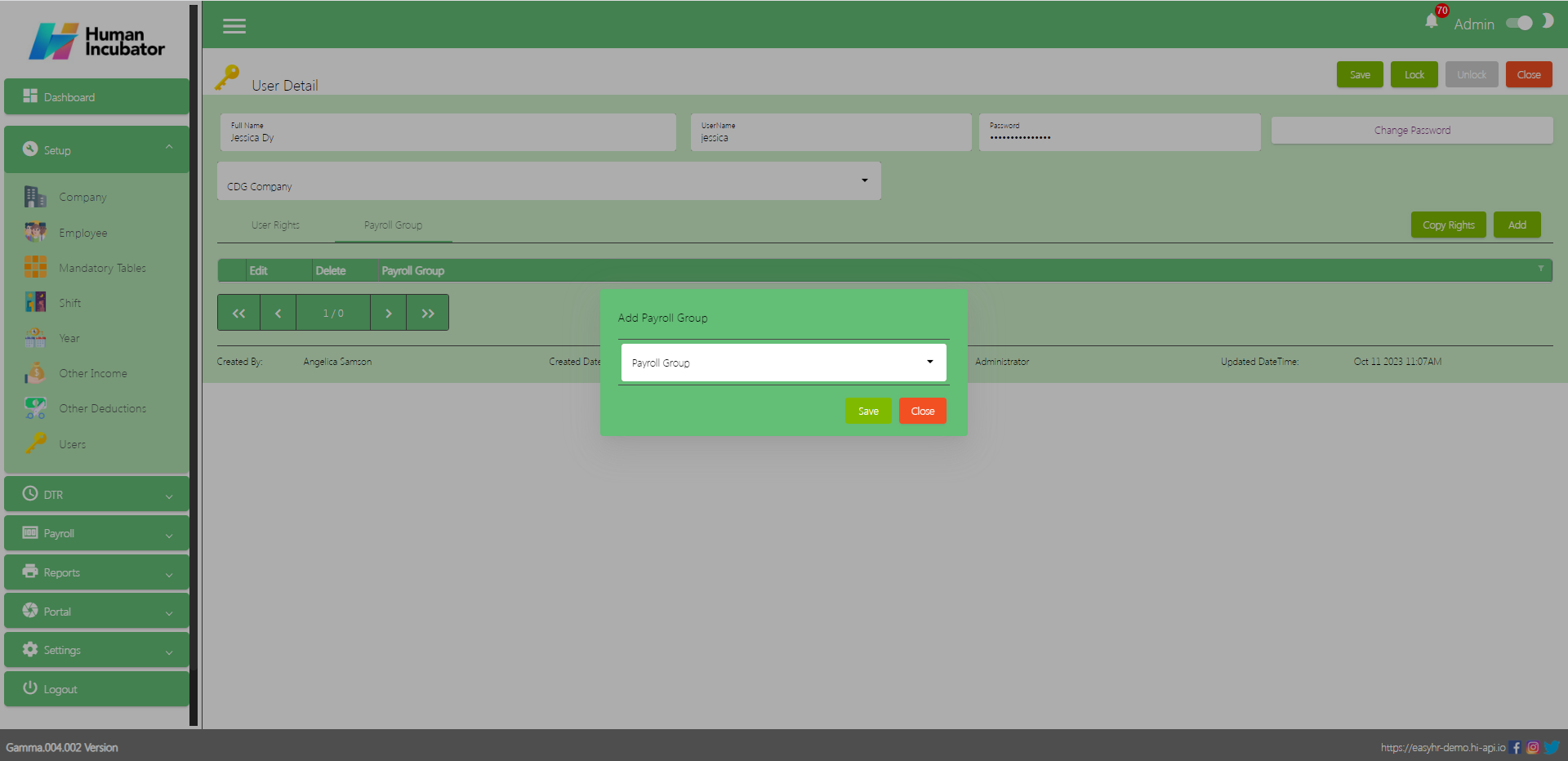

Payroll Group

- Click Add button to add what payroll group to access

- Select Payroll Group

- Click Save button to add in table

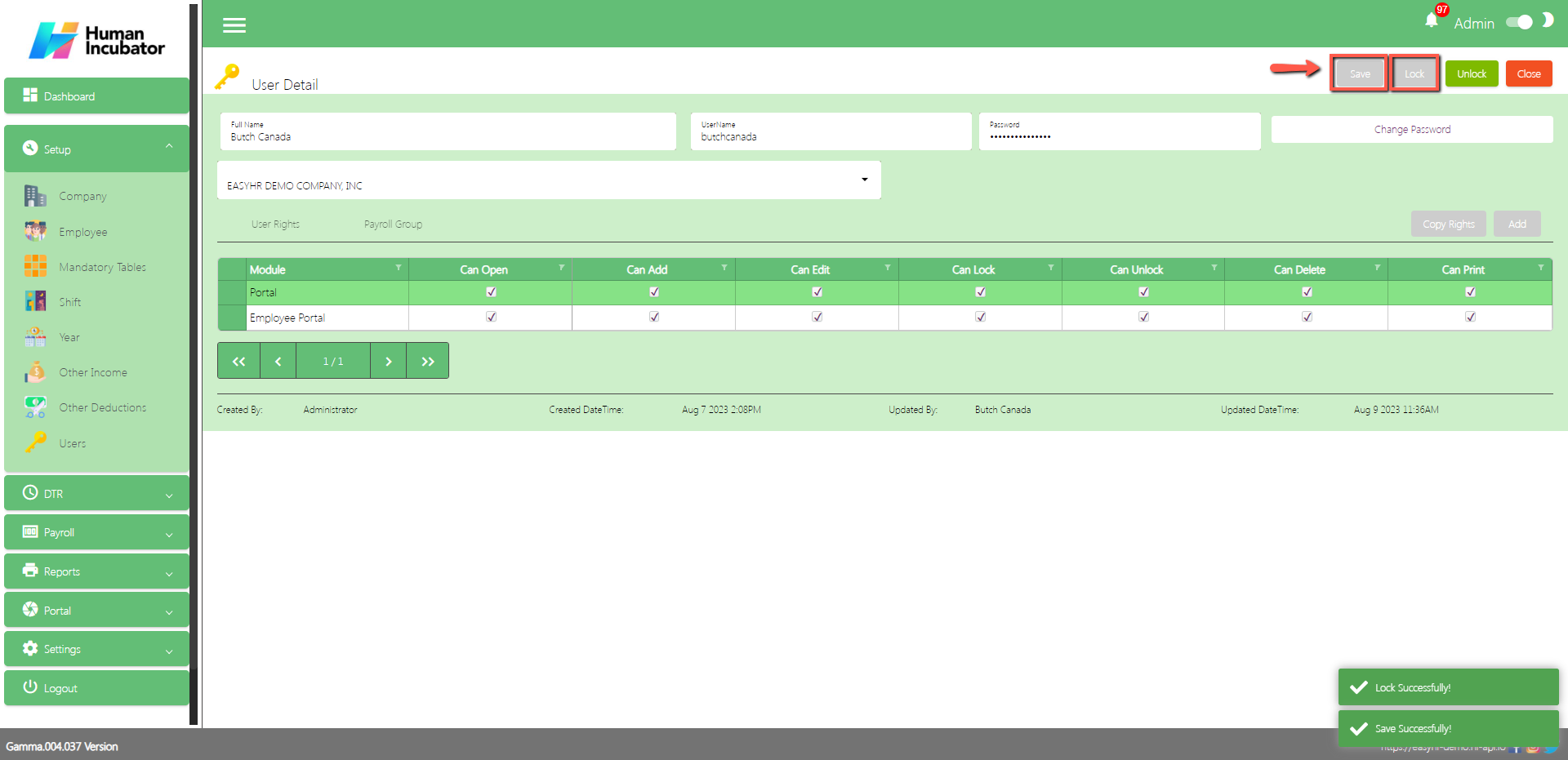

Save/Lock

- Make sure to save/lock the record so that it can access the user every transaction.

- Click Close button to go back in User List

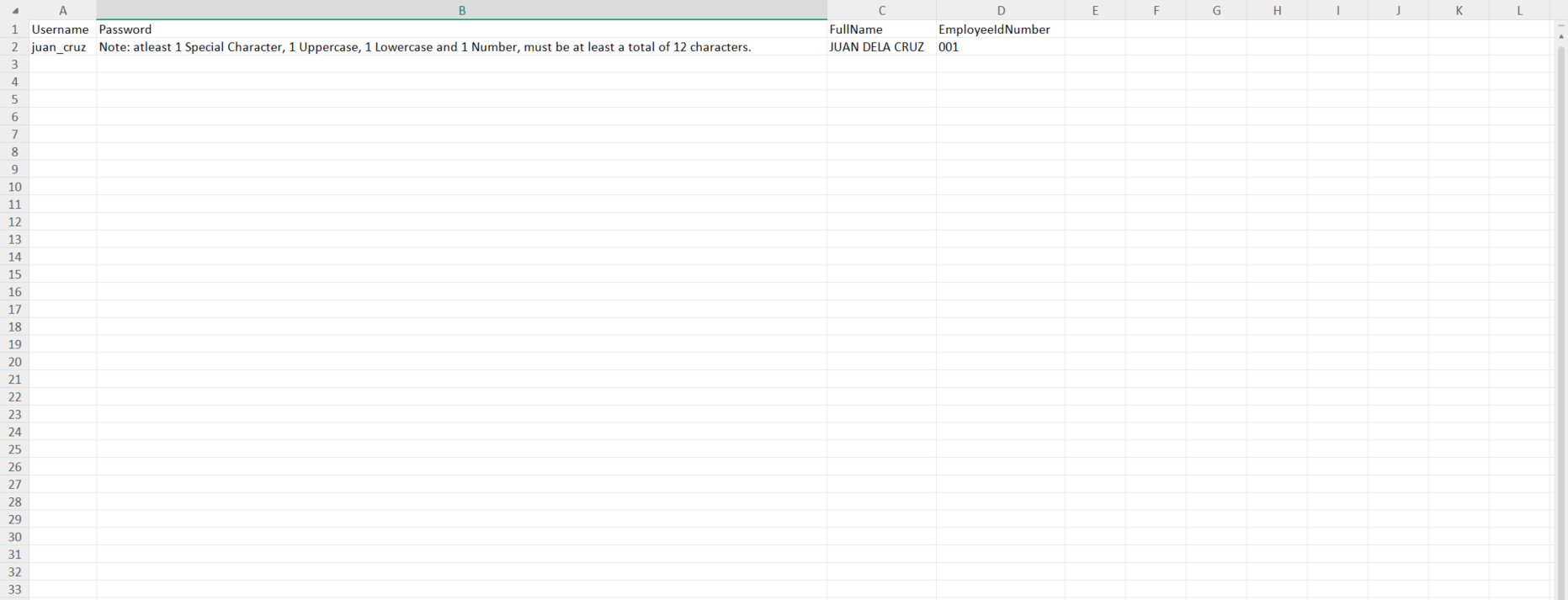

Upload User

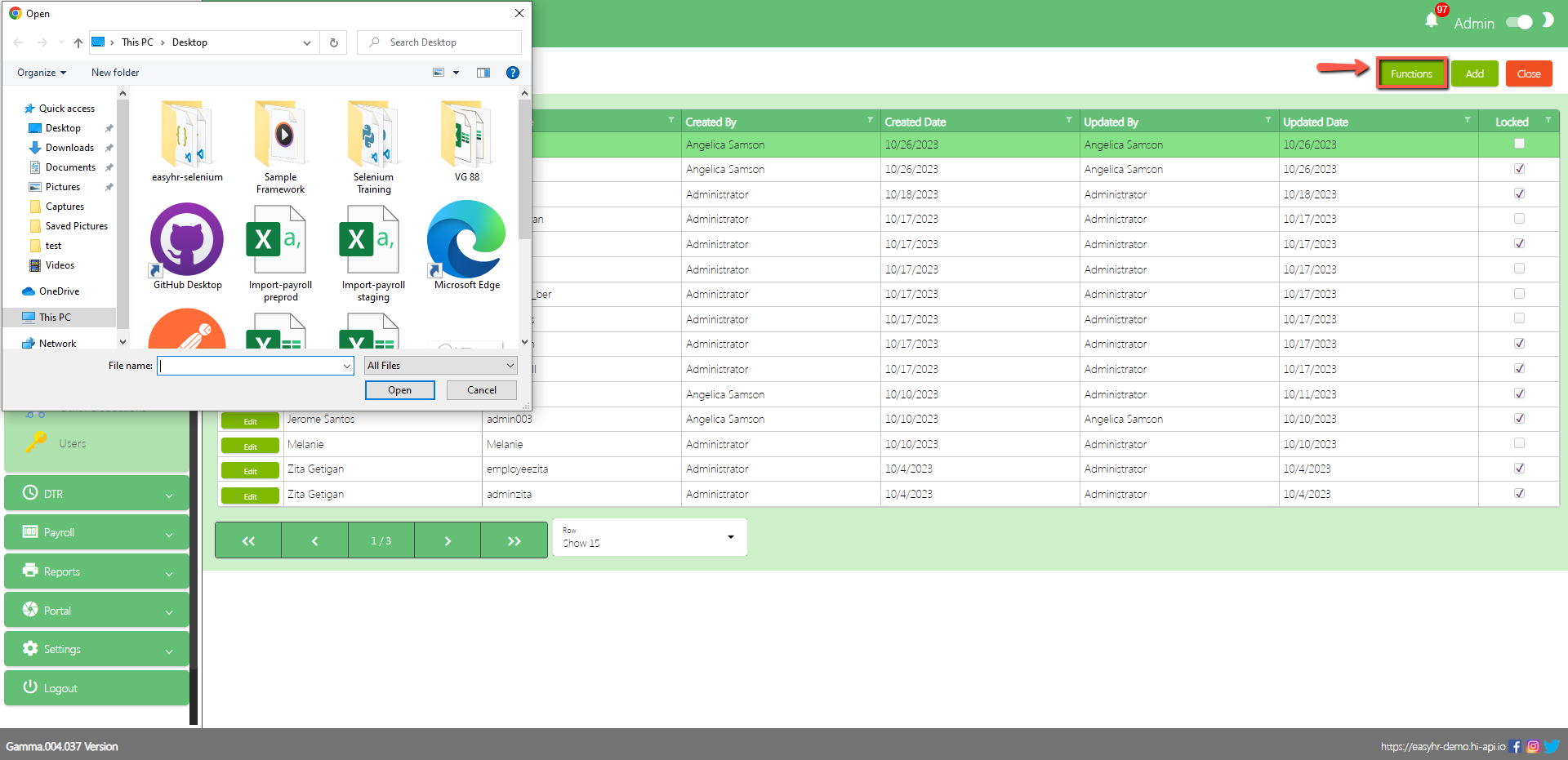

- To Upload User, click Functions button that can be seen on the right side of the screen

- To Download file format

- To Edit the format

- To Input Username

- To Input Password (Note: There is a Password requirements stated)

- To Input Fullname

- To Input EmployeeIDNumber

- Click Upload User to select master file and click Open

- Select User and Click Copy User Rights button to copy the rights for the previous User

- Uploading Master file Successfully

- File uploaded add to table

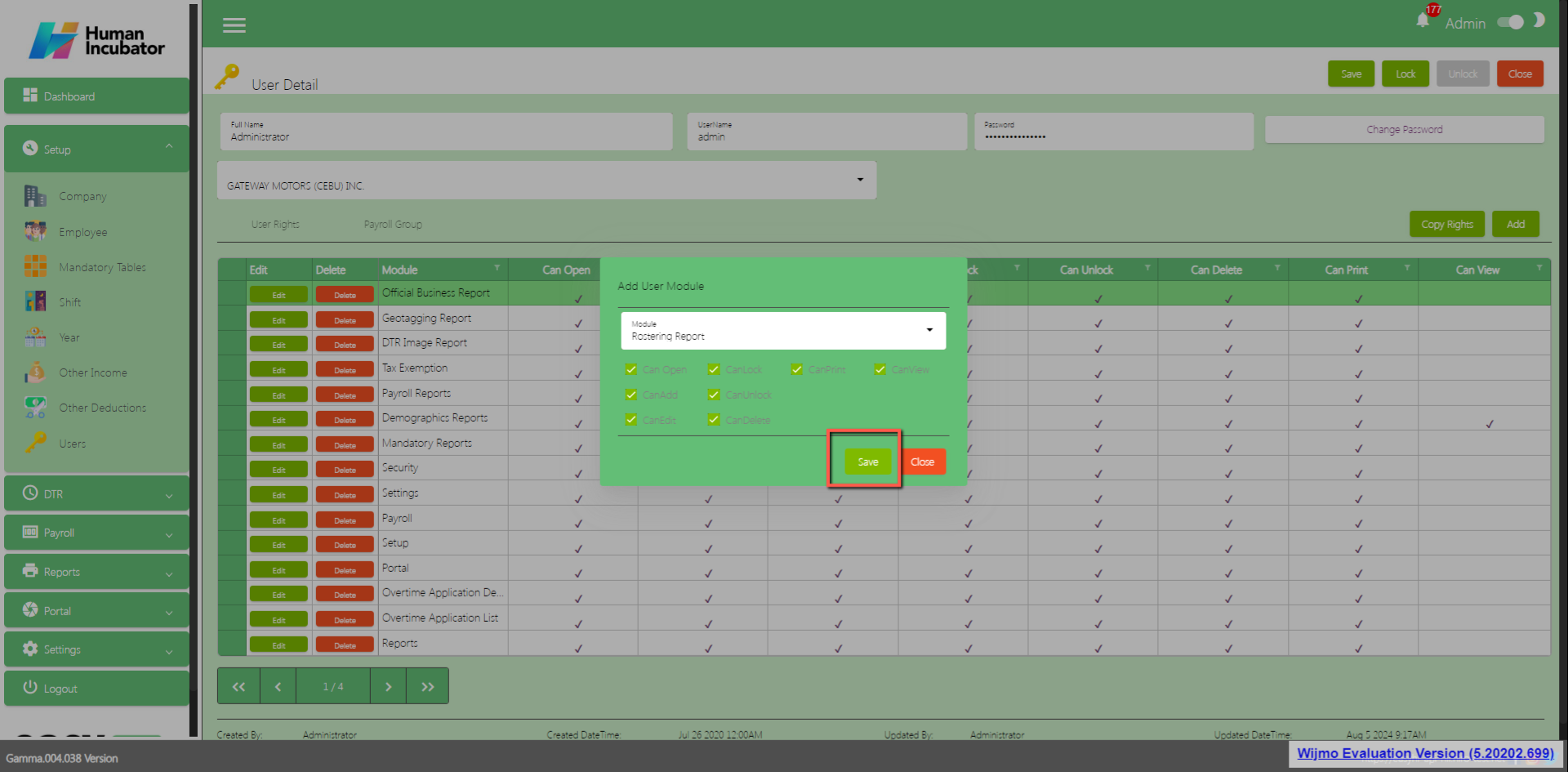

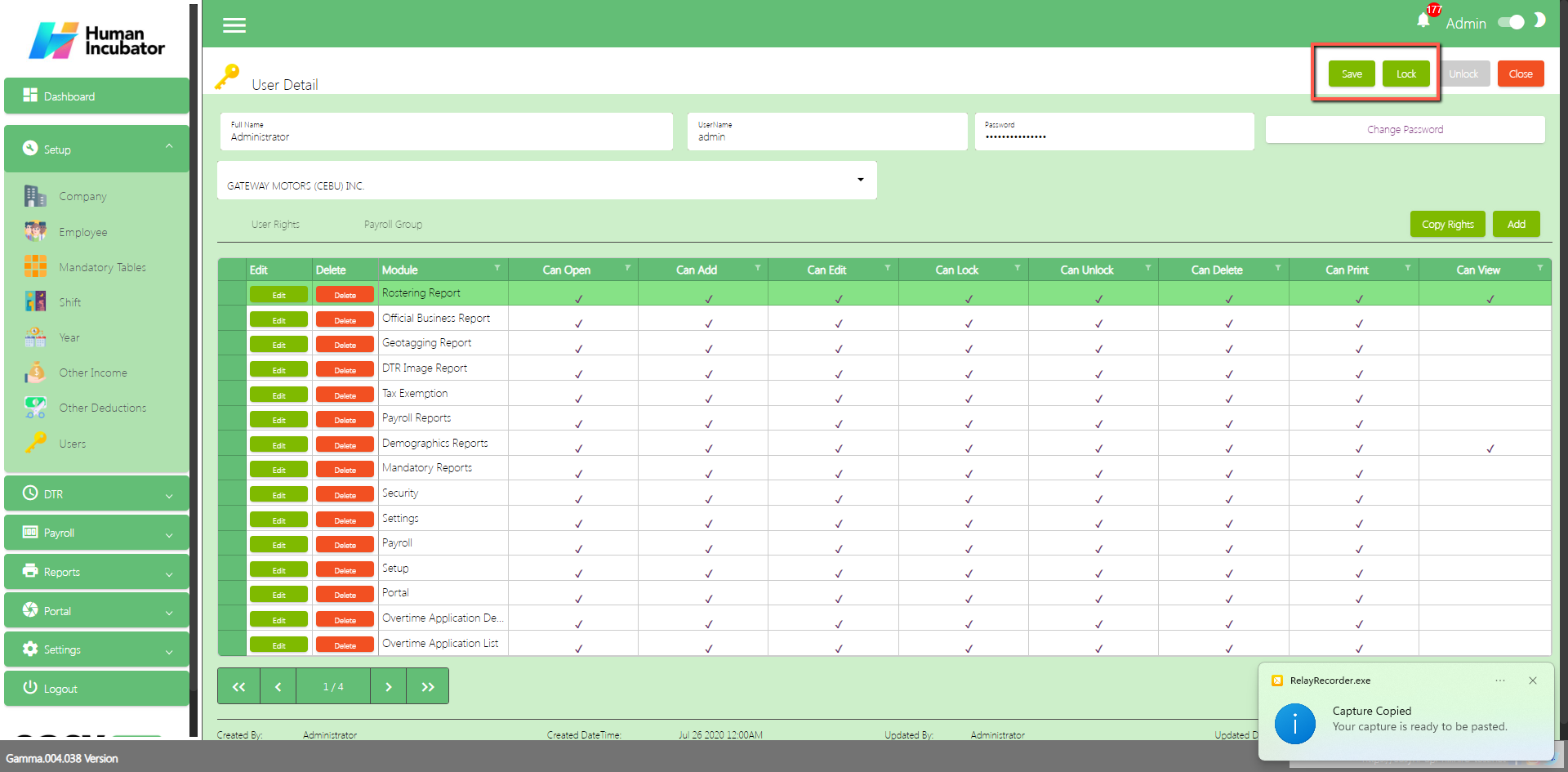

Rostering

Steps

1. In the Setup module click Users

2. Edit User

3.Go to the User Rights Tab

4. Click Add

5. Select Rostering Report

6. Click Rights Can Open, Can Add, Can Edit, Can Lock, Can Lock, Can Unlock, Can Print and Can View

7. Click Save

8. Click Save and Lock

9. Click Close