Section VI: Payroll

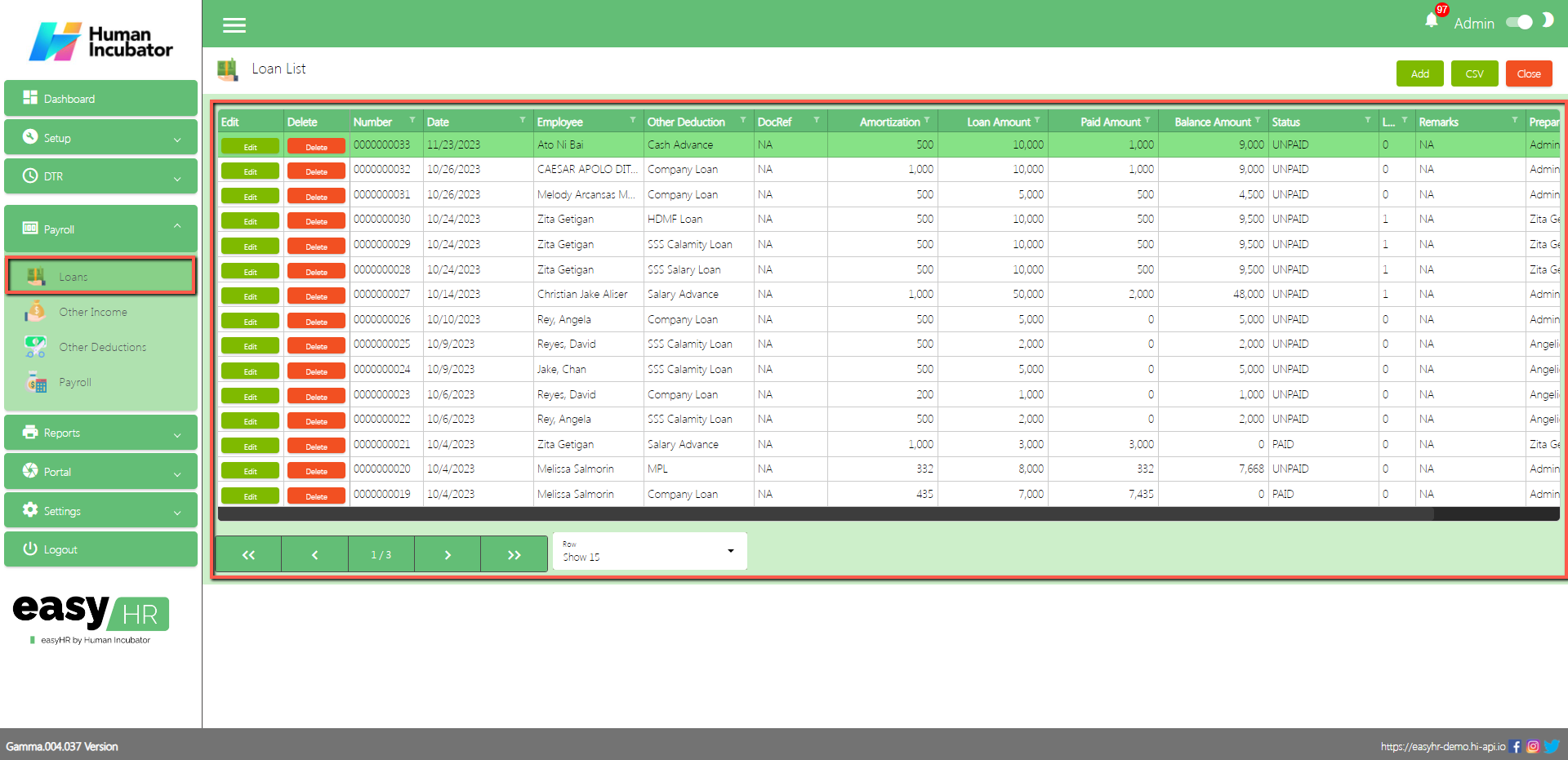

Loan

Overview

- Loans are used to view the list of loan balances for employees and also the user can add loans

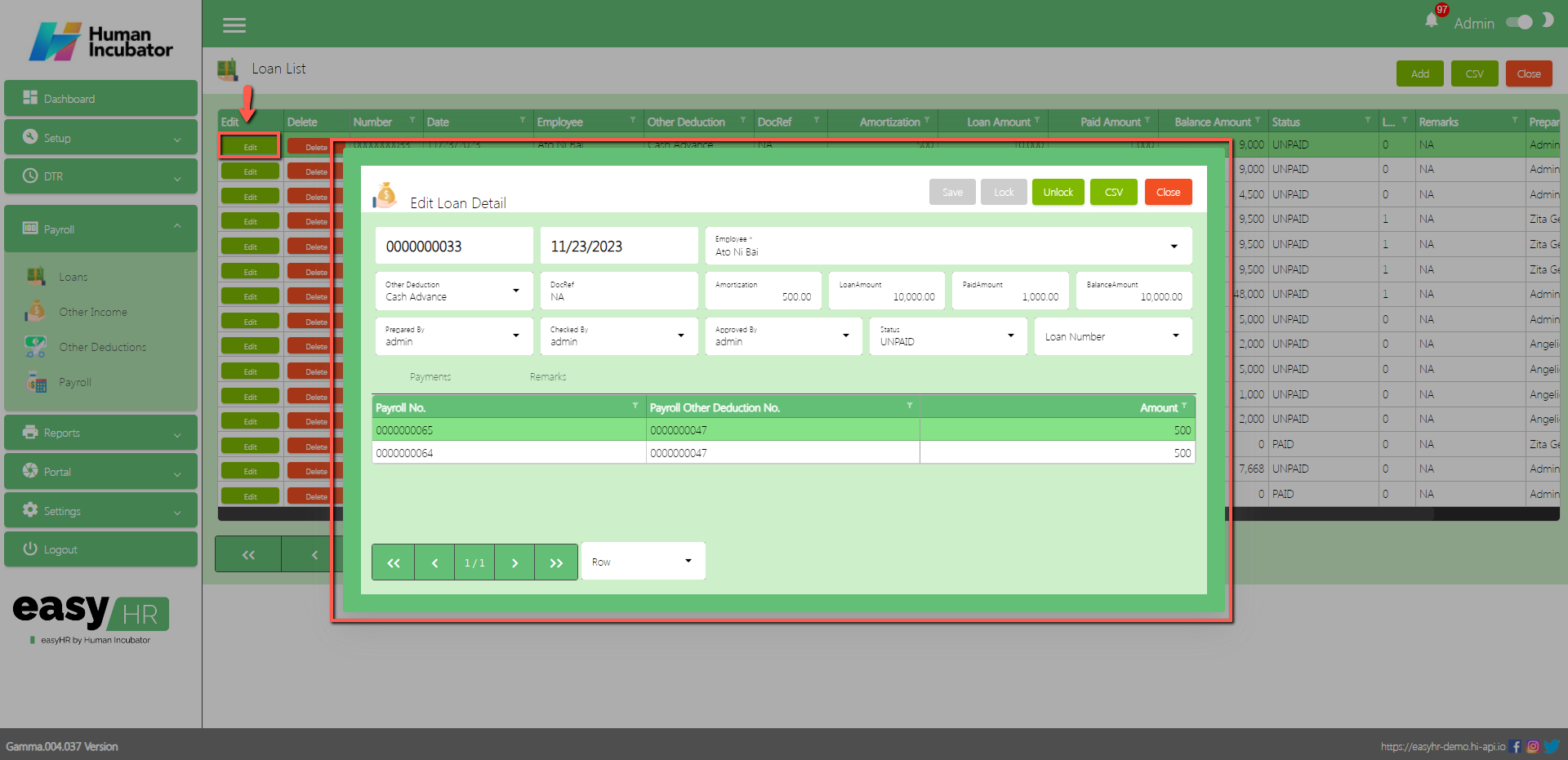

Loan List

- Shows all the list of loans for employee

Column Table

- Edit: This has a function to edit the loan

- Delete: This has a function to delete the loan (Note: You will not be able to delete the loan if it has already a transaction data)

- Number: This is for the loan number (Note: It will automatically generate according to the sequence of the added Loan)

- Date: Date of the loan added

- Employee: Name of the Employee

- Other Deduction: Name of the Other Deduction

- DocRef: You can input any doc ref

- Amortization: Payment amortization of the loan

- Loan Amount: Amount of the loan

- Paid Amount: Paid amount of the loan

- Balance Amount: Balance amount of the loan

- Status: Status of the loan if it is paid or unpaid

- Loan Number: This loan number is used to separate the loans for the Get loan feature in the Other Deduction module

- Remarks: You can input any remarks

- Prepared By: Fullname of the user who added the loan

- Locked: Check if is already locked

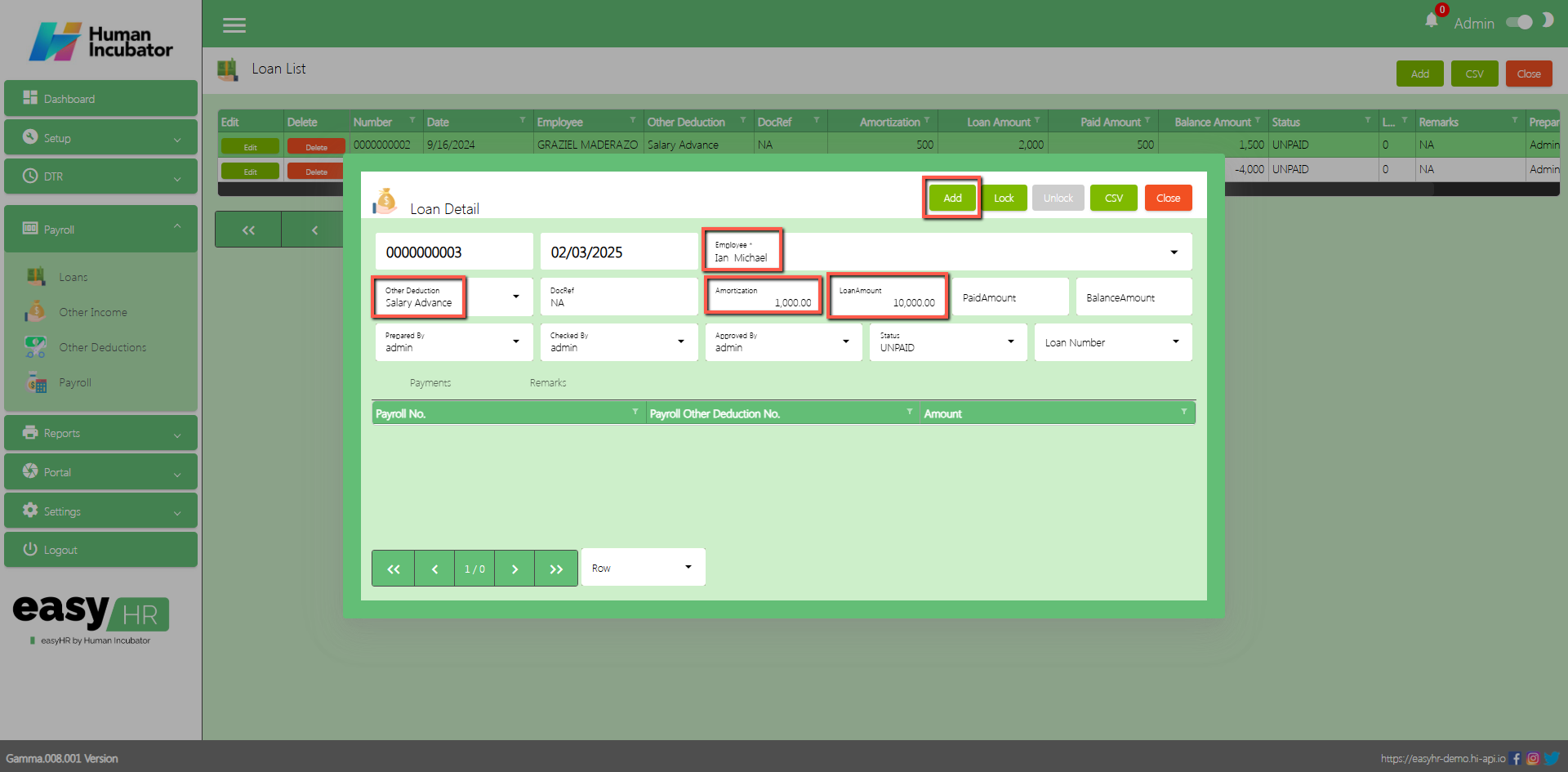

Loan Detail

- To Add a new Loan, click the Add button that can be seen on the right side of the screen

- Fill all the important fields in Loan detail like:

- Select Employee

- Select Other Deduction (Loan Name)

- Input monthly Amortization and Loan Amount

- Select Checked By and Approved By

- Select Loan number (Optional)

- Click ADD button to add the loan

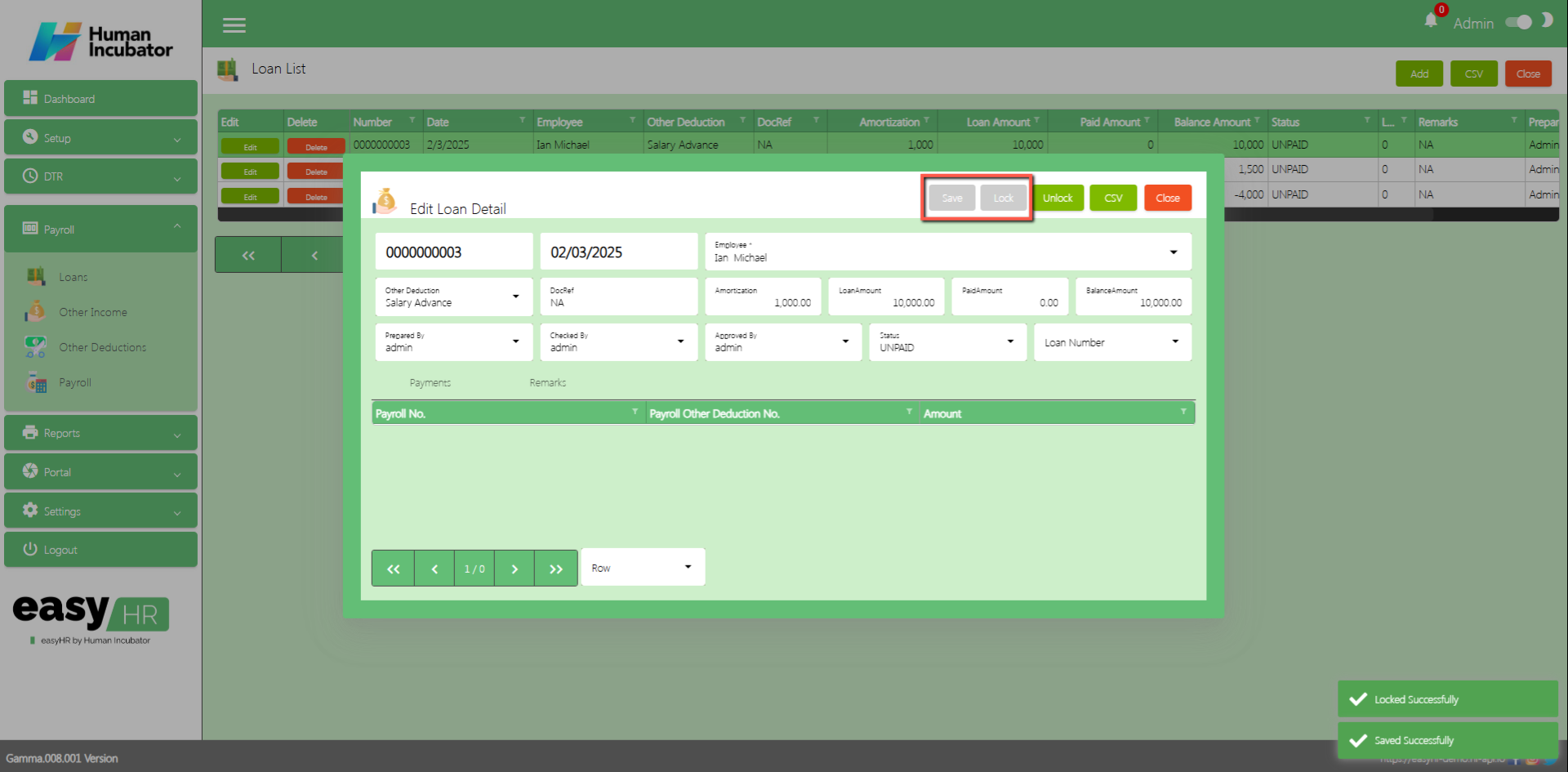

- Click Edit button and Save/Lock so that the loan will be posted

Show Loan Detail

- Click Edit button to show the loan details of employee

Column Table

- Payroll No.: Payroll number history of the loan

- Payroll Other Deduction No.: Payroll Other Deduction number history of the loan

- Amount: Payment Amount history of the loan

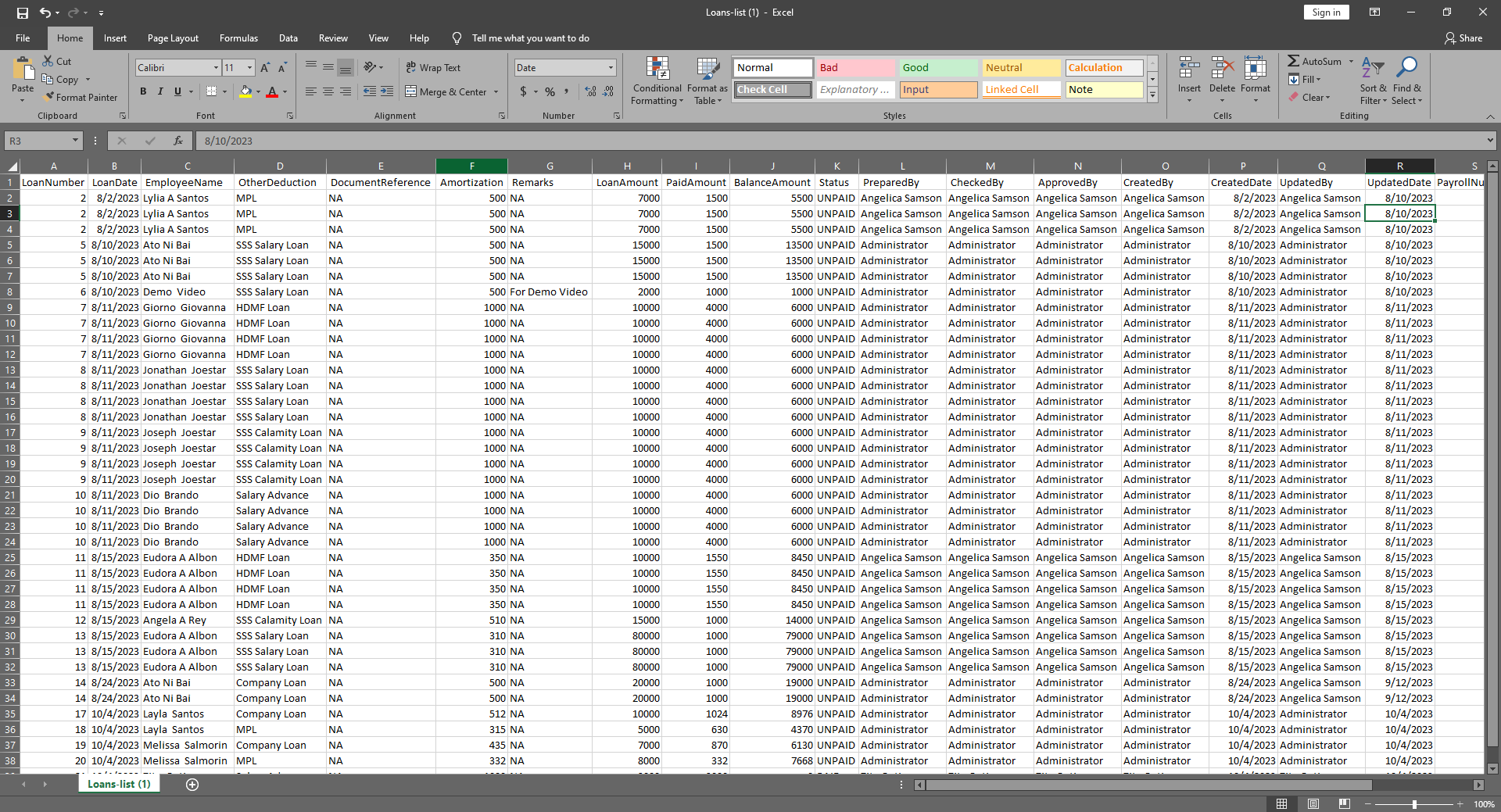

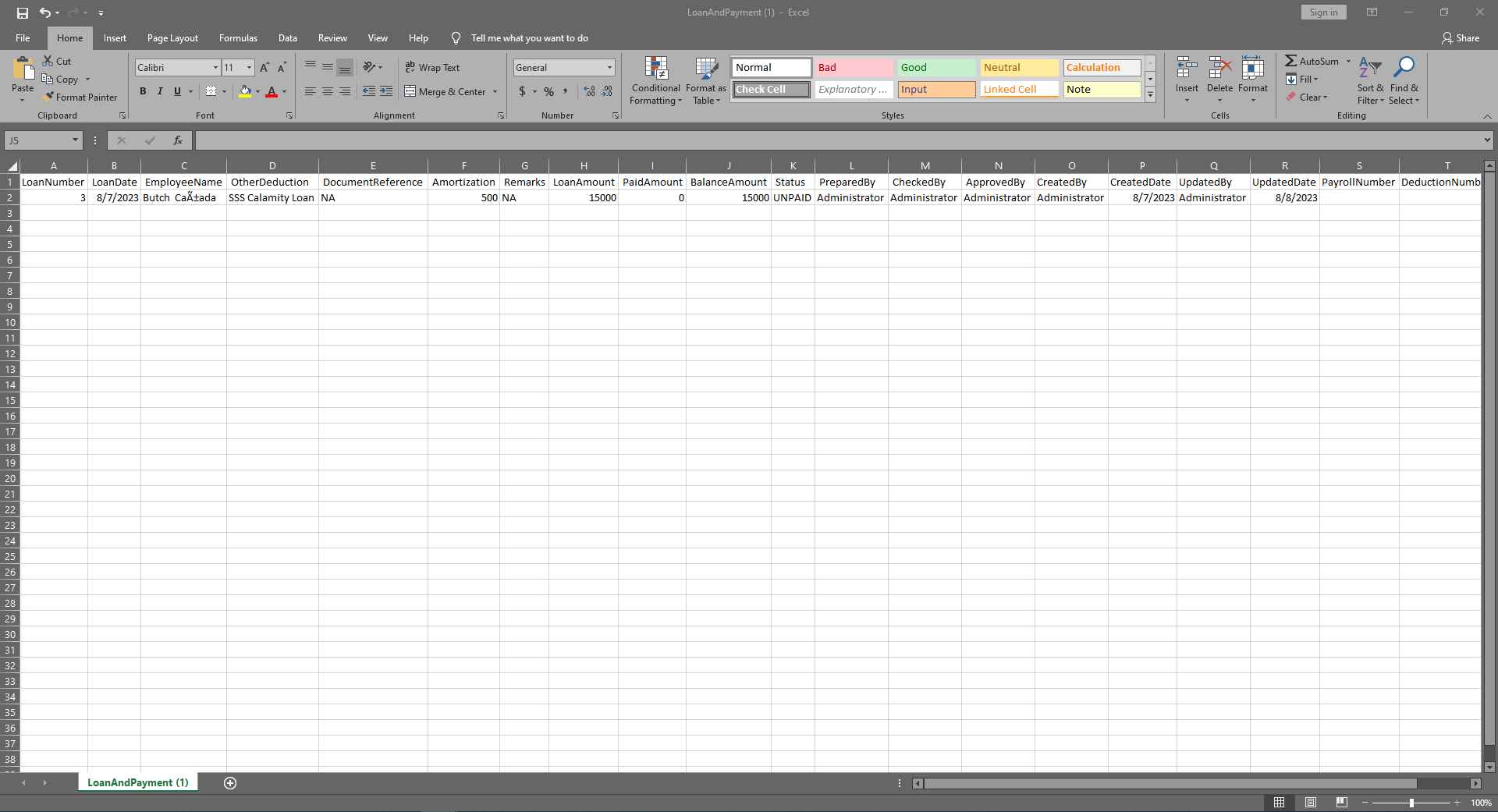

Download CSV In Loan List

- Click the CSV button to download the CSV file

Download CSV In Loan Detail

- Click the CSV button to download the CSV file

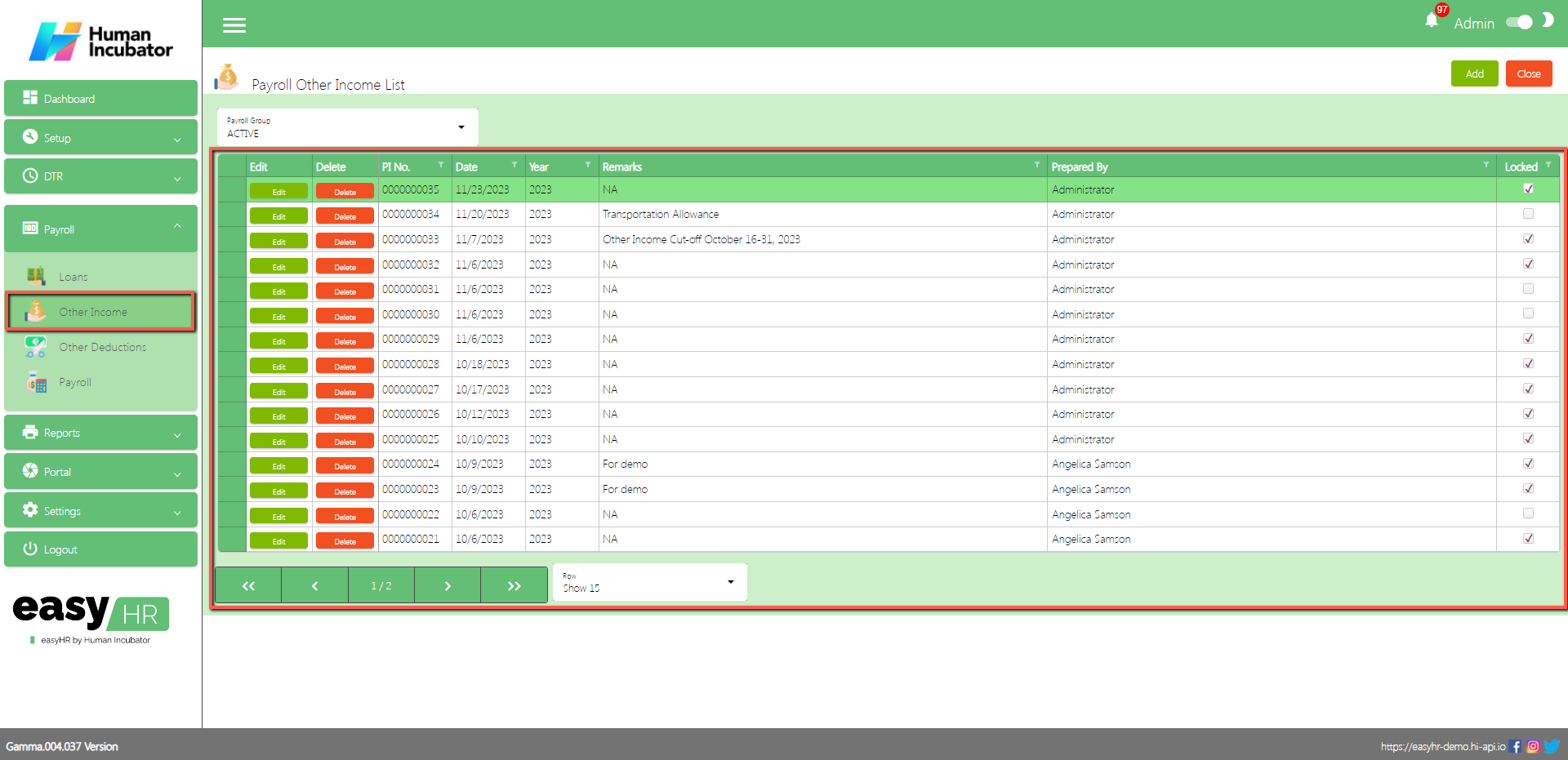

Other Income

Overview

- Other Income is used to add other income to include to employee payroll and also the user can compute the 13th month for employees

Payroll Other Income List

- Shows all list of Payroll Other Income

- Select Payroll Group

Column Table

- Edit: This has a function to edit the Other Income

- Delete: This has a function to delete the Other Income (Note: You will not be able to delete the Other income if the payroll connected is already locked)

- PI No.: This is for the Other Income number (Note: It will automatically generate according to the sequence of the added Other Income)

- Date: Date of the Other Income added

- Year: Year Date of the Other Income added

- Remarks: You can input any remarks

- Prepared By: Full Name of the user who added the Other Income

- Locked: Check if this is already locked

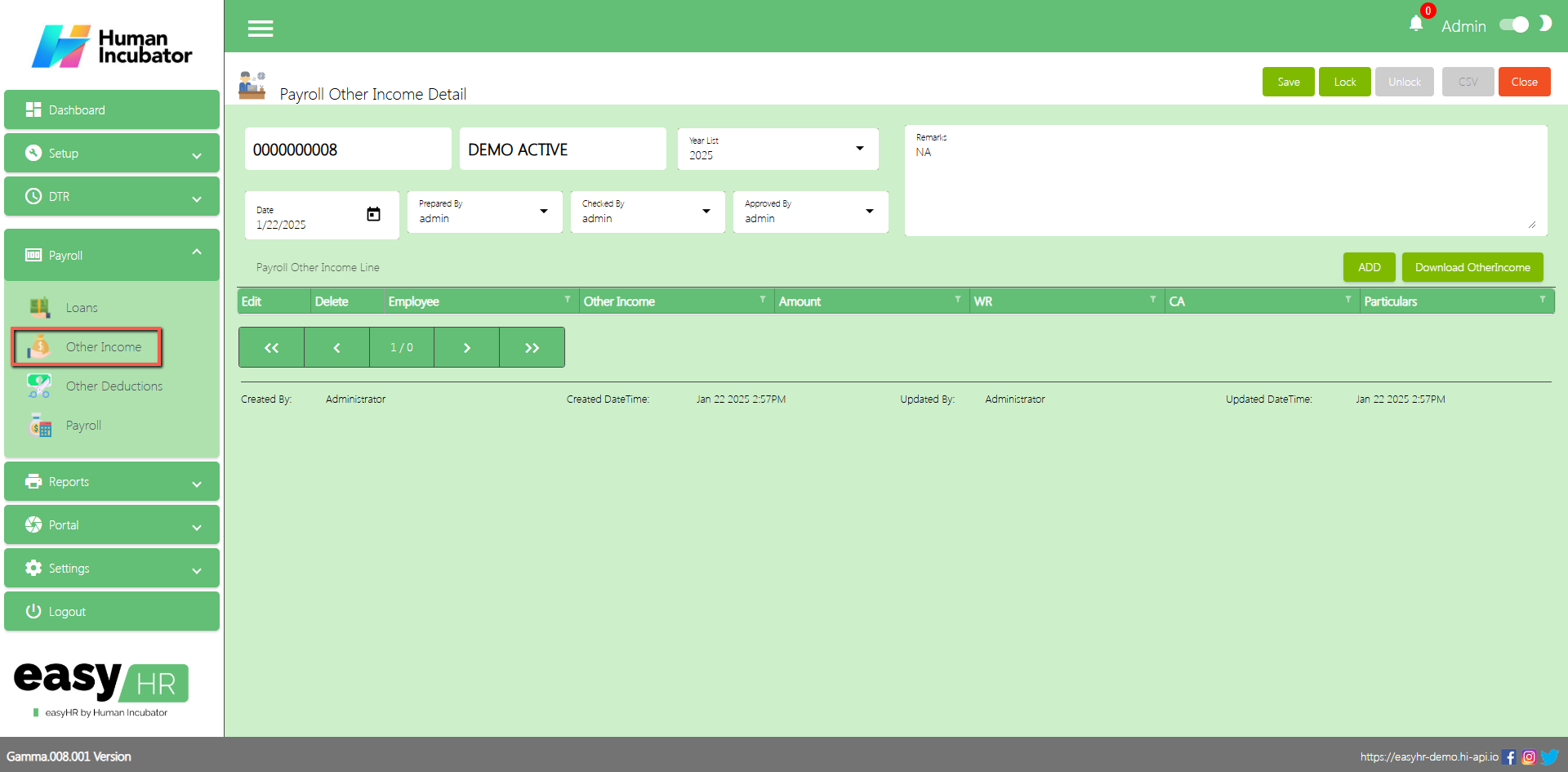

Payroll Other Income Detail

- To Add a new Payroll Other Income, click the Add button that can be seen on the right side of the screen

- Fill all the important fields in Loan detail like:

- Input Remarks

- Select Date

- Select Prepared By

- Select Checked By

- Approved By

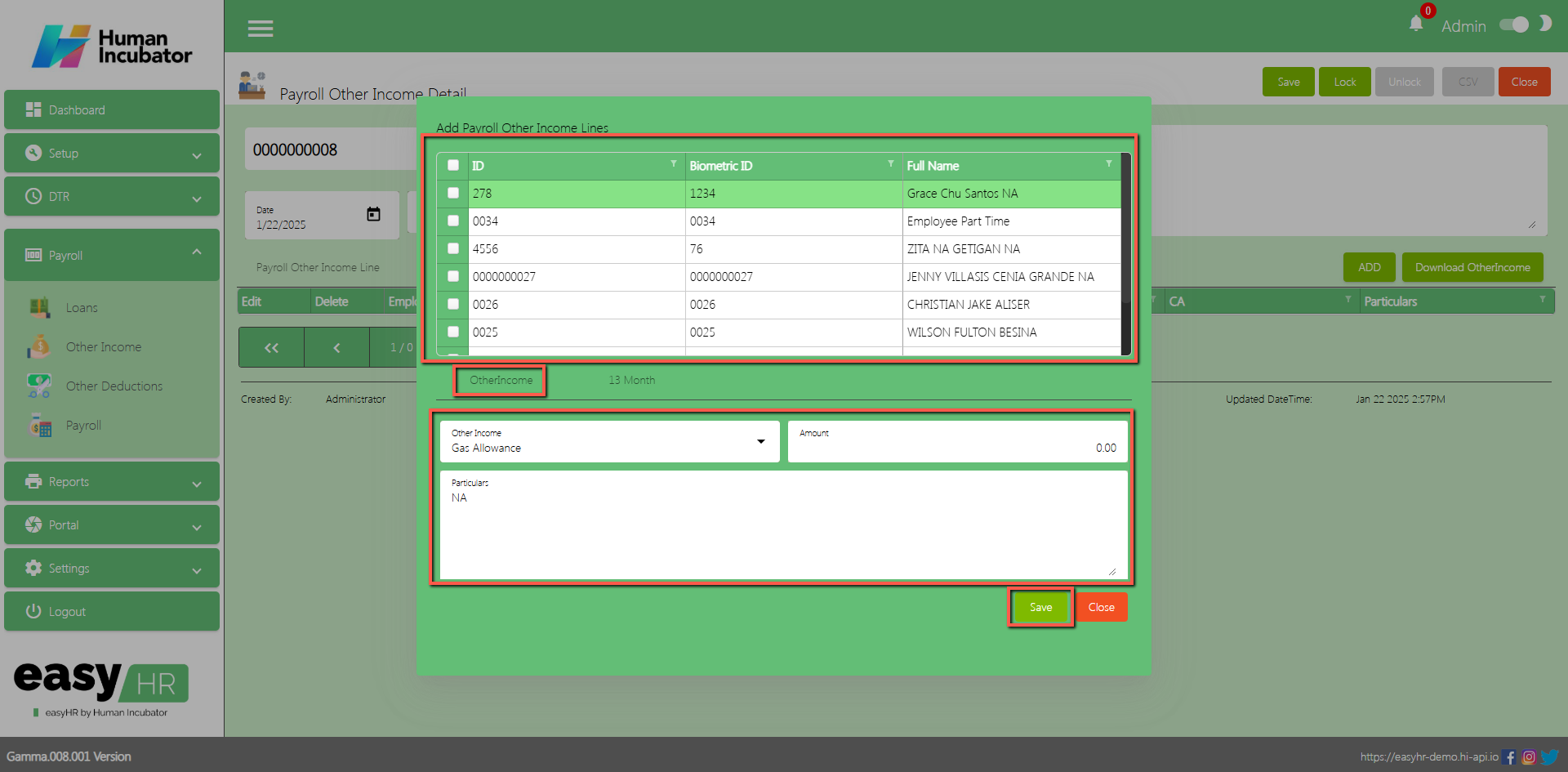

Add Payroll Other Income Lines

- To Add a manually Payroll Other Income lines, click the Add button

- There 2 tabs in add payroll other income lines

- Select Employee

- Other Income Tab and 13th Month Tab

- In Other Income tab there are important fields need to fill up and select

- Select Other Income Name

- Input Amount

- Input Particulars

- Click Save button to add in Payroll Other Income Line

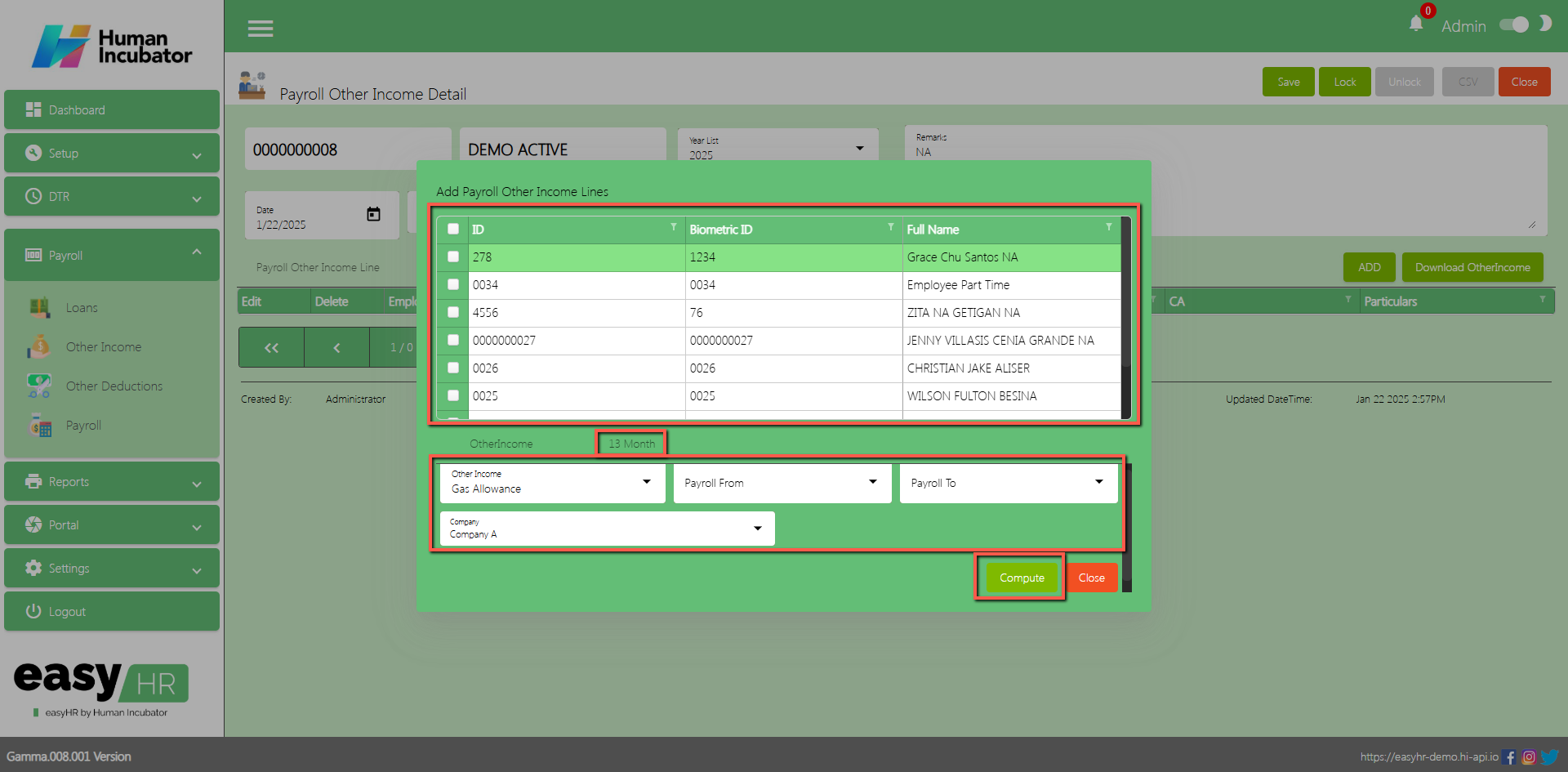

- In 13th Month tab there are important fields need and select

- Select 13th Month

- Select Payroll From

- Select Payroll To

- Select Company

- Click Compute button to compute the 13th month

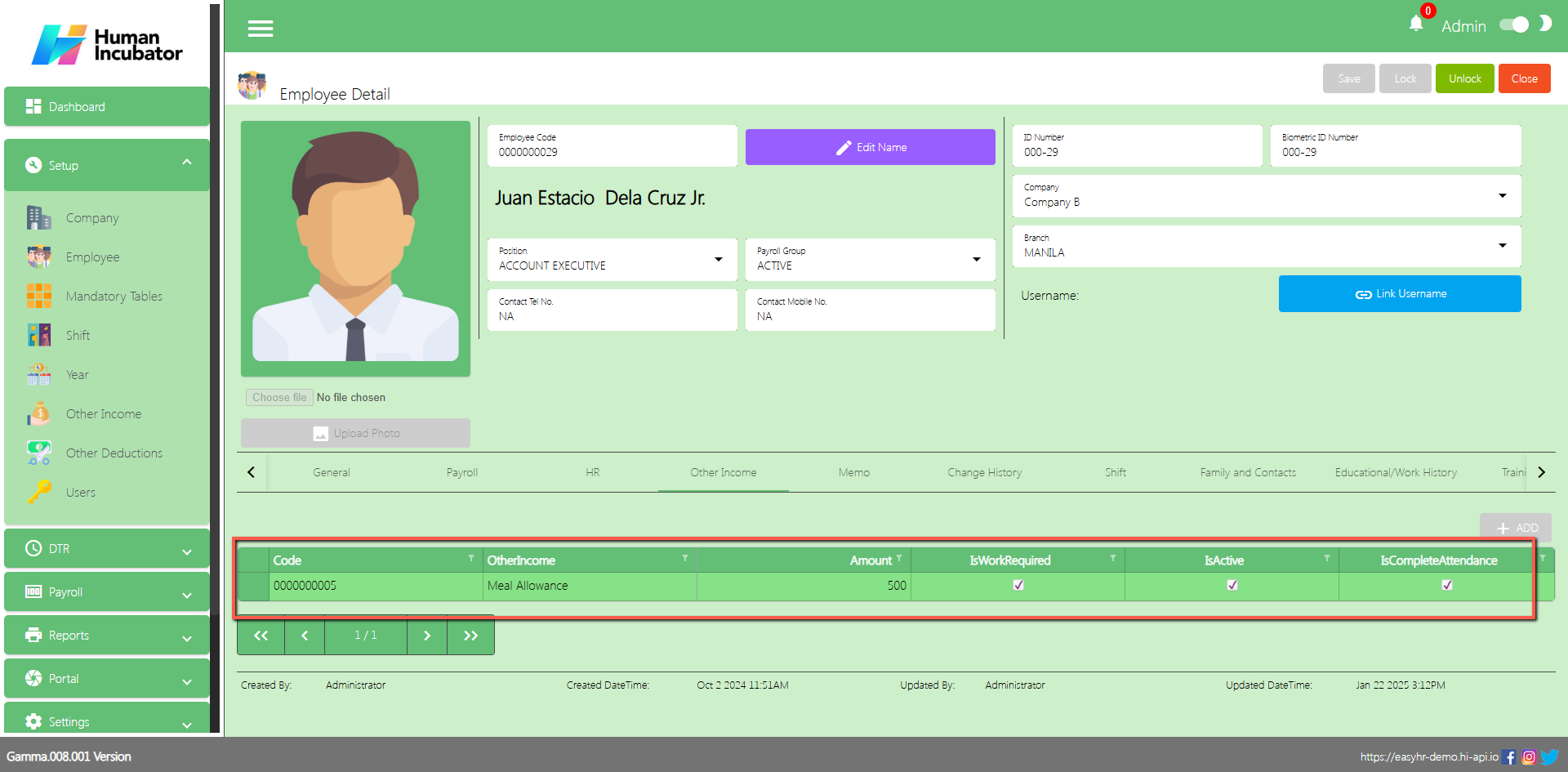

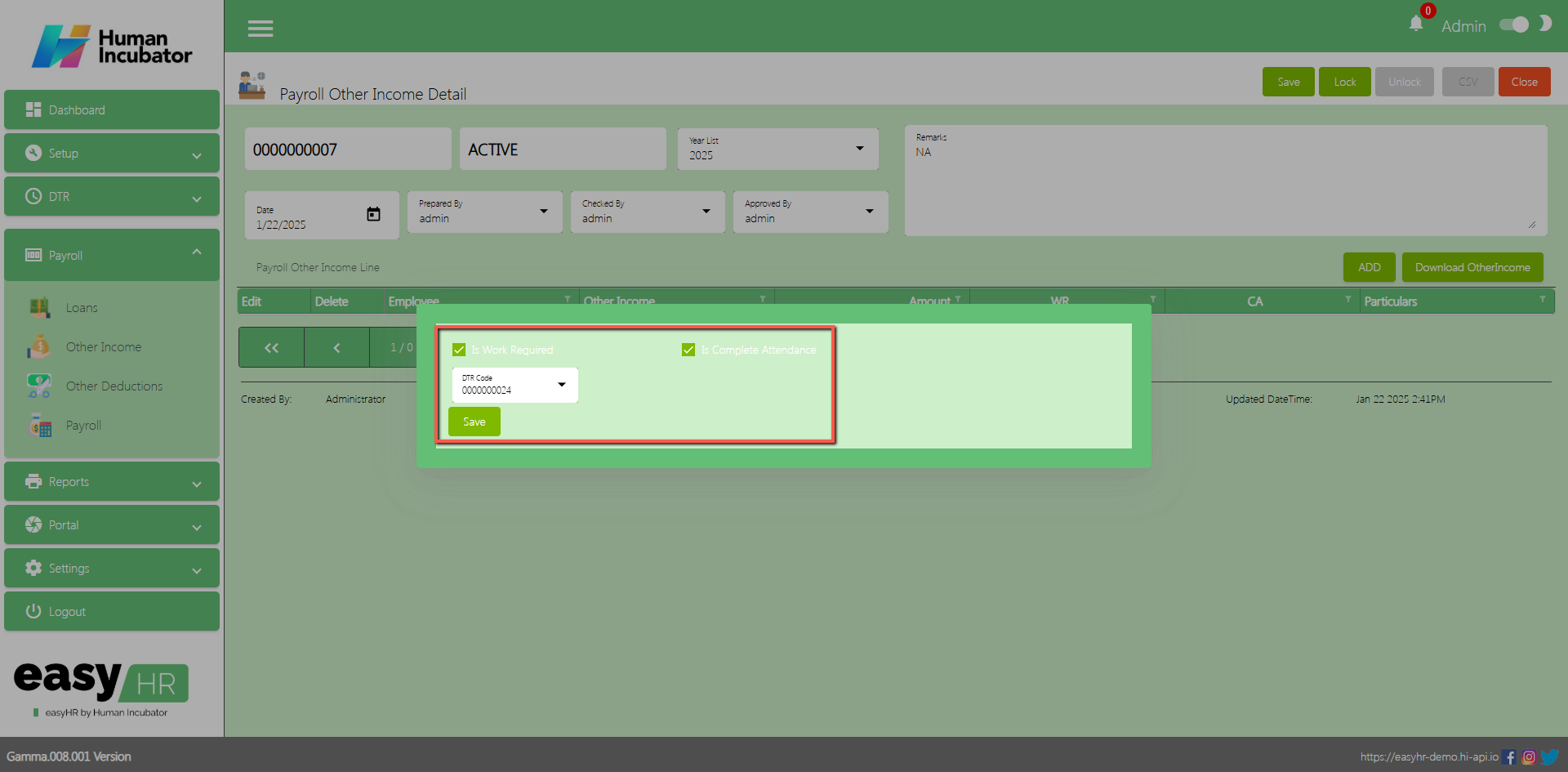

Download Other Income

- Click Download Other Income button to download the other Income of employee (It will get all the other income added on their 201 file based on payroll group)

- Check the Checkbox if Is Work Required or Is Complete Attendance.

- Select DTR Code

- Click Save button to add in Payroll Other Income Line

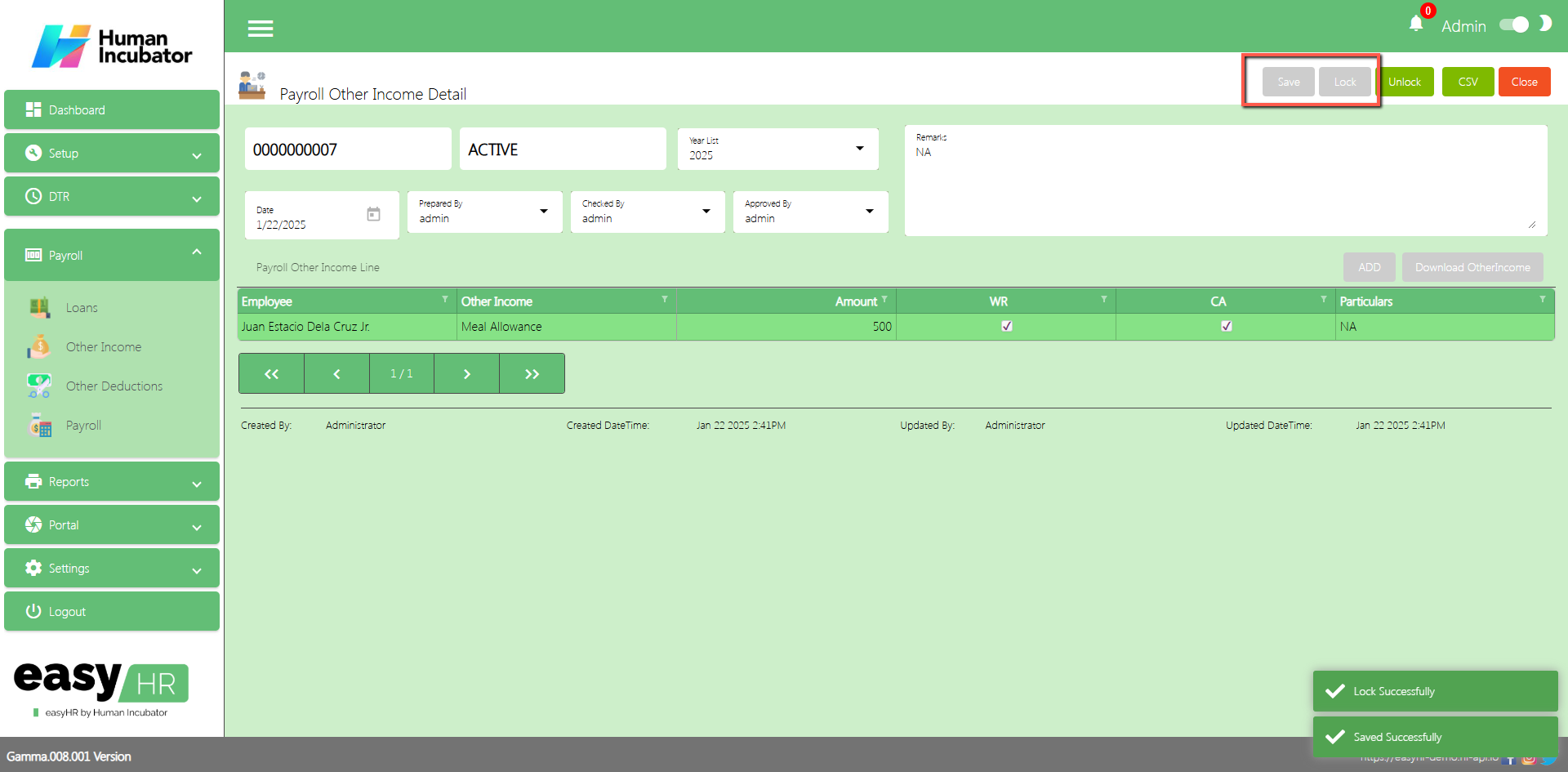

Save/Lock

- Make sure to save/lock so that this record is read and computed in the system also the Other Income code will be viewed in the Payroll module.

Column Detail

- Employee: Name of the Employee

- Other Income: Name of the Other Income

- Amount: Amount of the Other Income

- WR: Meaning “Work Required” the employee will only get the other income if the employee has a work

- CA: Meaning “Complete Attendance” the employee will only get the other income if the employee got Complete Attendance

- Particulars: You can input any remarks

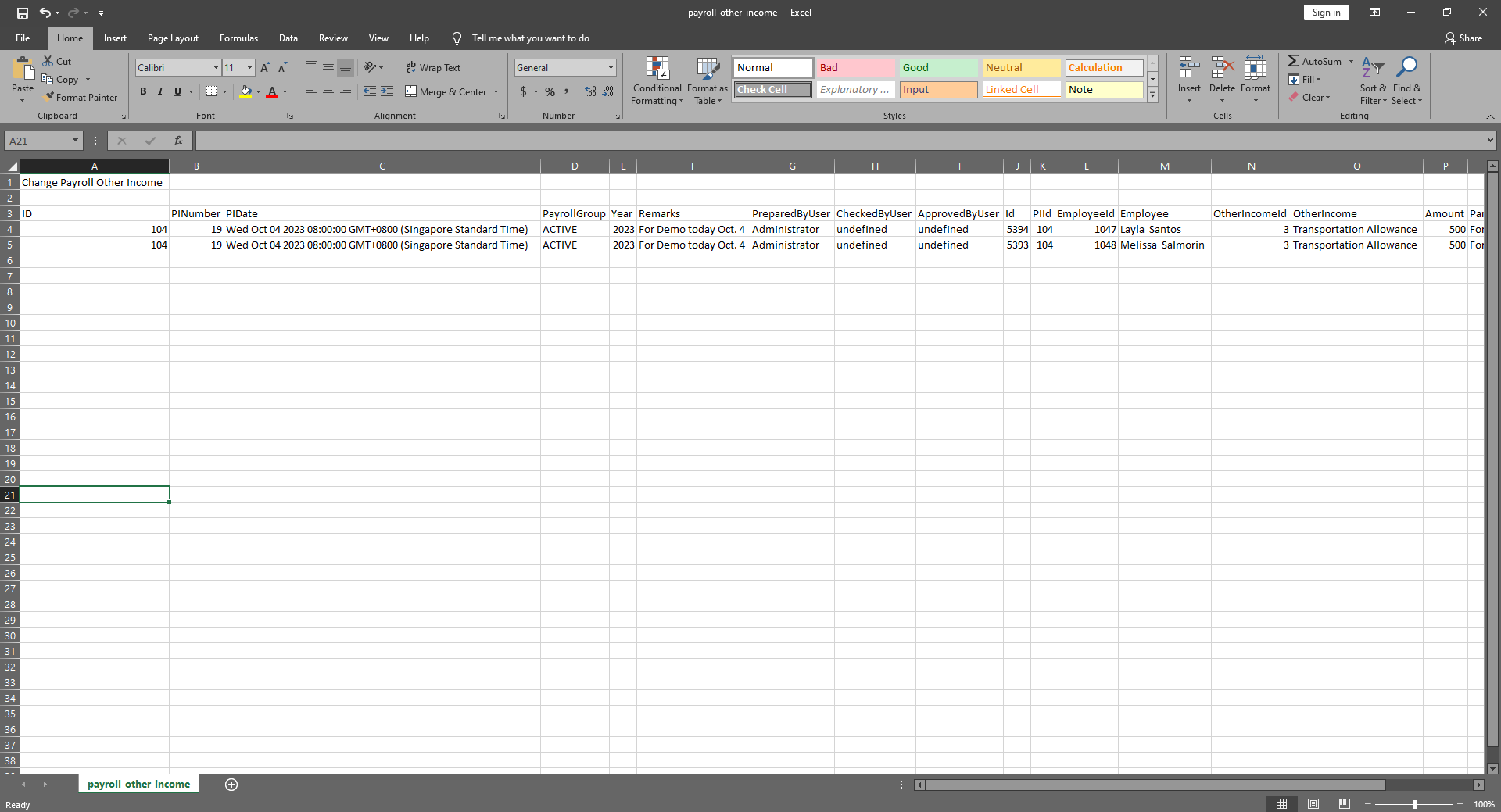

Download CSV In Payroll Other Income Detail

- Click the CSV button to download the CSV file

Other Deductions

Overview

- Other Deduction is used generate the deduction or loans of employee and also the user can add the loan for the 1 time payment deduction

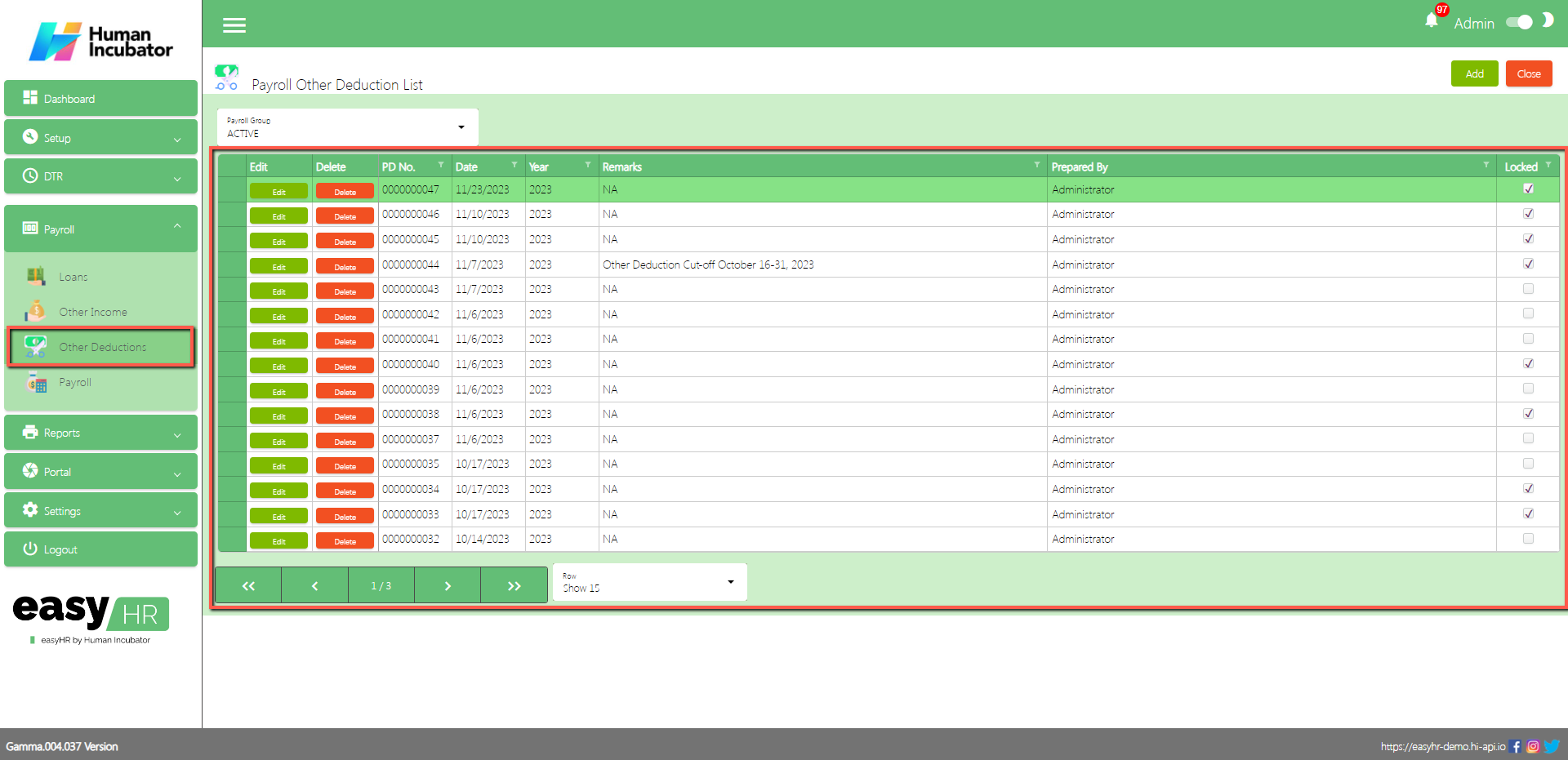

Payroll Other Deduction List

- Shows all the list of Payroll Other Deduction

- Select Payroll Group

Column Table:

- Edit: This has a function to edit the Other Deduction

- Delete: This has a function to delete the Other Deduction (Note: You will not be able to delete the Other Deduction if the payroll connected is already locked)

- PD No.: This is for the Other Deduction number (Note: It will automatically generate according to the sequence of the added Other Deduction)

- Date: Date of the Other Deduction added

- Year: Year Date of the Other Deduction added

- Remarks: You can Input remarks

- Prepared By: Full Name of the user who added the Other Deduction

- Locked: Checked if this is already locked

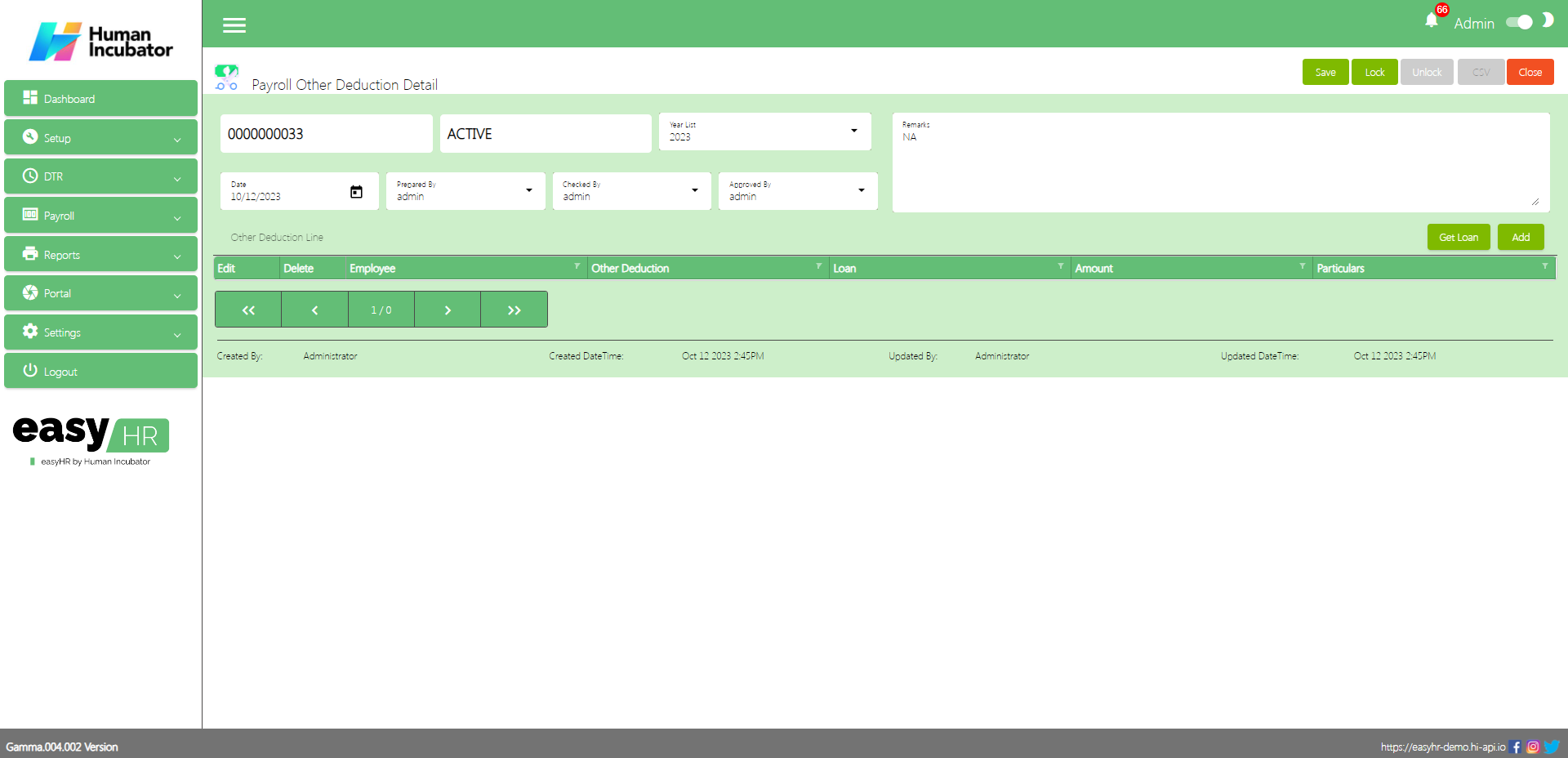

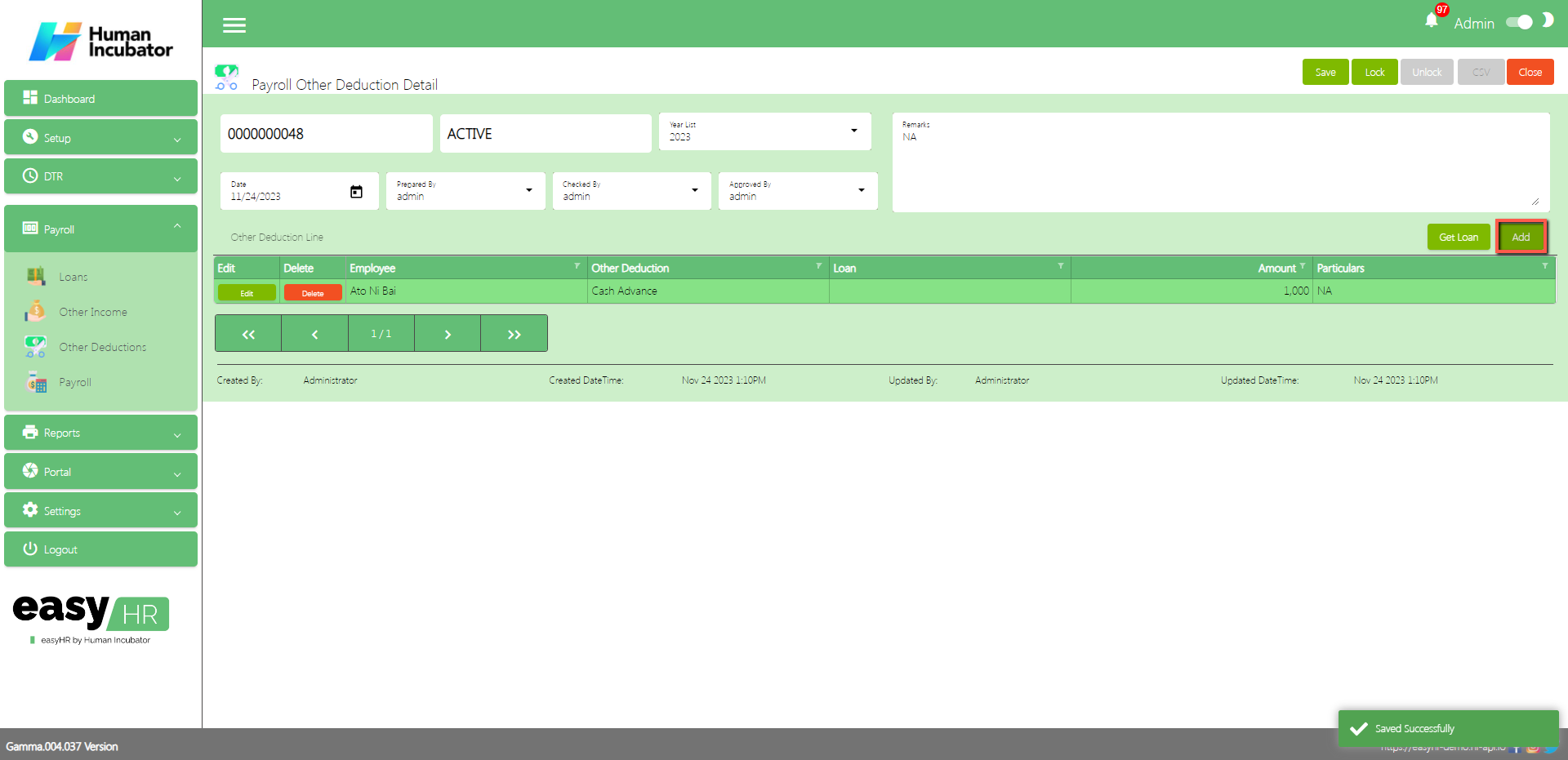

Payroll Other Deduction Detail

- To Add a new Payroll Other Deduction, click the Add button that can be seen on the right side of the screen

- Fill all the important fields in Loan detail like:

- Select Checked By

- Select Approved By

- Input Remarks

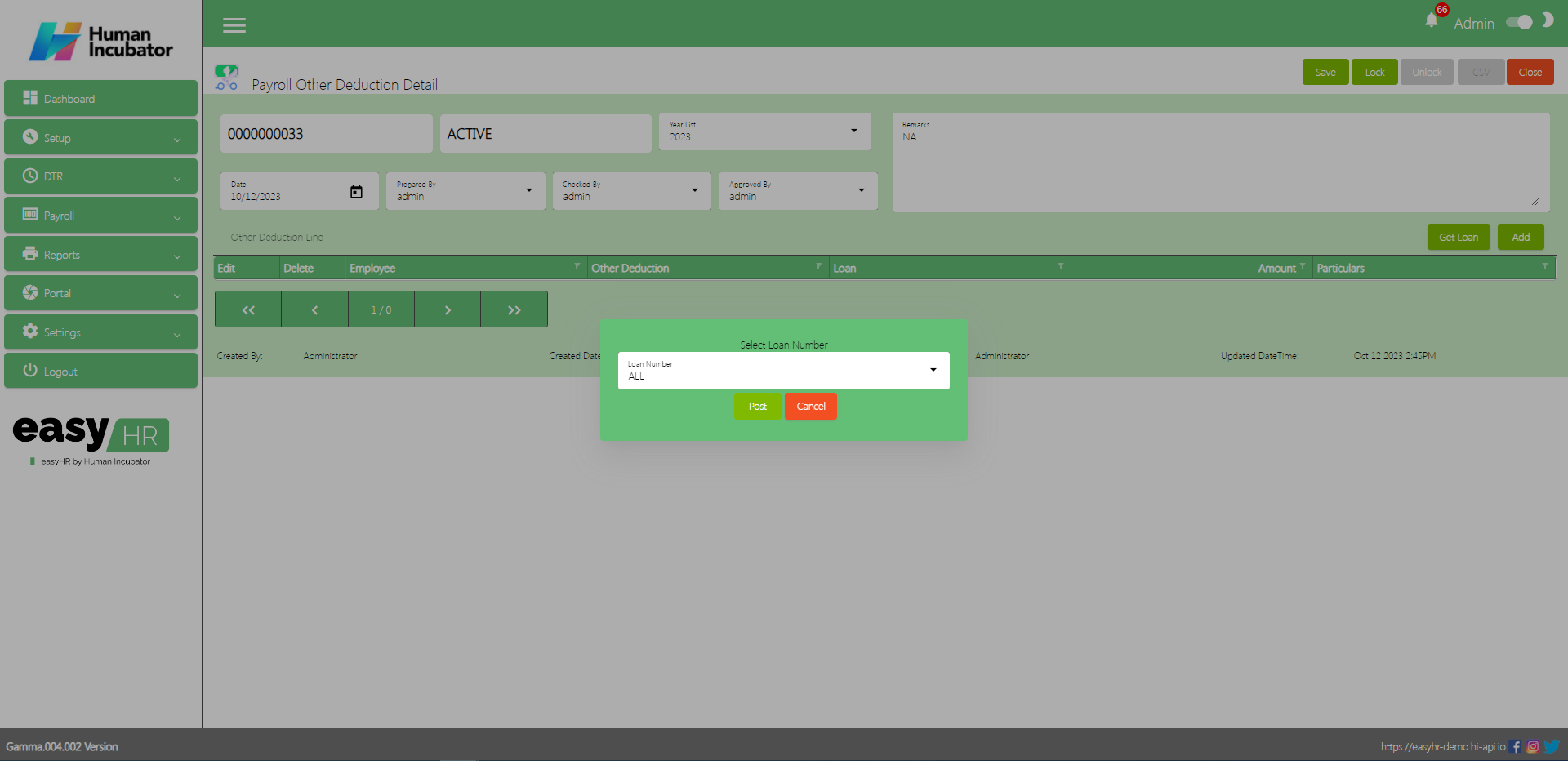

- Click Get loan button to get all employees loan

- Select All to Loan Number

- Click Post button to add in another deduction line

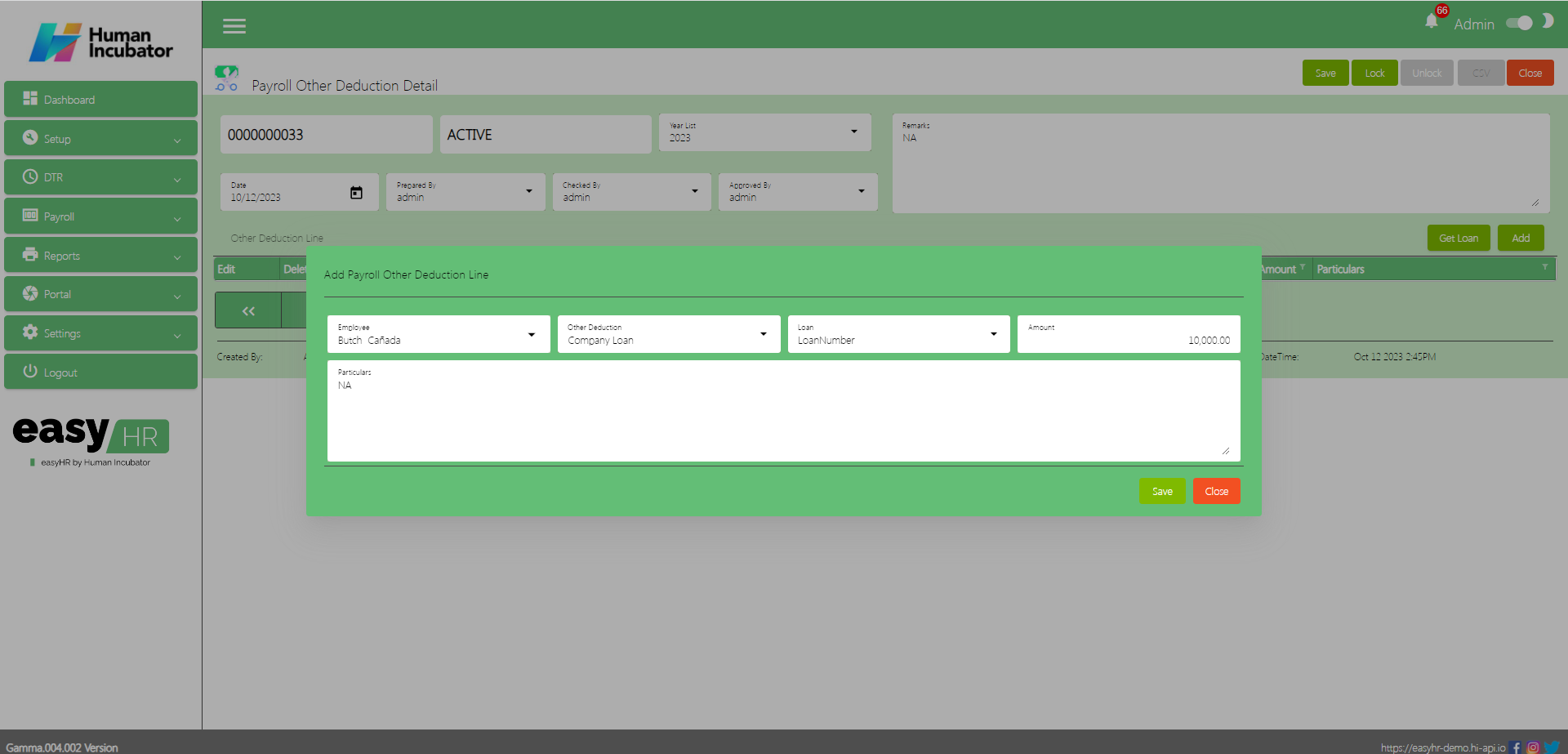

- Click Add button to manually or individually add a loan to the employee.

- Select Employee

- Select Other Deduction Name

- Select Loan Number

- Input Amount

- Click Save button to add in another deduction line

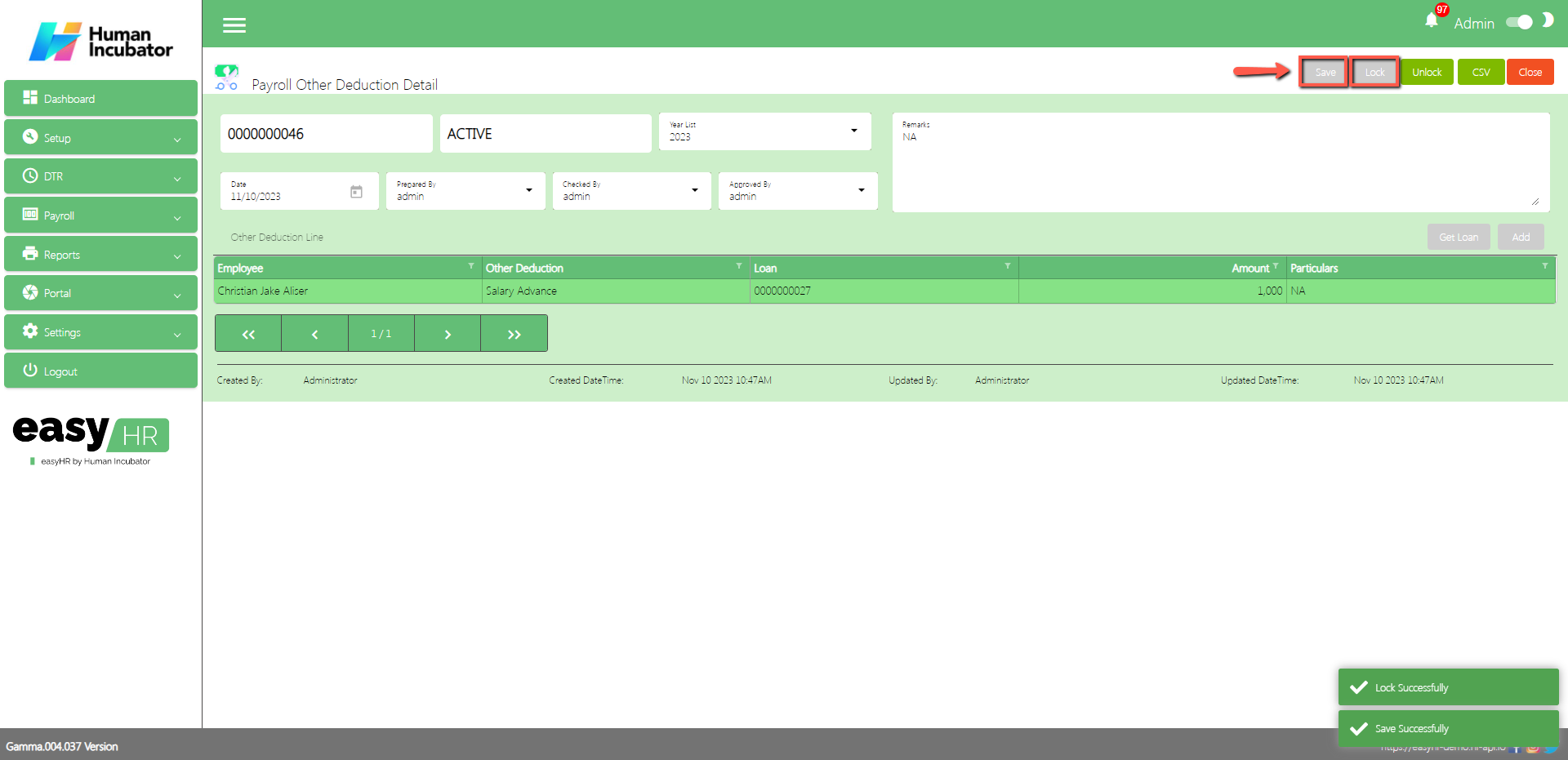

Save/Lock

- Make sure to save/lock so that this record is read and computed in the system also the Other Deduction code will be viewed in the Payroll module.

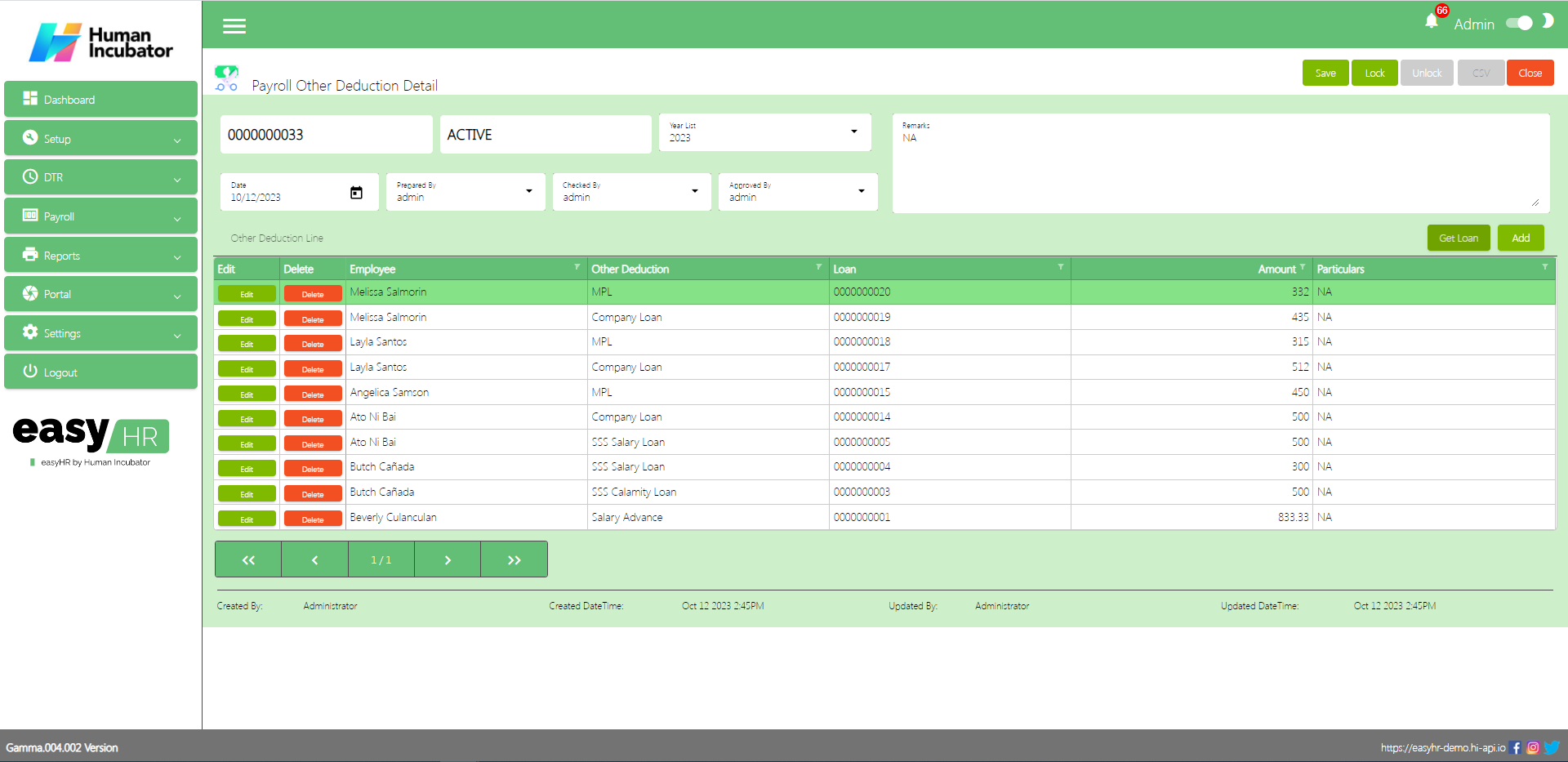

Column Table

- Employee: Name of the Employee

- Other Deduction: Name of the Other Deduction

- Loan: Loan number of the Employee

- Amount: Loan payment amount

- Particulars: You can add any particulars

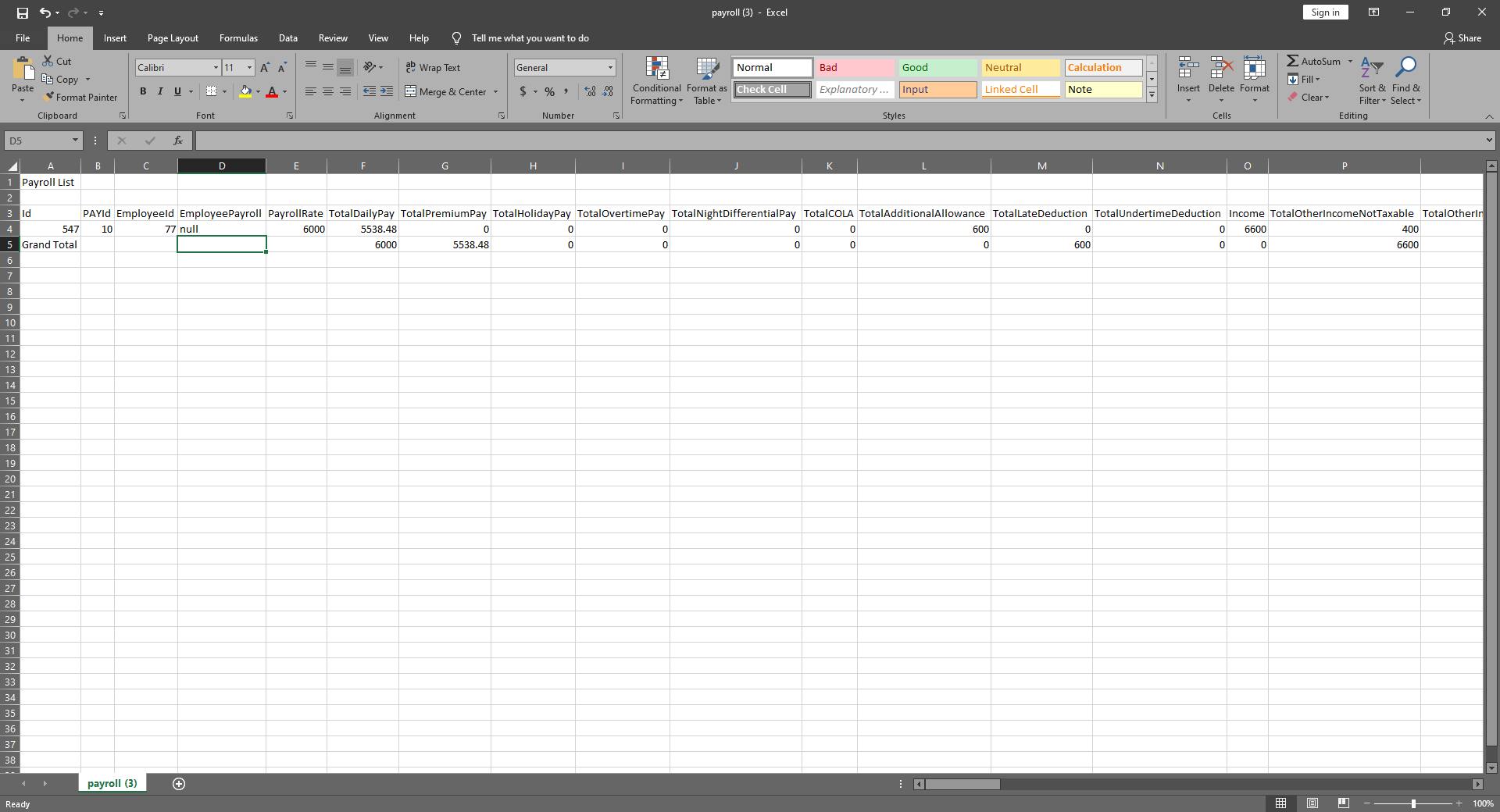

Payroll

Overview

- Payroll is used to compute all the Deduction, Other Income, Daily rate, Monthly Rate, Net Income

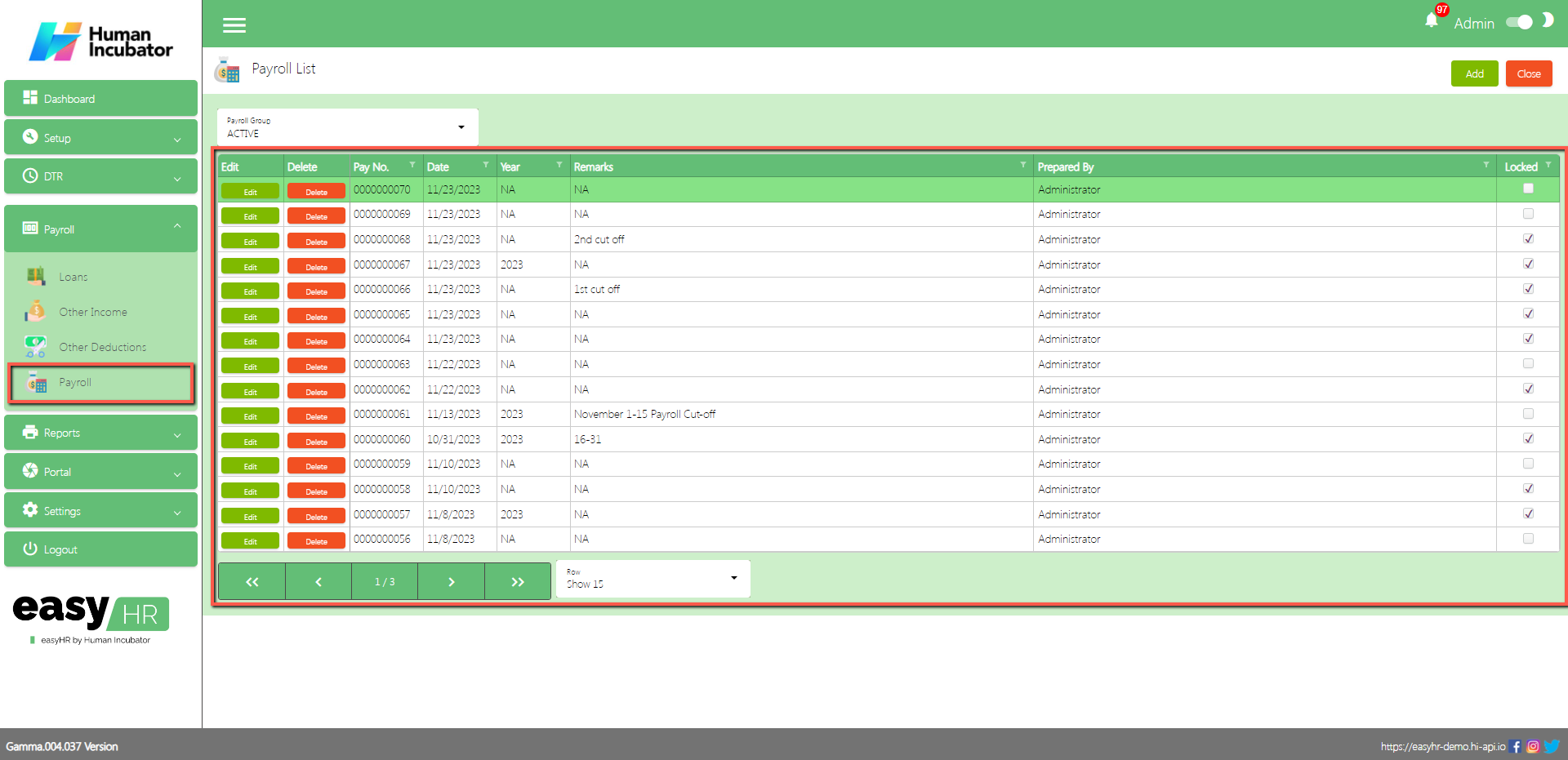

Payroll List

- Shows all the list of Payroll

- Select Payroll Group

Column Table

- Edit: This has a function to edit the Payroll

- Delete: This has a function to delete the Payroll (Note: You will not be able to delete the Payroll if it has still a Payroll lines)

- Pay No.: This is for the Payroll number (Note: It will automatically generate according to the sequence of the added Payroll)

- Date: Date of the Payroll added

- Year: Year Date of the Payroll added

- Remarks: You can Input any remarks

- Prepared By: Full Name of the User who added the Payroll

- Locked: Check if the Payroll is already locked.

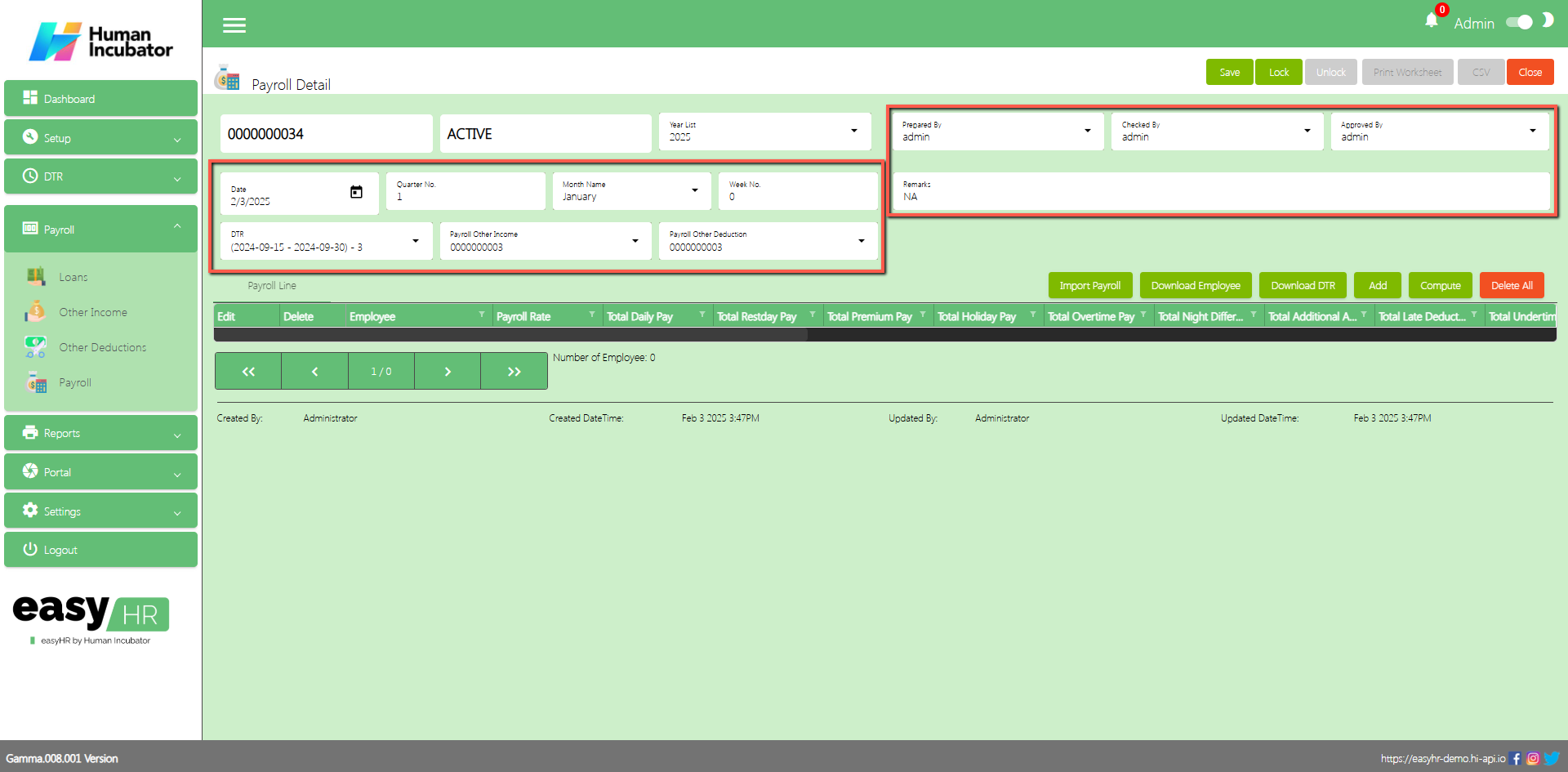

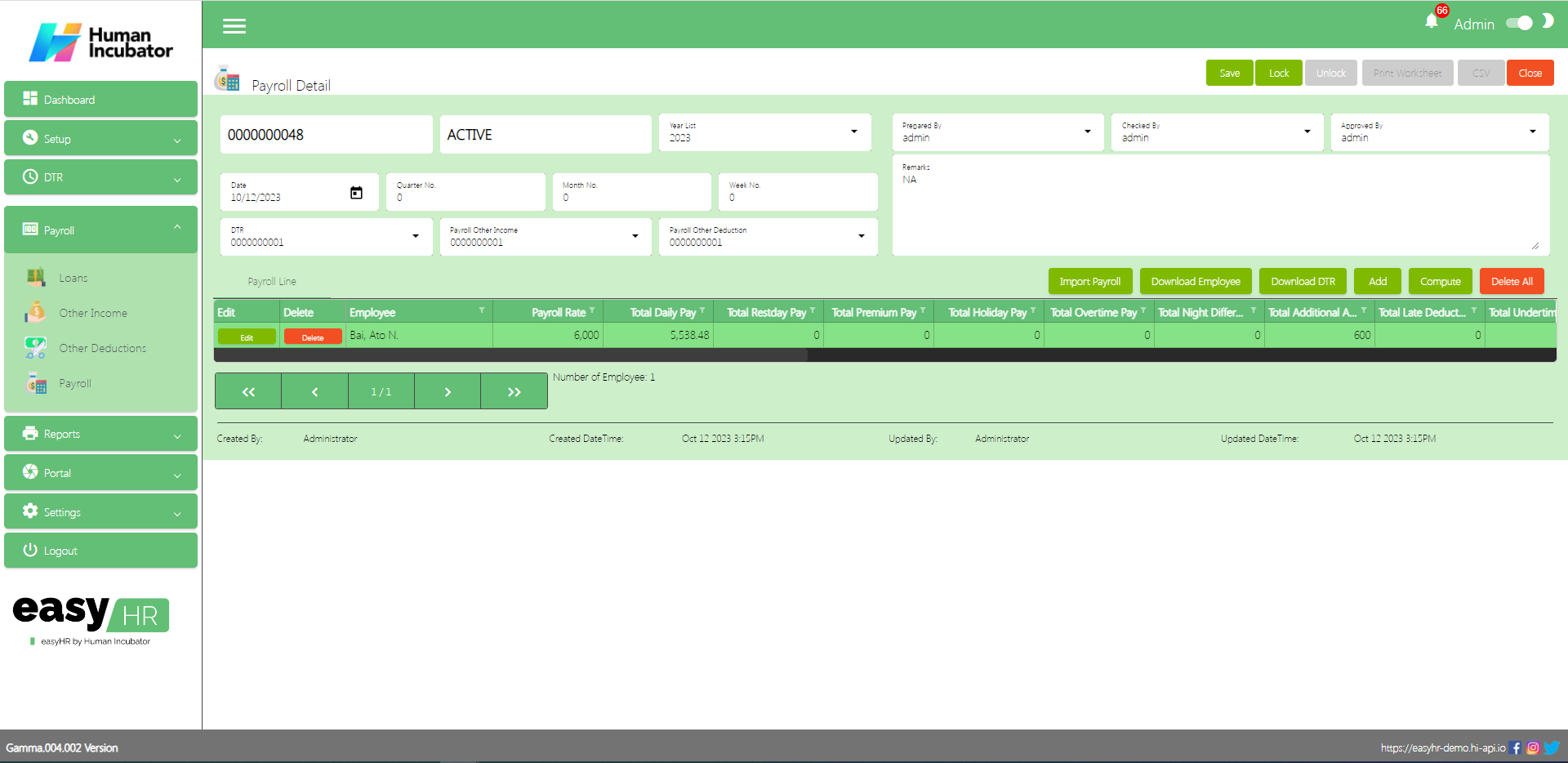

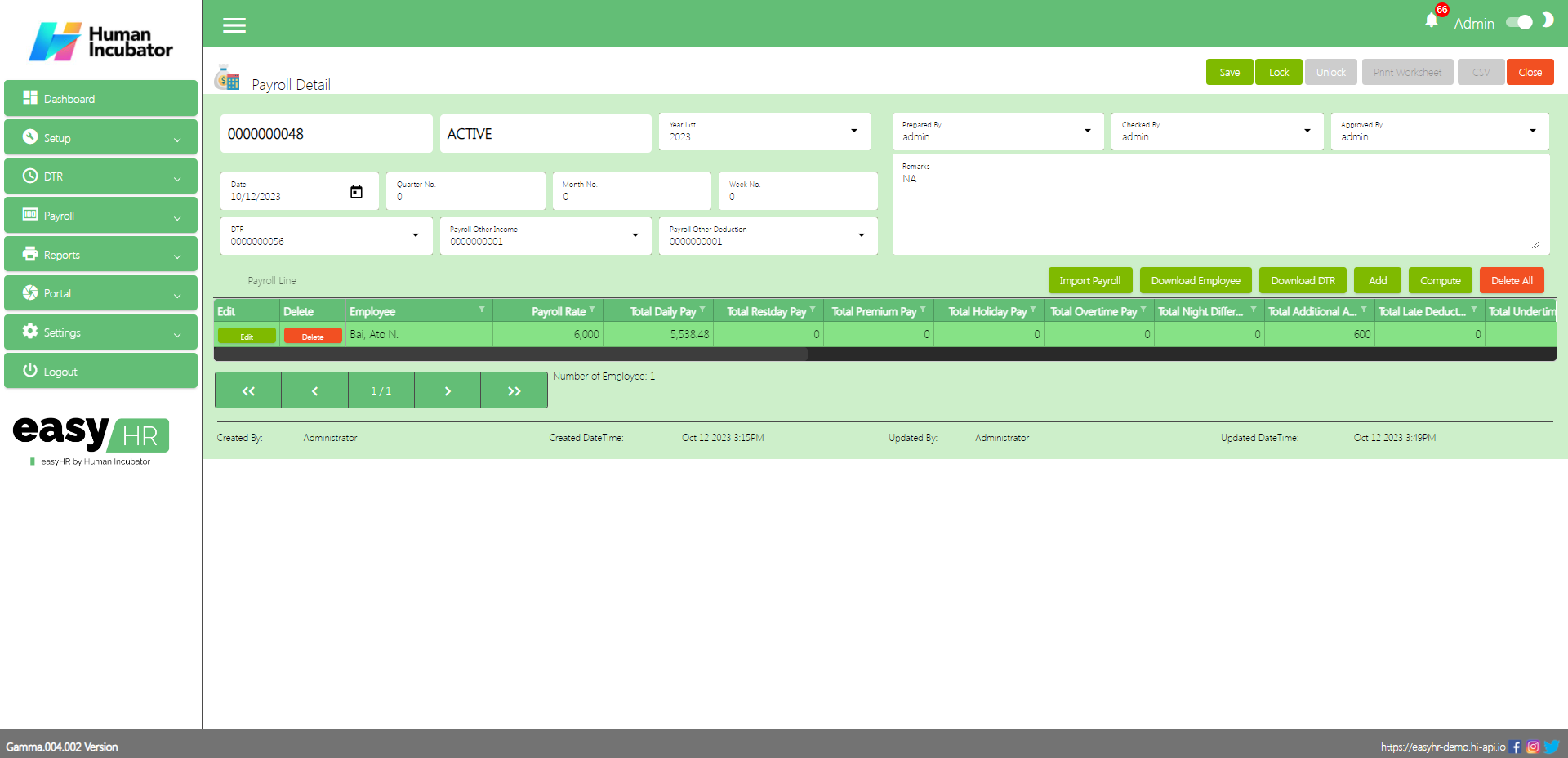

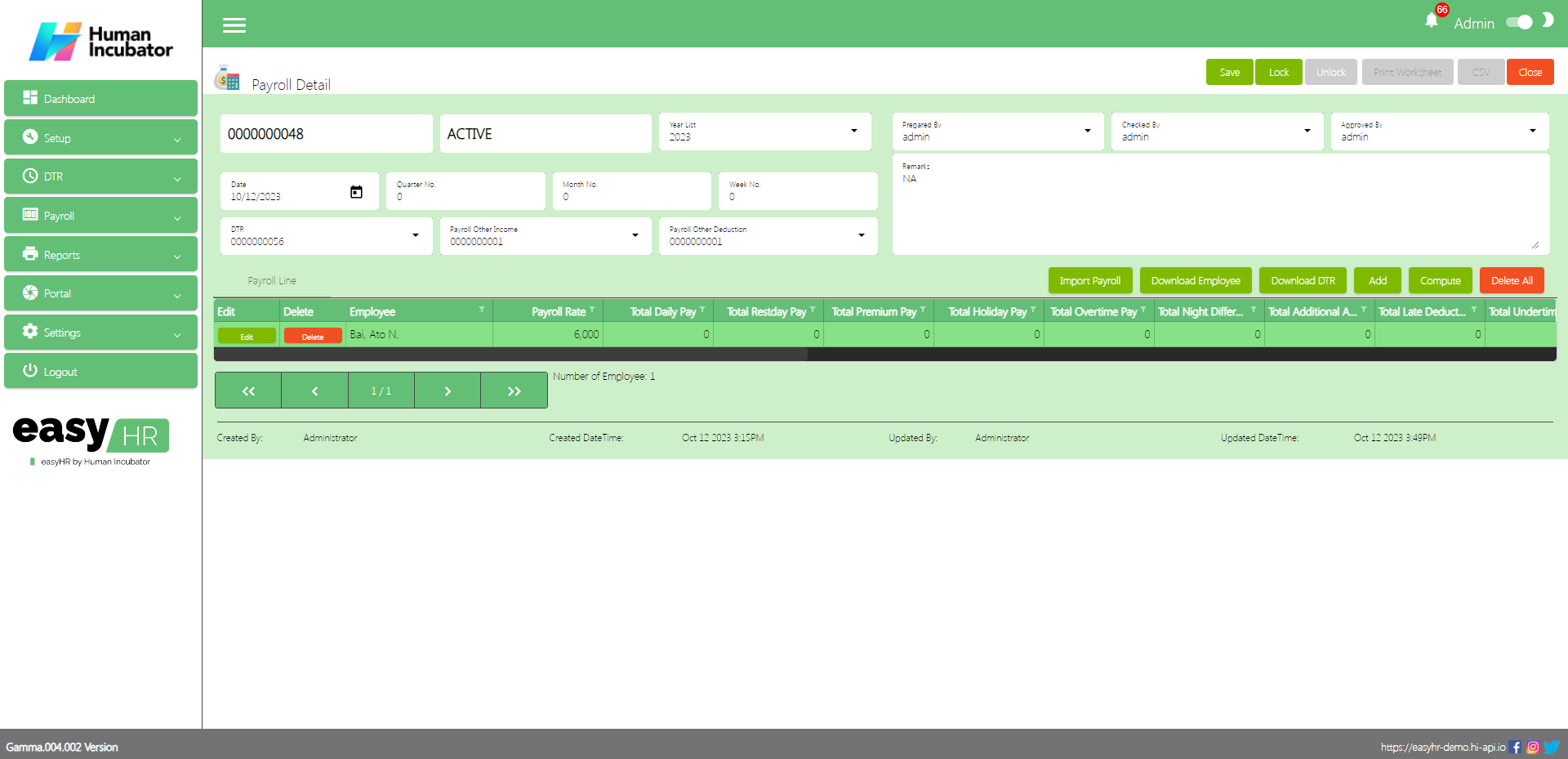

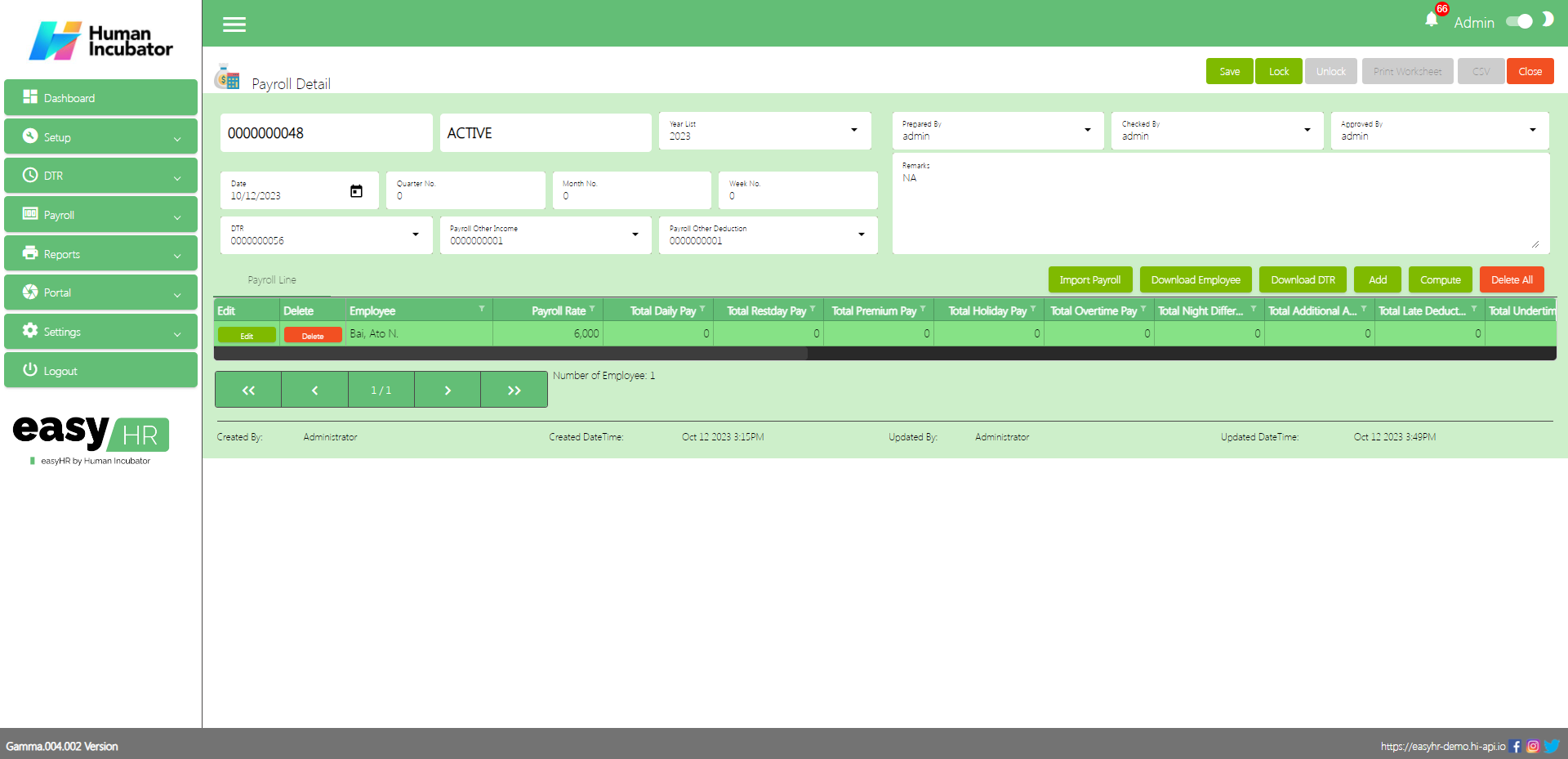

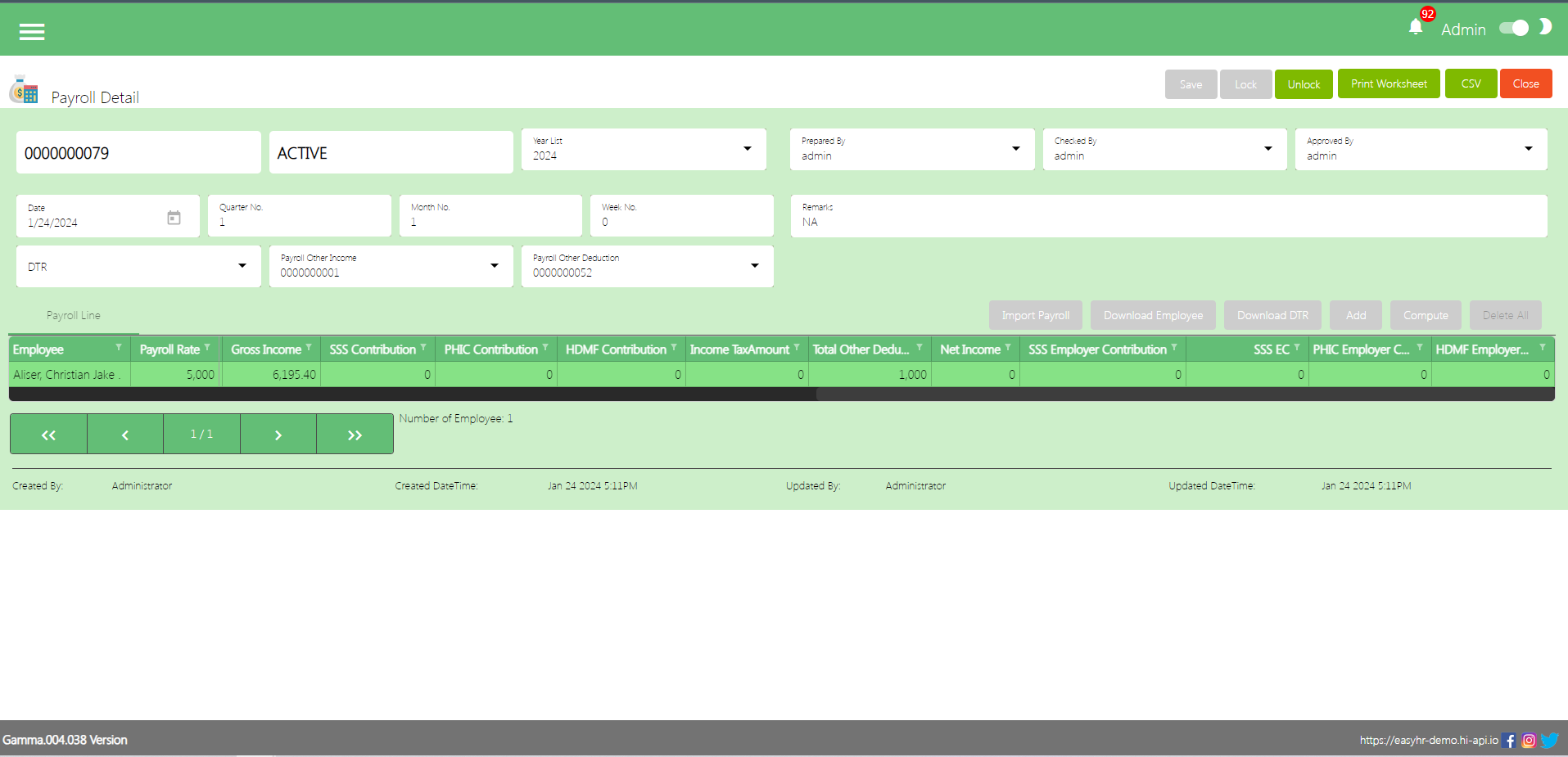

Payroll Detail

- To Add a new Payroll, click the Add button that can be seen on the right side of the screen

- Fill all the important fields in Payroll detail like:

- Select Date (Optional)

- Input Quarter Number

- Select Month Number

- Input Week Number (For Weekly Payroll Type)

- Select DTR Number (Select the number based on the payroll cut-off )

- Select Payroll Other Income Number (Select the number based on the payroll cut-off )

- Select Payroll Other Deduction Number (Select the number based on the payroll cut-off )

- Select Checked By

- Select Approved By

- Input Remarks

- Click Save button to save all details

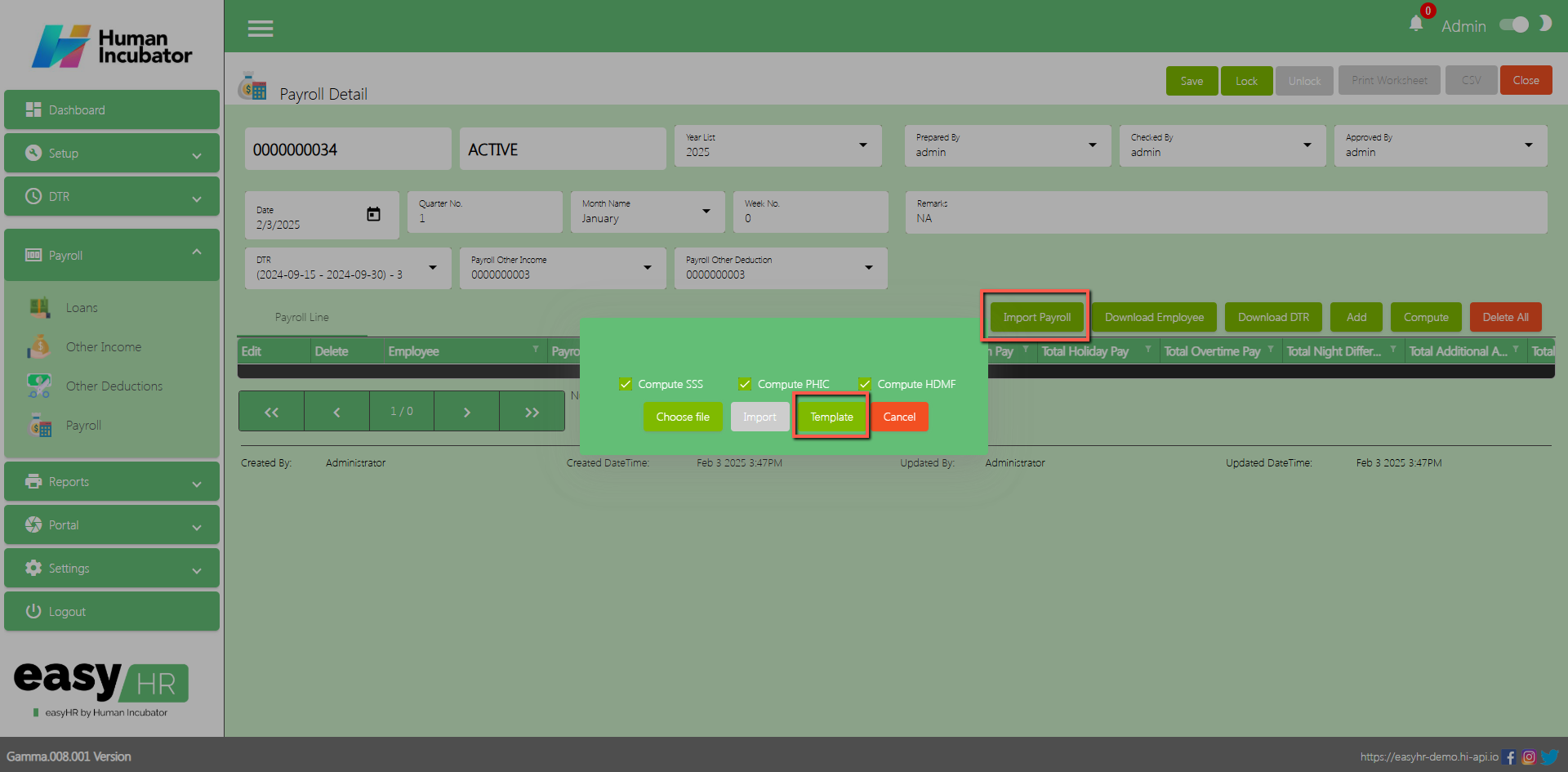

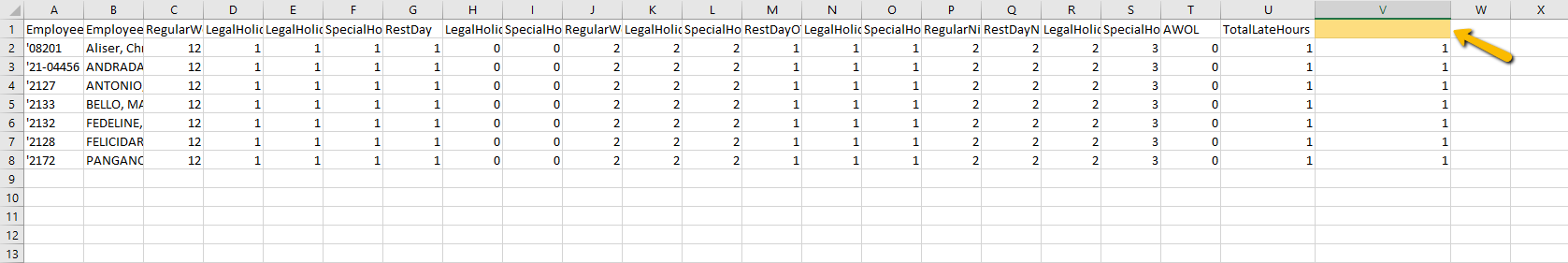

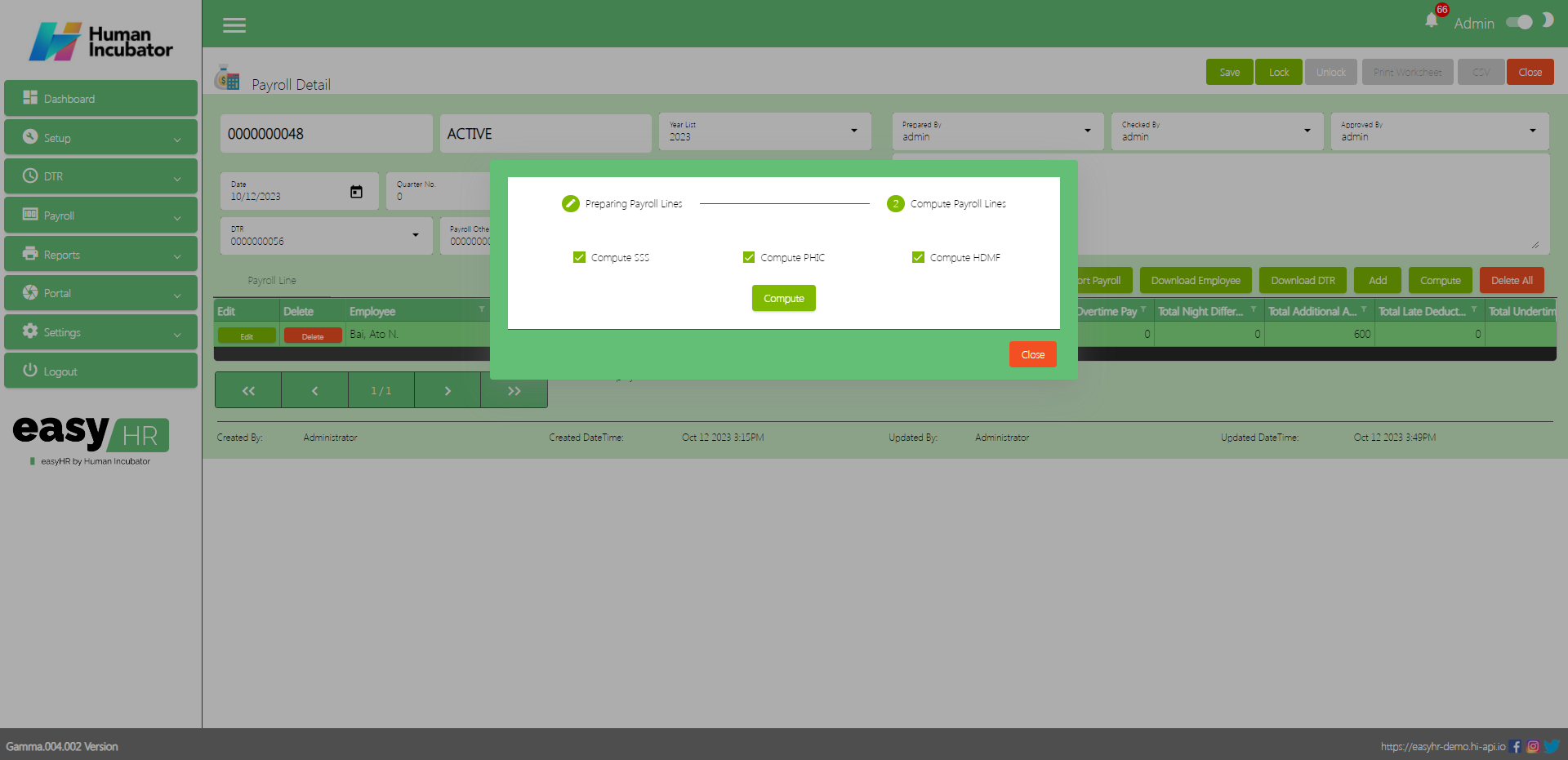

Import Payroll

- Click Import Payroll button to import payroll master files

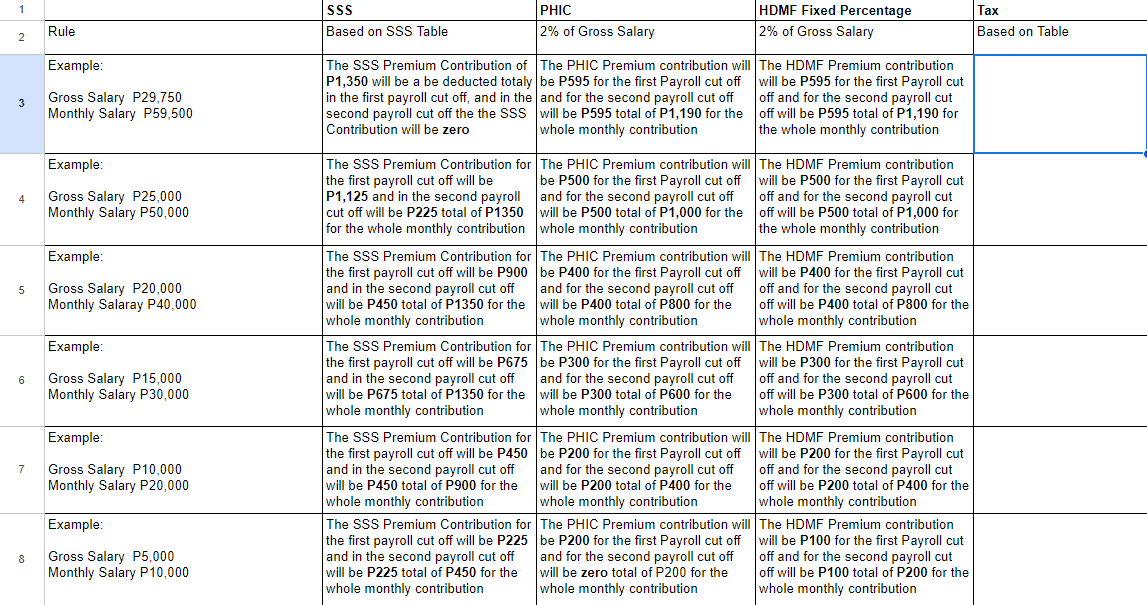

- Check the checkbox for Compute SSS, Compute PHIC and Compute HDMF to compute the mandatory deductions during the importing

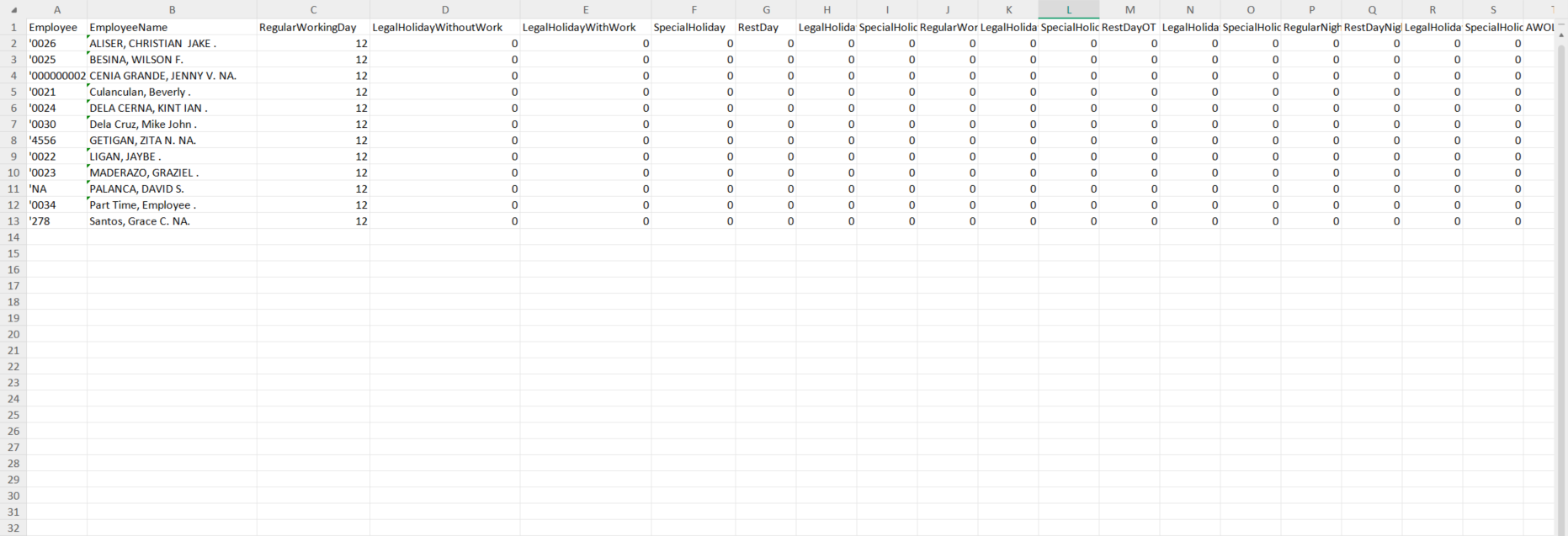

- Click Template to download the template

- Edit file template and input numbers based on the columns

- Example: Regular Working Days – input the total number of working days for the cut-off

- Example: Legal Holiday Without Work – Input the total number of working days that has work during legal holidays for the cut-off

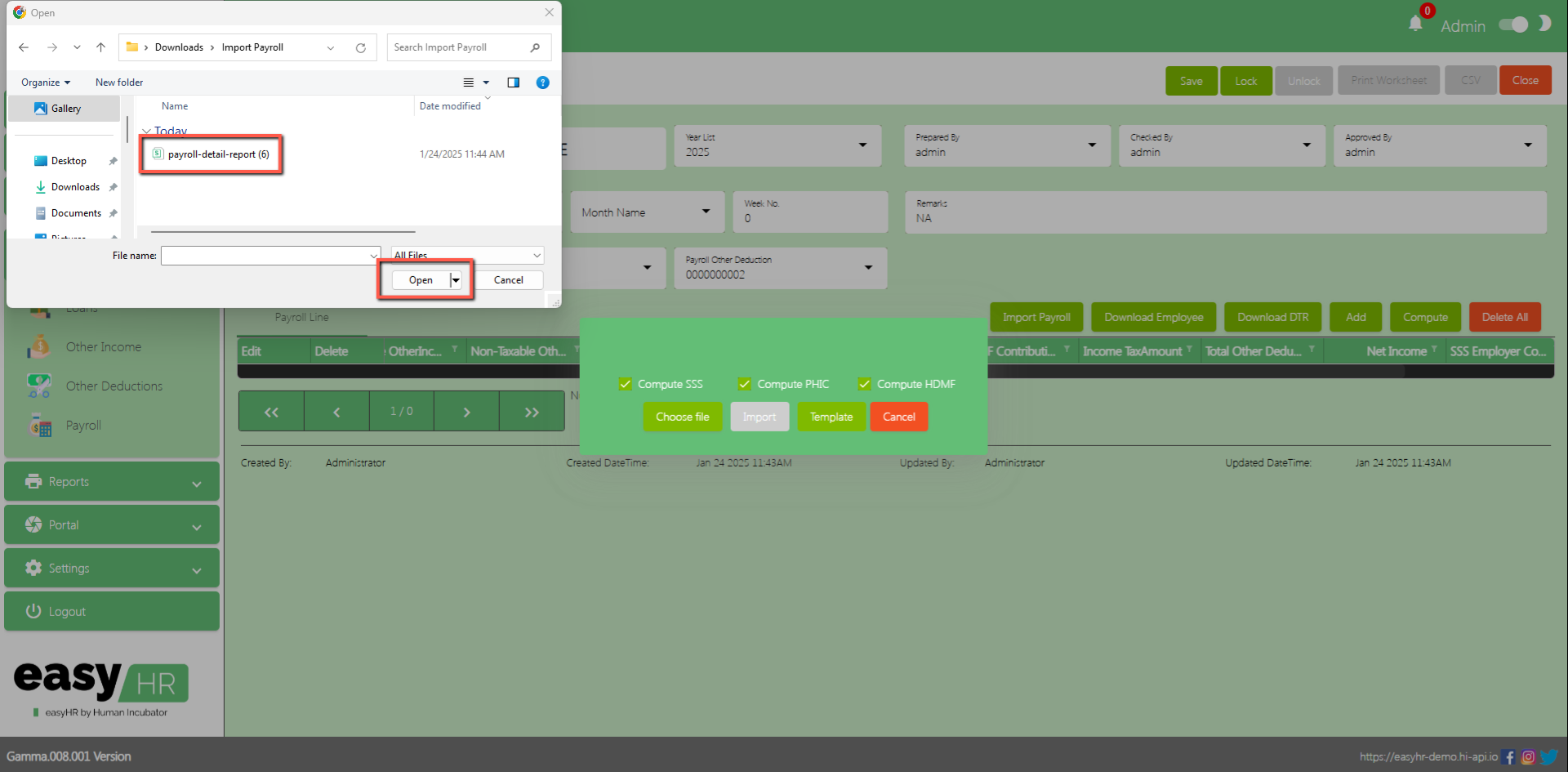

After editing the file you can now import the file by clicking the import

- Click Choose file

- Select the file

- Click Open or just double click the file

- Click Import ( Employee payroll is successfully imported )

- Click Done button

- If there are no issue in the file template it will import successfully

Importing of Payroll with an incorrect file template

- If any of the columns is mistakenly deleted then you will try to import that file there will be an error message that the file imported is incorrect.

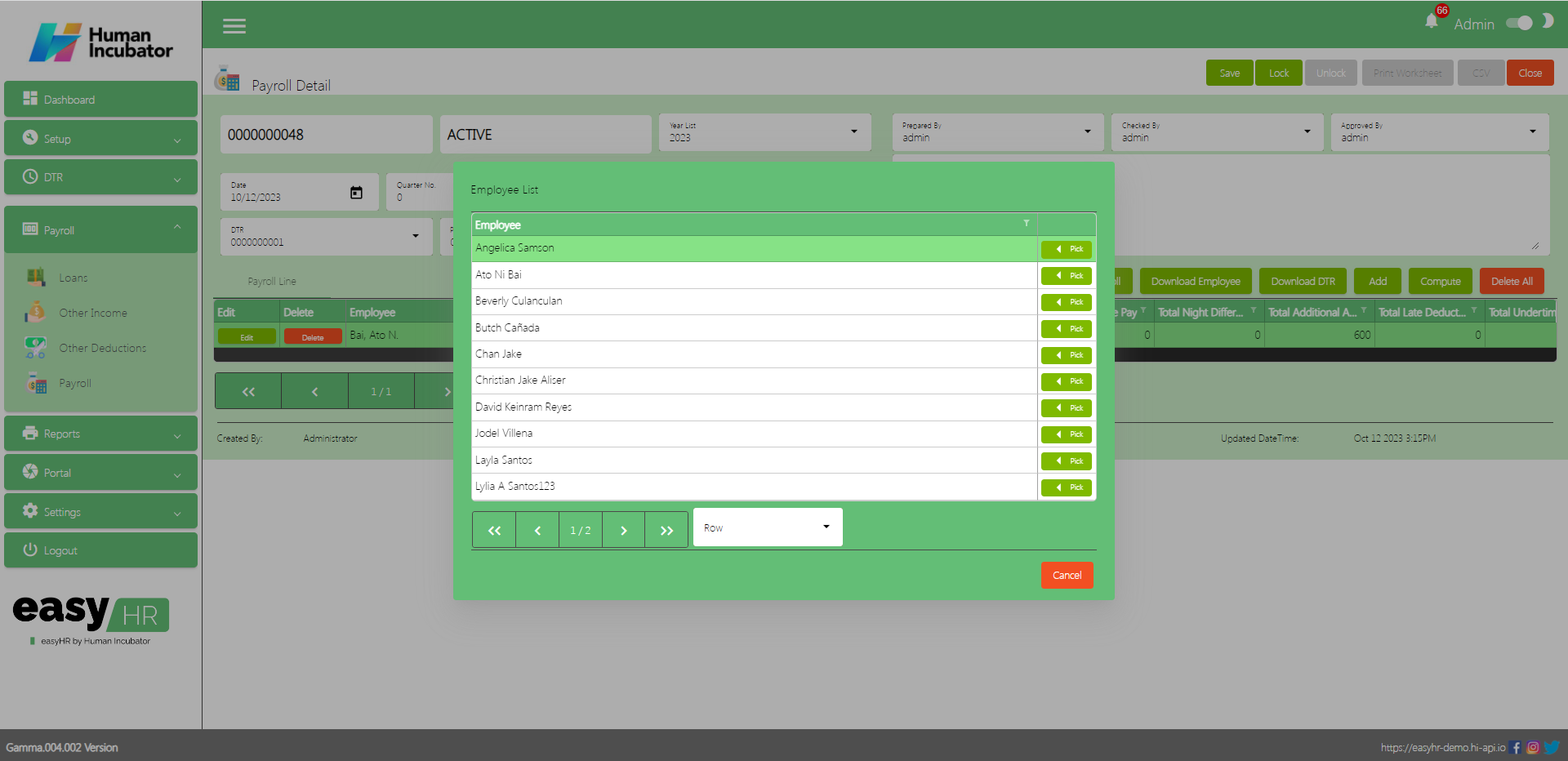

Download Employee

- Click Download Employee to Download individual employee

- Click Pick Employee in Employee list

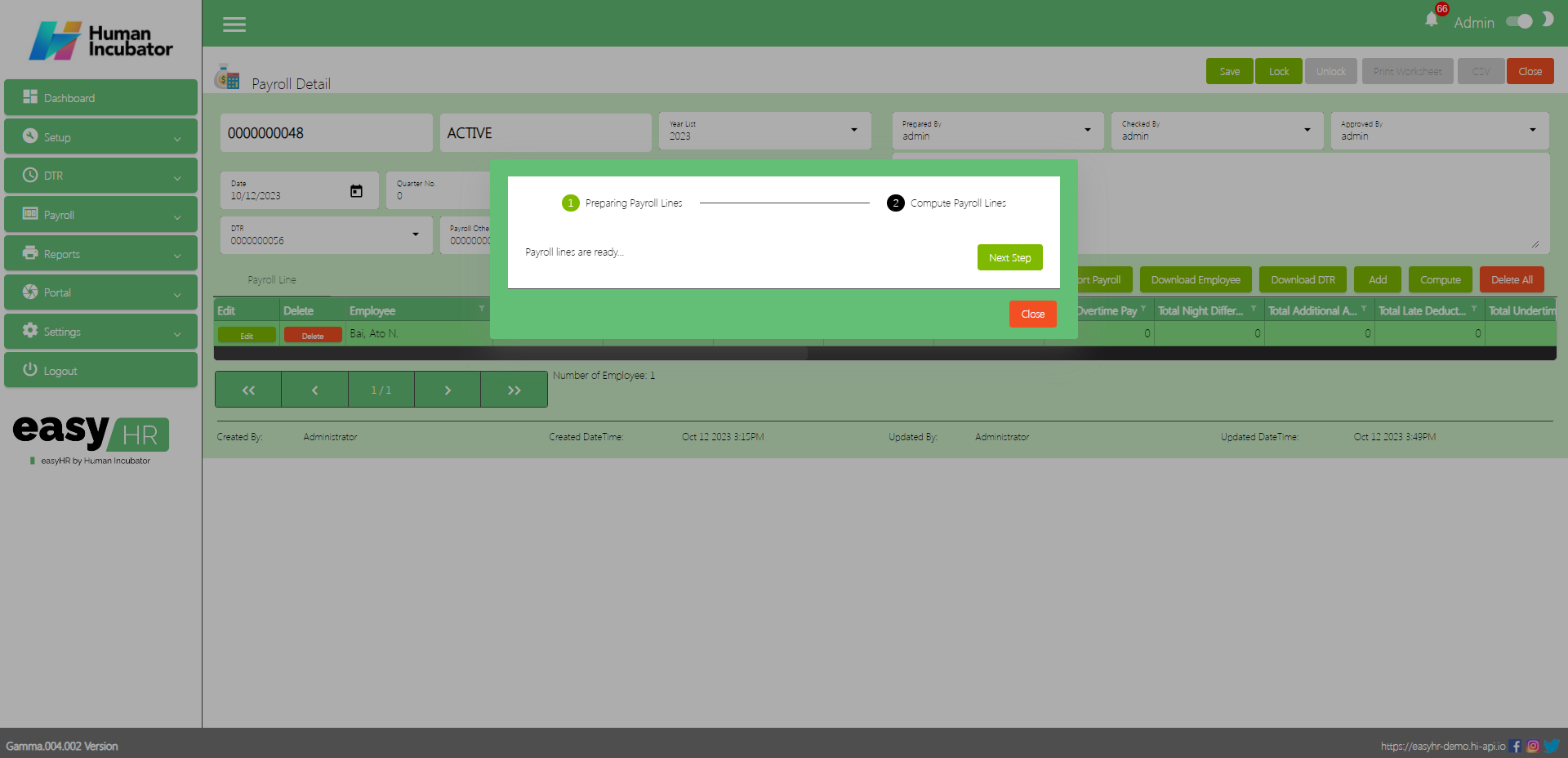

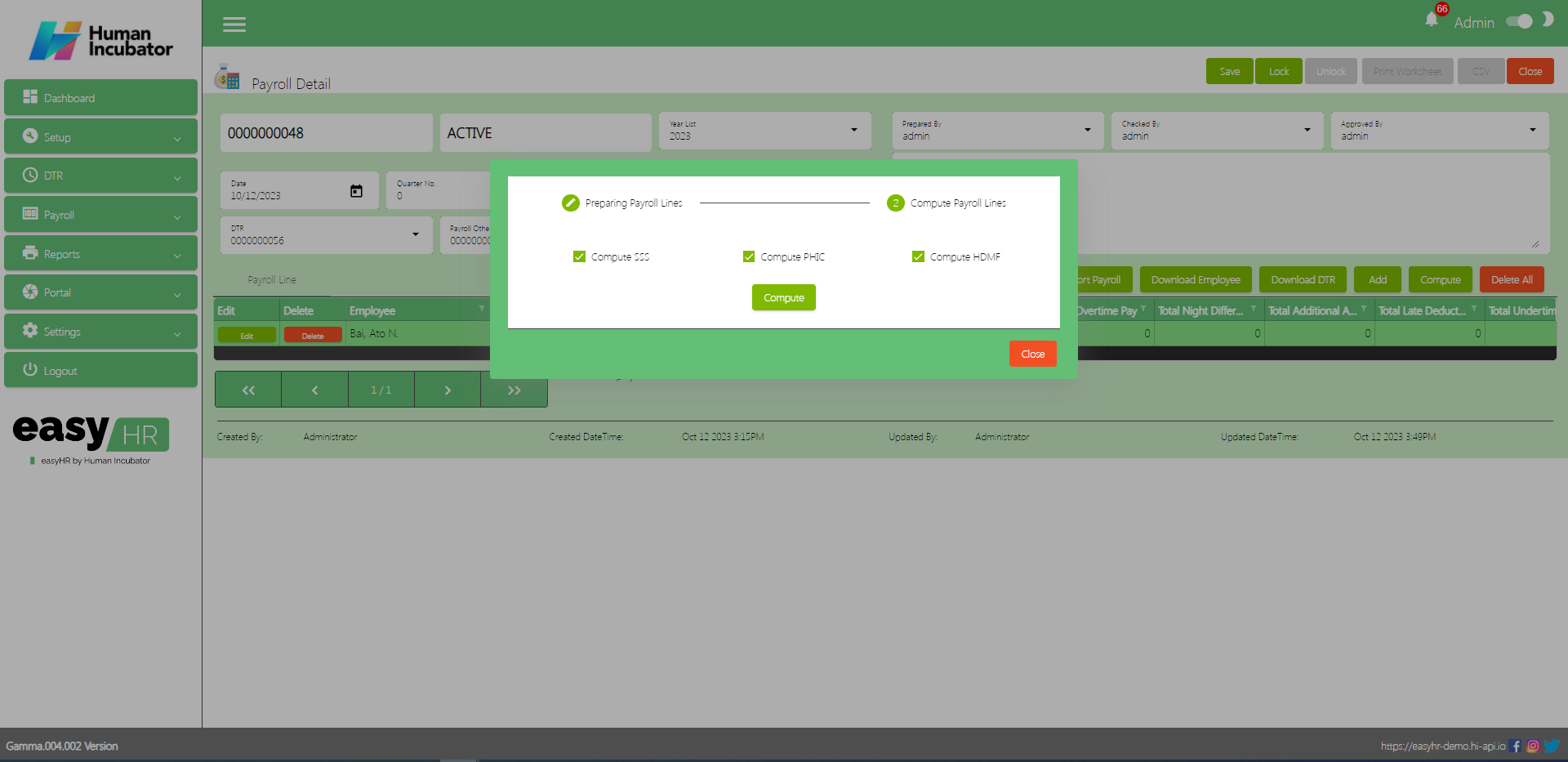

- Click Compute button to Compute the Payroll line

- Click Next button

- Click Compute button to Compute your mandatory deduction

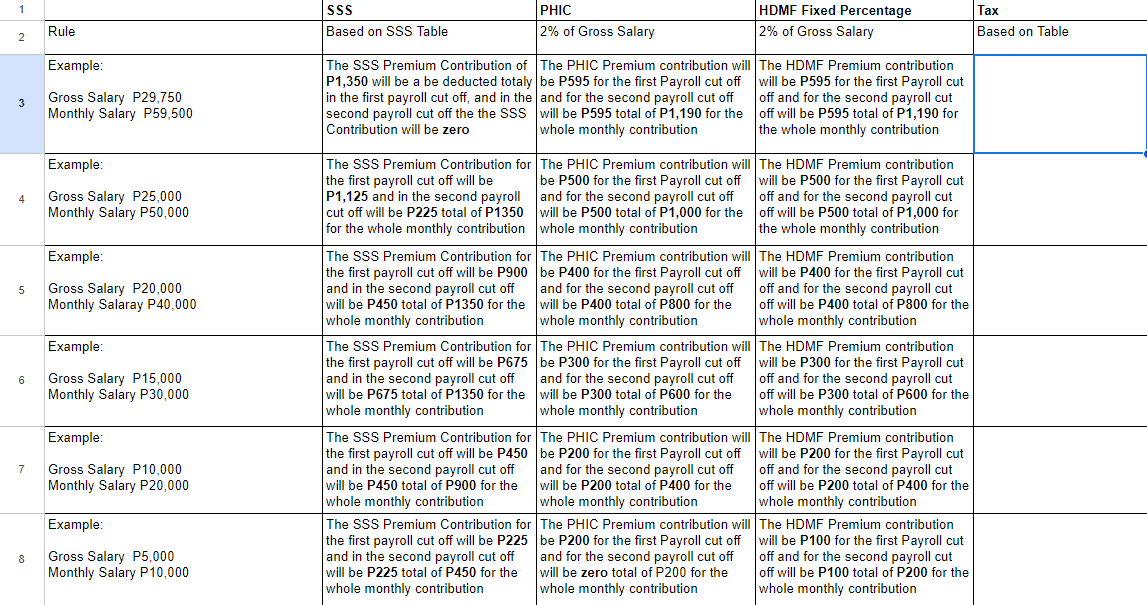

Note: The mandatory deduction is calculated based on the payroll rate and is divided into two, corresponding to each cutoff period. However, if an employee’s payroll rate exceeds PHP 29,750, the full SSS mandatory deduction will be applied in the first half, leaving no deduction for the second half.

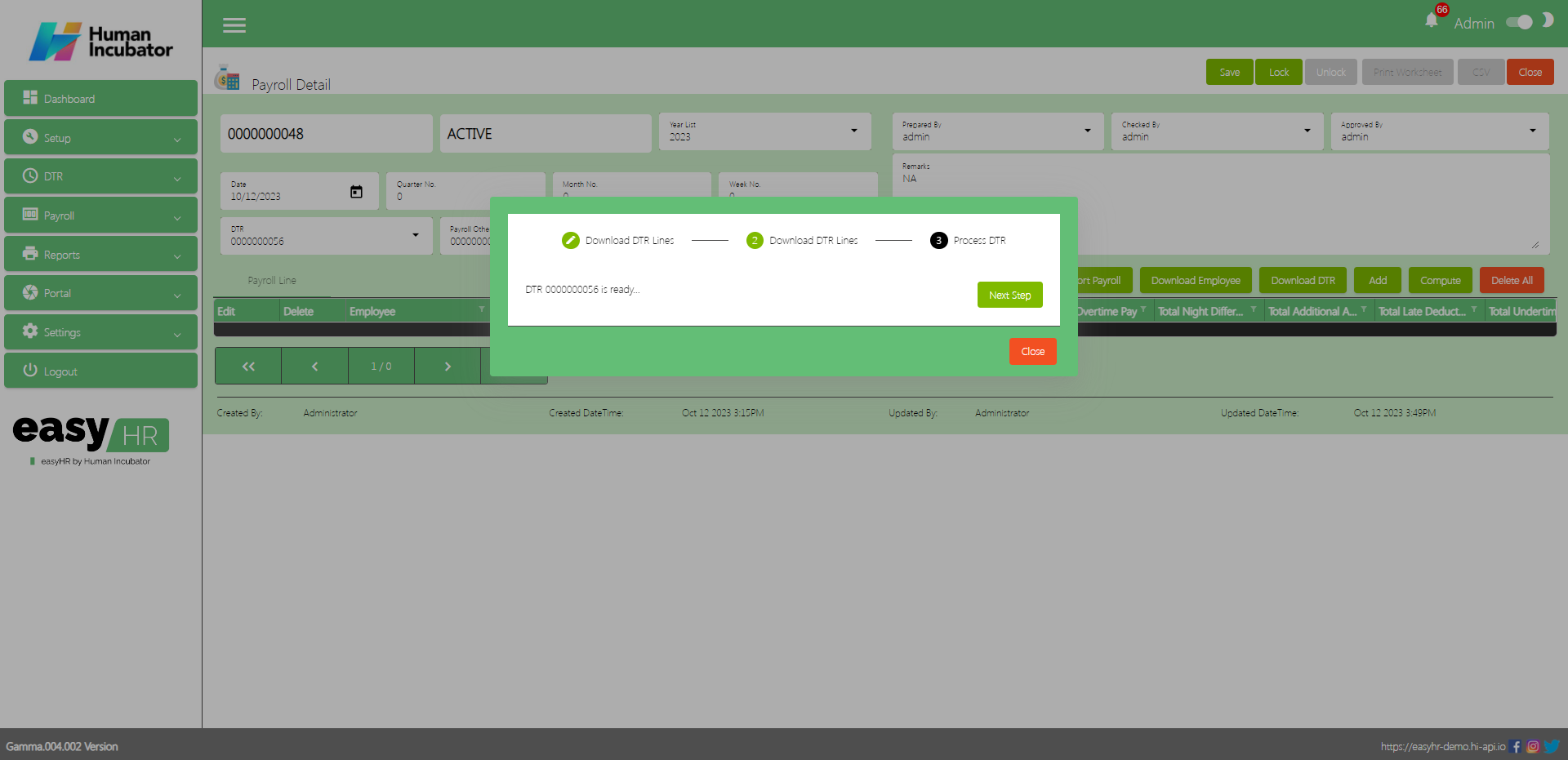

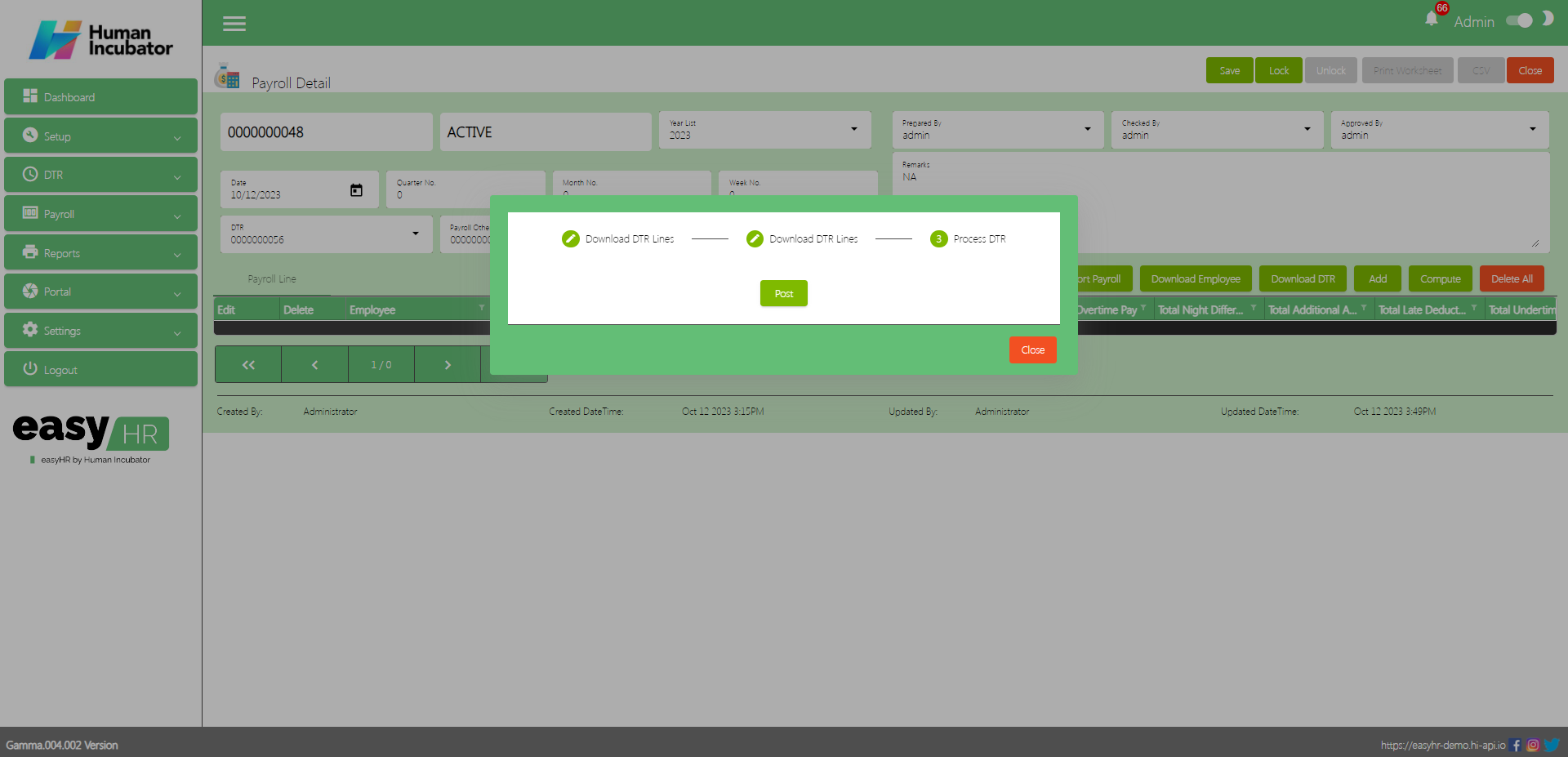

Download DTR

- Click Download DTR to Download all DTR of employees from the DTR module

- Click Next button

- Click Post button ( Processing.. )

- Click Done button to add in payroll line

- Click Compute button to Compute the Payroll line

- Click Next button

- Click Compute button to Compute your mandatory deduction

(Note: The mandatory deduction will be based on the payroll rate for the first half and the deduction for the second half will deduct the remaining amount based on the monthly rate)

(Note: If the payroll rate exceeded 29,750 amount the SSS mandatory deduction will deduct fully in the first half but the deduction for the second half will be zero)

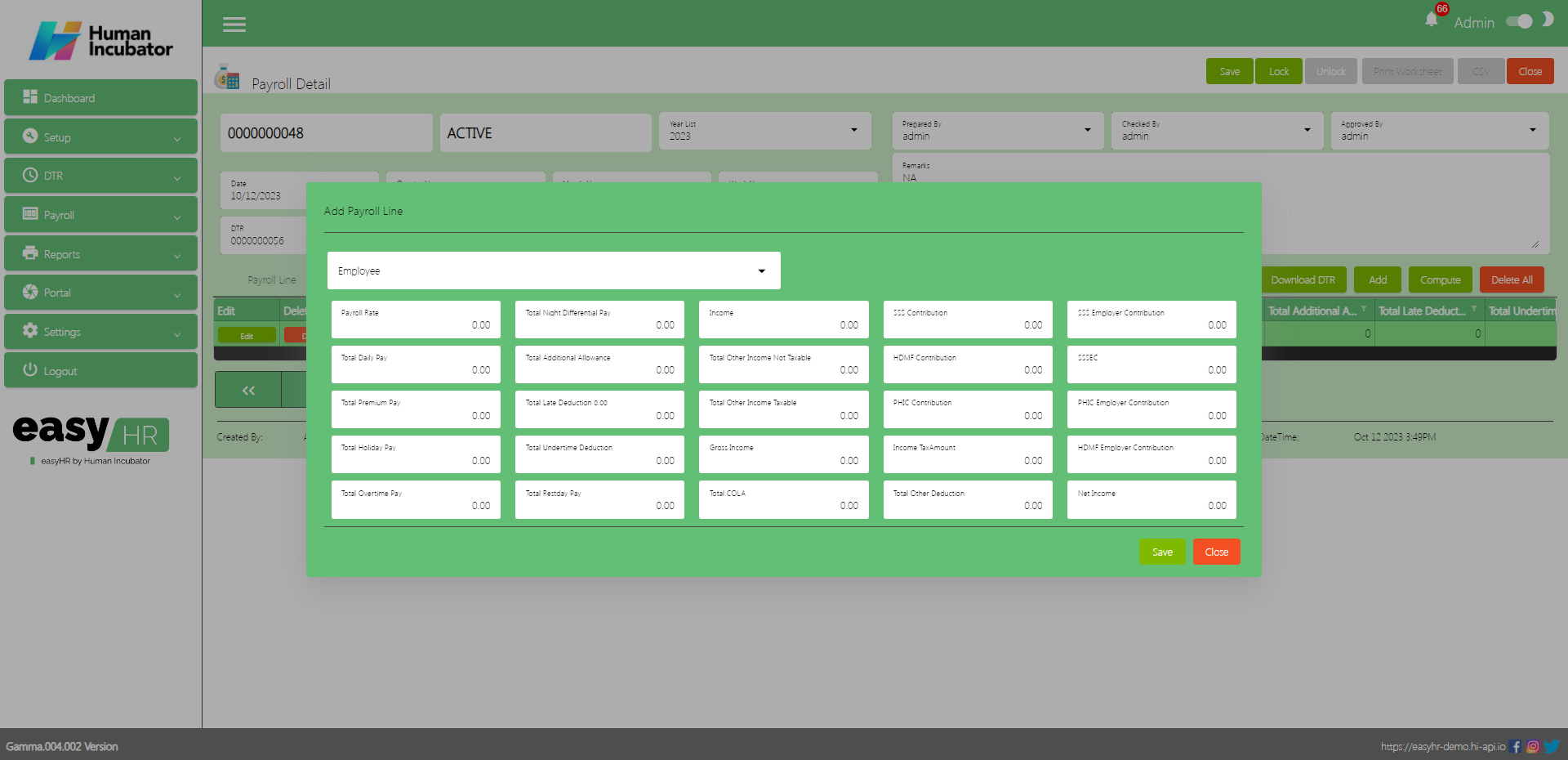

Add

- Click Add button to manually add payroll line

- Select Employee

- Fill all the important fields in Add Payroll Line

- Click Save button to add payroll line

Delete All

- Click Delete button to delete all payroll line

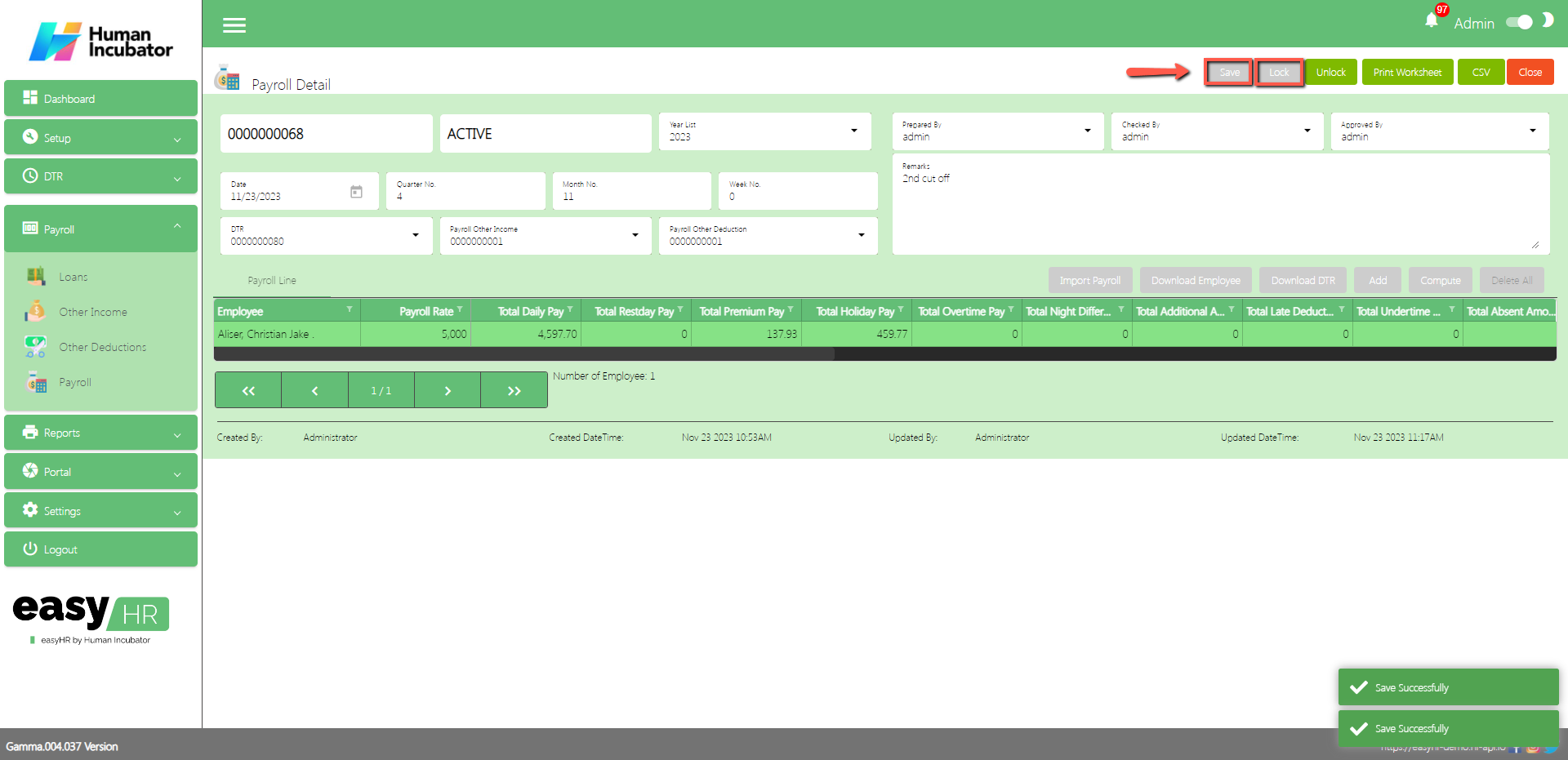

Save/Lock

- Make sure to save/lock so that this record is displayed in the reports module.

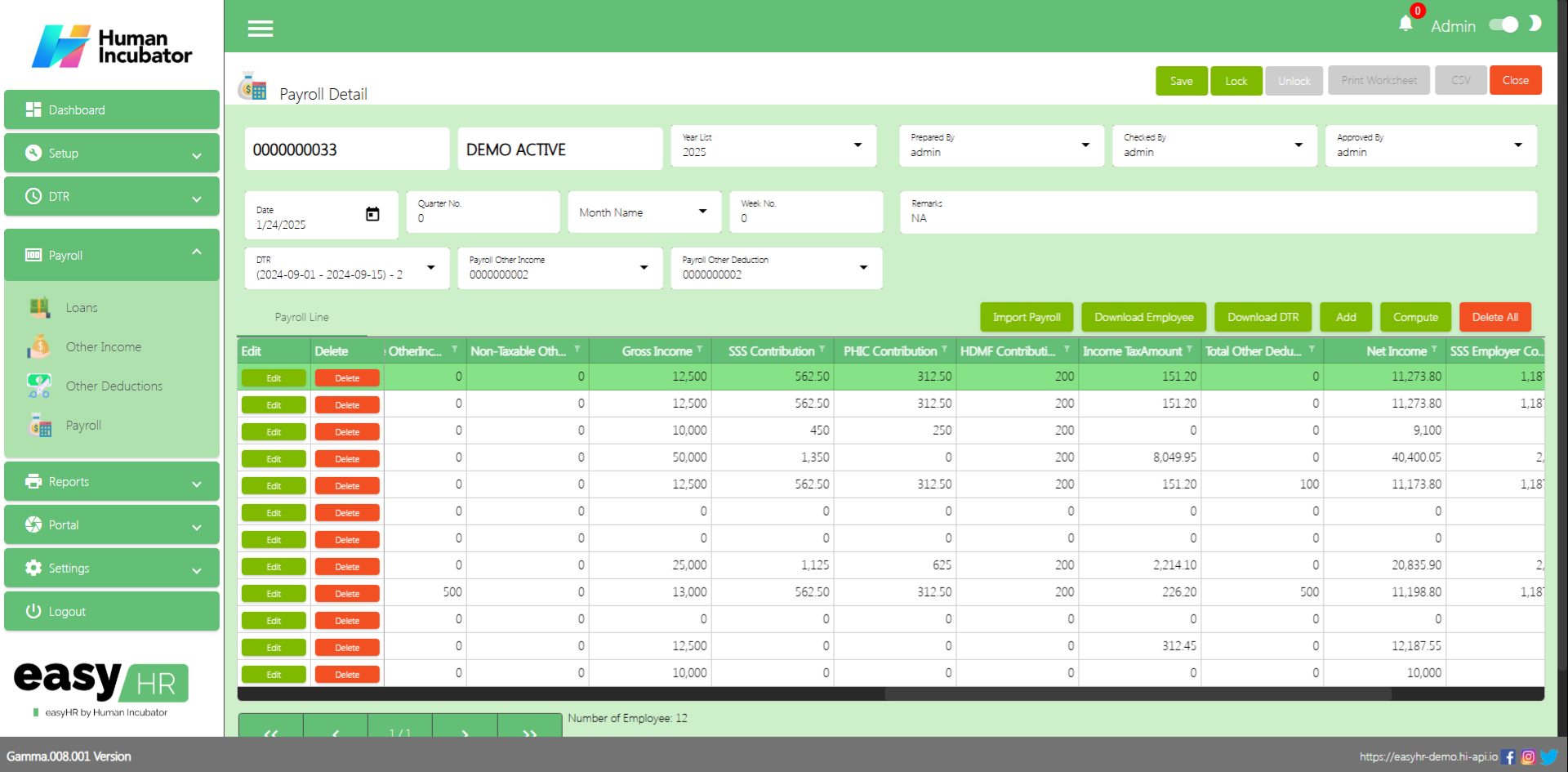

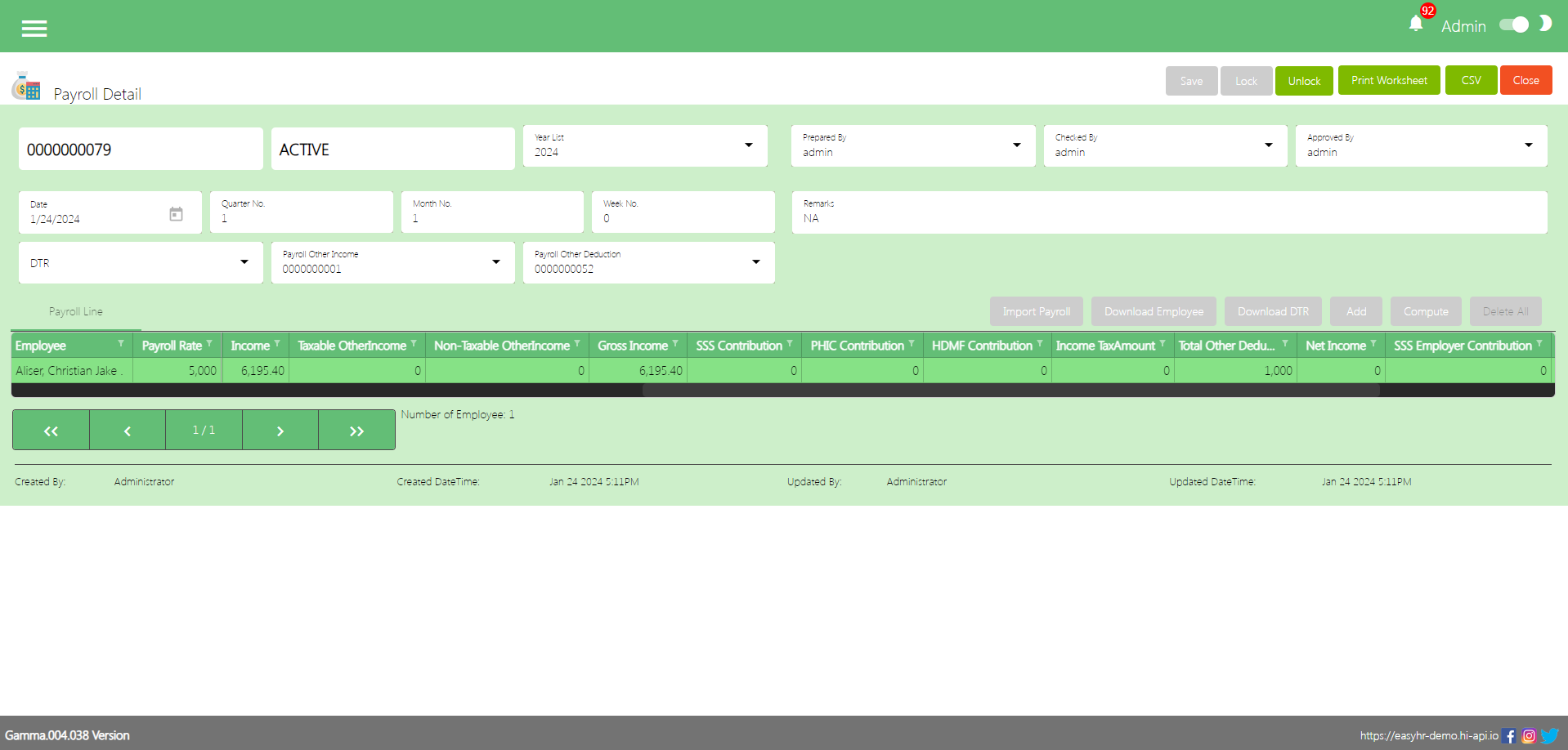

Column Table

- Employee: Name of the Employee

- Payroll Rate: Payroll Rate of the Employee

- Total Daily Pay: Total Daily Pay of the Employee based on the number of working days

- Total Restday Pay: Total Rest Day Pay of the Employee

- Total Premium Pay: Total Premium Pay of the Employee (Note: Premium Pay means Special Holiday Pay)

- Total Holiday Pay: Total Holiday Pay of the Employee (Note: Holiday Pay means Regular Holiday Pay)

- Total Overtime Pay: Total Overtime of the Employee

- Total Night Differential: Total Night Differential Pay of the Employee

- Total Additional Allowance: Total Additional Allowances of the Employee

- Total Late Deduction: Total Late Deduction of the Employee

- Total Undertime Deduction: Total Undertime Deduction of the Employee

- Total Absent Amount: Total Absent Amount of the Employee

- Income: Total Income of the Employee

- Taxable OtherIncome: Taxable Income of the Employee

- Non–Taxable Other Income: Non-Taxable Income of the Employee

- Gross Income: Total Gross Income of the Employee (Note: If the Employee has Taxable or Non-Taxable Income it will be added in total in the Gross Income)

- SSS Contribution: SSS Contribution of the Employee

- PHIC Contribution: PHIC Contribution of the Employee

- HDMF Contribution: HDMF Contribution of the Employee

- Income Tax Amount: Income Tax Amount of the Employee

- Total Other Deductions: Total Other Deductions of the Employee

- Net Income: Total Net Income of the Employee (Note: This includes all Other Incomes and All Deductions such as Mandatory Deductions, Tax Deductions and Other Deductions of the Employee)

- SSS Employer Contribution: SSS Contribution of the Employer

- SSS EC: SSS EC of the Employer

- PHIC Employer Contribution: PHIC Contribution of the Employer

- HDMF Employer Contribution: HDMF Contribution of the Employer

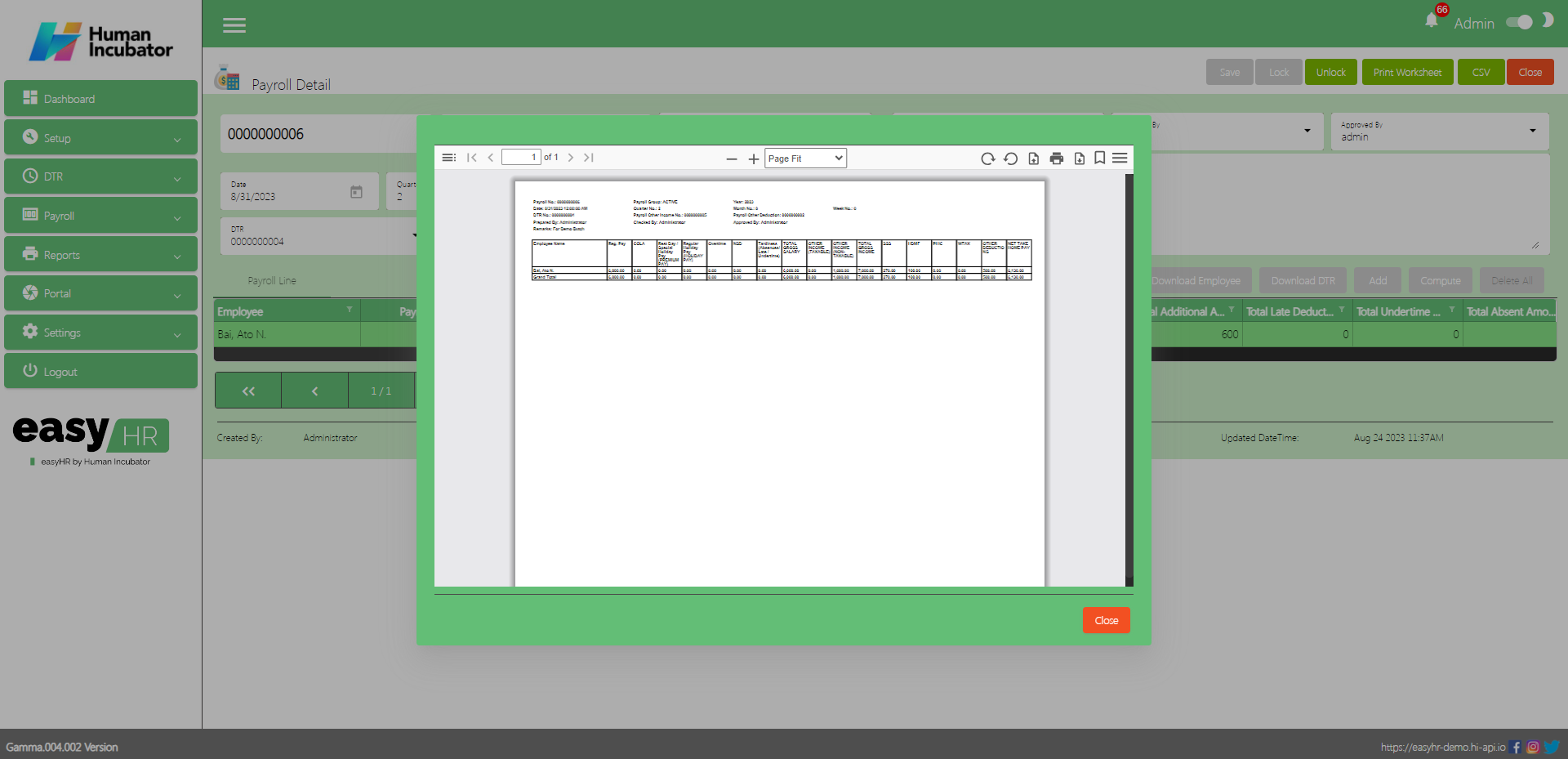

Print WorkSheet

- Click Print WorkSheet if the user want to print payroll line

Download CSV

- Click the CSV button to download the CSV file