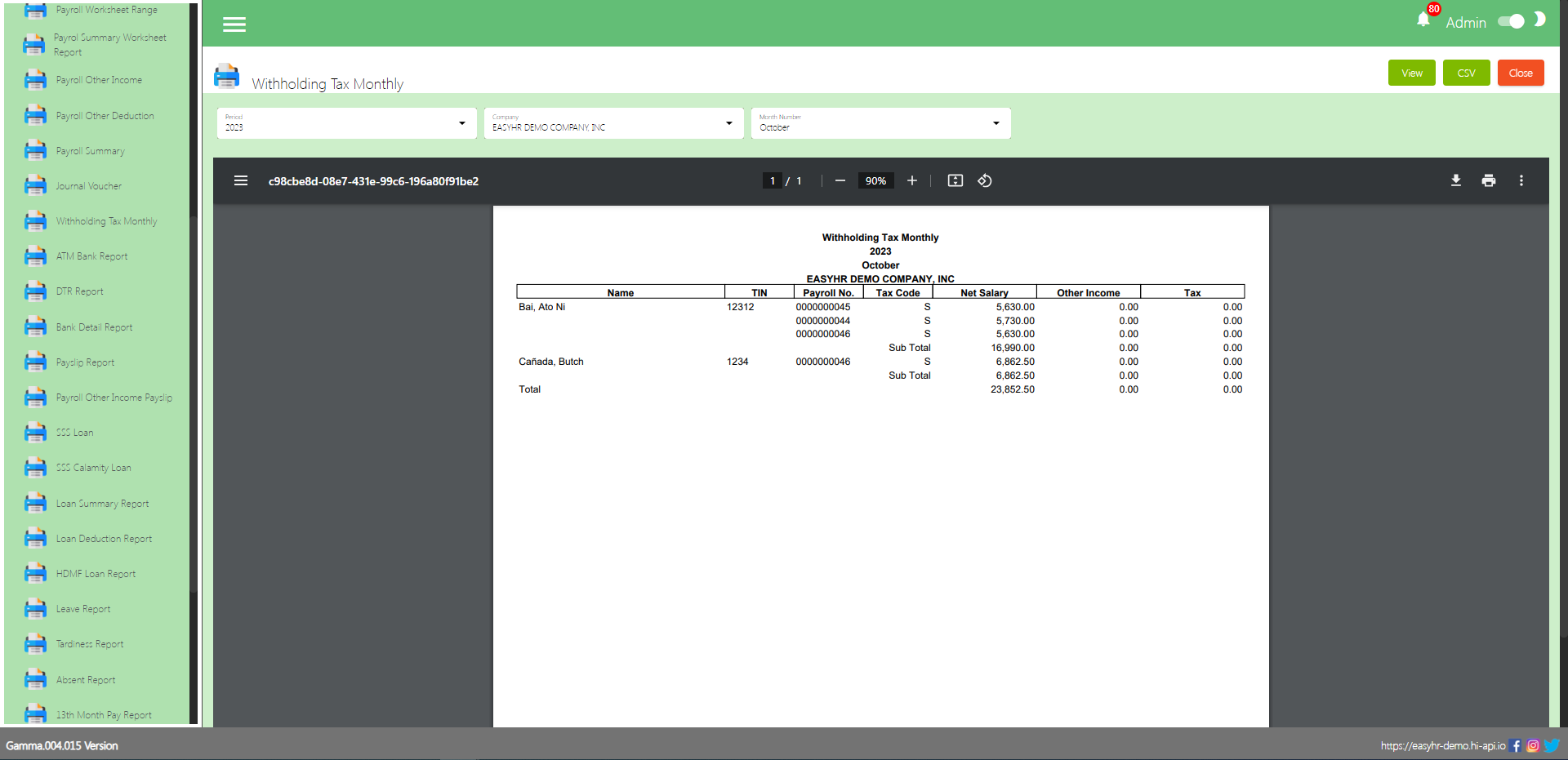

Withholding Tax Monthly

Overview

- Withholding Tax is a tax collected by a payer (typically an employer) from the payment made to a payee (usually an employee or a vendor) and remitted to the government on behalf of the payee. It’s a mechanism used to ensure that individuals and businesses pay their income taxes or other applicable taxes throughout the year.

- If the employee is a variable type the net salary displayed is based on the (Income – Mandatory).

Withholding Tax Monthly

- Generate or view report

- Select Year

- Select Company

- Select Month

- The user can Download this report and also can Print.

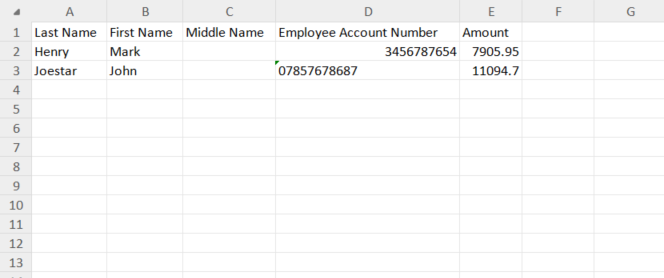

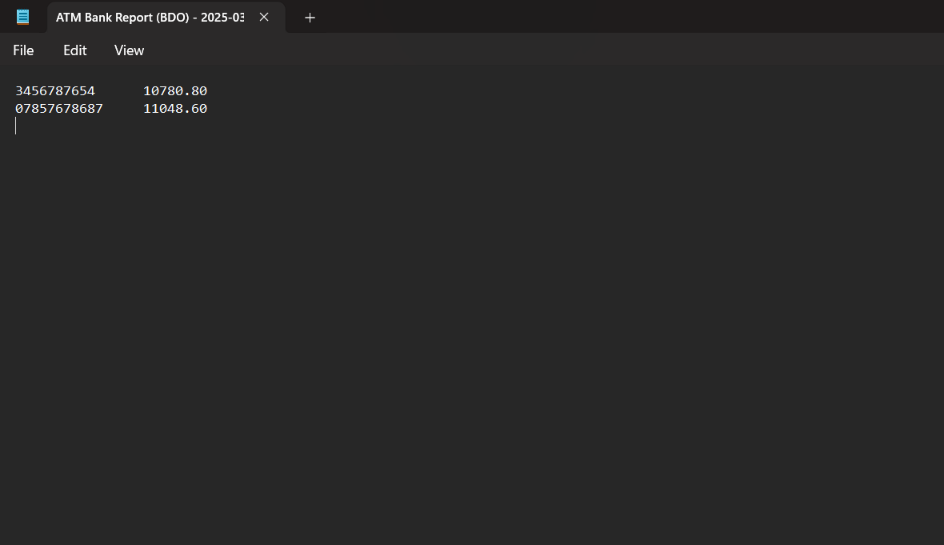

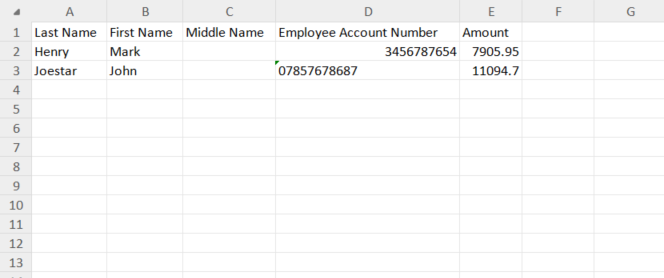

Download CSV

- Click the CSV button to download the CSV file.

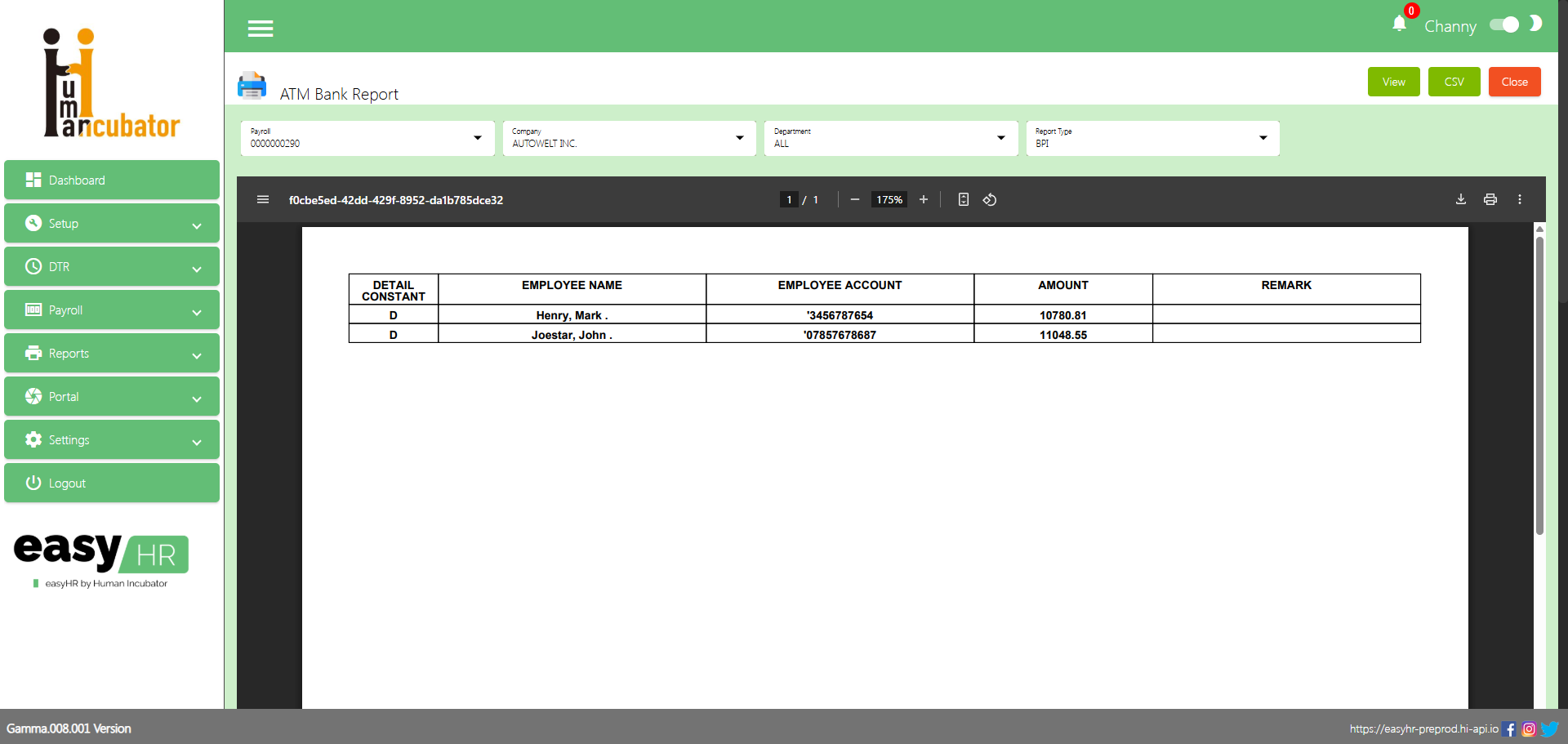

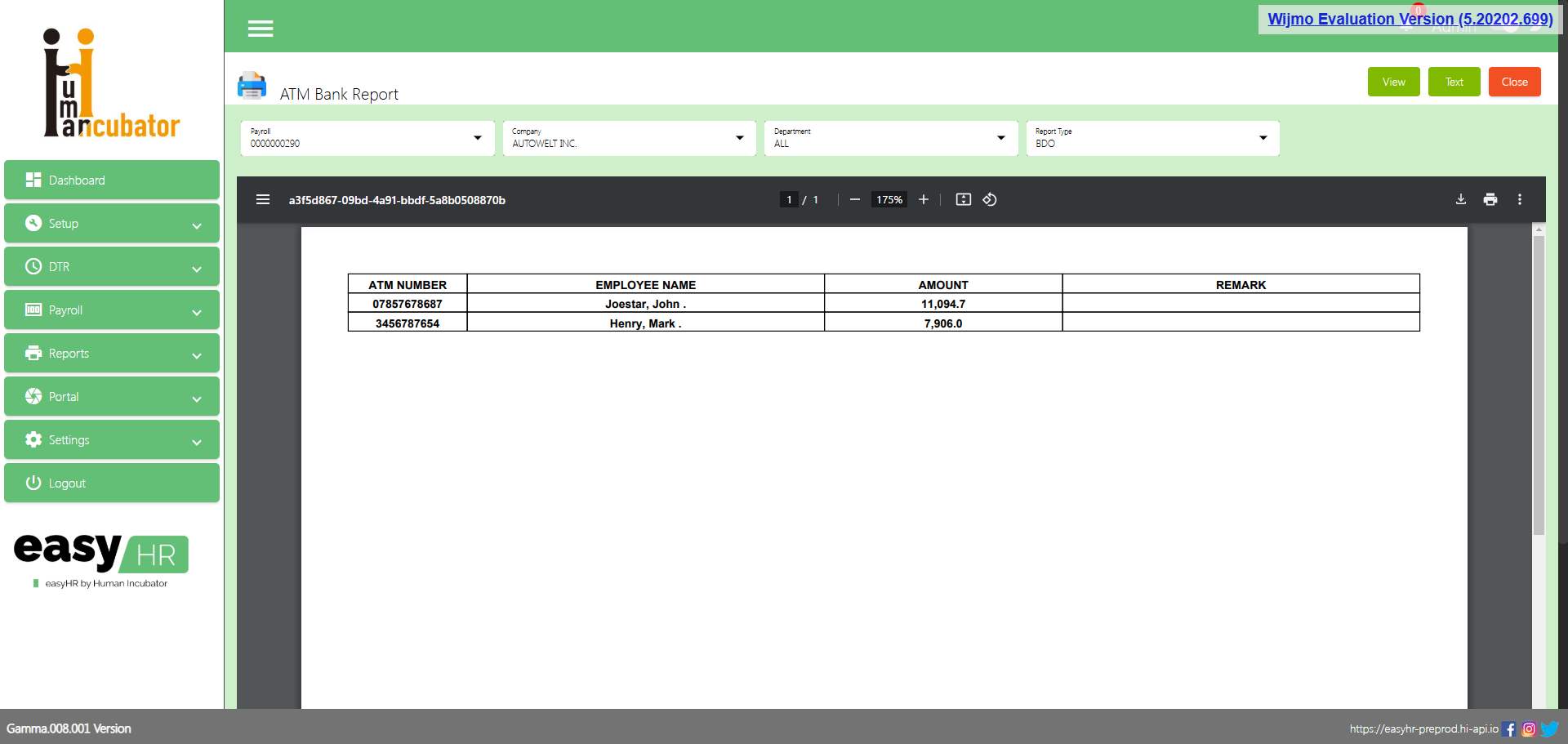

ATM Bank Report

Overview

- ATM Bank report is a summary of the transactions and activities associated with a bank’s network of ATMs over a specific period, such as a day, week, month, or year. These reports are generated to monitor the performance, usage, and financial aspects of ATM operations.

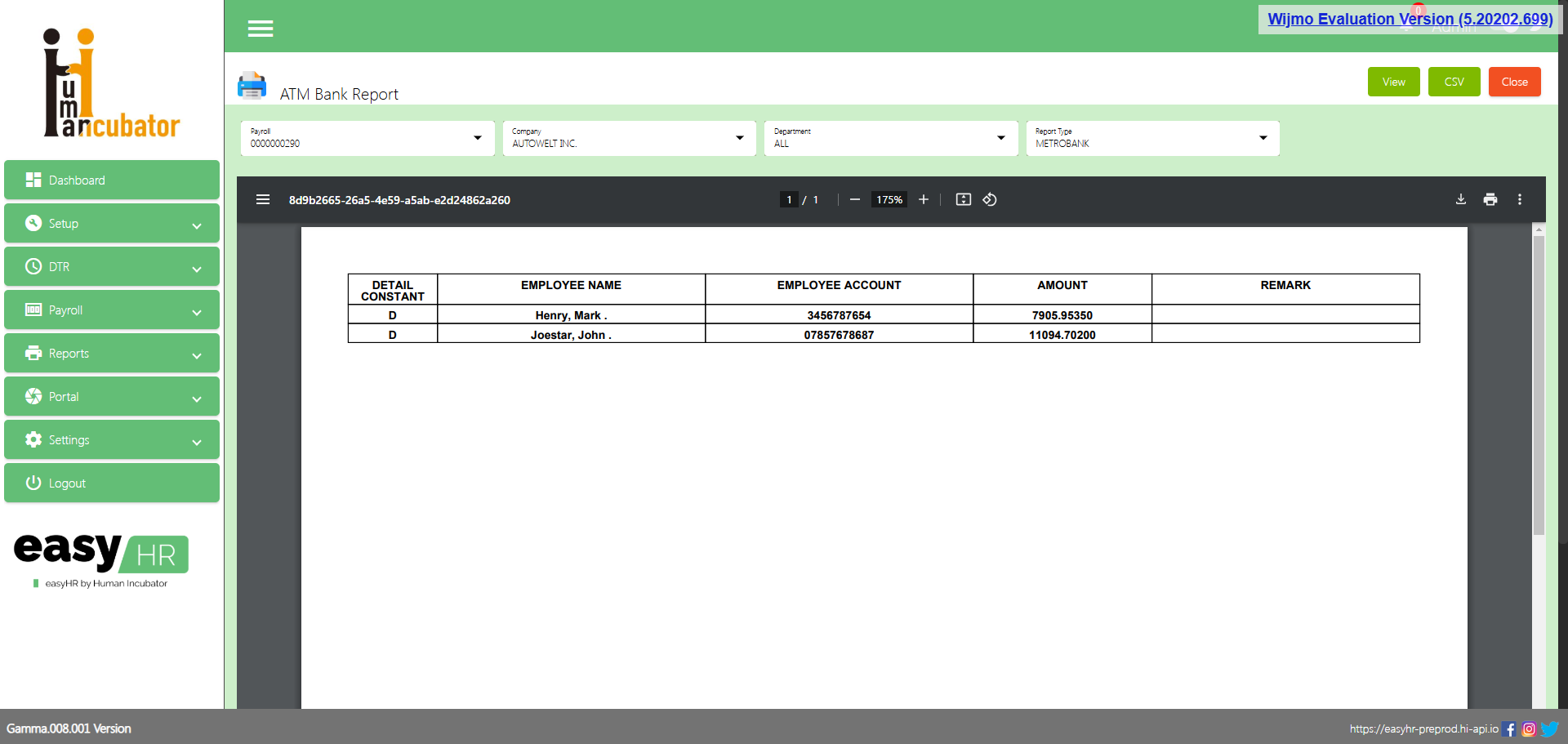

ATM Bank Report

- Generate or view report

- Select Payroll Code number

- Select Company name

- Select Department ( The User can select all departments )

- Select Report Type

- Click the View button to generate report.

DTR Report

Overview

- DTR report used by organizations and employers to track and record the attendance and working hours of their employees on a daily basis. This report is essential for various purposes, including calculating payroll, monitoring employee punctuality, and ensuring compliance with labor regulations.

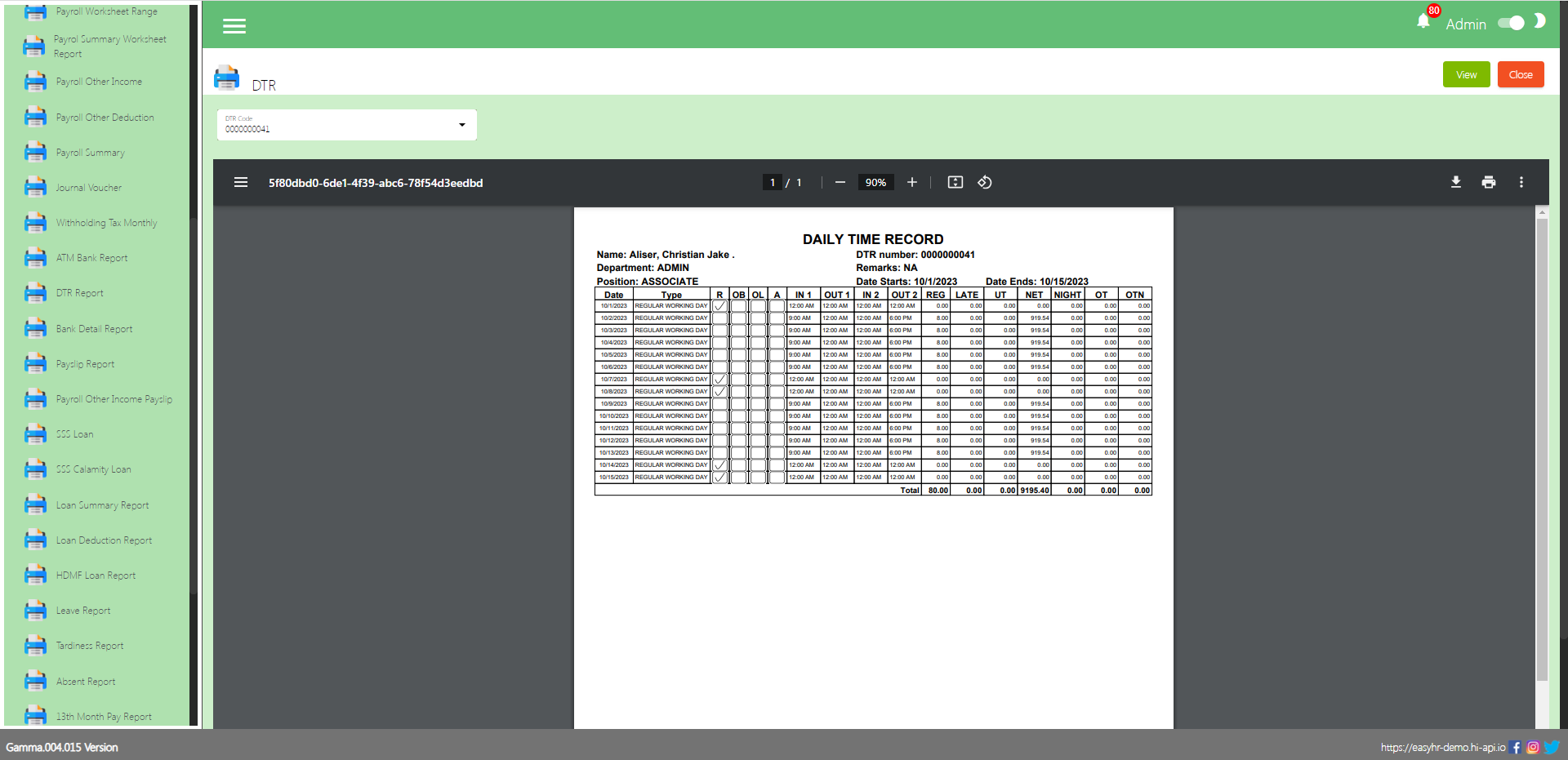

DTR Report

- Generate or view report

- Select DTR code number

- Click the View button to generate a DTR report.

- The user can Download this report and also can Print.

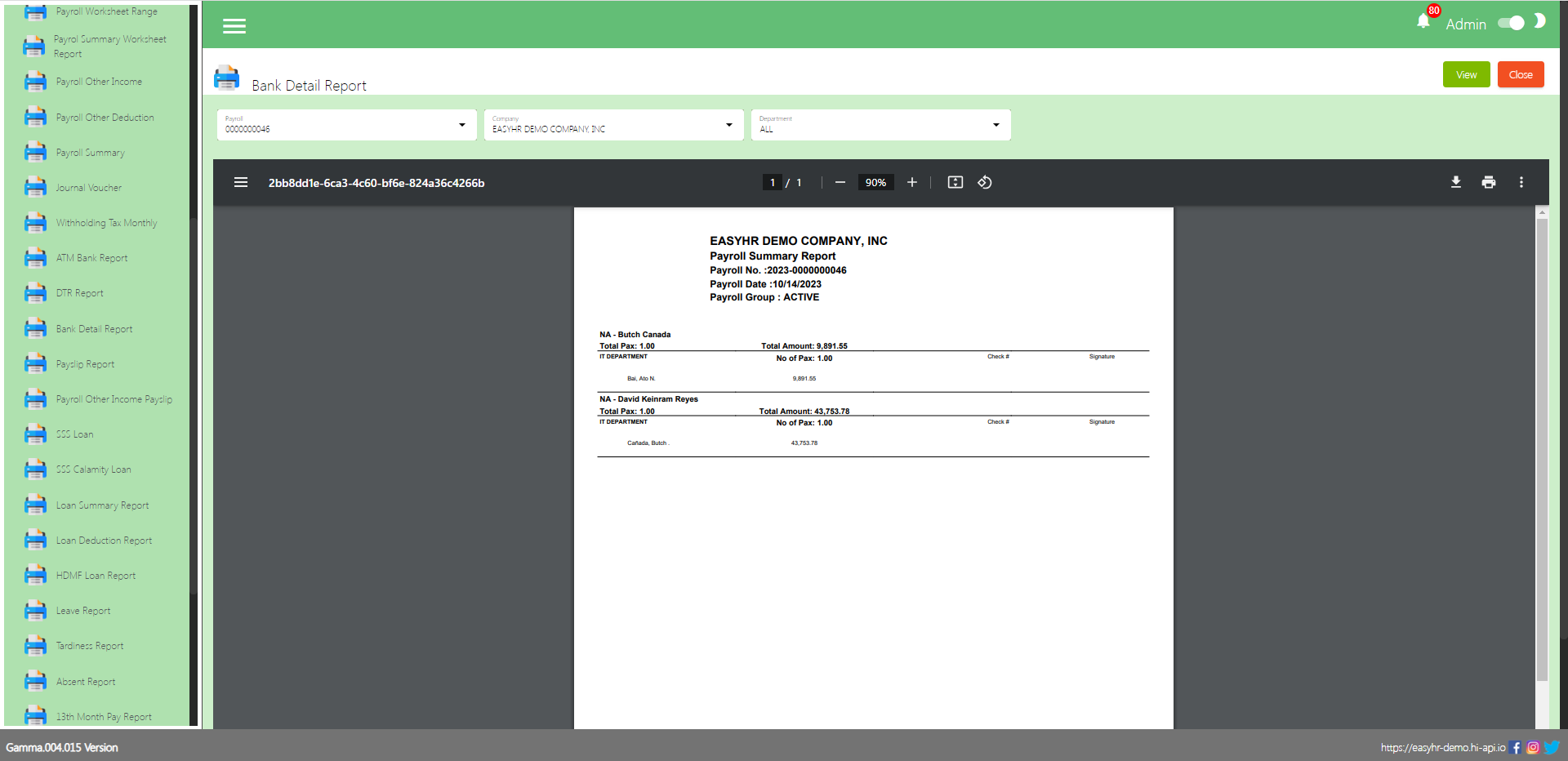

Bank Detail Report

Overview

- Bank Detail Report provides a comprehensive overview of a company’s or individual’s financial transactions and account activity with a specific bank or financial institution. This report is used for various purposes, including financial analysis, reconciliation, and compliance.

Bank Detail Report

- Generate or view report

- Select Payroll Code number

- Select Company

- Select Department ( The user can select all departments )

- Click the View button to generate a bank detail report.

- The user can Download this report and also can Print.

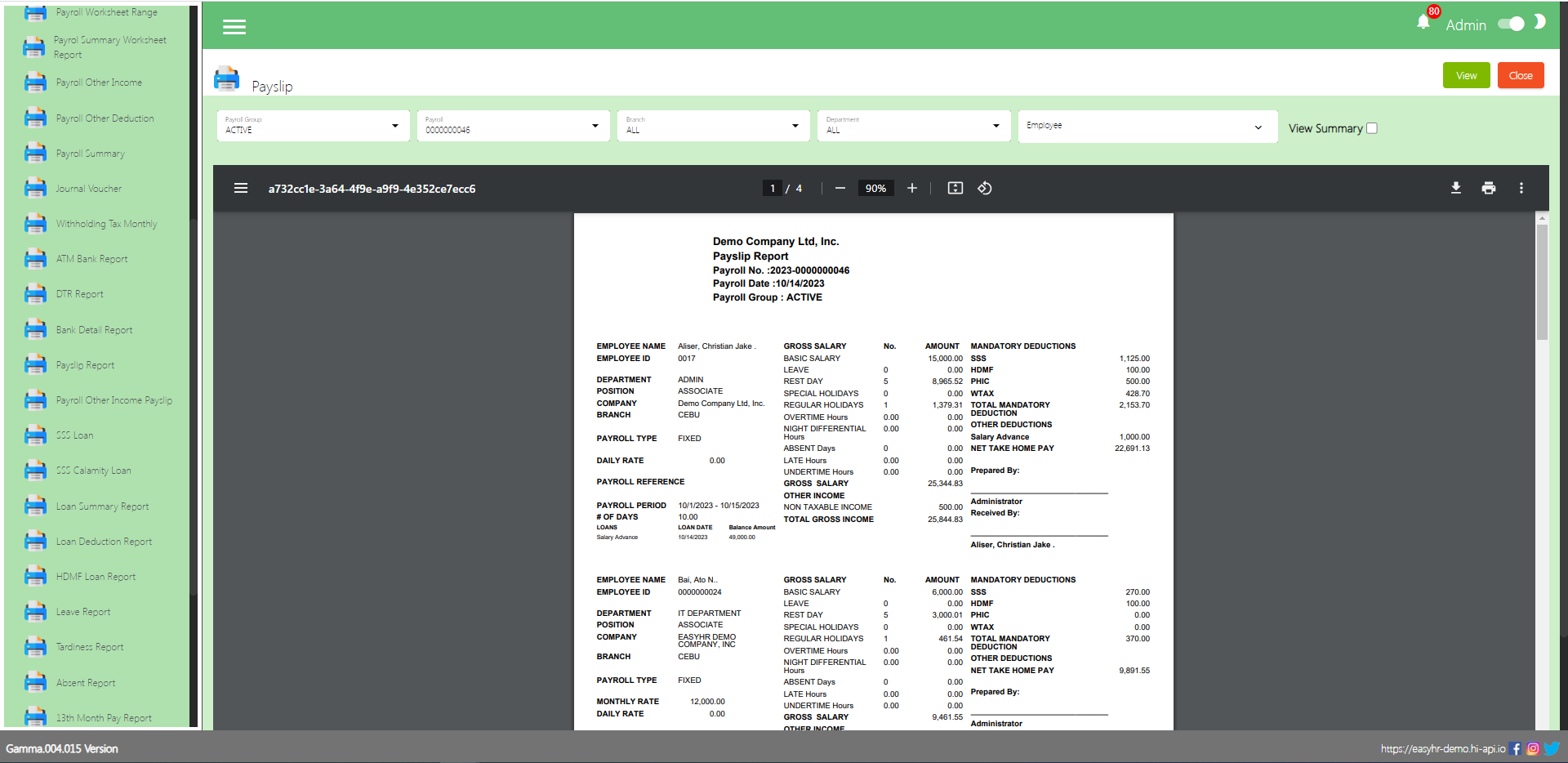

Overview

- Payslip Report is a document that provides a detailed summary of an employee’s earnings, deductions, and net pay for a specific pay period. It is typically issued by an employer to an employee along with their salary or wage payment. The payslip serves as a record of an employee’s compensation and is important for both financial management and legal compliance.

Payslip Report

- Generate or view report

- Select Payroll Group

- Select Payroll code number

- Select Branch ( The user can select all branches )

- Select Department

- Select All employees ( The user can select one employee )

- Click the View button to generate a Payslip report.

- The user can Download this report and also can Print.

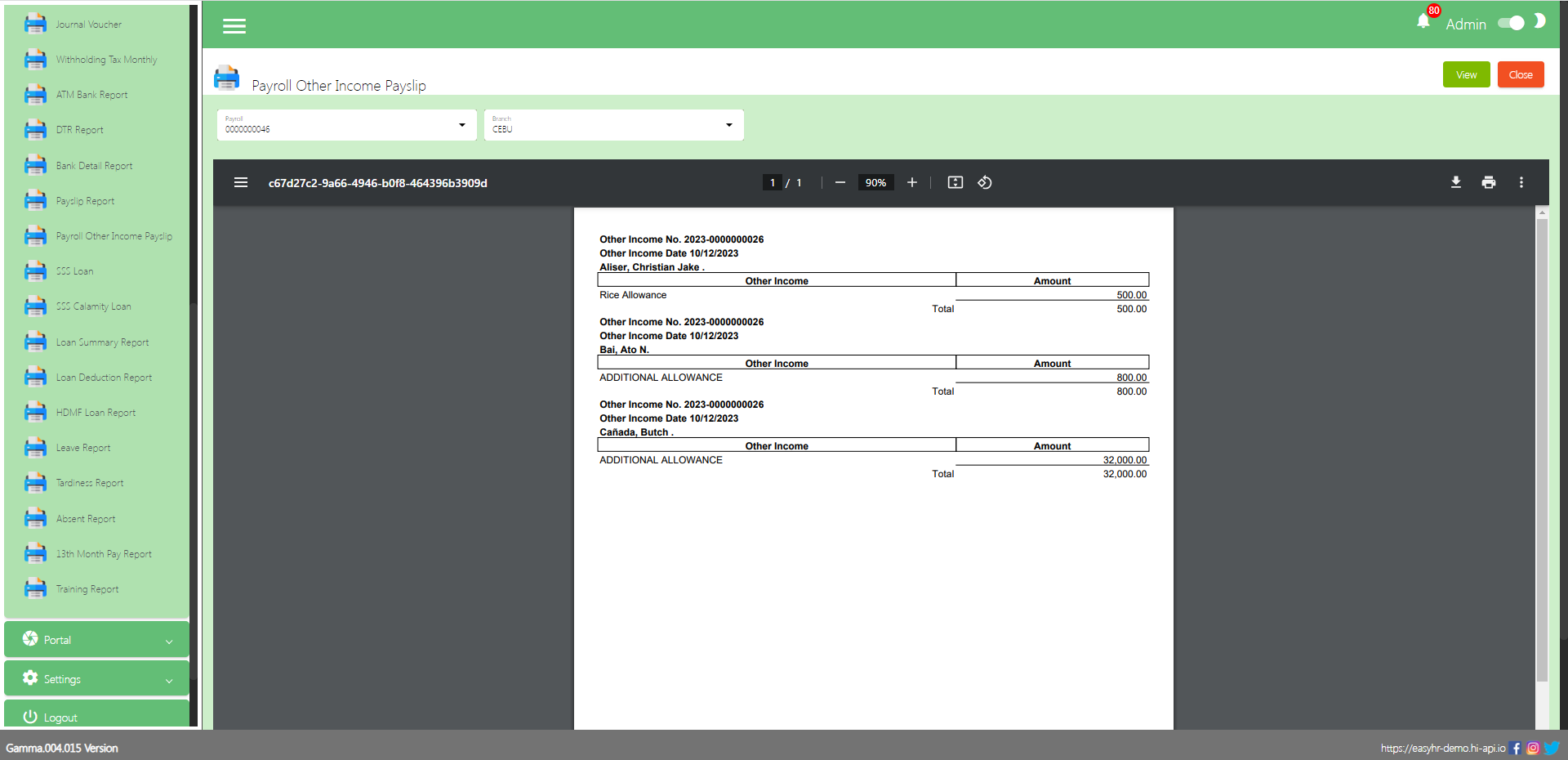

Payroll Other Income Payslip

Overview

- Payroll Other Income Payslip is a document that provides a summary of an employee’s earnings, specifically focusing on additional or supplementary income beyond their regular salary or wages. This report details various types of “other income” or compensation that an employee might receive. It is an important component of the overall payslip, helping employees understand their complete compensation package.

Payroll Other Income Payslip

- Generate or view report

- Select Payroll code number

- Select Branch

- Click the View button to generate a payroll other income payslip report

- The user can Download this report and also can Print.