Payroll Worksheet

Overview

- Payroll Worksheet used to calculate and summarize the payroll for their employees. It’s an essential tool for ensuring that employees are accurately compensated for their work, and it helps the employer comply with tax and labor laws.

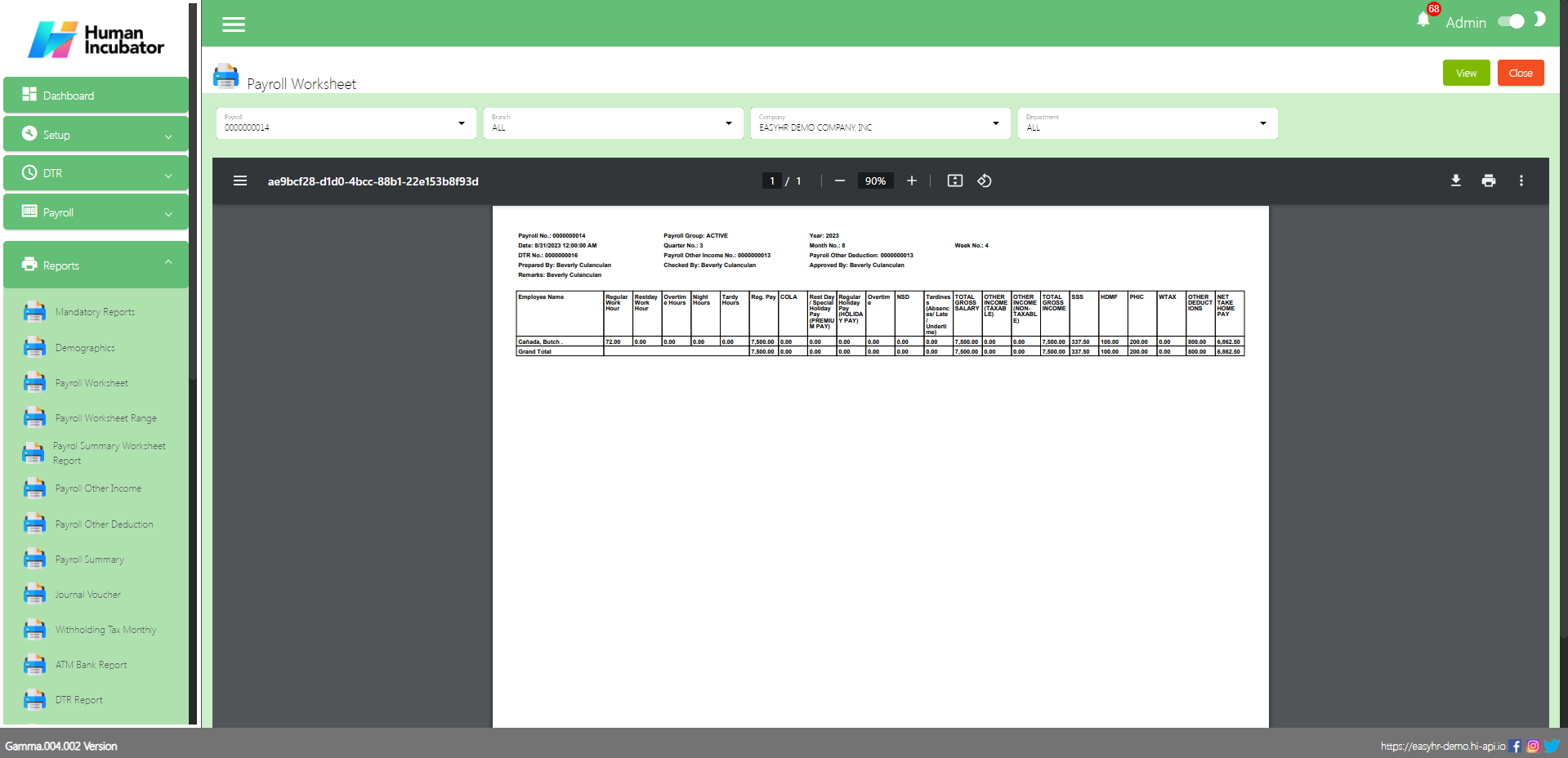

Payroll Worksheet

- Generate or view reports

- Select Payroll number

- Select Branch ( The user can select all Branches )

- Select Company

- Select Department ( The user can select all Departments )

- Click the View button to generate a Payroll worksheet report.

- The user can Download this report and also can Print.

Payroll Worksheet Range

Overview

- Payroll Worksheet Range typically refers to the range of dates or time period covered by a specific payroll worksheet. This range is essential for accurately calculating and summarizing the payroll for a set period.

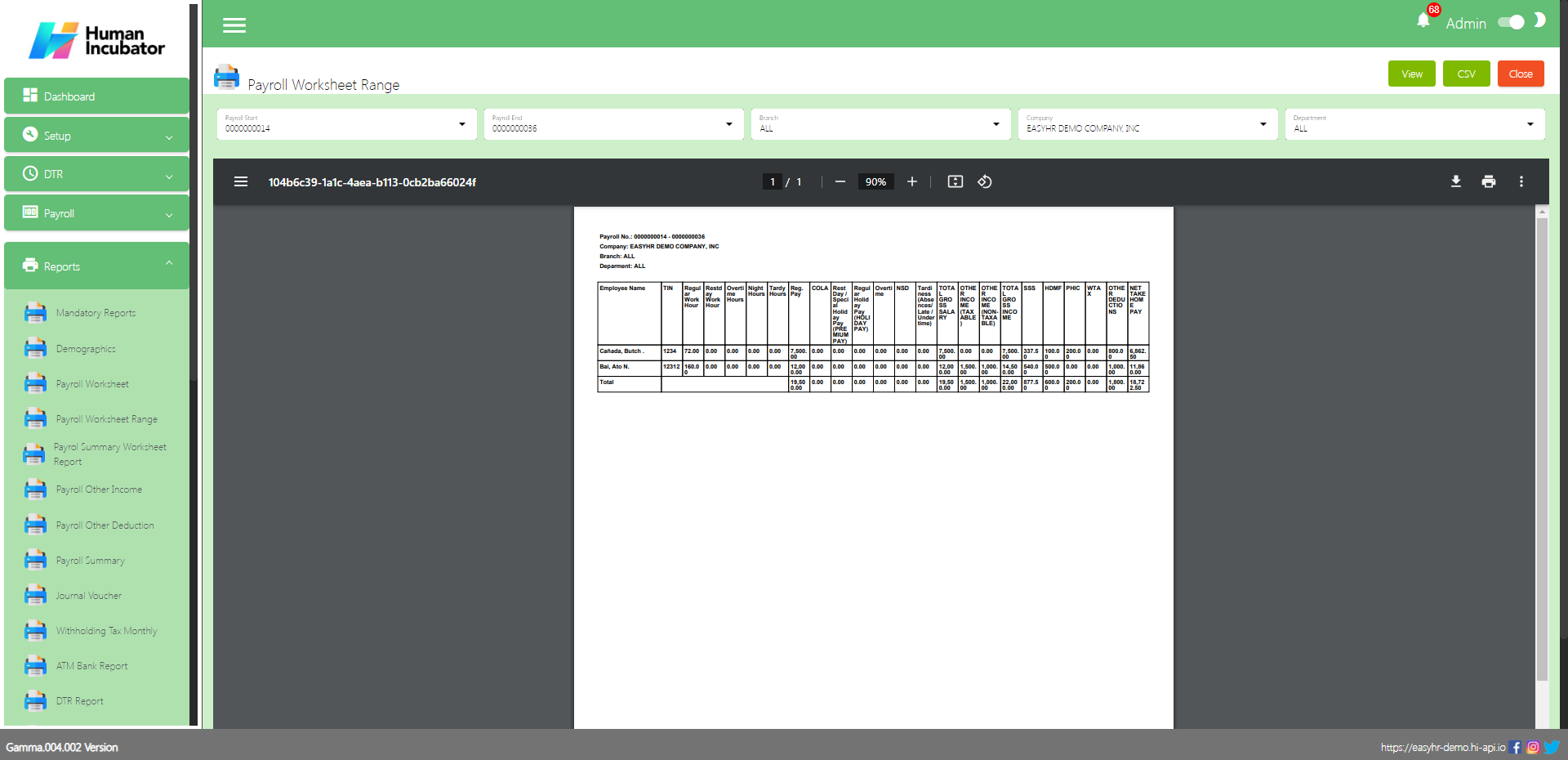

Payroll Worksheet Range

- Generate or view reports

- Select Payroll Start

- Select Payroll End

- Select Branch ( The user can select all Branches )

- Select Company

- Select Department ( The user can select all Departments )

- Click the View button to generate a Payroll worksheet range report.

- The user can Download this report and also can Print.

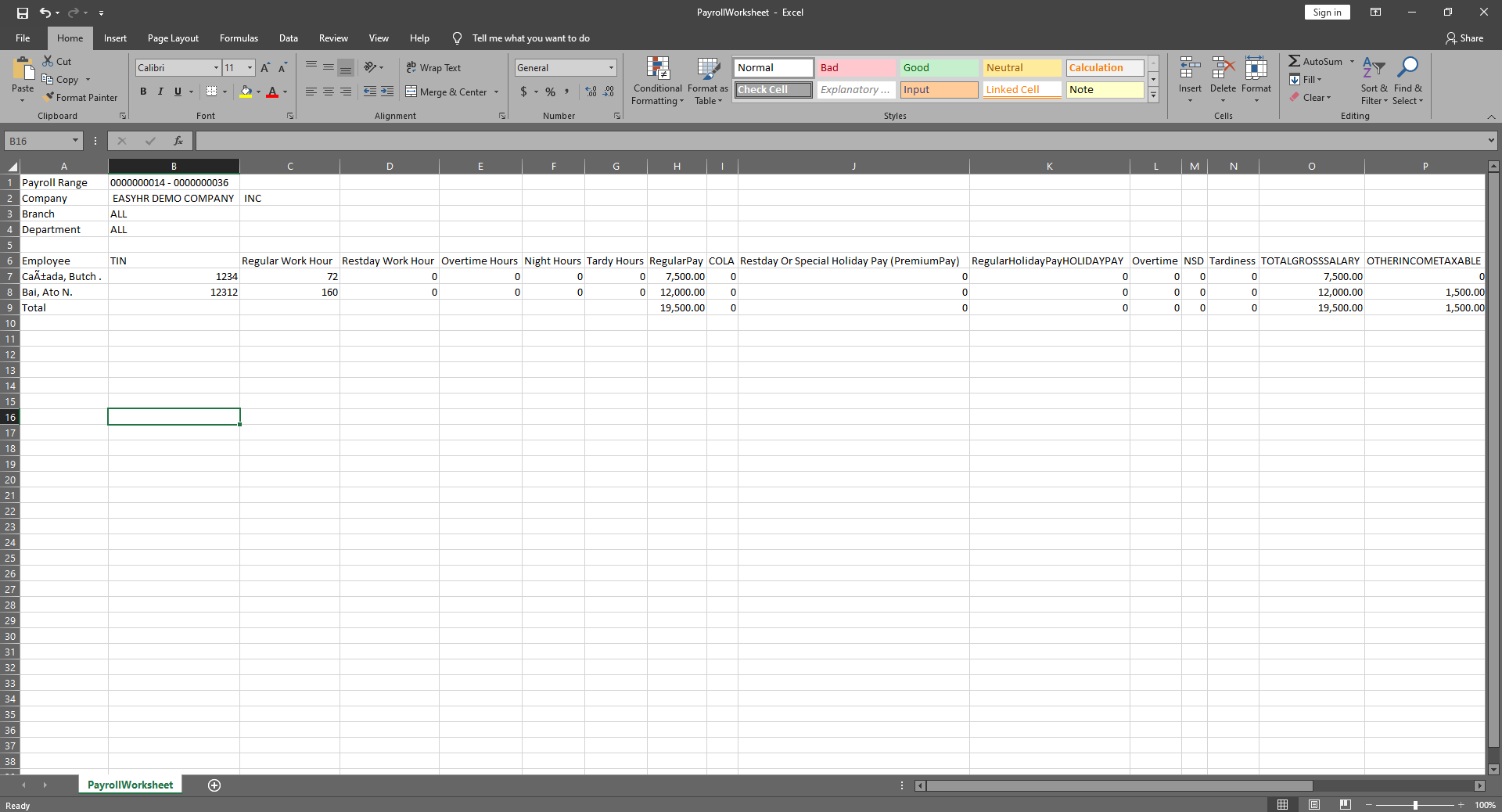

Download CSV

- Click the CSV button to download the CSV file

Payroll Summary Worksheet Report

Overview

- Payroll summary worksheet report that provides a concise overview of the key payroll information for a specific period, such as a pay period, month, or year. This report is typically used by businesses and organizations to summarize payroll data, track expenses, and ensure accurate financial reporting.

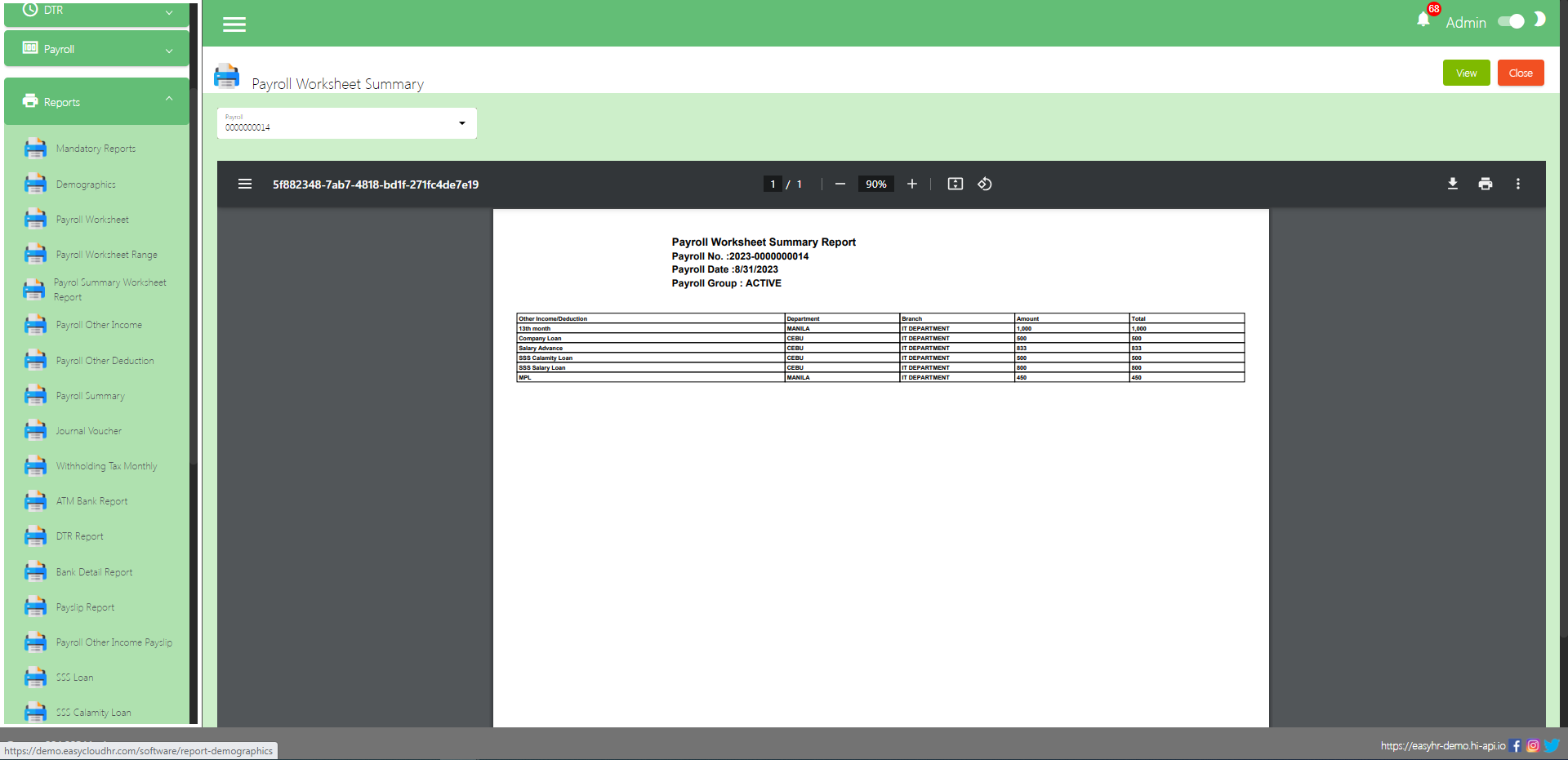

Payroll Summary Worksheet Report

- Generate or view reports

- Select Payroll number

- Click the View button to generate a Payroll summary worksheet report.

- The user can Download this report and also can Print.

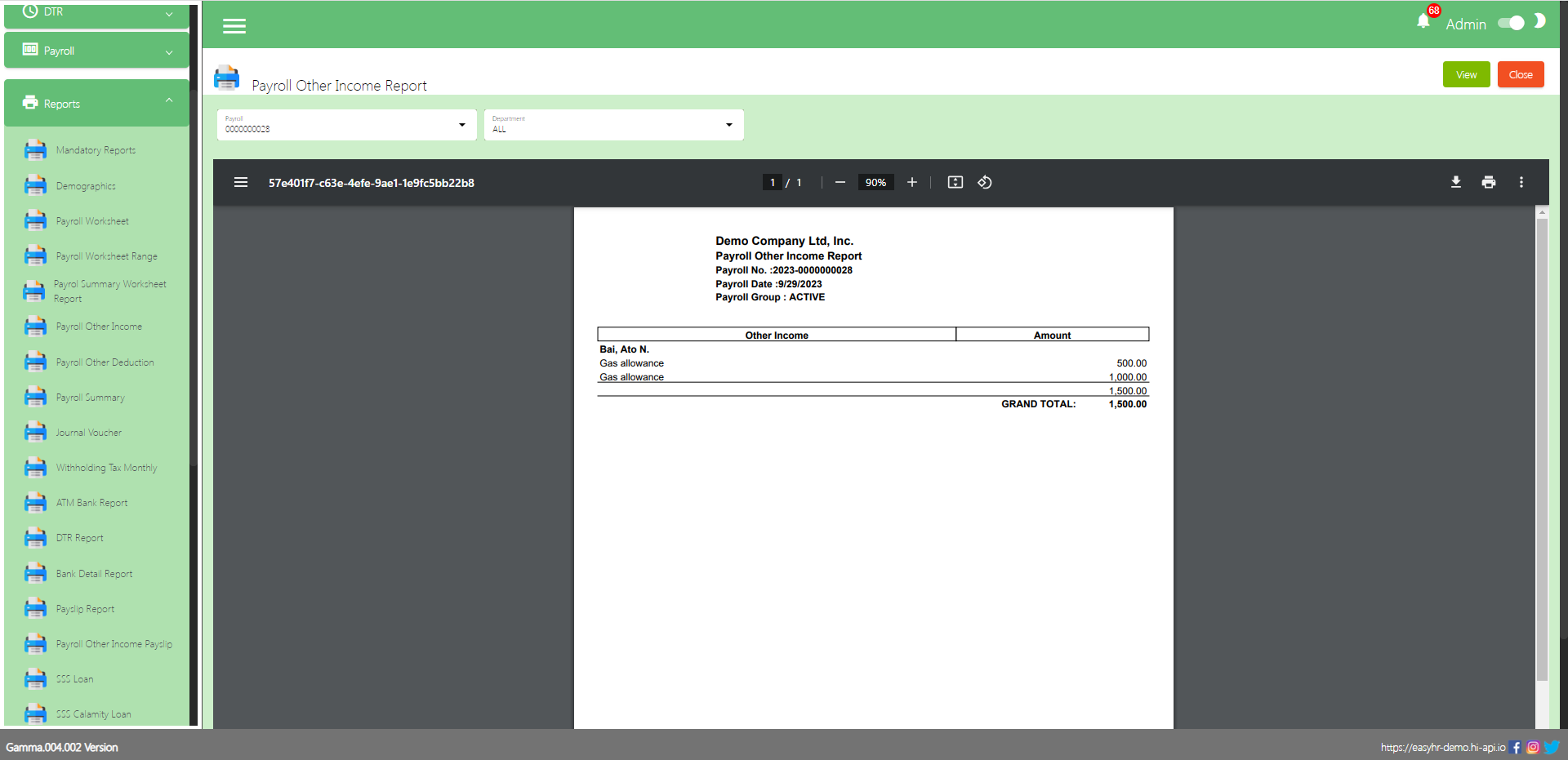

Payroll Other Income Report

Overview

- Payroll other income report that provides a summary of additional sources of income that employees receive in addition to their regular wages or salary. This report is used by businesses and organizations to track and account for various types of supplemental income that may affect an employee’s overall compensation and tax liabilities.

Payroll Other Income Report

- Generate or view report

- Select Payroll number

- Select Department ( The user can select all Departments )

- Click the View button to generate a Payroll other income report.

- The user can Download this report and also can Print.

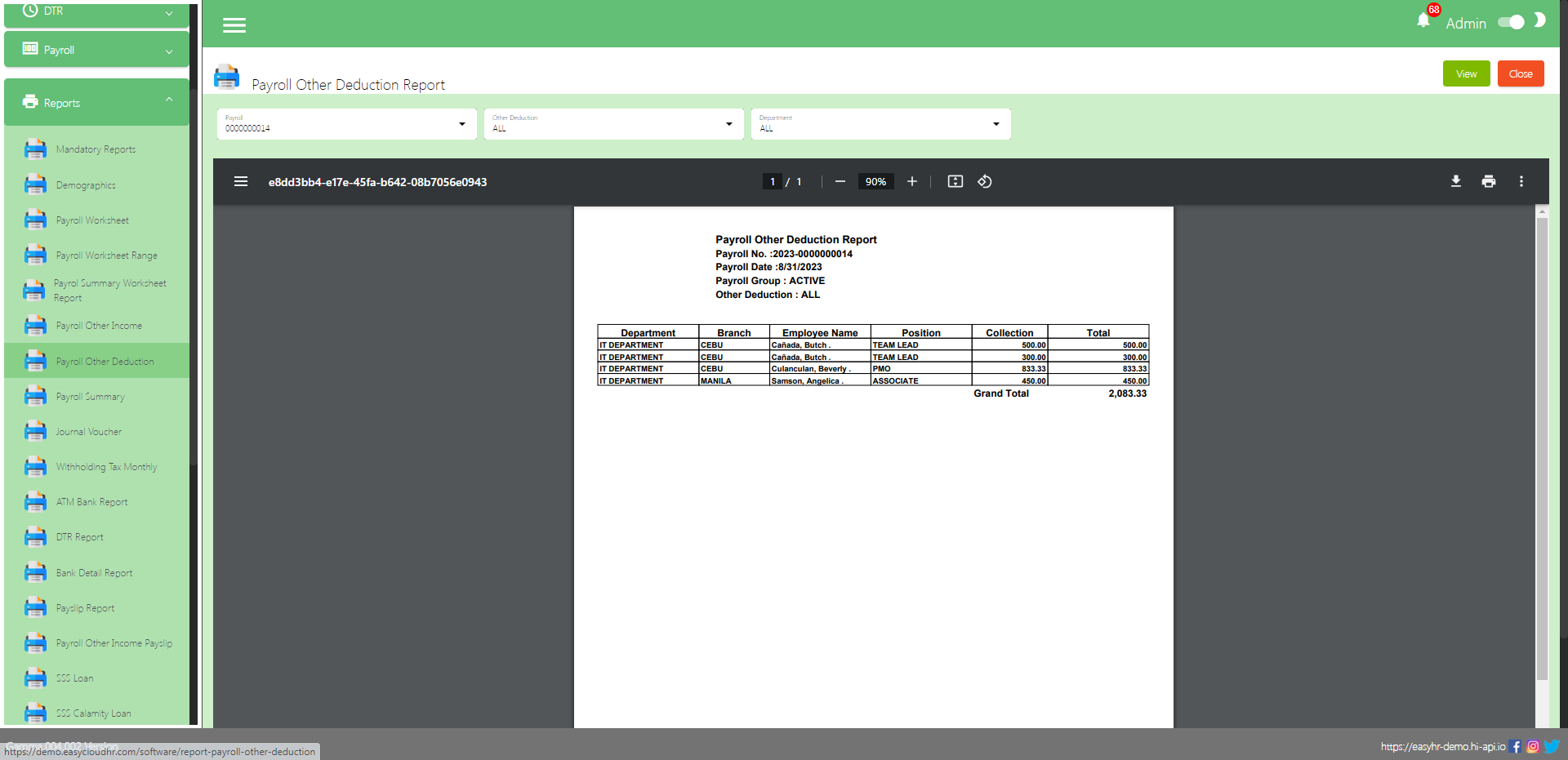

Payroll Other Deduction Report

Overview

- Payroll Other Deduction Report provides a summary of deductions from an employee’s pay that are not related to taxes, Social Security, or Medicare. These deductions can include items like insurance premiums, retirement contributions, union dues, or any other voluntary or mandatory deductions specified by the employee or employer. The report helps businesses and organizations track and account for various types of deductions that impact an employee’s net pay and financial obligations.

Payroll Other Deduction Report

- Generate or view report

- Select Payroll number

- Select Other Deduction name ( The user can select all other deductions )

- Select Department ( The user can select all departments )

- Click View button to generate Payroll Other Deduction Report.

- The user can Download this report and also can Print.

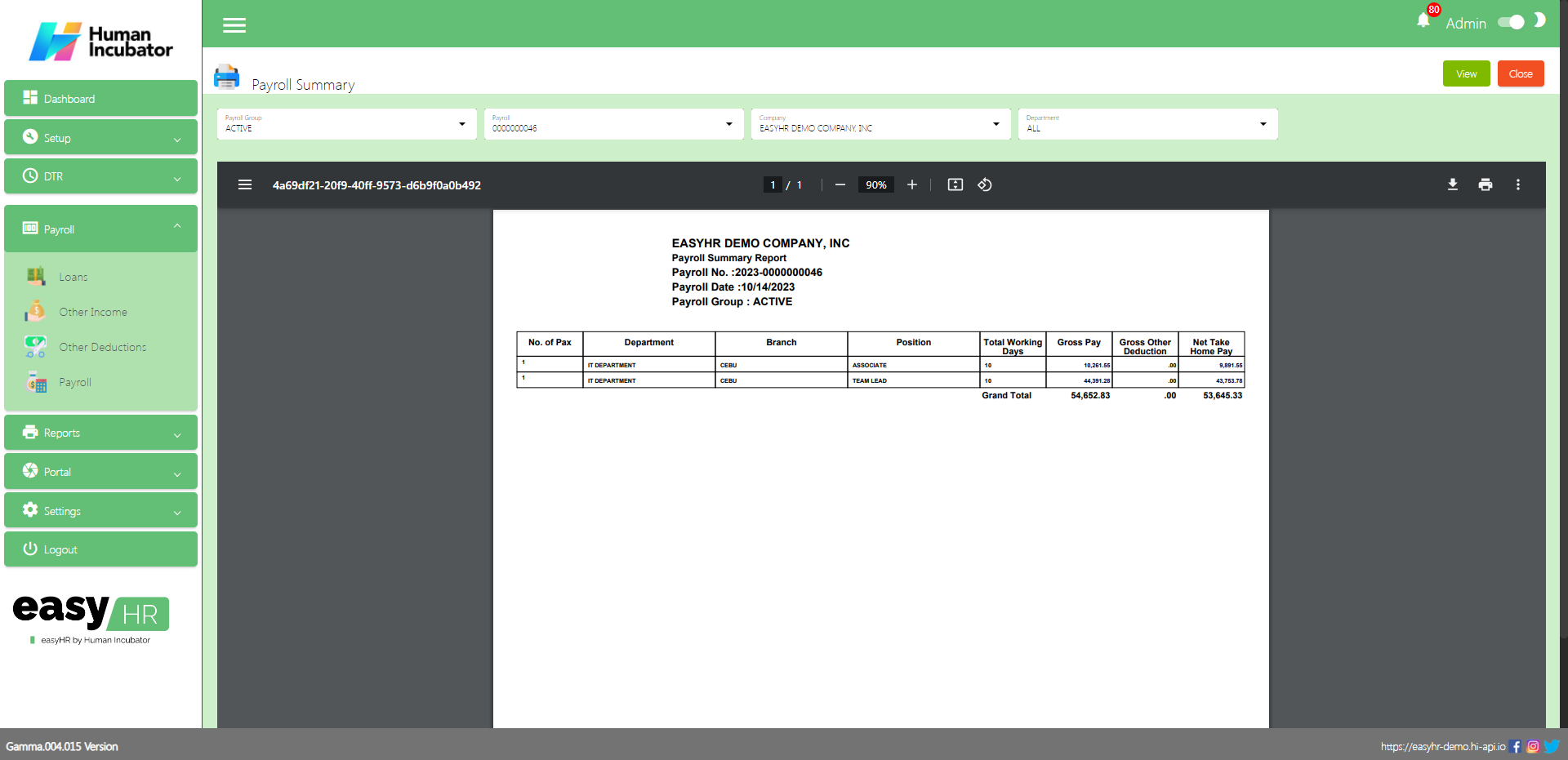

Payroll Summary

Overview

- Payroll Summary provides a concise summary of the financial aspects of a company’s payroll process. It typically includes key information related to employee compensation, taxes, deductions, and other payroll-related expenses for a specific period, such as a month or a pay cycle. This overview is essential for both accounting and management purposes, helping businesses keep track of their labor costs and ensure compliance with relevant regulations.

Payroll Summary

- Generate or view report

- Select Payroll Group

- Select Payroll Code number

- Select Company

- Select Department ( The User can select all departments )

- Click the View button to generate a Payroll Summary report.

- The user can Download this report and also can Print.

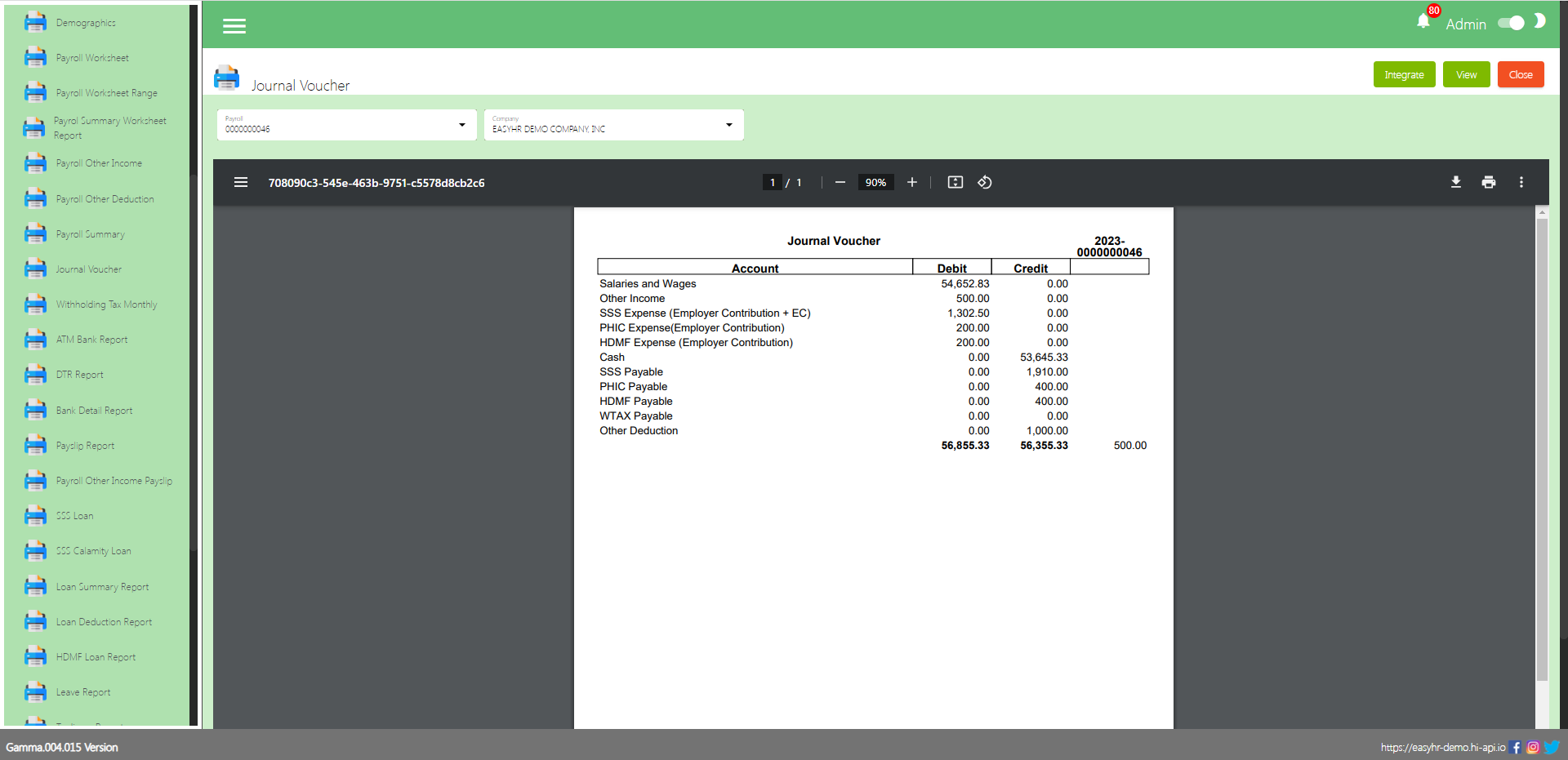

Journal Voucher

Overview

- Journal Voucher is used in accounting to record financial transactions. It serves as a temporary or preliminary entry, which is later adjusted or corrected before it is posted to the general ledger. Journal vouchers are commonly used when a transaction doesn’t fit neatly into the standard accounting entries or when there is a need for additional information or approval before finalizing the transaction.

Journal Voucher

- Generate or view report

- Select Payroll Code number

- Select Company

- Click the View button to generate a journal voucher report.

- The user can Download this report and also can Print

- The user can Integrate to EasyFS system